Market access/funding has improved significantly for BB and B-rated countries, and the most vulnerable are now in funded International Monetary Fund (IMF) programmes. Markets tend to anticipate the signing of such deals, while greater programme participation facilitates upgrades by encouraging action and accountability.

In July, Oman and Azerbaijan were upgraded to investment grade (IG) by rating agencies, reflecting their fiscal improvements, structural reforms, and economic diversification efforts. While these were not a surprise to us, it highlights the strong fundamental trajectory of EM ratings at a time of concerns over fiscal sustainability in developed markets (DMs). With stronger growth potential and lower debt levels, EMs are in a better position to manage and sustain their debt.

Improving fundamentals

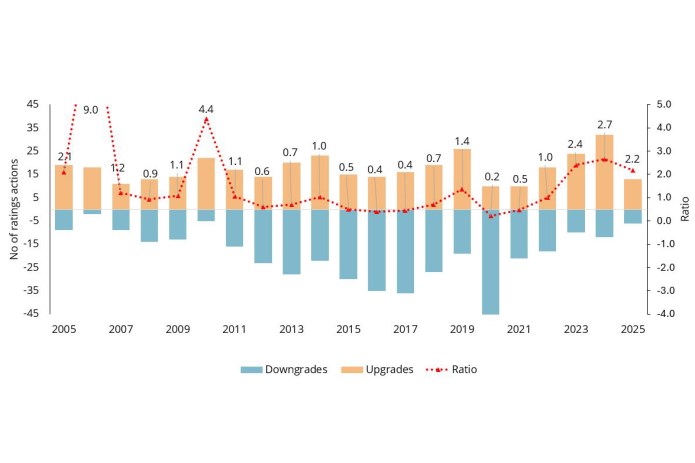

The fundamental improvement in EMs is reflected in higher credit quality. The IG portion of the EMD hard currency (HC) index has increased significantly and is now over 50% compared to around 15% in 2000. Additionally, the average rating is BB+, rising from BB- at the turn of the century.[1]

The EM/DM economic growth differential is also expected to shift higher in 2025 (primarily due to weaker US growth) and continue to climb in 2026.[2] Coupled with easing financial conditions, this has typically been very supportive for the relative performance of EMD.

EMD is ripe for active management

Through our observations over the years, we have found that markets frequently anticipate changes ahead of credit rating agencies. This necessitates forecasting a country’s credit risk one to two years in advance, allowing active managers like us to seek undervalued improvements. We then need the market’s assessment of credit risk to match our forecasts, with spreads tightening accordingly.

– Sorin Pirău, Portfolio Manager

As bonds become eligible for IG indices such as a Global Aggregate index, this helps drive further demand from global investors, supporting spreads. The diversity in the EMD HC universe is an opportunity for active investors to take advantage of mispriced opportunities by employing a rigorous approach to assess potential shifts in sovereign credit risk.

Footnotes

[1] Source: Janus Henderson Investors, Bloomberg, JP Morgan EMBI Global Diversified Index, as at 31 July.

[2] Source: Macrobond, IMF estimates as at 30 June 2025.

Note: There is no guarantee that past trends will continue, or forecasts will be realised.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

The J.P. Morgan EMBI Global Diversified Index (EMBIGD) tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis, and the investment choices they make. The opposite of passive investing.

Credit spread. The difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Credit rating: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P ranks investment grade bonds from the highest AAA down to BBB and high yields bonds from BB through B down to CCC in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit risk: The risk that a borrower will default on its contractual obligations to make the required interest payments or repay the loan. Anything that improves conditions for a company can help to lower credit risk.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Economic diversification is the process of shifting an economy away from a reliance on a single or a few income sources to a wider range of sectors and markets.

Financial conditions refer to the ease with which businesses and individuals can access and afford financing. These conditions are influenced by various factors, including interest rates, asset prices, credit availability, and risk appetite. They play a crucial role in shaping economic activity, investment decisions, and market behaviour.

Fiscal sustainability refers to a government’s ability to maintain its current spending, tax, and other policies in the long run without threatening its solvency or defaulting on its liabilities.

Fundamentals: In the context of corporate debt, “fundamentals” refer to the essential financial health indicators and characteristics of a issuer that suggest its ability to meet debt obligations.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.