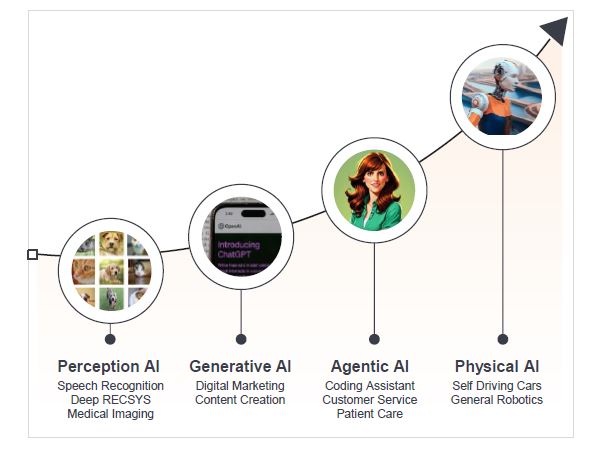

Much of the AI limelight in the last couple of years have been centred on generative AI, ie. humans interacting with machines. Another component of AI application is physical AI, which makes use of observations and interactions to solve problems in the physical world with information captured from tools like sensors, cameras, radar, and light detection and ranging (LiDAR).

Developments in AI

Source: Janus Henderson Investors.

Autonomous driving is a key example of the maturation of AI and the advent of physical AI. In the last 12 months we have witnessed an inflection in tech advancements and deployments. Waymo, the autonomous driving unit of Alphabet, has now reached 10 million trips, doubling cumulatively in the last five months alone, with over 250,000 paid autonomous taxi rides each week;1 while Elon Musk has committed to having fully autonomous Model Y Tesla vehicles on the road in Austin in June.2 While Waymo and Tesla represent two different approaches to developing autonomous driving, progress along both paths is finally moving at an exponential pace.

Autonomous driving: the opportunity

The large investments being made in autonomous driving reflect the size of the economic opportunity: 75-80 million vehicles sold per year, and a global auto manufacturing market worth approximately US$3 trillion in 2024.3 Additionally, the opportunity to directly transform and disrupt sectors such as delivery, logistics, auto-related finance and insurance, as well as improving the use of our time and longevity.

Key reasons why autonomous driving is becoming an innovation priority:

- Demographic need

The latest World Road Transport (IRU) Organisation Report IRU showed that global truck driver shortage is increasing with continued aging of the driving workforce. The share of truck drivers aged over 55 is almost 32%,4 with a tightening supply of human drivers there is an economic imperative to find a solution to this demographic timebomb.

