A compelling yield and diversification opportunity in BBB CLOs

Income is set to be a primary driver of fixed income returns as credit spreads across traditional corporate markets sit at or near historical tights. In such an environment, we are reminded that the starting yield of an investment is the best indicator of future returns.

As part of the investment‑grade universe, BBB‑rated CLOs offer high‑yield‑comparable income through a higher‑quality structure, with additional diversification benefits from floating‑rate coupons. This combination enables investors to pursue income and diversification while mitigating interest rate risk and avoiding the single name vulnerabilities embedded in lower quality corporate credit.

Figure 1: Spreads and yields remain attractive relative to high yield corporate bonds

Source: Data as at 31 December 2025. Janus Henderson Investors, JP Morgan, ICE indices, Bloomberg. Showing JP Morgan BBB CLO Index, ICE BofA US High Yield Index. 1 For CLO, based on discount Margin, for corporate credit, Swap OAS. 2 For CLO, Yield to Maturity is represented. For corporate credit, Yield to Worst is presented. 3 Credit indices based on effective duration. For BBB CLO, based on estimates. Yields may vary and are not guaranteed. The above are the team’s views and should not be construed as advice and may not reflect other opinions in the organization.

Some may argue that – while offering similar credit spread and total yield – BBB CLOs have longer spread duration and therefore are exposed to higher potential market volatility than high yield credit. While this is true mechanically, we believe it is not the right lens through which to assess risk.

The more relevant focus is on fundamentals. BBB CLOs derive resilience from structural features – including subordination, performance triggers and collateral diversification (which we address below) – that materially reduce idiosyncratic default risk at the tranche level. As a result, periods of price volatility driven by shifts in risk sentiment have not historically translated into permanent capital impairment.

This distinction matters from a portfolio perspective. High yield bonds and leveraged loans embed single name default risk that can lead to lasting portfolio net asset value (NAV) erosion as credit conditions tighten. BBB CLOs, by contrast, transform and absorb underlying loan defaults within the securitisation structure, ensuring the stability of outcomes at the tranche level for investors.

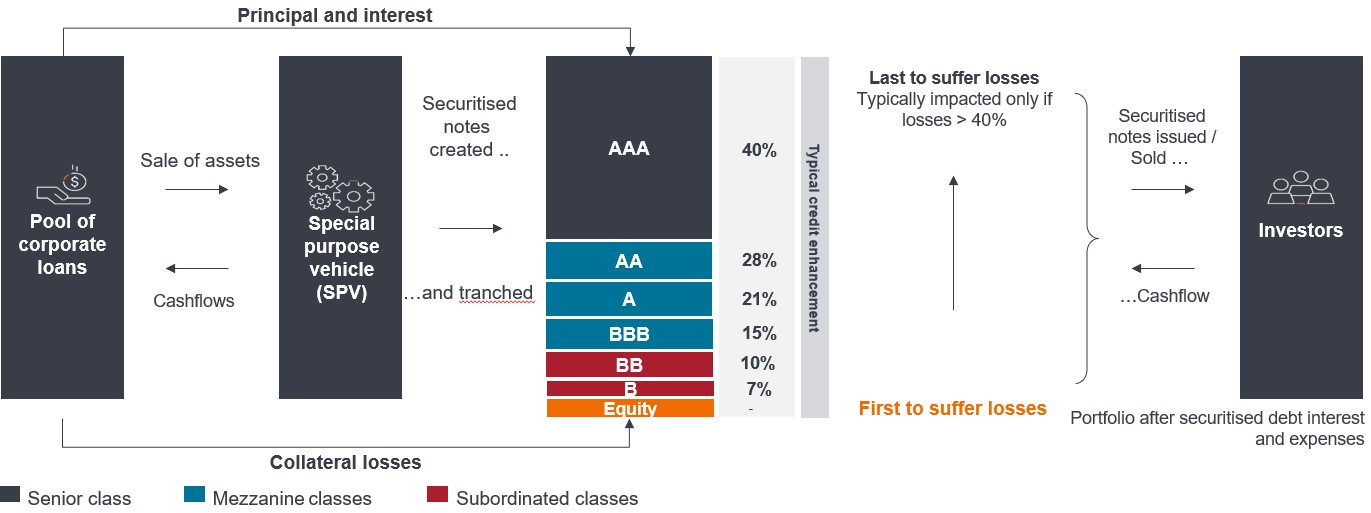

Structural safety from defaults through securitised CLO structure

The uniqueness of a securitisation is the degree of protection embedded within the structure. Unlike direct exposure to loans or high yield bonds, investors are not reliant on the credit performance of a single borrower. Instead, returns are supported by multiple layers of structural protection designed to shield senior tranches from collateral impairment.

