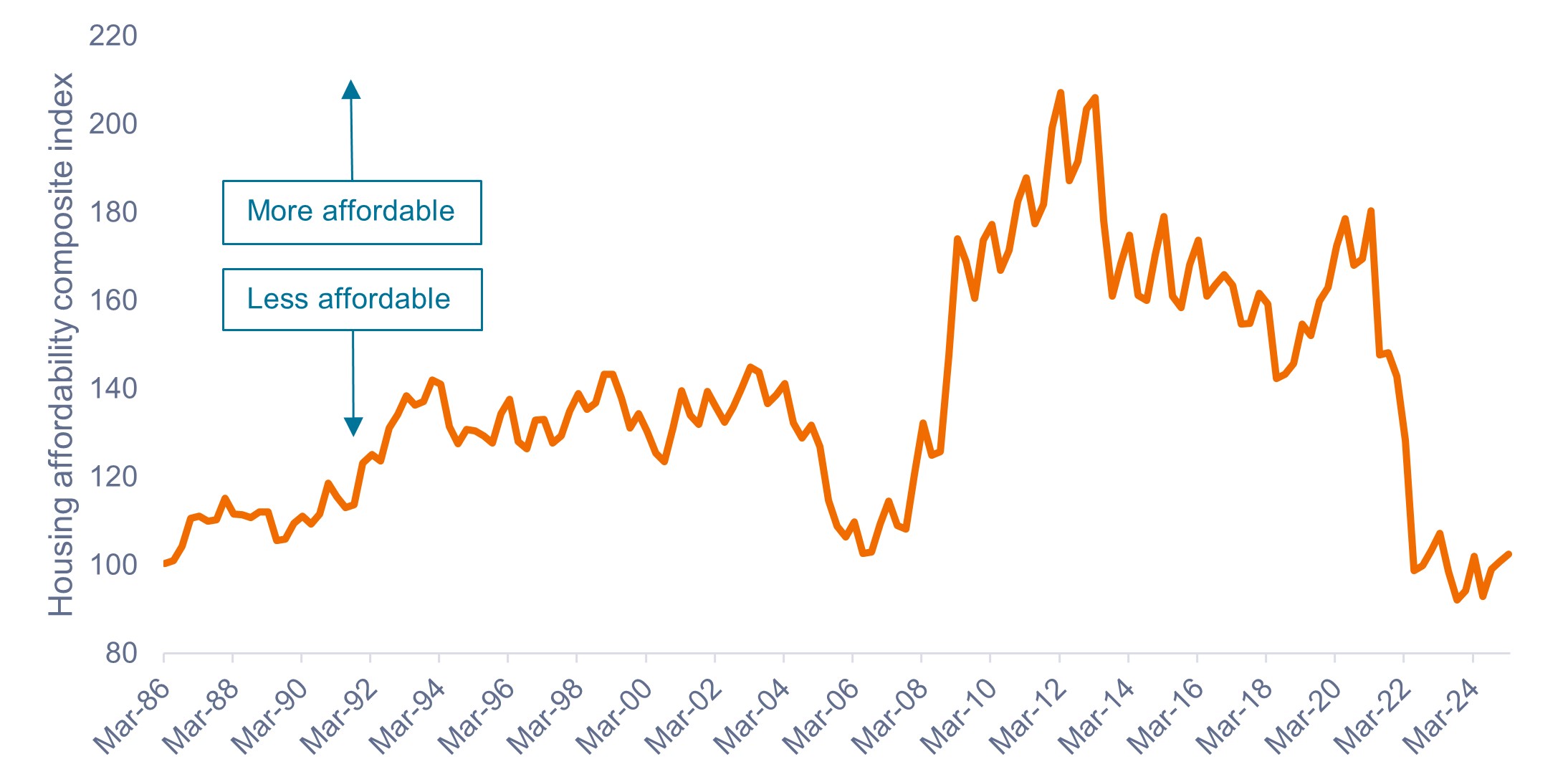

A sharp and protracted rise in home prices following the onset of COVID, coupled with much higher mortgage rates since 2022, has brought U.S. housing affordability down to historically low levels, as shown in Exhibit 1.