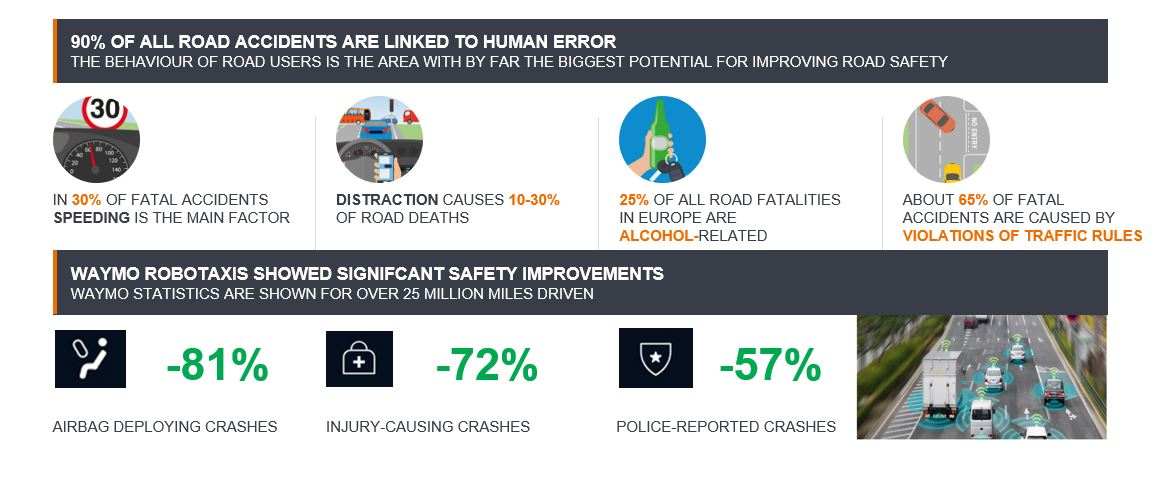

- Safety

Around 90% of all accidents are linked to human error.5 Waymo statistics show that robotaxis can lead to a reduction of more than 80% in terms of airbag deploying and injury-causing crashes.6

- Productivity, convenience and efficiency

Autonomous vehicles can also reduce congestion by optimising traffic flow; improve mobility for those who are unable to drive; enhance energy efficiency via reduced fuel consumption, as well as help make travel time more productive (eg. working, reading, relaxing).

Sustainable transport

Humans are not always ‘intelligent’

Source: Swiss Re, Waymo. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Autonomous driving: progress check

While progressing rapidly now, the path and pace to full rollout and profitability is determined by four key vectors:

1. Safety

As exemplified by GM’s Cruise robotaxis, safety is a challenging issue. Previously a leader, the company ended its commercial robotaxi operations due to an accident where it was found that GM had misled regulators. Responsible AI development following the principles of transparency, security, and remediation of errors, will continue to be paramount in the building of trust in AVs (autonomous vehicles).

2. Regulation

Progress depends on regional AV regulation, which is rapidly evolving alongside a parallel track for responsible AI. Over 50 countries had either introduced or drafted AV legislation by the end of 2024. We expect that the pace of adoption and the investment winners will vary by region, with a few global winners alongside some regional champions.

The greatest vehicle commercialisation has been in the US given widespread state regulation, a supportive climate for testing and development, and investment from Silicon Valley. China is the global leader alongside the US with 500,000 robotaxis expected to be operating across 10+ cities by 2030. Meanwhile, the EU has targeted 2025 for a Unified Regulatory Framework for AVs, while the UK’s AV Act will see the introduction of AVs in 2026.

3. Affordability

Driving down the cost of autonomous vehicles and software for autonomous driving is key to broadening adoption. Uber has a unique view of robotaxi affordability and hopes to unlock meaningful addressable markets (scale adoption) when costs drop below human-driven rides. Uber estimates that human-driven rides cost roughly $2 per mile in the US. As small AV players may lack the capital and are burdened by heavy R&D (research and development) costs, and the associated costs of building a user base, partnerships with companies like Tesla and Alphabet (Waymo), allows leveraging of existing customer bases and apps (e.g X and Google Maps). Partnering with ride-hailing services like Uber and Lyft can also accelerate access to customers.

4. Scalability

There are two divergent approaches to developing autonomous software with different implications for affordability and scalability:

- Compound AI systems (CAIS) – this is the most traditional rules based, compute efficient and transformed stack approach with high sensor power and geofencing. It avoids use of expensive data centres and relies on less data to train as training data is supervised versus end-to-end networks. CAIS is currently being used by all the commercial robotaxis (Waymo, Cruise, Apollo Go). Waymo’s current leadership was developed with the roll out of Jaguar I-PACE vehicles with Waymo Driver technology. Waymo Driver works on four dimensions namely LiDAR, camera, radar and compute. LiDAR paints a 3D picture of surrounding vehicles, while cameras provide a 360-degree view in both daylight and low-light conditions enabling vehicles to tackle more complex environments. The strength of this approach lies in the ability to optimise each of its dimensions, and being able to debug and correct them.

- End-to-end neural networks ─ this is evolving as an AV 2.0 version, championed by Tesla and Wayve. Reliant on reinforcement learning instead of the modular approach of perception, mapping, prediction and planning, it focuses on one neural network, which in theory should allow adaptation to new environments and driving policies more quickly. The development of AI has improved the rate of learning for software such as Tesla FSD (full self-driving). However, in terms of actual miles driven with no human intervention the approach remains unproven.

