The relative value opportunity

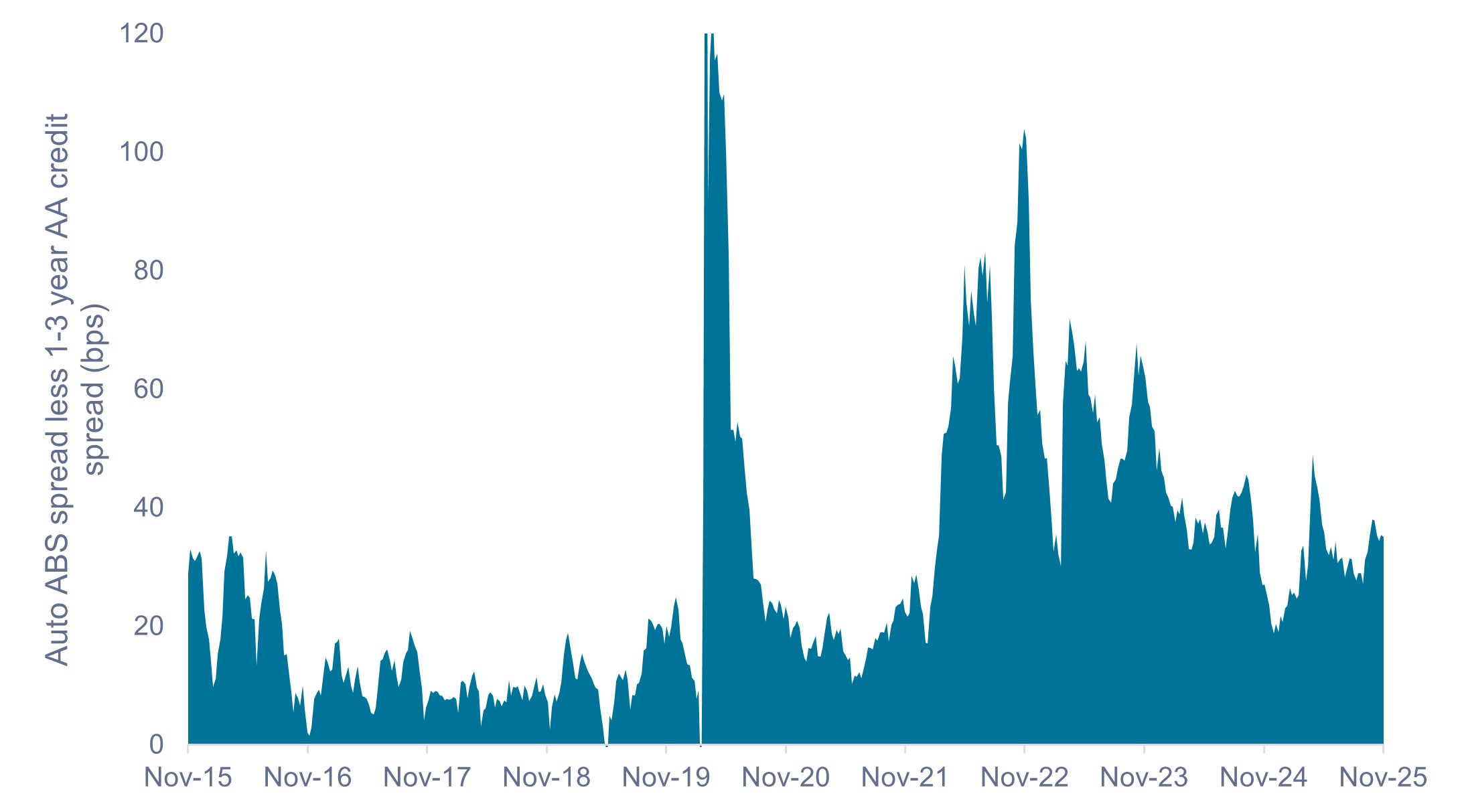

In the post-COVID era, and particularly since early 2022, asset-backed securities (ABS) have offered a meaningful spread pickup relative to corporate bonds of similar rating and duration. Auto ABS – the largest subsector at 38% of the entire U.S. ABS market – pays a spread premium versus similar AA-rated credit, as shown in Exhibit 1.

Given that prime consumer loans make up roughly 75% of the U.S. auto ABS market, we believe the market is in much better shape than some news headlines may imply. As a result, we believe the excess spread income (currently around 35 bps) is a key source of yield and an important contributor to total return in an environment where corporate valuations look rich and rates are projected to fall.

Exhibit 1: Spread differential: Auto ABS vs. short-duration AA rated credit (2015-2025)

Auto ABS pays an attractive spread premium over similarly rated short-duration credit.

Source: Bloomberg, as of 30 November 2025. Spread differential based on option-adjusted spreads for the Bloomberg ABS Auto Index, which carries a AA+/AA average credit rating, and the Bloomberg U.S Credit 1-3 Year AA Index. Past performance does not predict future results.

