Source: Janus Henderson Investors, Bloomberg, as of 19 September 2025.

Note: Price-earnings ratios based on blended forward 12-month earnings estimates.

Conversations about how tech fits within a broader equities allocation invariably include two questions: First, “Doesn’t it account for a large portion of the benchmark?” and second, “Isn’t it expensive?”

The share tech and internet stocks in the S&P 500® Index has expanded to roughly 40%. This has left investors who had been underweight tech even less exposed to powerful secular themes such as artificial intelligence (AI). Others trimmed exposure during the rally, seeking to avoid concentration. But there is risk to being materially underweight tech.

Our view is that, as themes like AI play out over a multi-year horizon, leading tech companies will compound earnings at a rate far higher than that of broader equities. Modestly increasing tech exposure – but still keeping it under market weight – can position investors to participate in themes that we believe are likely to account for an increasing portion of aggregate corporate earnings.

In the past five years, technologies like cloud computing were first catalyzed by the digital transition brought by COVID-19 lockdowns then joined by the generational theme of AI. The power of the sector’s business models is illustrated by operating margins expected to average 34% over the next two years, compared to 18% for broader stocks. Attractive margins and top-line growth are estimated to deliver earnings growth averaging 19% over the next two years compared to 13% for the S&P 500.

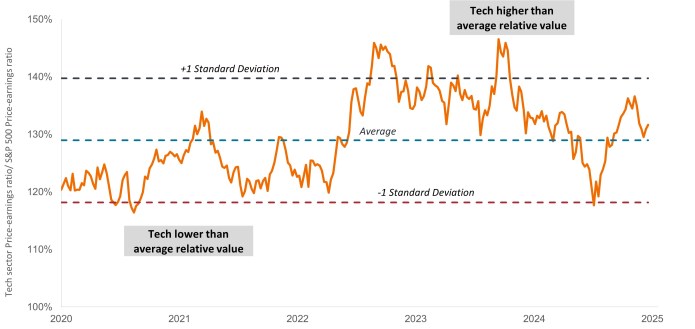

These projections, when coupled with reasonable valuations, provide a compelling argument for investors to reconsider the size of their tech allocation.

We believe the market continues to underappreciate the ability of leading tech companies to compound earnings across the duration of the secular theme with which they are associated. Within this context, many of these innovators’ valuations remain reasonable.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.