Janus Henderson Investors A still-resilient U.S. economy vindicates the Fed’s hawks

Not long after the headline Consumer Price Index (CPI) peaked in June 2022, we stated that guiding inflation down from 9.1% to 5.0% would be much easier than the path between 5.0% and the Federal Reserve’s (Fed) target of 2.0%.1 We believe this view has been borne out by developments in the U.S. economy and has placed added pressure on the Fed to get the next series of policy decisions right. It’s within this context that we assessed the U.S. central bank’s decision to raise its benchmark lending rate to a range of 5.25% to 5.50%.

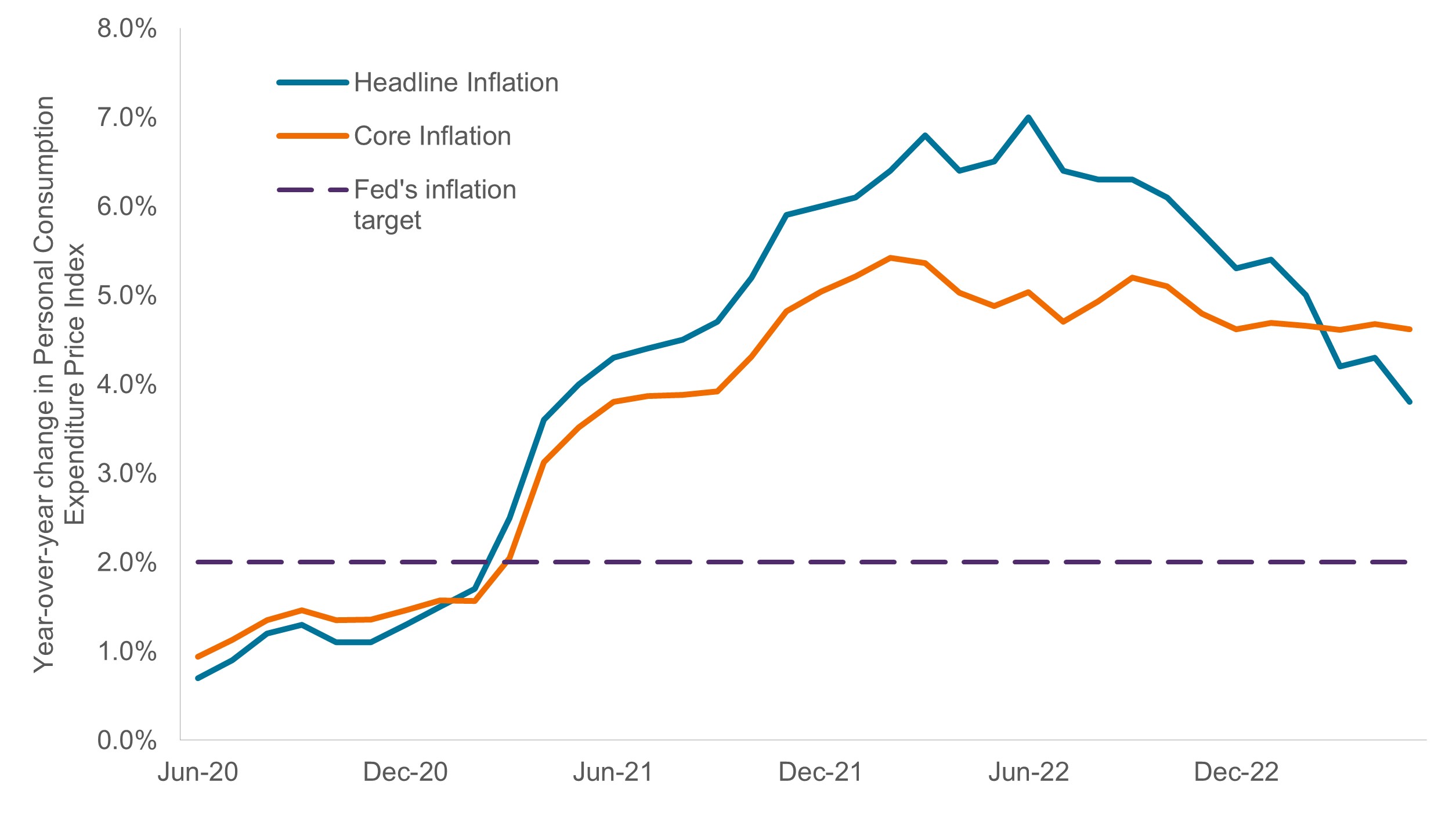

We consider the Fed’s move well founded, as the U.S. economy has entered a period where further inroads against inflation will likely be hard fought. Core CPI sits at a still-elevated 4.8% and – for those not paying attention – the Fed’s preferred gauge, the core Personal Consumption Expenditure (PCE) Price Index, has only slid from a cycle peak of 5.4% to 4.6%. That is well above Fed Chairman Jerome Powell’s comfort zone, a point that he has consistently repeated in the nearly one year since his blunt Jackson Hole speech where he stated that reining in inflation was the central bank’s singular focus at present.