Exhibit 1: Housing affordability composite index (1986 – 2025)

Higher prices and interest rates have brought housing affordability down to all-time lows.

Source: National Association of Realtors, as of 31 March 2025.

Talk of high mortgage rates, poor affordability, and slowing home sales has dominated news headlines, causing some investors to feel apprehensive about two key barometers for the health of the U.S. economy: The strength of the U.S. consumer and the state of the housing market.

In our view, these data points tell only a sliver of the full story.

According to our analysis, the U.S. consumer and the broader housing market remain in a strong position despite headwinds, for three key reasons.

1. Affordability challenges do not impact all households

While poor housing affordability – particularly if persistent – can be problematic from a socioeconomic standpoint, the situation appears less bleak from an investor perspective, for a couple of key reasons.

First, affordability challenges impact only a small percentage of the total number of homeowners in the U.S. on an annual basis.

The roughly 4 million homes sold in the U.S. every year represent less than 5% of the total inventory of 80+ million homeowner-owned, single-family homes. By implication, over 95% of the market does not transact (i.e., buy or sell a home) during a 12-month period, sheltering those homeowners from current market conditions.

Second, existing homeowners are less impacted by affordability challenges than first-time buyers.

This is especially true for homeowners who have owned a home for longer than five years. While first-time buyers might be entering the market at a challenging time, existing homeowners would have ostensibly benefitted from rising prices by building up equity in their current home that can be unlocked when purchasing a new home.

In summary, first-time homebuyers and lower-income households are likely to be adversely impacted by current affordability issues, yet this subset represents only a small slice of the entire universe of U.S. homeowners.

2. The power of fixed rates and the borrower’s put option

When it comes to navigating higher interest rates, U.S. mortgage borrowers hold all the cards.

Existing borrowers are largely shielded from rising rates by a) the long-term nature of most mortgage loans (typically 30 years), b) fixed interest rates, and c) the borrower’s ability to – without penalty – pay off their loan at any time for any reason, or to refinance if rates fall below their existing rate.

Quite simply, this is the power of the put option: U.S. borrowers can stay in their existing fixed-rate mortgage if rates rise, but they maintain the option to refinance to a cheaper loan if rates move lower, which is what happened en masse in 2020 and 2021.