Navigating the AV hype cycle

It is important to note that there are currently no ‘pure’ play AV-listed companies. We believe that the excess profit and value creation will accrue to the company that becomes the main platform, or controls the software, driving scale and network effects.

We see a likely build of hype around AV over the next three years, with a broadening of launches and consumer adoption and passengers keen to focus on the safest and best tested systems. Our experience tells us first to market doesn’t always equate to the best or the winner. While there are leaders, there are many miles still to be driven and tested, in addition to numerous new partnerships before a definitive winner can be defined. As with all rapidly accelerating technologies, hype cycles will emerge and need to be navigated.

Key players in the autonomous driving space

In addition to large semiconductor content given their software requirements, there is a broader and changing enablement layer of infrastructure. Semi companies such as Lattice and Monolithic Power Systems work with AV manufacturers, DRAM (memory) maker Micron has a disproportionate exposure to autos, while connector companies like TE Connectivity and CATL (Contemporary Amperex Technology) could benefit from content and scaling of the technology.

Waymo, Tesla, Uber and NVIDIA have continued to drive the pace and scale of AV development given their technology capabilities, as well as access to capital and customers:

- Waymo (owned by Alphabet)

Waymo has been testing in California since 2015 with the most stringent state regulatory requirements. Its self-driving technology, Waymo Driver (Level 4 high autonomy) is conducting 250k rides per week across four US cities, extending to Atlanta, Miami and Washington soon, and recently began testing in Tokyo. As a subsidiary of Alphabet, Waymo can leverage on Alphabet’s capital, AI models, cloud infrastructure, Google Maps and Waze apps to train models.

The pace at which Waymo is now racking up miles is challenging previously held concerns that its approach would be too slow to ramp up its services. Waymo plans to add 2000 more robotaxis to its fleet by 2026 bringing the total to 3500 vehicles. Waymo Driver is the driver that “never gets drunk, tired or distracted”. There is a novelty factor in use, but the high utilisation of services – Waymo’s Austin service was reported to be busier than 99% of Austin human drivers, suggesting that public confidence and trust is building rapidly too. Beyond robotaxis, Waymo also announced a strategic partnership with Toyota to accelerate the development of autonomous driving, which could lead to wider dissemination of Waymo Driver into personally-owned vehicles (PoVs).

- Uber

For much of 2024, Uber was pressurised by concerns that robotaxis would deplete their competitive advantage. But this narrative is changing; Uber has an existing partnership with Waymo in three US cities, and has announced various AV partnerships for deployments in US, Europe and the Middle East. As well as mobility, Uber is working with AV partners like Aurora on delivery and trucking; commercial, semi-autonomous trucks were launched in May in Texas. The scale of Uber’s platform brings affordability for autonomous driving that is tied to utilisation. Uber has the potential to capture supply from subscale AV players that lack consumer network and capital resources to generate their own demand. However, long term, there remains a concern that Uber could be disintermediated by a scaled AV player developing their own demand generation platform.

- Tesla

As an AV 2.0 player, Tesla has some advantages to scaling given its generalised approach, and the volume of data gathered from the number of miles driven using its FSD (Full Self-Driving software). Tesla Autopilot has shown significant improvements over average drivers. However, its FSD software is considered Level 2 autonomy, requiring active driver supervision.

The leap to achieving unsupervised robotaxis in Austin Texas and in California in 2025, will be, in Elon Musk’s own words still “super hard”. Tesla has tentatively set June this year as the date for a fully autonomous small-scale launch. At the end of 2024 Tesla had spent more than US$2.7bn on AI chips alone before it begins road testing. This scale and capital spending could of course serve as a future competitive moat but for now compounds the higher near-term cost per mile vs human drivers.

