As so often, the long-term most impactful pieces of news are underreported and find little attention in the day-to-day hectic noise of the stock market. We saw this in a recent Bloomberg story on the European Central Bank (ECB), a piece that reflects the current situation in Europe and potential positive changes for its key institutions. This is a trend that, in our humble opinion, has been extremely rare over the last decade(s), but which we are now seeing on an almost weekly basis.

The focus on this specific update was that the ECB has convened a task force that will look for ways to simplify banking rules. The move is believed to be in response to a controversial letter from the central bank governors of Germany, France, Italy and Spain, directed to European Commission Financial Services Commissioner Maria Luis Albuquerque, which criticised European banking rules as “unduly complex”. Their argument is for a “comprehensive assessment” to ensure a “level playing field” with other major jurisdictions like the US.

A huge wall of money is trapped by tight banking regulation

As previously commented here, we agree with the statement from Société Générale’s CEO that Europe’s ‘gold-plating’ and layering of regulations unduly traps around €100 billion of bank CET1 capital in balance sheets (Bloomberg, 6 February 2025). This equity capital exists but cannot be put to productive use due to overzealous interpretations of rules by the European banking regulator. Other senior managers at European banks tell us the same story. Assuming a 13-14% average CET1 ratio across the sector, this could be equivalent to a €700bn boost to risk-weighted assets if used productively. EU GDP currently stands at around €17.9tn. Releasing this trapped equity capital and putting it to productive use via new banking business could unleash a 4% GDP boost for the bloc.

Indications that the EU’s most powerful central bank governors are ready to oppose the ECB’s regulatory arm signals that EU member states are keen to address regulatory overreach. We find it especially notable that Bundesbank Governor Joachim Nagel is one of the leaders pushing back, given the European banking regulator – an arm of the ECB – is chaired by one of the Bundesbank’s own (Claudia Buch). Their respective headquarters are just a few minutes walking distance apart in the city of Frankfurt.

Pressure is aligning with governments to push for reform

Pushing ahead, despite the inevitable prospect of debates, clashes and culture shocks, this issue is too important to let go. The timing, now that the new German government has been formed, suggests new Chancellor Friedrich Merz is on the side of the reformers.

As an aside, we previously also highlighted that the ECB had been challenged in the Court of Justice of the European Union (CJEU) by two of the most powerful European banks – UniCredit and Santander. The former lawsuit was launched in June 2024, the latter in February 2025. In our experience, it is highly unusual for banks to sue their regulator over regulatory decisions. Together with the above-mentioned March 2025 statement by Société Générale’s CEO, it suggests that discontent with the European banking regulator has been building for some time, given that it is increasingly boiling over into the public sphere. We find this extremely encouraging from a European stock market perspective.

Deregulation is the key to unlock growth in Europe

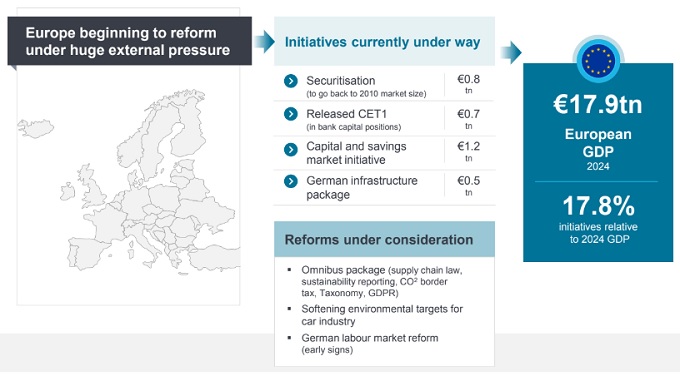

To recall, we have identified medium-term initiatives that collectively have the potential to boost European GDP by nearly 18% (Exhibit 1). With the exception of the German infrastructure package, most of this would be driven by capital and savings that already exist in Europe, independent of US tariff negotiations or peace in Ukraine. It is our view that it can be unleashed by deregulation, which is beginning to happen now.

Exhibit 1: Winds of change for European reform

Source: Janus Henderson Investors Analysis, as at 16 April 2025.

While we expect any changes to take some time to feed through into the economy, very little of this is presently baked into investors’ minds, portfolio positioning or European stock valuations. On top of the quantifiable initiatives, there are also serious regulatory reforms underway that we cannot put a figure on, but which can certainly have a positive impact on the economy, and thus on the stock market. From this starting point, we feel the prospects for longer-term European stock market performance seem encouraging.

Balance sheet: Financial statement that provides a statement of a company’s assets, liabilities and equity at a specific point in time.

CET1 capital: A bank’s highest quality of regulatory capital, readily available to absorb losses.

Risk-weighted assets: This is a minimum financial requirement for capital that banks must hold as a cushion against potential losses.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.