Some safety features for CLOs are as follows:

- Rules‑based documentation: CLO transactions are governed by detailed and highly prescriptive legal documentation that defines how interest and principal cash flows are distributed across the capital structure.

- Cash‑flow waterfall and subordination: Payments flow sequentially from the most senior tranches to the most junior, ensuring higher‑rated tranches receive priority in both interest and principal. This is a form of credit enhancement[1].

- Performance‑based triggers: Embedded tests and covenants redirect cash flows to more senior bondholders if collateral performance deteriorates, providing an additional layer of protection.

- Built‑in diversification: Portfolio concentration limits restrict exposure to individual borrowers, industries and lower‑quality credits, preventing any single loan from materially impacting overall tranche performance.

A typical BBB tranche benefits from approximately 15% subordination, meaning losses must first be absorbed by equity, BB and single B tranches. Using conservative assumptions – such as a 55% recovery rate on defaulted loans – cumulative defaults would need to reach around 33% before a BBB tranche incurs its first unit of principal loss. This calculation excludes the mitigating impact of excess spread captured within the structure. Excess spread provides an additional buffer – the surplus income from the underlying loan portfolio after paying all interest expenses and operating costs of the CLO structure.

Figure 2: CLO structure and credit enhancement

Source: Janus Henderson Investors. For illustrative purposes only. These credit enhancement figures are illustrative of the credit enhancement available in a European CLO.

Turning to a real-life example, First Brands, a default in the loan market, highlights how investment structure can transform outcomes. Loans that suffer severe price impairment can be damaging when held directly. Within a CLO, however, the same default may have no observable impact at the BBB tranche level. This is due to the combination of subordination in the structure and diversification within the CLO itself, which holds 100– 300 underlying loans, depending on jurisdiction. A CLO strategy also adds diversification at the portfolio level across many CLO deals and managers, which we also discuss later.

In this context, default risk is transformed from a portfolio level concern into a structural one, where outcomes are governed by predefined rules rather than credit events at the individual issuer level. Investors can access elevated yields in CLOs while materially reducing the risk of permanent capital loss from idiosyncratic defaults – a key distinction relative to high yield and loan allocations.

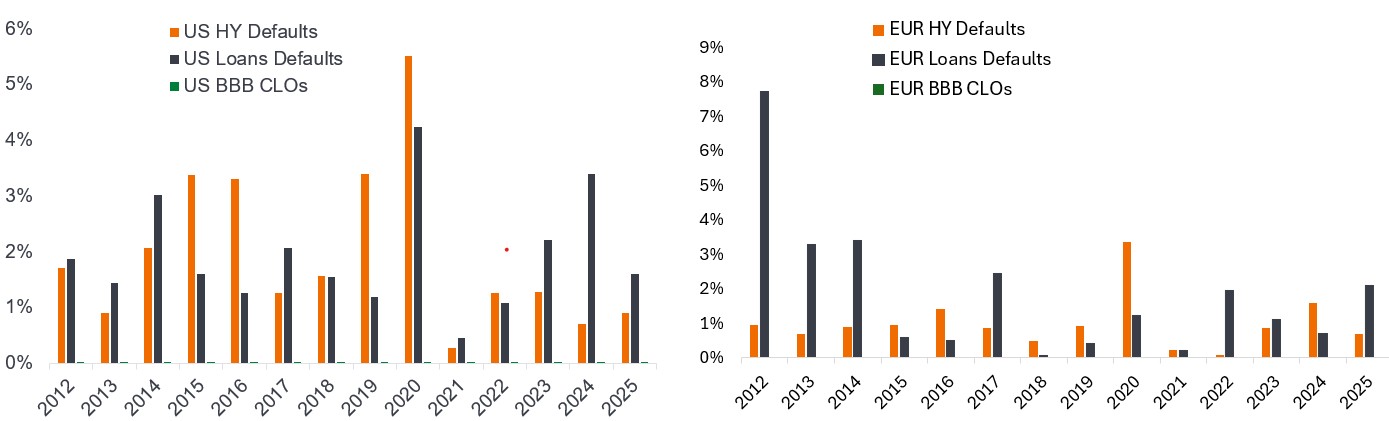

These features have translated into a strong historical record for BBB tranches. Since the Global Financial Crisis (GFC), BBB rated CLO tranches have experienced no realised defaults, even during periods of market stress, such as the pandemic outbreak in 2020. This stands in contrast to the meaningful defaults in high yield and loans (Figure 3).

