The securitised credit market enters 2026 with a clear theme: a growing and broadening opportunity set for European investors, driven by regulatory alignment and global issuance trends. This evolution is creating scope to globalise portfolios, capture relative value and access new opportunities in primary markets, amid a volatile macro backdrop.

Globalisation of portfolios: regulatory alignment unlocks scale

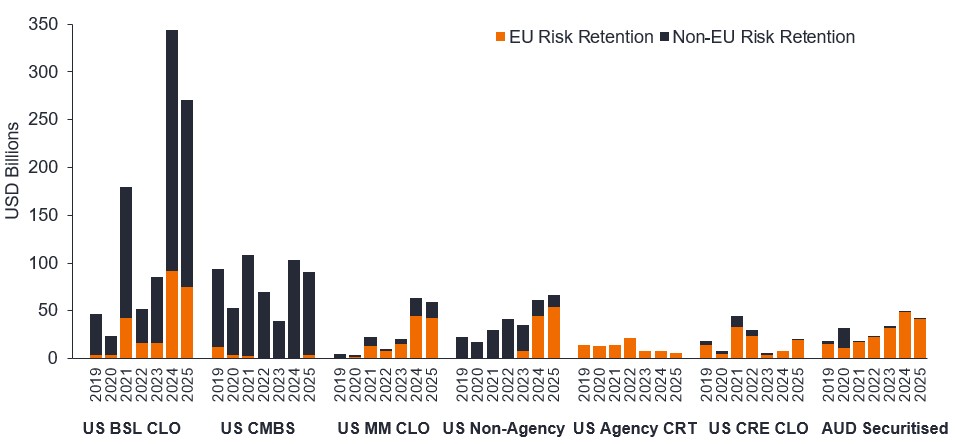

One of the most significant developments is the rise in EU-compliant securitised issuance from non-European jurisdictions. The ability of European-based investors to create truly globally diversified securitised portfolios was greatly diminished following the implementation of the European Securitisation Regulation in 2019. However, global securitisation issuers are recognising more the benefits that structuring their deals to meet European requirements can bring by expanding the breadth and depth of their investor base.

Figure 1: A number of sectors showing higher eligible issuance

Source: Janus Henderson Investors as at, 30 September 2025.

Note: Not all US issuance that is EU/UK risk retention eligible is fully EU/ UK Securitisation Regulation compliant as other articles of the regulation may not be met. BSL CLO: Broadly Syndicated Collateralised Loan Obligations; CMBS: Commercial Mortgage-backed Securities; MM CLO: Middle-market Collateralised Loan Obligations; CRT: Credit Risk Transfers; CRE CLO: Commercial Real Estate CLO; AUD Securitised: Australian securitised.

One jurisdiction that has reaped the benefits of this is Australia, a large securitisation market relative to the size of its economy with less restrictive regulations than Europe. Despite this, most of their issuers choose to comply to European regulations and the jurisdiction has benefitted from continued growth and, this year in particular, from significant spread compression. After setting a post Global Financial Crisis (GFC) issuance record last year, Australian securitised markets recorded another strong year of issuance in 2025[1]. This is a space we have long been active in with our global platform having dedicated local resource and longstanding relationships with issuers. In fact, this is a sector in which we significantly invested in recent years while our competitors either had no allocation or were only just starting to. We still have a constructive view albeit less so given the rapid spread compression experienced throughout 2025.

For European investors, this expansion of eligible issuance means portfolios can increasingly move beyond regulatorily imposed regional constraints to more truly global diversification, while maximising relative value and scalability. For example, rotating from Australian ABS, where there is now less relative value, to US Non-agency RMBS, which has in recent years also started to meet European requirements and is currently standing out as compelling relative value. Our global securitised platform provides the in-depth expertise and local relationships which enable us to efficiently access these markets, allowing for the optimisation of risk/ return profiles and fundamental diversification that securitised credit offers.

Additionally, European regulators are taking proactive measures to address the imbalance of overly restrictive securitisation regulations, which should also hopefully start to further enhance market dynamics in the near future.

Securitised issuance: strong supply matched by demand

After a strong 2024, issuance levels remain elevated in 2025 already having reached a post-GFC record of €151 billion, which is expected to be exceeded again in 2026 at €175 billion[2]. Overall, this supply has been absorbed effectively, shown by steady inflows amid growing investor interest in securitised strategies, supporting credit spreads.

Within Europe, Spain has been a bright spot, as its economy has benefitted from being amongst the strongest in the region, with a notable increase in issuance, particularly from bank platforms with full capital stack transactions. Conversely, Germany has been slower to recover, however, performance in German consumer ABS has begun to stabilise. The anticipated fiscal stimulus linked to rearmament spending could support further improvement from mid-2026. Next year, we expect to continue to see such issuance trends from consumer profiles and banking-related platforms in Europe.

Finding relative value in the primary markets

Primary markets have been active in offering full capital stacks; much of this has been driven by European banks utilising securitisation to achieve capital relief. Such offers from banks are favourable in our view, given their positive track record, solid governance as well as long history of transparent data. Mezzanine bonds offer enhanced carry relative to senior tranches; their increasing availability in some sectors has been a notable feature of 2025, which could continue next year. That said, mezzanine spreads have compressed significantly so caution is warranted when moving down the capital structure.

European CMBS has shown signs of life with issuance reaching nearly €8 billion[3], a tiny proportion of the market but the second highest annual total since the GFC. Positively, the breadth of high-quality sponsors is increasing, as is asset quality. This has added some welcome diversification at attractive levels and more full capital stack issuance. Hopefully this is the start of a virtuous circle for this sector, with further increase in issuance expected next year.

Navigating volatility: correlation with corporate credit

We expect that securitised markets will continue to track broad risk markets with a degree of lag and beta in 2026, as macro volatility and policy uncertainty persist. Rates volatility, inflation persistence, and geopolitical tensions will likely feed through to spreads. However, securitised assets offer structural resilience in this environment.

Floating-rate coupons dampen total return volatility, while exposure to specific pools of collateral, such as auto loans, consumer receivables, mortgages, provides fundamental diversification opportunities by region, jurisdiction and asset class. These features position securitised credit as a defensive, income-generative allocation amid uncertainty. We believe investors should remain diversified within their fixed income portfolios throughout the interest rate cycle, with floating interest rate exposure being a key component of a well-diversified portfolio.

Importantly, while market beta will influence spreads, underlying collateral performance remains anchored in consumer and real asset fundamentals. This linkage reduces sensitivity to idiosyncratic corporate risk, which we have seen reinforcing the case for securitised credit as a stabilising force within diversified portfolios.

Capturing structural safety in 2026

Securitised credit in 2026 offers scalable, high-carry exposure with built-in volatility mitigants, at a time when fixed income spreads are tight and susceptibility to volatility looms on the horizon. Given the expanding global opportunity set under EU-compliant frameworks, European securitised investors have broadened their own horizons with the asset class positioned to deliver resilience and relative value in the year ahead. With strong technicals, robust issuance, and primary markets offering attractive entry points, we believe securitised credit stands out as a strategic allocation for 2026.

Footnotes

[1] Source: JP Morgan International Securitisation Research, as at 30 September 2025.

[2]Source: Deutsche Bank, 28 November 2025.

[3] Source: BAML, 27 November 2025.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.