I recently returned from my first research trip to Japan, where I spent two packed weeks travelling across Tokyo, Kyoto and Osaka attending conferences and meeting companies. The goal was to immerse myself in the local investment landscape, meet with companies and experts on the ground, and uncover compelling ideas worth exploring further. Reflecting on the trip, I came away with the view that one of the most compelling investment opportunities lie in companies that benefit from the long-term trend of digitalisation.

Why Japan’s digital push is different

Conversations with leaders at domestic Japanese IT service, consulting, and software firms – including NEC, BayCurrent, and Rakus – consistently reinforced a central theme: corporate Japan is still playing catch-up to Western peers in digital maturity.

Many Japanese companies rely on heavily customised, legacy systems maintained by a small cohort of senior employees, many of whom are nearing retirement. The Covid-19 pandemic exposed the fragility of these architectures, directly impacting the competitiveness of Japanese corporates.

Unlike Western counterparts, Japanese firms typically have small, under-resourced IT teams – a reflection of chronic underinvestment, rigid hierarchies, and lower compensation. These cultural factors deter tech talent from joining traditional corporates, with engineers instead gravitating towards IT-focused companies that offer better working conditions and career growth. As a result, internal tech teams remain underdeveloped, even as IT spending has accelerated post-pandemic.

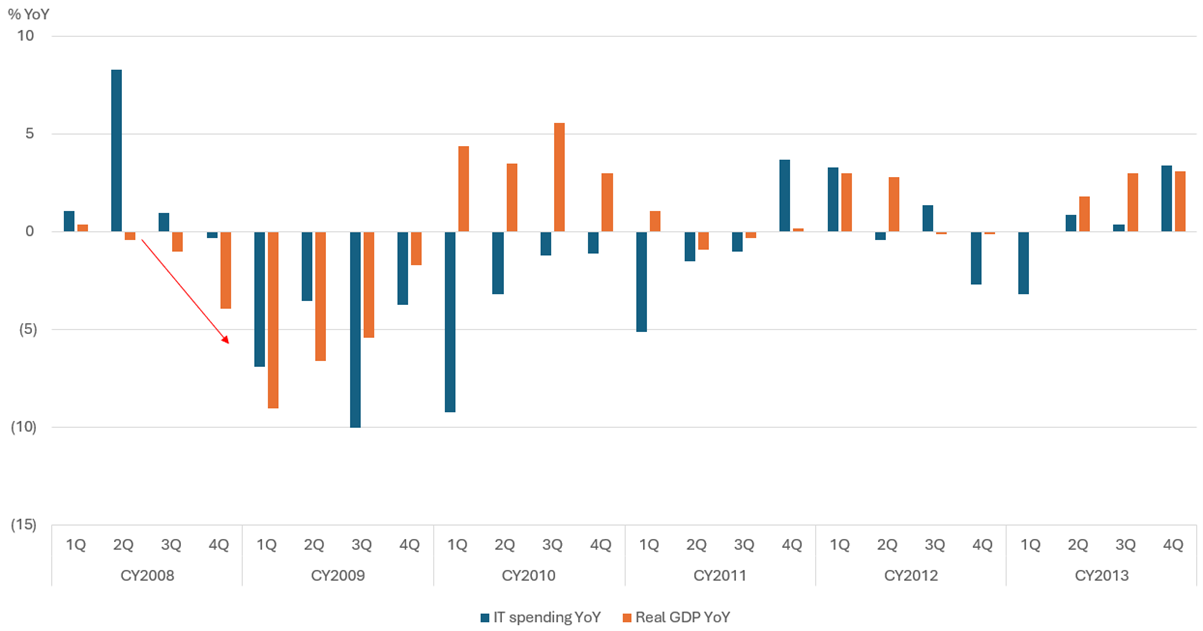

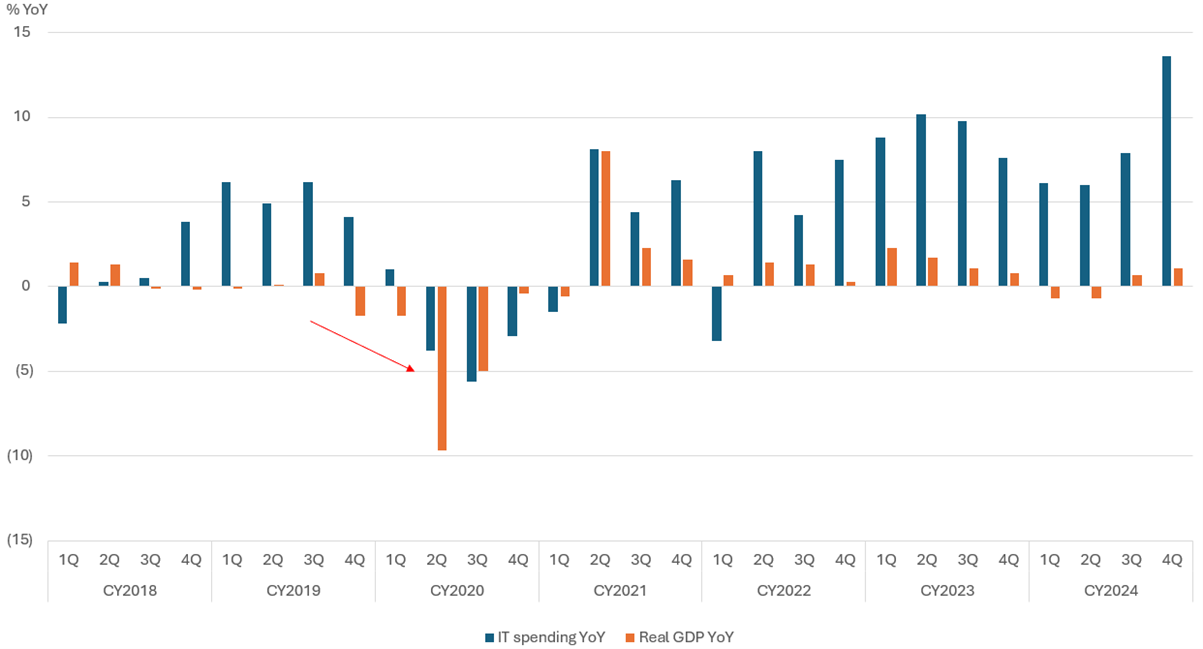

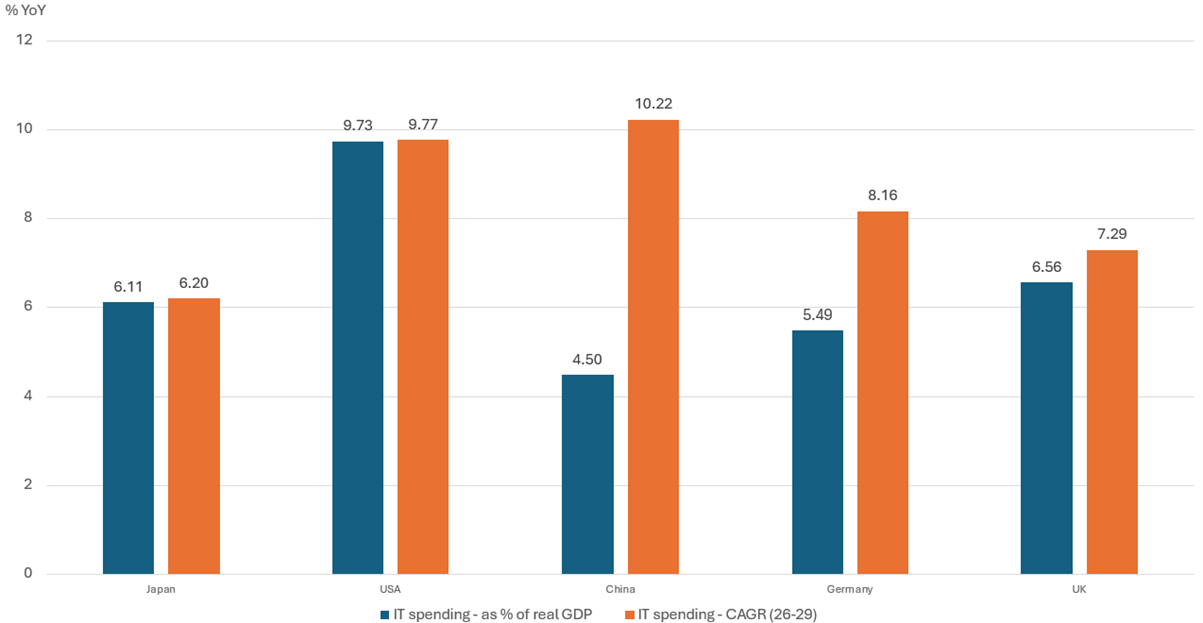