Figure 3: No historical defaults in BBB CLOs vs HY and loans post-GFC

Source: UBS, Janus Henderson Investors, as at 31 December 2025.

Past performance does not predict future returns.

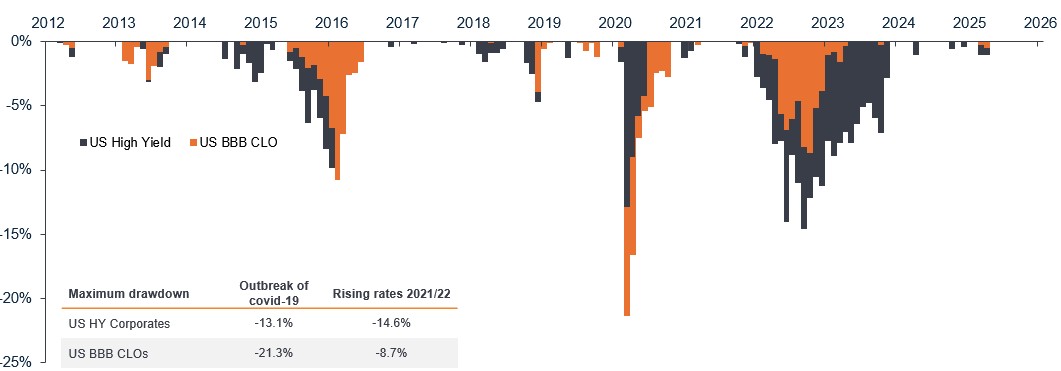

Comparable volatility to high yield but better cumulative long-term returns

While investment grade (IG) BBB CLOs exhibit solid fundamentals and structural protection, they are not immune to market volatility. Historically, price fluctuations in BBB CLOs have been broadly comparable to those observed in high yield credit, with periods of pronounced mark to market volatility during systemic market stress.

The COVID 19 sell off in 2020 provides a useful reference point. During this period, BBB CLO prices declined, reaching an average price of 75 (a 25% discount to par) as liquidity premia widened and risk was repriced across markets. Importantly, these moves were driven by market dynamics rather than structural impairment.

In periods of stress such as these, the primary dislocation occurs in bid offer spreads – the cost of liquidity – rather than the ability to transact. CLO prices normalised relatively quickly as market confidence returned. This reflects the broadening depth and liquidity of the CLO market – with around 100 market makers in the US and 19 in Europe – and the transparency of pricing, underlying collateral and structural protections.

Figure 4: Drawdowns: similar mark-to-market risk compared to high yield credit

Source: Janus Henderson Investors, Bloomberg, JP Morgan, as at 31 December 2025.

Note: Chart showing cumulative drawdowns. US BBB CLOs: J.P. Morgan Collateralized Loan Obligation BBB Index. US HY Corporates: ICE BofA US Corporate Index.

Drawdown returns from 30 December 2011 to 31 December 2025.

Past performance does not predict future returns.

The floating rate nature of CLOs also influences volatility patterns. When both interest rates and credit spreads are on the move, floating rate instruments have historically experienced less severe drawdowns than fixed rate high yield bonds. This was evident during the rate volatility of 2022–2023 and remains key to portfolio construction. Particularly given rate uncertainty and increasingly unsynchronised rate cycles globally in 2026 and beyond.