Tesla unquestionably has data and manufacturing advantages in both the US and China, which means it is well positioned to benefit from its vertical integration and operations in both countries. The Tesla approach is a more generalised solution using AI and AI silicon designed by Tesla for autonomous driving as opposed to expensive sensors and high precision maps of neighbourhoods.

AI has accelerated improvements in FSD exponentially with fewer human interventions being required, but it is a camera-only solution. It uses a network of cameras to perceive the environment and make driving decisions. While this should make the approach more affordable and scalable, the vision-only software that Tesla relies on (Photon-to-Control) may have issues in safety validation. This is because it essentially minimises intermediate steps in processing the raw data that the camera sees. So while progress is evident at present, Tesla could be further away from commercialising an AV platform, particularly given the lack of fully autonomous miles driven (Level 4).

- NVIDIA (3-computer solution)

AI models are trained in NVIDIA DGX to tackle complex driving scenarios while NVIDIA Omniverse simulates diverse physical-based environments to test and validate AV systems. The third element, NVIDIA AGX offers an in-vehicle compute platform delivering high performance compute to enable automated and autonomous vehicles to process camera radar and LiDAR data for real time safety decisions. Similar to Waymo’s approach, NVIDIA is partnering across the industry (with Toyota, Mercedes Benz, Rivian, Volvo and BYD, Uber and Amazon). NVIDIA’s physical AI solutions and creation of synthetic data is key to unlocking autonomous driving and next generation models that rely on simulated data rather than real world driven miles. This historically, was a key inhibitor of progress from a cost, time and scale perspective.

Conclusion

Autonomous driving is one of the most significant and impactful evolutions of physical AI. It will revolutionise not only transport systems but also the way we live, and is leading to exciting investment opportunities.

While the AV market is progressing rapidly, we expect broader adoption of autonomous driving in owned vehicles to be slower. However, this is being accelerated with the pace of general AI innovation. We are at a key inflection point in terms of regulatory development, and which technology approach will prevail.

As ever, we believe it’s important for investors to be exposed to the companies that are leading innovation, rather than those that are being disrupted. Focusing on competitive advantage rather than optionality, and drawing on experience can help investors to better navigate the opportunities from this exciting and early hype cycle technology.

Waymo is a trademark of Waymo LLC. Waymo vehicle image sourced and used with permission.

1 CNBC.com; ‘Waymo says it reached 10 million robotaxi trips, doubling in five months,’ 20 May 2025.

2 Reuters; Tesla’s public robotaxi rides set for tentative June 22 start, CEO Musk says, 11 June 2025.

3 ACEA Economic and Market Report 2024; IBIS World Industry Report 2024.

4 IRU.org.; Global Truck Driver Shortage Report 2024, published April 2025.

5 NHTSA; Critical Reasons for Crashes Investigated in the National Motor Vehicle Crash Causation Survey.

6 Waymo.com; Waymo Driver compared to human benchmarks, as at 9 June 2025.

Compute: the computational resources necessary for AI systems to perform tasks, such as processing data, or training machine learning models.

Hype cycle: refers to a volatile, cyclical pattern of excessive optimism, followed by disillusionment, when a new technology or investment trend becomes popular.

LiDAR: an acronym for light detection and ranging; pulsed lasers are used to map a three-dimensional model of an environment quickly and more accurately. In autonomous driving, it adds ‘eyes’ as the vehicles need to quickly develop an image of the world around them to avoid hitting pedestrians, animals, obstacles, and other vehicles.

Navigating the hype cycle: the hype cycle reflects a volatile, cyclical pattern of excessive optimism, followed by disillusionment, when a new technology or investment trend becomes popular. Markets typically overestimate the short-term potential of a new technology or innovation and underestimate its long-term potential, creating volatile movements both up and down for underlying stocks exposed to these technologies. Via active management, fund managers draw on their expertise and investment experience of investing through previous hype cycles aiming to deliver better investment outcomes.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.