As it became apparent in recent months that the Federal Reserve (Fed) was nearing the end of its rate-hiking cycle, the market coalesced around the view that policymakers had only two options: a pause or a pivot. Over time, pause became code for the Fed having achieved its terminal rate – i.e., no more increases – but conditions would not yet merit a reduction in the overnight lending rate. With today’s announcement, however, the U.S. central bank chose a third path: a skip.

One may be inclined to split hairs between the meaning of a pause and a skip, but we think the hawkishness of today’s announcement that the Fed is skipping a meeting – choosing instead to keep the upper limit of the federal funds rate at 5.25% – implies that we’ve yet to reach this cycle’s apex in the policy rate.

Given the notorious difficulty in determining the impact of earlier tightening measures (let’s not forget the monthly $90 billion reduction in the Fed’s balance sheet), we see today’s decision as the Fed buying time to better gauge the lagging effect of 500 basis points (bps) of rate hikes. Further complicating efforts are a resilient U.S. labor market and questions concerning the degree to which turmoil in U.S. regional banks could weigh on credit conditions.

A third way

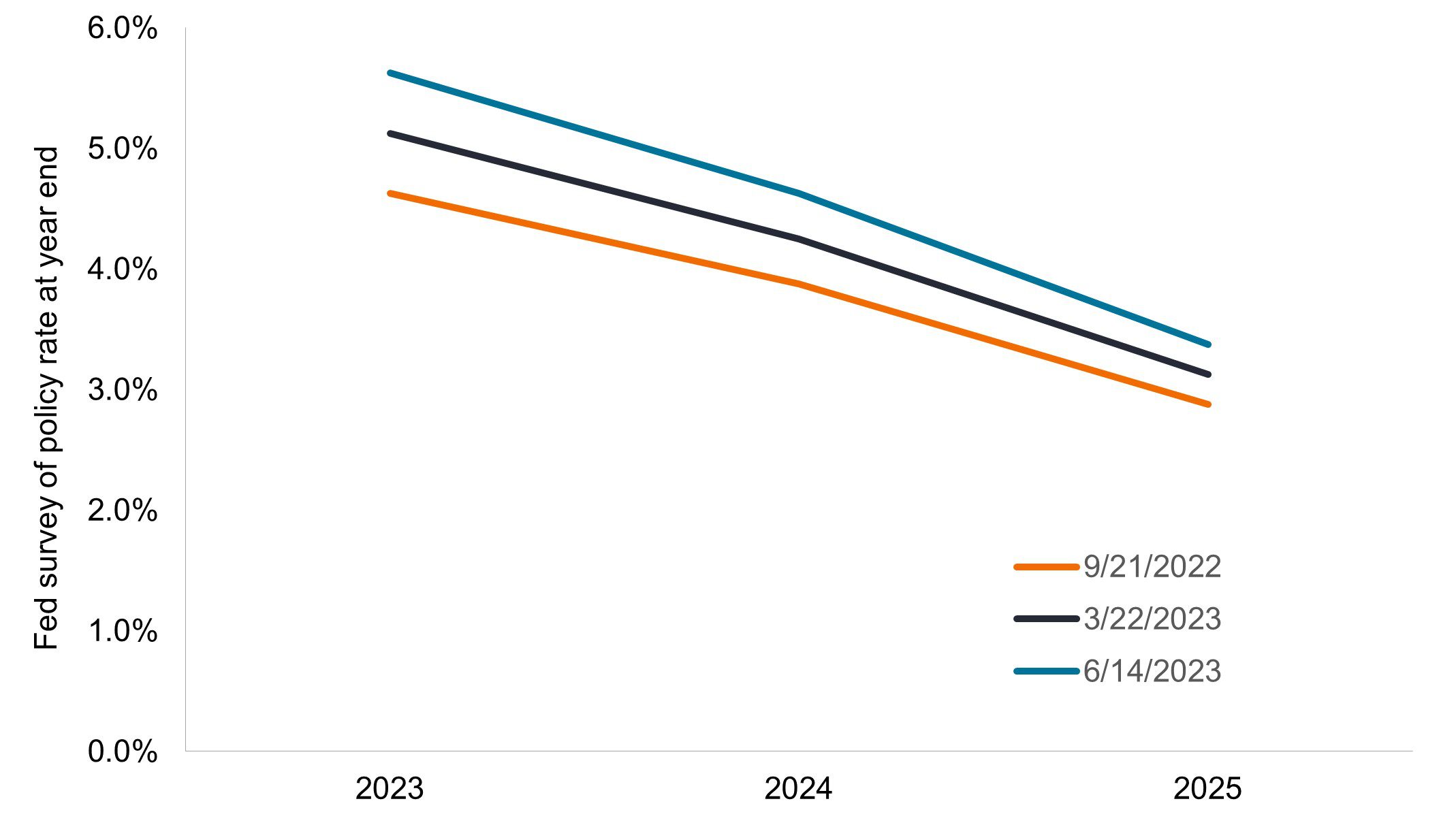

Our long-held view that “a pause does not equal a pivot” has been validated as the path of the fed funds rate implied in futures markets has crept up, with investors now accepting that a cut is not forthcoming in 2023. Still, the implied rate in the Fed’s revised Summary of Economic Projections – its widely-followed “Dots” survey – caught our attention as Federal Open Market Committee (FOMC) members now see as much as an additional 50 bps in rate increases this year. We don’t believe these hikes are etched in stone, but rather provide the Fed flexibility – and perhaps temporarily silences hawks who were hoping for a rate increase at this meeting.

Evolution of Fed’s Dots survey

Over the past nine months, the Fed has consistently increased its expected path for the overnight policy rate, with it now potentially peaking as high as 5.75% by the end of this year.

Source: Bloomberg, as of 14 June 2023.

Source: Bloomberg, as of 14 June 2023.

In addition to a revised Dots path, the FOMC made additional changes to its economic projections. Most notably, it lowered its end-of-2023 unemployment rate from 4.5% to 4.1%. Behind this shift is acknowledgement of a sturdy U.S. employment environment.

Of all the lagging indicators that many investors mistakenly follow in seeking to divine the course of future monetary policy, the unemployment rate tends to be the most lagging. We find this especially relevant during this cycle as companies’ tendency to hoard labor is magnified by nominal economic growth remaining resoundingly positive, meaning a soft landing is not off the table. Employers also don’t want to cut capacity should the economy surprise to the upside. Also at play is the well-publicized dearth in workers. Attracting employees has been an arduous task in the post-pandemic era; why try to repeat that?