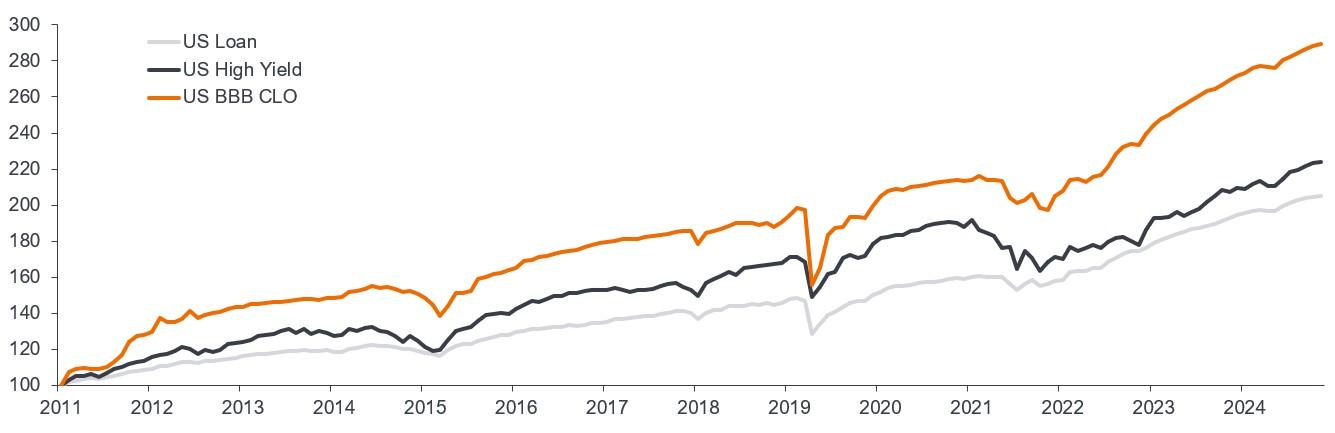

For long-term investors, cumulative performance is a more relevant metric than short term drawdowns. Over extended periods, BBB CLOs have delivered higher cumulative total returns than both high yield bonds and leveraged loans (Figure 5). This outcome reflects the elimination of permanent losses associated with corporate defaults and restructurings, which can weigh heavily on returns in traditional credit.

Figure 5: BBB CLOs have outperformed high yield and loans over the long term due to reduced idiosyncratic risk

Cumulative performance based at 100 (December 2011 – October 2025)

Source: Janus Henderson Investors, JP Morgan, ICE, S&P UBS as at 30 September 2025.

Note: Indices used: JP Morgan BBB CLO Index, iBoxx High Yield Index, JP Morgan Leveraged Loan Index.

Past performance does not predict future returns.

Fundamentals still matter in BBB CLOs, requiring an active, disciplined approach

Although structural protections significantly reduce default risk at the tranche level, fundamental analysis remains critical for BBB CLO investing. As investors move lower down the capital structure of a CLO, sensitivity to collateral quality, manager behaviour and deal documentation increases.

Ergo, one of the determinants of performance is the quality of the CLO manager, responsible for actively selecting, managing and monitoring the portfolio of loans that sit within a CLO. Market convention categorises managers into tiers based on experience, underwriting discipline, risk management and historical performance through stress scenarios. At Janus Henderson, we have a more conservative view on risk. This translates to consistency across our CLO strategies, with a common bias toward better-quality deals and higher tier (more defensive) managers, which tend to show lower exposure to weaker credits and higher average loan prices. These attributes can enhance performance resilience during periods of market dislocation where price dispersion increases.

Effective CLO analysis, in our view, rests on a comprehensive underwriting framework comprising the following:

- Collateral assessment – including borrower fundamentals, industry exposures, and ratings migration risk.

- Counterparty and manager review – evaluating investment processes, monitoring capability and historical treatment of bondholders.

- Structural analysis – focusing on covenants, triggers and cash‑flow diversion mechanisms that protect senior tranches.

- Cash‑flow modelling – using stress scenarios to assess default risk in the most severe scenarios and long‑term return potential.

Reflecting our conservative view, we prefer stronger collateral pools, liquid positions and robust structures that provide adequate compensation for risk. In severe market dislocations, tactical exposure to lower quality investments may be justified, but such positioning is typically opportunistic and temporary.

A growing global opportunity set for CLO investors

Scale and experience materially enhance the effectiveness of selecting opportunities in the IG CLO space. A global securitised credit platform enables access to a broader opportunity set, early visibility into new issuance – such as in the US market from Europe – and superior execution across primary and secondary markets. It also allows investors to allocate capital dynamically between regions as relative value shifts.