Notably, IT spending has become more of a structural growth driver post the Covid-19 pandemic unlike in the financial crisis, even as GDP growth remained subdued (Exhibit 1 and 2). Despite this uptick, Japanese IT investment as a proportion of real GDP still lags behind global peers, highlighting significant potential for further expansion (Exhibit 3).

Exhibit 1: Global Financial Crisis (2008-09) – Japan IT spending and real Japan GDP YoY

Source: Citic Securities CLSA

Exhibit 2: Covid-19 and now – Japan IT spending and real Japan GDP YoY

Source: Citic Securities CLSA

Exhibit 3: IT spending as % of real GDP and IT spending Compound Annual Growth Rate (CAGR) – Japan still has plenty of room to catch up with peers

Source: Citic Securities CLSA

Japan’s ageing population and declining birthrate have further intensified the need for automation and digitalisation. With a shrinking workforce, companies are increasingly dependent on external IT vendors to fill the talent gap and modernise operations. This has created a “seller’s market” for IT services, where demand for vendors like NEC and BayCurrent is strong. Demand is so strong that clients are often locked into long-term relationships with vendors due to the complexity and customisation of existing systems.

AI is emerging as a growth driver, supporting the longevity of this trend. Larger firms like NEC and Fujitsu are beginning to integrate AI into help desks, call centres, and consulting services, although current adoption remains modest. Smaller Japanese firms, as highlighted in discussions with smaller Japanese software companies, are still not even utilising basic tools like ChatGPT.

