Looking beyond rates to earnings

As companies adapt to higher rates and inflation moderates, Portfolio Manager Jeremiah Buckley explains why he believes earnings will now be key to market growth.

4 minute read

Key takeaways:

- Higher rates will eventually have broad impacts across the economy; however, the correlation between rates and market valuation may not be as strong as some perceive.

- Indeed, we’ve seen multiple expansion this year despite significantly higher rates – albeit driven primarily by a handful of stocks.

- Ultimately, stock prices follow earnings, and we believe several factors can drive earnings growth despite higher rates and a complicated market environment.

Like many others, we believe rates will remain structurally higher over the coming years than over the last decade, which will have considerable effects across the economy. Contrary to the mainstream sentiment, however, we think the correlation between higher rates and valuations isn’t as strong as perceived.

Will rates drive market valuation?

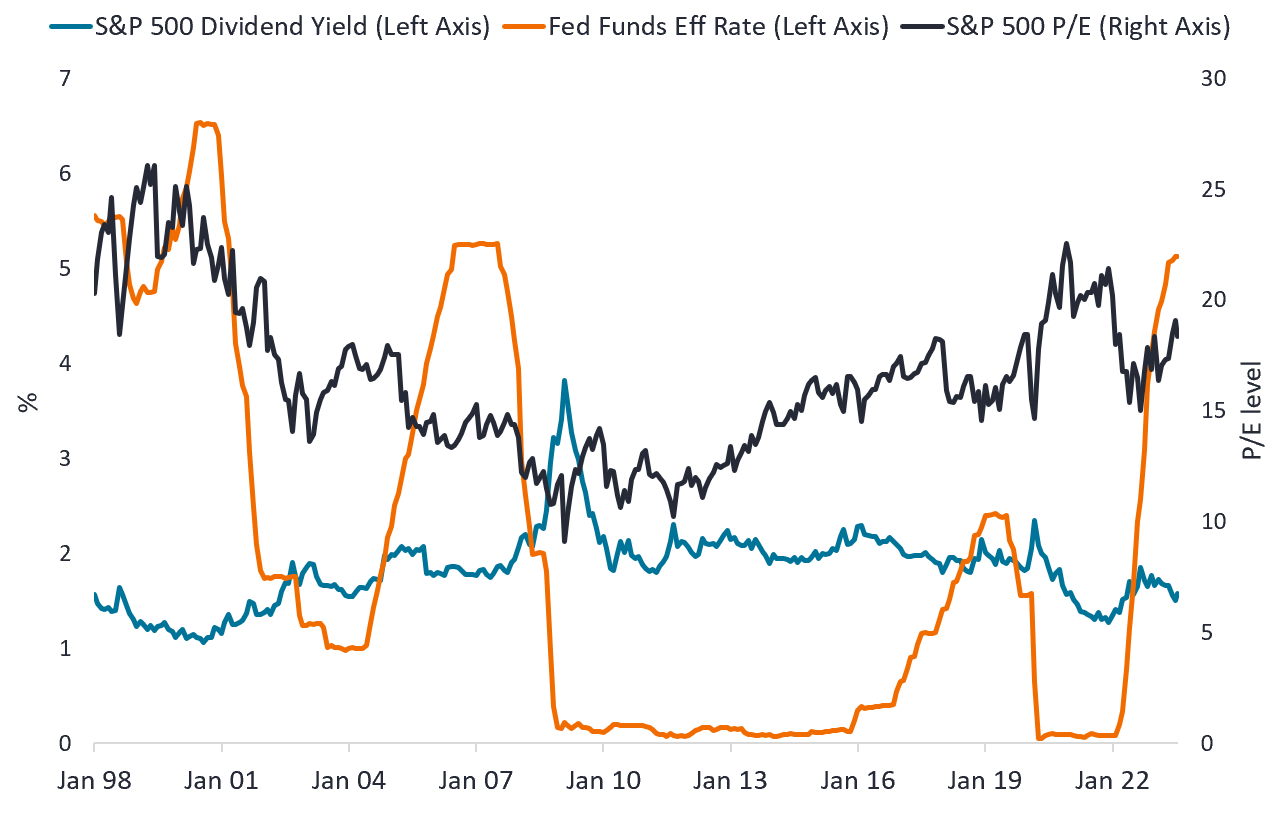

Valuations in the U.S. equity market over the last 25 years have tended to remain consistent, despite significant fluctuation in rates. The price-to-earnings (P/E) multiple on the S&P 500® Index is normally in the mid to high teens with a dividend yield of approximately 1.7 to 2%. As seen in Exhibit 1 below, both the P/E ratio and dividend yield have been in those ranges not only when the federal funds rate was close to zero, but also when it was as high as 4% to 5%.

Exhibit 1. S&P 500 P/E, S&P 500 dividend yield, and Federal Funds Effective Rate

Source: Bloomberg,as at 16 August 2023. Data from 1 January 1998 to 16 August 2023.

Source: Bloomberg,as at 16 August 2023. Data from 1 January 1998 to 16 August 2023.

Higher interest rates certainly impact demand from consumers and corporations, and the increase in financing costs has impacted our earnings estimates for 2023 and 2024. The upshot is that, based on these adjusted estimates, we think equity multiples are still in a normal historical range, despite the target fed funds rate now being much higher than a year ago.

What will fuel earnings growth?

Market performance this year, while strong, has been extremely narrow − dominated by a handful of technology stocks seen to be the likely beneficiaries of artificial intelligence (AI). While most of the market appreciation this year has been due to multiple expansion (typically, when stocks prices rise more than the corresponding movement in earnings), we believe earnings growth will be the key to market movement going forward.

To that end, companies are acutely focused on productivity, which is being enabled by technology investments (including AI) that could help reduce corporate costs. We believe that across all industries, the best companies will be able to use AI to their benefit rather than be disrupted. We see opportunities where market misperception has led to a divergence in value, and we continue to sort through the potential winners and losers related to this long-term theme.

The labor market is still healthy, and we are seeing improving labor force participation, which can help ease labor cost inflation. We see tailwinds for companies as supply chains have begun to normalize and businesses return to more usual ordering and production patterns. These factors, along with decreased material input costs, could help lower companies’ cost of goods sold and contribute to improved margins. This could present opportunity, specifically in otherwise strong long-term businesses that have suffered from recent inventory gluts.

Although we expect a volatile and bumpy ride, we are bullish on earnings growth prospects for the rest of the year and into 2024, even assuming a scenario of slow-to-flat real economic growth. If we eventually enter a recession, it will be one of the most anticipated we’ve ever witnessed, and at least some of that potential scenario is already factored into the market. Policy rates remain above what we would expect to be the long-term normal, and if we do see a material slowdown in demand, central banks have some dry powder to help stimulate growth.

Quality is key in a complex market

With more restrictive monetary policy and likely slower real growth, we believe companies with secular growth advantages will lead equity market performance. In this environment, it is important to focus on higher quality companies – those with strong capital positions and warranted pricing power.

In our view, companies that have flexibility on their balance sheet and consistency in their cash flows have an advantage over competitors that are more reliant on looser financial conditions. Furthermore, we believe companies whose products and services have created incremental value for their customers for years have earned the right to raise prices to cover inflationary costs and maintain profitability.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.