The expansion of the investible universe for European investors broadens this opportunity. An increasing proportion of CLOs issued in non EU jurisdictions – such as the US – are now structured to comply with European securitisation regulations. As a result, the eligible global investment grade CLO universe, spanning AAA through BBB tranches, is now estimated at approximately US$545 billion[2]. BBB tranches typically represent around 7% of a CLO’s capital structure, while high-quality IG tranches collectively account for roughly 90% of the overall CLO market[2]. Accessing this global opportunity set is central to capturing the most compelling relative value as it emerges to optimise carry and long-term returns.

Reshaping credit exposure through BBB CLOs

BBB rated CLOs occupy a distinct position within the broad fixed income universe. They offer yields comparable to high yield credit, but with an IG profile, floating rate exposure and structural protections that significantly mitigate default risk. While price volatility can be comparable to that of high yield bonds, historical evidence suggests that cumulative returns have been superior across full market cycles.

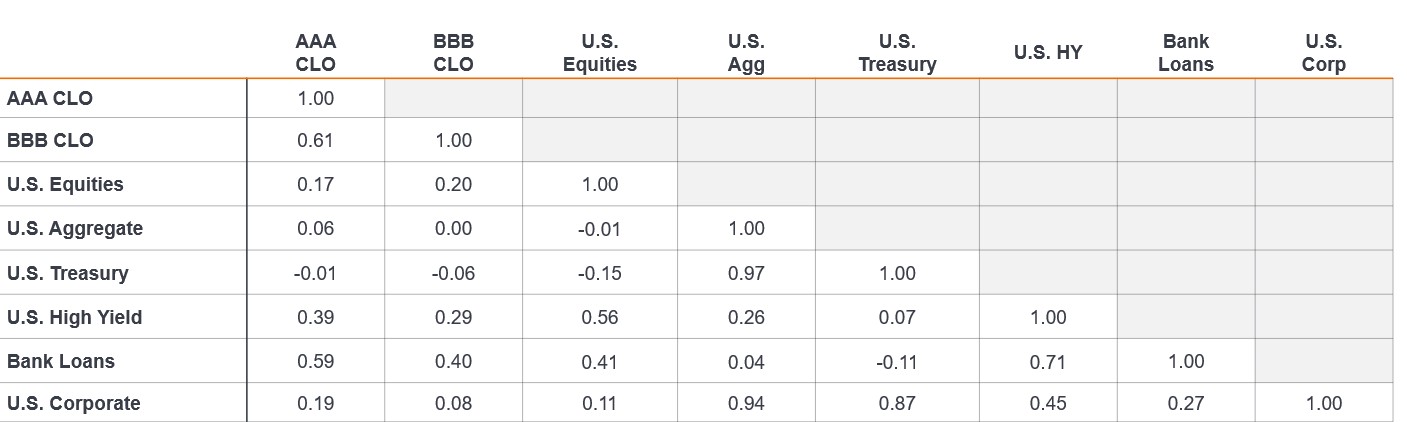

In an environment where income is once again central to fixed income outcomes, and where dispersion and refinancing risk are rising, BBB CLOs provide a way to reshape credit exposure. This is particularly crucial as the importance of diversification (Figure 6) rises in a late-cycle credit environment of tight credit spreads, where diversification across risk types matter. By replacing single name default risk with diversified, rule based cash flows, BBB CLOs offer a measured and structurally robust pathway to sustainable income generation over the long term.

Figure 6: CLOs offer diversification benefits with low correlations to both US equities and US fixed income asset classes

Source: Bloomberg, JP Morgan, as of 30 September 2025.

Notes: Monthly correlations for the 10-year period ended June 30, 2025. Indices used to represent asset classes: AAA CLOs (J.P. Morgan CLO AAA Index), BBB CLOs (J.P. Morgan CLO BBB Index), US Equities (S&P 500 Index), US Aggregate (Bloomberg US Aggregate Bond Index), US Treasury (Bloomberg US Treasury Index), US High Yield (Bloomberg US Corporate High Yield Index), Bank Loans (Morningstar LSTA US Leveraged Loans Index), US Corporate (Bloomberg U.S. Corporate Index), Agency MBS (Bloomberg US MBS Index), ABS (Bloomberg US Agg ABS Index), CMBS (Bloomberg US CMBS Investment Grade Index).

Footnotes

[1] Credit enhancement is used in securitisation to improve the credit quality and ratings of the debt tranches.

[2] Source: Janus Henderson Investors, JP Morgan CLO Factbook, as at 30 September 2025.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.