In summary, Japan’s digitalisation runway is significant, driven by legacy technology systems, chronic underinvestment, ageing demographics, labour shortages, and the rise of AI. The starting point for most corporates is foundational: migrating from bespoke, legacy systems to cloud-based workflows. Japan has recognised these issues and is keen to drive rapid digitalisation—its digital transformation (DX) plan is encouraging businesses to modernise IT infrastructure, adopt cloud solutions, and leverage advanced technologies for sustainable growth. This transformation is not only critical for competitiveness, but also closely linked to sustainability, as automation and digital tools help address demographic challenges and resource constraints. This creates an attractive set-up for companies that are enabling or benefitting from digitalisation.

How can investors access this trend?

- Enablers – Building the digital backbone: Companies that provide the core technologies powering digitalisation.

- Beneficiaries – Monetising digital demand: Firms that capitalise on the digital economy through content and services.

- Hybrid players – Driving and leveraging transformation: Businesses that enable digitalisation for others while improving their own efficiency.

Enablers: the picks and shovels of Japan’s digital build‑out

Disco: mission‑critical at the back end

In a more digitalised world, the semiconductor supply chain is the backbone of modern society—enabling everything from smartphones and data centres to electric vehicles and AI. At the heart of this transformation is Disco, a Japanese leader in precision cutting, grinding, and polishing equipment with dominant global share of 75-80%. Disco’s mission-critical tools are the silent enablers behind the circa one trillion semiconductor devices produced annually, underpinning the relentless march of digitalisation.