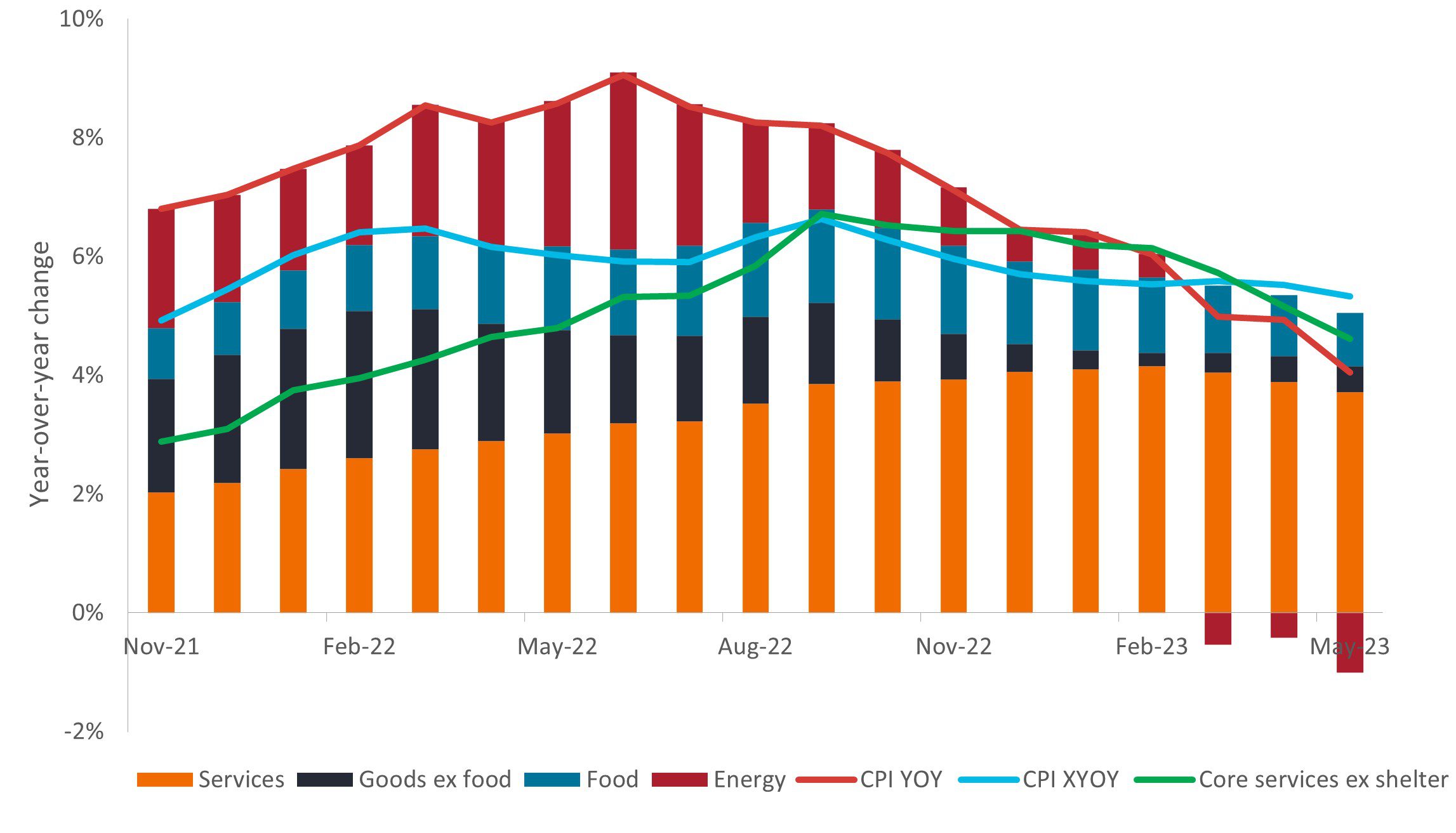

Inflation rolling over – just not fast enough?

Also of note is core inflation being revised up for 2023 from 3.6% to 3.9%, as measured by the Fed’s favored metric. This measure resided at 4.7% in April (and 5.3% in May based on the separate Consumer Price Index). With both measures still in the 5.0% neighborhood, we think the Fed had little choice but to signal that its eye was still firmly on inflation eating into household purchasing power.

While perhaps justified based on inflation data, we believe future rate hikes would come with considerable risks. Much of inflation has already rolled over. Goods prices are lower thanks to the easing of supply dislocations and pandemic-era stimulus spending running its course. Producer prices have come down and services excluding shelter – long a source of upward price pressure – has eased as well.

Perhaps most telling, shelter itself, when adjusted for the lagging nature in which this measure is constructed, is softening as the gains in newly signed leases are well off their cycle peaks. With the trend heading down, one or two late-year rate increase could add to gathering disinflationary forces, but do so by extinguishing demand, which would inevitably weigh on the economy and the corporate sector.

Components of Consumer Price Index

With energy, goods, and even services (ex-shelter) falling, additional tightening could further weigh on demand at a time when the economy is already softening in the wake of last year’s historic tightening.

Source: Bloomberg, as of 14 July 2023.

Source: Bloomberg, as of 14 July 2023.

Credit conditions: The wild card

We appreciate the Fed leading its statement with a comment on the soundness of the U.S. banking system. However, it then immediately echoed our concerns that tightening credit conditions – due in part to the spring regional bank tumult – could not have arrived at a worse time.