Core inflation proving stubborn

With both the labor market and consumption in the U.S. chugging along, the Fed’s campaign to steer core inflation down toward its 2.0% comfort zone is far from complete.

Source: Bloomberg, as of 27 July 2023.

Some segments of the investment community seem to not be noticing these developments. The S&P 500® Index is less than 5.0% beneath its early-2022 record high, and the difference between the yields on high-yield corporate bonds and those of their risk-free benchmarks has fallen by over 25% since this past March. Riskier assets rallying to such a degree signals that investors are possibly expecting monetary policy to be approaching a dovish pivot.

While we, too, believe we are nearing the end of the current hiking cycle, we are compelled to adopt a more cautious assessment with respect to a policy turn as we believe the Fed’s hawkish bias remains intact.

Growing tension?

Chairman Powell has deftly built consensus within the Federal Open Market Committee, signalling that voting members are prioritizing inflation returning to levels that are far less punitive to American consumers. Still, we think that June’s unanimous decision to pause rate hikes was perhaps “unanimous” in name only. Rather, we believe that decision was an implicit compromise between the Fed’s hawkish and more centrist wings, with any lingering doves being consigned to the margins until the economy shows more visible signs of softening. The hawks have been focused on core PCE prices’ plodding decline, while centrists are likely frightened that the 16 months of previous tightening will inevitably stall the U.S. economy.

This week, the hawks got their 25 basis point (bps) increase and the centrists got time to parse through additional data. Six weeks have passed since the June meeting and it will be another eight weeks until September’s update of the Fed’s economic projections. Together, that’s more than a quarter of a year’s worth of economic activity to examine. Thus far, it seems the centrists can breathe easier as one of the noteworthy changes to the Fed’s statement was that it now views the U.S. economy expanding at a moderate pace rather than the modest one it referenced in June.

This upgrade likely makes the Fed’s hawks feel vindicated for gaining the optionality of increasing rates by another 25 bps at some point. When pressed, Chairman Powell was noncommittal that another hike was imminent. Our view is that the combination of favorable economic data and continued unanimity among Fed voters, if anything, keeps an additional rate increase in play.

Conflicting signals?

Core inflation remaining well above 4.0% signals that the job is not done. If the goal of rate hikes was to stress the labor market, it has thus far not succeeded. U.S. nonfarm payrolls gains have averaged 239,000 over the past five months, well below 2022’s torrid pace of 399,000 but still within the range that signals a healthy jobs market.

From another survey, the unemployment rate stands at 3.6%, just a touch above its record low. Consumption by many measures remains solid. Retail sales excluding goods, gasoline, and building materials has beaten consensus forecast for much of the year, and while down from 3.5% in the first quarter, inflation-adjusted final sales to private domestic purchasers came in at a respectable annualized 2.3% in the second quarter.

More capital-intensive segments of the economy, however, have softened, given their greater sensitivity to interest rates. Residential building permits are trending down and year-over-year national home prices, based on a widely followed index2, have declined for three straight months – their first foray into negative territory since the U.S. emerged from its housing crisis. Within industry, the Institute for Supply Management Manufacturing Purchasing Manager’s Index has been mired in contraction territory for eight months. These are the data that cause the Fed’s centrists to lose sleep.