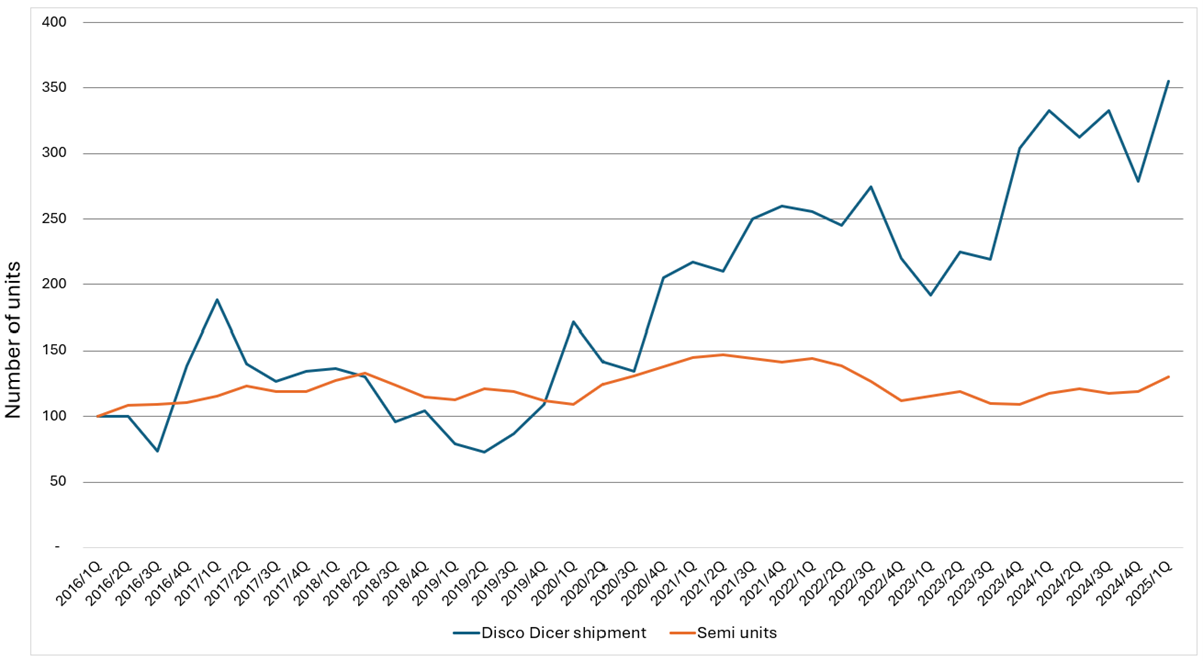

As front-end transistor scaling hits physical limits, value has shifted to advanced packaging—where the intensity of testing, thinning, cutting, and assembly per wafer is rising sharply. Disco exemplifies this shift.

Exhibit 4: Dicing equipment is seeing greater growth as complexity in semiconductor chips increases through applications in areas such as AI

Source: Jefferies, WSTS, Company data as at 10 December 2025

Wafer dicing involves the separation of individual dies from a wafer and is essential in the production of electronic devices such as microprocessors, memory chips, and sensors. The primary goal of wafer dicing is to separate the individual dies with high precision and accuracy without damaging them.

We view the company as a high‑competitive moat compounder supported by (i) dominant share (~85%) in a mission‑critical niche, (ii) exposure to structural step‑ups in packaging complexity (HBM, CoWoS, hybrid bonding, SiC), and (iii) an attractive razor‑and‑blades model (capital tools plus consumables)

Disco plays a foundational role in enabling greater digitalisation — enabling smaller, faster, and more energy‑efficient chips. For example, its technology supports AI & High‑Performance Computing through advanced packaging, the Green Transition via efficient chips for EVs and renewable systems, and Industrial IoT & automation for productivity gains across sectors.

Through these contributions, Disco plays a vital role in enabling technological progress and supporting a more digital, efficient, and sustainable global economy.

