In a year of many surprises for financial markets, one of the biggest may be the rally in non-U.S. stocks. While the S&P 500 Index is up little more than 2% year to date in 2025, the MSCI All Country World Index ex USA has gained 16% – a sharp reversal of recent past performance for the indices.[i]

What’s more, there are signs ex U.S. equities could have more to gain, thanks to still-attractive valuations and structural changes resulting from Trump administration policies. For investors – many of whom started 2025 overweight U.S. stocks – these signs may be worth heeding.

Outside the U.S., a renewed focus on growth

In recent years, non-U.S. equities have sometimes started off the calendar strong, only to see their gains eventually trounced by high-growth U.S. peers. But increasingly, there are reasons to believe that pattern might break.

For one, shifting trade policies and geopolitical tensions are leading more governments to roll out fiscal stimulus. Defense spending in Europe, for example, has been rising since the Russia-Ukraine war began in 2022 and could be set to dramatically increase following a NATO summit in late June, when European countries could pledge to lift defense spending to between 3.5% and 5% of gross domestic product (GDP), up from an average of about 2% today. That spending could also have a multiplier effect on Europe’s GDP as hiring and capital investment ramp up. Indeed, in March, Germany voted to relax its “debt brake” for defense spending and earmarked €500 billion (~11% of GDP) for infrastructure projects over the next 12 years. More broadly, we are seeing new and increased urgency from leaders such as Mario Draghi, former European Central Bank (ECB) president, and Ursula Von Der Leyen, president of the European Commission, pushing the case for increased competitiveness of European firms via consolidation and innovation.

China, meanwhile, has been rolling out stimulus packages to revive domestic consumption and raised its fiscal deficit target this year to 4% of GDP, up from 3% in 2024. Furthermore, in pursuit of technology independence, Beijing is starting to show more support for its private-sector tech companies. That includes the announcement of a 1 trillion yuan ($139 billion) state-backed venture capital fund to help advance artificial intelligence and expanded credit resources for tech- and science-focused companies.

