Jason England

Jason England is a Portfolio Manager in the Global Short Duration & Liquidity Group at Janus Henderson Investors. Prior to joining Janus in 2017, Jason was with PIMCO, most recently as senior vice president and portfolio manager for core sector fund separate account portfolios. While there from 1994 to 2015, he was involved with launching their first hedge fund, exchange-traded fund, and global multi-asset product portfolios as well as management of numerous fixed income and asset allocation portfolios.

Jason received both a bachelor of science degree in business administration and finance and his MBA from the University of Southern California, Marshall School of Business. He has 30 years of financial industry experience.

Articles Written

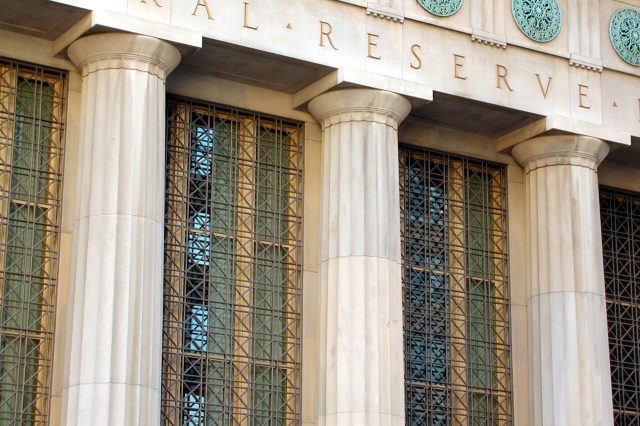

The Fed’s inflation fight: No victory … yet

While progress has been made, the Fed continues to signal that the battle to lower inflation is far from over.

A still-resilient U.S. economy vindicates the Fed’s hawks

With it too soon to declare victory against inflation, we believe the market should accept that interest rates will remain near current levels for longer than it expects.

Fed seeks flexibility in complex late-cycle environment

With inflation still elevated, the Fed seeks to buy time to assess the impact of policy tightening.

The Fed reaches its predicted terminal rate – now what?

Keeping its eye on persistent inflation, the Fed reaches its expected terminal rate and plans to stay there for a while.

The Fed reaches its predicted terminal rate – now what?

Keeping its eye on persistent inflation, the Fed reaches its expected terminal rate and plans to stay there for a while.

Global Perspectives: Short duration takes the spotlight in fixed income

A discussion on how investors can navigate the short-duration opportunity set within fixed income.

Global Perspectives: Short duration takes the spotlight in fixed income

A discussion on how investors can navigate the short-duration opportunity set within fixed income.

Another step towards policy tightening – with a caveat

Cautioning against classifying the Fed’s interest rate ‘liftoff’ decision as being unequivocally hawkish.

Fed Up? The fallout from overly sweetened monetary policy

Portfolio Managers Dan Siluk and Jason England believe that the tide may have turned and that financial markets are forcing the hands of global central banks to react to brewing inflation.

The Taper is (almost) here: What it means for bond investors

The imminent arrival of tapering by the US Federal Reserve amplifies challenges facing bond investors.