Beneficiaries: IP that can better monetise in a digital world

Nintendo: The durability of Japanese intellectual property (IP)

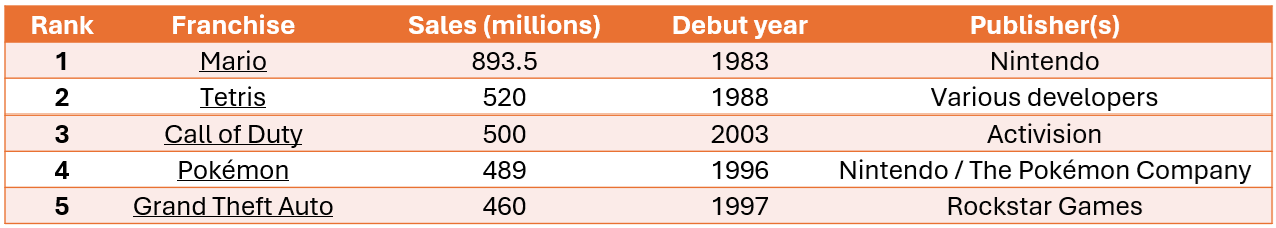

Japanese IP is extraordinary for its longevity—franchises like Pokémon (29 years), Super Mario (44 years), Dragon Ball Z (36 years), and Hello Kitty (51 years) remain cultural icons. These brands are built for durability, fan loyalty, and scalability across media. Gaming IP, in particular, thrives in a digital-first world: each iteration compounds value by blending nostalgia with fresh appeal. Digital distribution amplifies reach across games, films, TV, and merchandise, while fan ecosystems sustain engagement and spending for decades.

Nintendo exemplifies this model. Its IP – Mario, Zelda, Pokémon – has collectively generated over $100bn in lifetime revenue.1

The company is a key beneficiary from the global push in digitalisation. Nintendo’s pivot towards digital began in earnest around the launch of the Nintendo Switch in 2017. While Nintendo had offered digital downloads on previous consoles, the Switch marked a strategic shift: digital distribution became central to its business model, with a strong emphasis on eShop sales, downloadable content, and Nintendo Switch Online (NSO) memberships.

This transition accelerated during the COVID-19 pandemic, as consumer preferences shifted further towards digital purchases, and Nintendo responded by expanding its digital offerings, increasing software average selling prices (ASPs) by 20–30%, and growing its subscription base to 34 million paid NSO members (22% of the installed base).2

Figure 1: Nintendo ranks high among most valuable video game franchises

Source: (see footnotes 3-7)

Fast forward to today, the company has just launched its new Switch 2 console which comes with 8 times more storage than its predecessor and should lift digital attach rates if gamers purchase and store more software. NSO also has significant headroom versus peers like Xbox Game Pass and PlayStation Plus (which have almost ~40% penetration). Meanwhile, Nintendo’s IP flywheel is in full motion, with blockbuster game releases, cinematic successes such as The Super Mario Bros. Movie, and immersive attractions like Super Nintendo World—each reinforcing brand engagement and driving cross-selling across games, merchandise, and memberships.

In summary, as the world moves towards a more digital, connected entertainment landscape, companies like Nintendo look well-placed to benefit.

Hybrid players: automation and datafication of manufacturing

Keyence: automation on the factory floor

Keyence is both an enabler and beneficiary of digitalisation, offering exposure to factory automation and the datafication of manufacturing. Its advanced machine vision, sensors, and controls improve yield, quality, and labour productivity—cutting production costs and energy usage substantially and are critical for driving productivity and digital transformation.

Its technologies empower Japanese corporates to embed real-time data into workflows, automate inspection, and optimise processes, driving the digital transformation of manufacturing. For example, the integration of rule-based and AI techniques in Keyence’s VS series allows seamless inspection tasks that combine precision measurement with pattern recognition, while its hardware-software synergy ensures robust performance even in complex environments. The company’s deep domain expertise and proprietary image libraries also enables rapid deployment of edge AI solutions with minimal training data.