What it means for markets

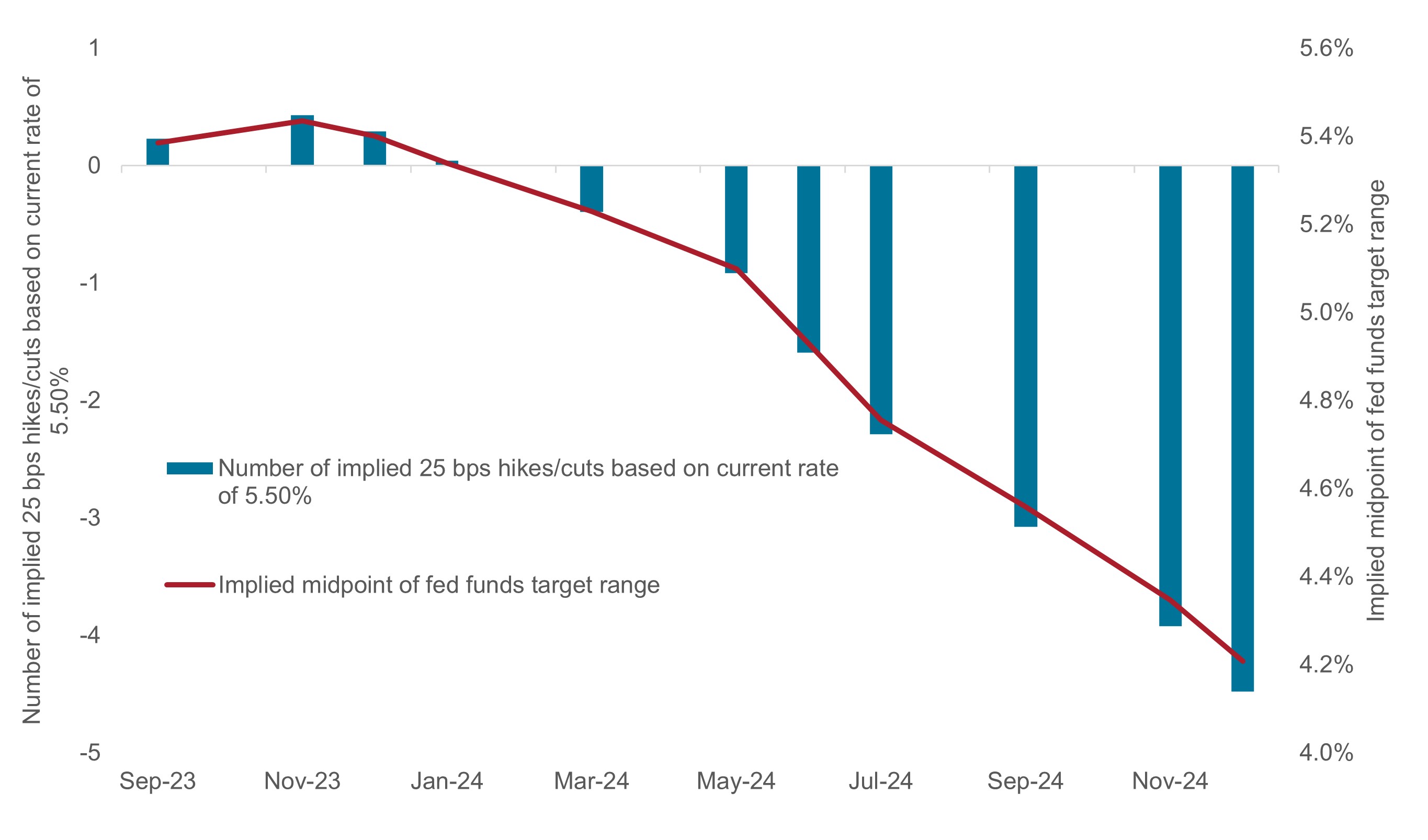

In the weeks between the Fed’s June and July meetings, the market slowly accepted the idea that a mid-summer hike was inevitable. Based on signals in futures markets, investors have been more circumspect that another – perhaps final – 25 bps increase will arrive by year’s end. Futures markets are pricing in the federal funds rate finishing 2023 at the current level and sliding by 1.25 percentage points, to 4.25%, by December 2024. In contrast, the Fed’s most recent “Dots” survey, in addition to projecting another 25 bps hike this year, shows rates likely residing at 4.75% in December 2024.

Level of fed funds target rate implied in futures market

In contrast to the Fed’s internal survey, and also resilient U.S. economic data, the futures market expects policy rates to commence a pronounced descent by early 2024.

Source: Bloomberg, as of 27 July 2023.

Now that the policy rate’s ceiling is (almost) settled, we believe the Fed’s and market’s diverging views are largely due to how long these respective camps think rates will remain at the cycle peak. Our view is that, as long the threat of an additional 25 bps hike is a possibility, coupled with intentional ambiguity on how long until rate cuts commence, yields on shorter- to mid-dated Treasuries are likely to remain near the upper end of their current range.

Importantly, barring unforeseen economic or geopolitical upheaval, we don’t expect short- to mid-dated bonds to rally until it becomes clear the Fed has the latitude to safely pause – and eventually lower – its policy rate, and we don’t see that happening until inflation falls further. This may not occur until well into 2024.

Until then, we expect much of the yield curve to remain range bound and data releases between now and September to spur some moderate volatility. Therefore we believe that riskier assets should be approached with relative caution given current valuations. Lastly, it is our view that further economic softening will likely be the price the Fed must pay to achieve its goal of putting this historic bout of inflation in the rear-view mirror.

1As measured by the Fed’s favored gauge, the year-over-year change in the core Personal Consumption Expenditure Price Index that excludes food and energy.

2S&P Corelogic Case-Shiller 20 City Composite Index.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Core Personal Consumption Expenditure Price Index is a measure of prices that people living in the United States pay for goods and services, excluding food and energy.

The FOMC dot plot is a chart that summarizes the FOMC’s outlook for the federal funds rate.

Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors, based on a survey of private sector companies.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.