In 2022, tightening credit conditions would have complemented rate hikes in combatting historic inflation. This year, with many leading inflation indicators already rolling over, a credit crunch could go a long way toward determining whether the U.S. economy escapes with a soft landing or a less favorable outcome. Underpinning our view are Senior Loan Officer surveys indicating tightening credit conditions. The impact of higher lending standards tends to lag by up to 12 months, meaning the full effects of this spring’s hesitance by bankers may not be fully felt until 2024.

Preparing for a wider range of market outcomes

One thing that has not changed with today’s decision is that the Fed is nearing the end of its rate-hiking cycle. We would have interpreted a true pause – remember, that’s code for achieving the terminal rate – and even “higher for longer” as not necessarily negative for riskier assets as the confirmation of a disinflationary trend would be a sigh of relief for the broader economy. Higher – but not rising – rates would also provide an argument for holding cash and cash equivalents.

We can only interpret today’s hawkish tone, however, as modestly negative for riskier assets. In our view, the combination of myriad inflation data series heading down and the possibility of more rate hikes (and let’s not forget tighter credit conditions) increases the odds of a policy mistake, including a harder-than-expected landing.

Slightly higher policy rates should result in shorter-dated yields remaining range bound and the yield curve flattening across longer dated tenors as economic growth remains muted. Yet, investors must be mindful of the risk that the Fed may have already gone too far. The harm to economic growth will only become apparent as lagging indictors fully reflect the sum of the past 18 months of policy tightening. Should that occur, a pivot would indeed be in the cards as policymakers seek to avert the worst possible economic outcomes.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.