In summary, Keyence is uniquely positioned at the heart of industrial digitalisation and sustainability. Its advanced technologies not only enable manufacturers to embed real-time data, automate processes, and optimise efficiency, but also deliver material reductions in energy use and waste.

Conclusion: Japan’s digital journey is underway

Japan’s digitalisation runway is substantial, offering significant investment opportunities. By embracing digitalisation, Japanese companies are positioned to overcome demographic challenges and resource constraints, driving technological progress and supporting a more efficient, sustainable global economy. The continued transformation of the Japanese market presents compelling prospects for investors looking to capitalise on this critical shift.

We believe the digitalisation trend in Japan offers a fertile landscape for identifying quality companies with durable competitive advantages. The most compelling opportunities are found in businesses that not only enable or benefit from digitalisation, but also demonstrate strong governance, forward-thinking management, and a commitment to addressing societal challenges such as ageing demographics and resource constraints.

Sustainability and digitalisation are increasingly intertwined: automation, cloud adoption, and AI are not just drivers of efficiency, but also critical tools for building resilient, future-ready business models. Companies that successfully navigate this transition—modernising legacy systems, investing in innovation, and embedding sustainability into their operations—are well positioned to deliver enduring value for all stakeholders.

As long-term investors, we seek out these high-quality franchises with robust moats, strong balance sheets, and the vision to adapt and thrive in a rapidly changing world. Japan’s digital journey, underpinned by supportive policy and a growing recognition of the need for sustainable growth, presents a unique opportunity to invest in the businesses that are shaping a more digital, efficient, and sustainable global economy.

1Source: Alibaba, ‘Best Selling Franchise of All Time Revealed: $150B Pokémon Dominates Over Star Wars & Disney’, 29 November 2025

2Source: Extreme Tech, ‘Nintendo Bumps Up Prices for Original Switch Consoles’, 5 August 2025.

3Source: (Mario) Best-selling videogame series”. Guinness World Records. June 10, 2025. Retrieved November 5, 2025.

4Source: (Tetris) “About Tetris®”. Tetris. Archived from the original on December 3, 2024. Retrieved December 21, 2024.

5Source: (Call of Duty) Park, Gene (October 30, 2024). “At half a billion sales, Call of Duty is as good as it’s ever been”. The Washington Post. Retrieved November 1, 2025. The Call of Duty series has sold more than 500 million copies to date, publisher Activision-Blizzard told The Washington Post.

6Source: (Pokémon) “Pokémon in Figures”. The Pokémon Company. March 2023. Retrieved May 23, 2025

7Source: (Grand Theft Auto) “Investor Presentation – November 2025” (PDF). Take-Two Interactive. November 6, 2025. Retrieved November 7, 2025.

Advanced packaging: Techniques that connect multiple chips/tiles within a package (e.g., HBM, chiplets), increasing back‑end process intensity.

Back‑end semiconductor equipment: Tools used after front‑end wafer fabrication—grinding, dicing, testing, assembly—critical for yield and performance.

Compound Annual Growth Rate (CAGR) is a financial metric showing the average annual growth of an investment over a specific time period (longer than a year).

Dicing equipment refers to specialized machines that precisely cut materials, most commonly semiconductor wafers into individual chips (dies), but also food into small cubes, using methods like diamond blades, lasers, or plasma to achieve uniform sizes and separation for assembly or cooking.

Front-end transistor scaling refers to the process of reducing the physical dimensions of transistors during the front-end-of-line (FEOL) semiconductor manufacturing process, which involves forming the active components of integrated circuits on a silicon wafer. The primary goal is to improve performance, increase transistor density, and reduce power consumption, in line with Moore’s Law.

Wafer dicing is the critical semiconductor manufacturing step of cutting a large silicon wafer, containing many integrated circuits (dies), into individual, functional chips using precise methods like diamond-tipped blades, lasers, or plasma, separating them along pre-defined “streets” so they can be packaged and used in electronic devices.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- The Fund follows a growth investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.