A supportive backdrop for stocks

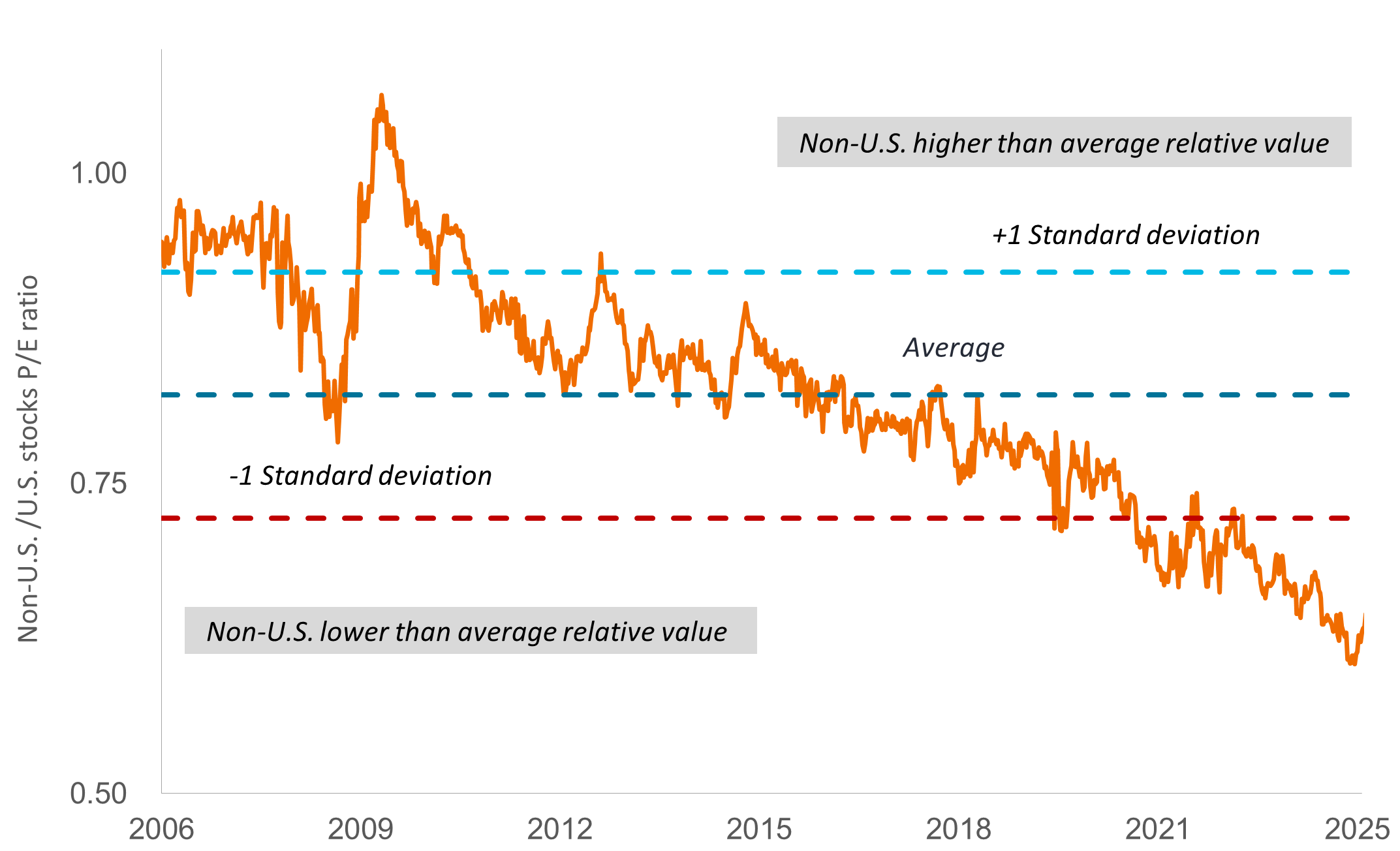

These policy changes are occurring at the same time financial market conditions are also shifting. On a price-to-earnings basis, U.S. stocks trade at a significant premium to ex U.S. peers (Exhibit 1). Additionally, uncertainty around tariffs and the credit worthiness of U.S. debt has put upward pressure on long-term Treasury yields, further limiting U.S. stocks’ relative attractiveness.

Exhibit 1: Overseas equities still trade at a deep discount to U.S. peers

Relative forward price-to-earnings (P/E) ratio of U.S. and non-U.S. stocks

Source: Bloomberg, data from 6 January 2006 to 13 June 2025. P/Es are based on forward 12-month estimated earnings. U.S. stocks = S&P 500 Index. Non-U.S. stocks = MSCI All Country World Index ex USA Index, which captures large- and mid-cap representation across 22 developed markets countries (excluding the U.S.) and 24 emerging markets countries.

Trump administration policies have also complicated the outlook on U.S. inflation and, consequently, the Federal Reserve’s ability to lower interest rates. By contrast, other major central banks have been loosening monetary policy. This month, the ECB cut rates for the eighth time in a year, bringing its policy rate down to 2% – more than two percentage points lower than in the U.S. And last month, China’s central bank lowered several of its benchmark lending rates, part of monetary easing shift that began in 2024.

Staying mindful of risks

Even as prospects for ex U.S. stocks improve, risks remain. Uncertainty around tariffs could slow the global economy. In its spring forecast, the European Commission lowered its growth outlook for the European Union to 1.1% for 2025. Last fall, it had projected 1.5% growth. The weakening of the U.S. dollar – which for now, has helped to prop up returns for investors in non-U.S. stocks – could also make the region’s exports less competitive and reduce earnings on a currency-adjusted basis.

Ongoing trade tensions have also weighed on China’s economy. In May, Chinese manufacturing activity fell into contractionary territory as exports slowed. Weak consumer demand and a prolonged property market downturn are further headwinds. And in Japan, GDP contracted from January to March, the first quarterly pullback in a year.

Opportunities for investors

Against this backdrop, we believe investors should be opportunistic about non U.S. equities – but selective. In our view, that means considering European defense and industrial firms that could benefit from increased government spending, particularly in Germany, where manufacturing capacity must be aggressively ramped up to meet defense goals. European banks also look well positioned. These companies have spent years building capital reserves that now are being returned to shareholders in the form of dividends and share buybacks. Prospects for banking-sector deregulation have also been rising amid a deregulatory push in the U.S., which could further boost profitability. Just this month, the ECB announced it would speed the process for approving bank share repurchases.

Conversely, we would steer investors away from companies with long supply chains, such as automakers, which we think face a wider range of outcomes from tariffs. As an alternative, investors might favor companies with subscription-based business models, which have minimal exposure to trade policies and therefore could prove more resilient in the current environment. Chinese Internet companies are also trading at some of the lowest valuations we’ve seen. We think these stocks could rerate higher should fiscal stimulus prop up domestic consumption (driving online ad spending) and government support for advanced technology continues. Finally, in Japan, select financial services firms could benefit as governance reforms drive capital markets activity such as divestures (which could continue irrespective of the macroeconomic backdrop) and rising wages and inflation revive demand for financial management services.

[i] Bloomberg, data from 31 December 2024 to 17 June 2025.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

MSCI All Country World Index℠ reflects the equity market performance of global developed and emerging markets.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

IMPORTANT INFORMATION

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.