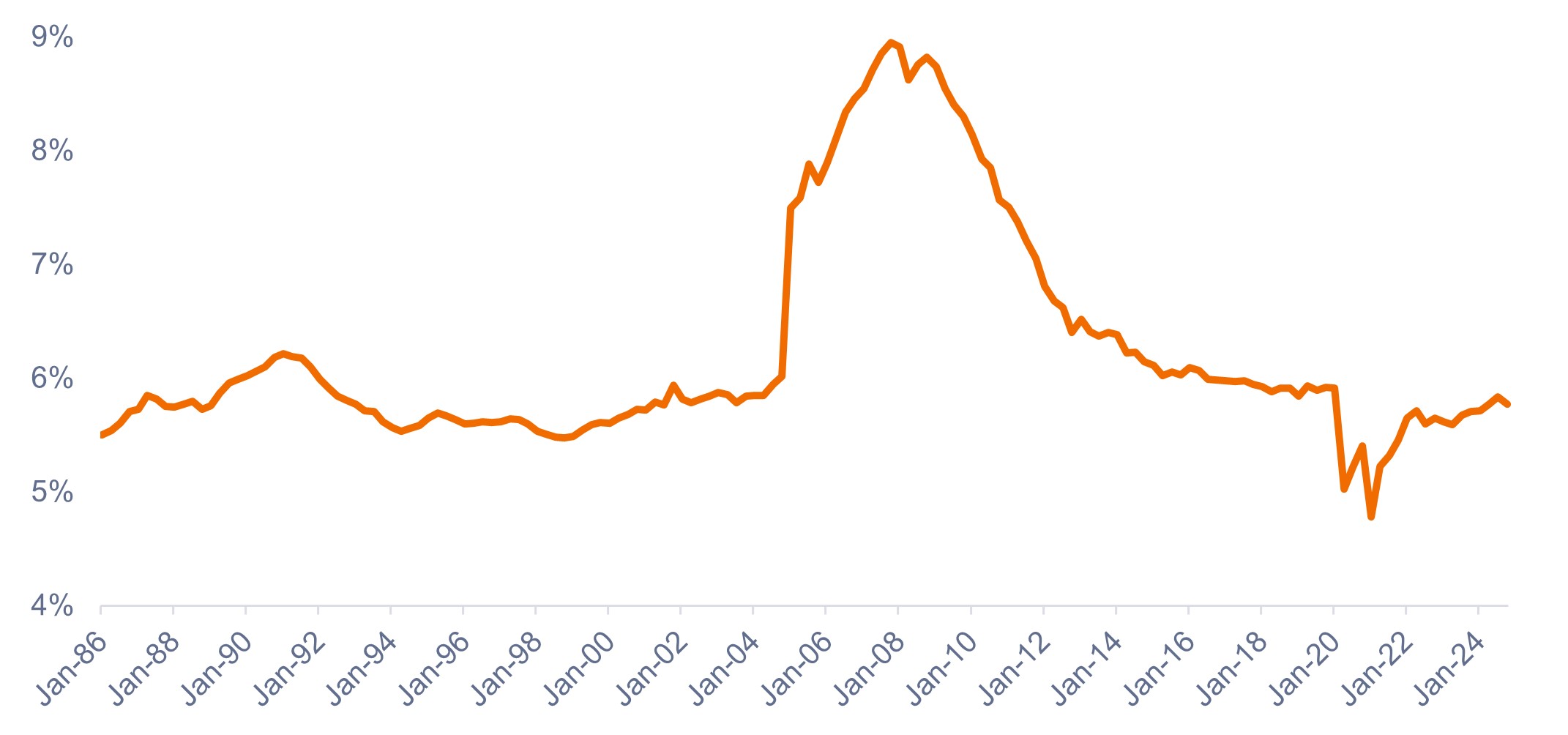

As shown in Exhibit 2, borrowers typically exercise their option to refinance when mortgage rates fall, resulting in a drop in the effective rate on outstanding mortgage debt. But when rates rise, borrowers are incentivized to hold onto their current fixed-rate mortgage, meaning rising rates have a much smaller impact.

Exhibit 2: Current 30-year mortgage rate vs. effective rate on mortgage debt outstanding (1986 – 2025)

The effective rate on mortgage debt outstanding has not risen materially.

Source: Bloomberg, Bureau of Economic Analysis, Freddie Mac, as of 31 March 2025.

3. U.S. homeowners do not appear to be house poor

Despite the rise in home prices and interest rates, U.S. households do not appear to be “house poor”1, as shown in Exhibit 3.

While the data for lower-income households and first-time home buyers might look quite different, most U.S. households appear to be in good shape, due to a combination of higher incomes, coupled with most homeowners having locked in extremely low mortgage rates in 2020 and 2021.

Exhibit 3: Mortgage debt service ratio (1986 – 2024)

U.S. homeowners are not overspending on housing despite higher prices and rates.

Source: Board of Governors of the Federal Reserve System, as of October 2024.

What it means for investors

The U.S. consumer continues to show resilience amid higher interest rates and less affordable housing, with debt service ratios still below their long-term averages. And with inflation cooling and rate cuts on the way, there may be some respite on the horizon.

As a result, we maintain a positive outlook on securitized consumer debt sectors such as asset-backed securities (ABS) and residential mortgage-backed securities (RMBS). We believe there are opportunities to find high-quality assets within ABS and RMBS that offer attractive yields on both a relative and absolute basis.

Additionally, agency mortgage-backed securities (MBS) continue to trade cheap relative to corporate sectors, while prepayment risk (the primary fundamental risk for MBS) remains near historical lows due to current mortgage rates being so much higher than the effective rate on outstanding mortgage debt.

1 Being “house poor” means spending a large portion of one’s income on housing costs, leaving little money for other essential expenses, savings, or discretionary spending.

Prepayment risk is the risk that a fixed-income securities investor will receive their principal prematurely, resulting in lost future interest payments.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

- The Fund invests in Asset-Backed Securities (ABS) and other forms of securitised investments, which may be subject to greater credit / default, liquidity, interest rate and prepayment and extension risks, compared to other investments such as government or corporate issued bonds and this may negatively impact the realised return on investment in the securities.