Rate shock is real

Recent months have seen a spurt higher in yields, with various conjectures put forward for the moves. Economists have rowed back on recession fears in the US while fresh emphasis has been put on bond supply. Could more structural factors be behind the rise in yields?

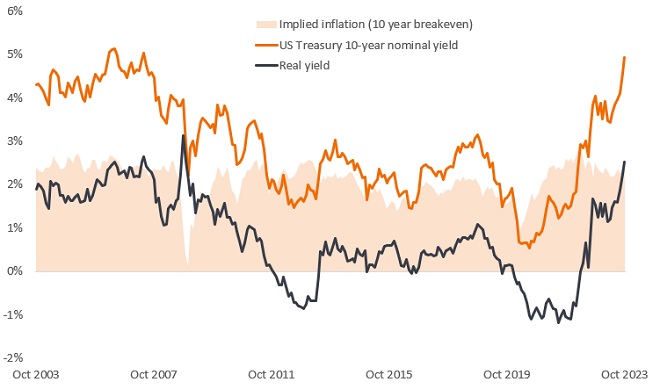

Figure 1: Real yields at a post-Global Financial Crisis high

Source: Bloomberg, US Treasury 10-year nominal yield, US Treasury 10-year Inflation Protected Securities (TIPS) yield (real yield). The 10-year breakeven rate is a measure of expected inflation, implying what market participants expect inflation to be in the next 10 years on average. It is derived from subtracting the yield on TIPS from nominal bonds yields of the same maturity. 31 October 2003 to 31 October 2023. Yields may vary over time and are not guaranteed.

For fixed income investors, the shifting narrative poses a particular dilemma. A stronger economy is potentially good for credit fundamentals but upward pressure on yields is an offsetting factor. Real rates have risen, reflecting a higher term premium and expectations for a “higher for longer” rates regime. Should we be reassessing our view that we are near peak yields?

*The Fixed Income Investment Strategy Group (ISG) brings together investment professionals from across the global fixed income platform and other Janus Henderson teams, providing a forum for debate around the fixed income asset class and key drivers of the market. The ISG Insight seeks to provide a summary of recent debate within the group.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.