Credit protections and selectivity may allay investor concerns

The recent bankruptcies of auto parts manufacturer First Brands and auto lender Tricolor have left some investors spooked and asking whether these events are an early warning sign for consumer credit. In our view, these two credit events were idiosyncratic in nature and unrelated to the health of the underlying consumer.

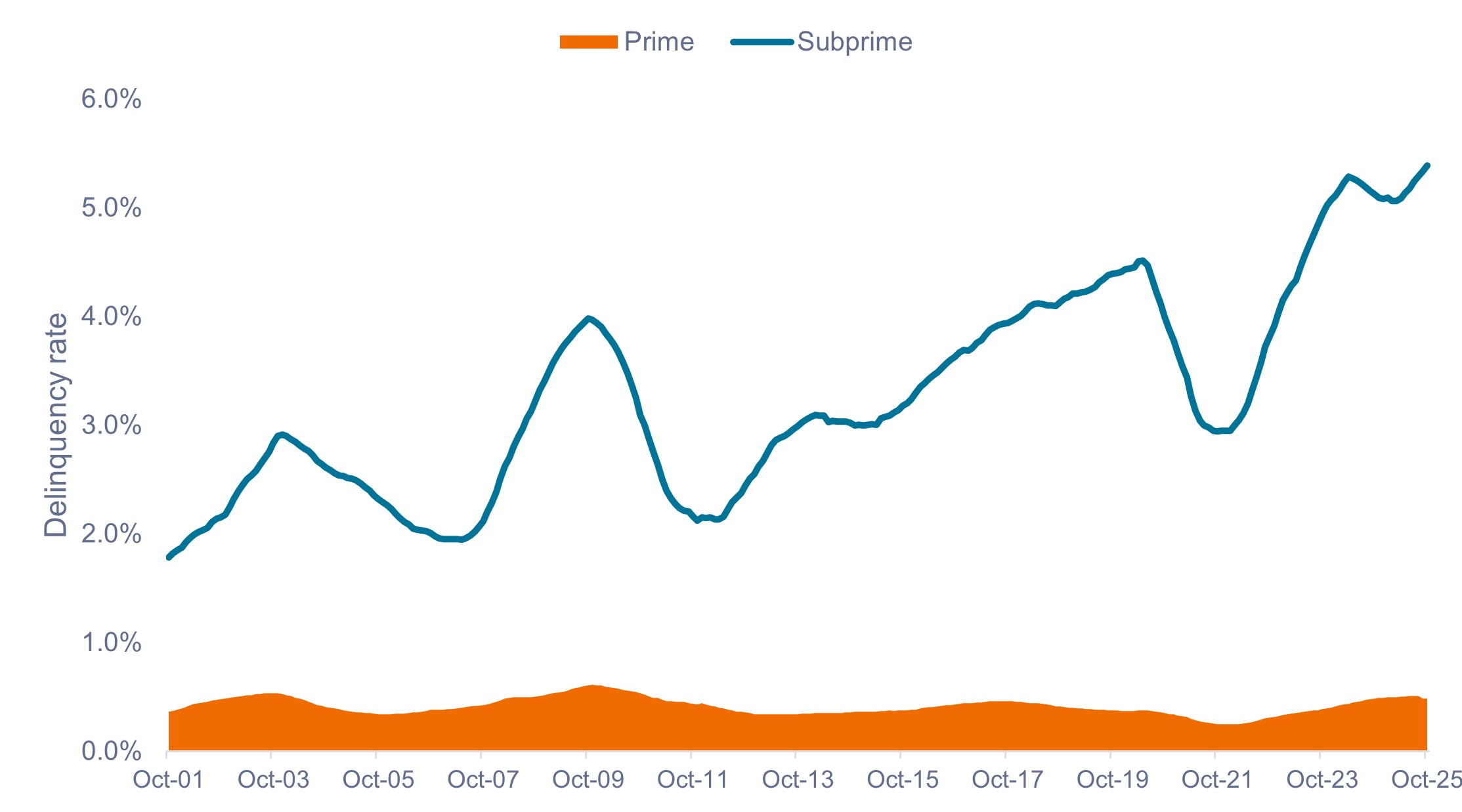

Even though delinquency rates on subprime auto loans have risen to recession-like levels, we do not see evidence of broader weakness in consumer credit markets, particularly among prime-rated consumer loans, as shown in Exhibit 2.

Exhibit 2: Auto ABS delinquency rates: prime vs. subprime (2001-2025)

The prime consumer (75% of the auto ABS market) remains on solid footing despite subprime stress.

Source: Intex, Goldman Sachs Investment Research, as of 31 October 2025. Chart shows trailing 12-month moving average of share of balances 60 days or more past due. Borrower credit scores: Subprime <620, prime >660.

While the ABS asset class’s excess premium may reflect anxieties regarding the financial health of U.S. households, we believe these concerns create an opportunity for active managers to acquire high-quality income-generating assets with strong structural protections at attractive prices.

Additionally, ABS structures today are substantially more robust than those issued before 2010, with stricter underwriting standards and higher levels of subordination that offer greater protection against losses.

Active management holds the key

While we prefer to keep subprime exposure to a minimum, even within subprime auto we see selective opportunities if one digs below the surface. Despite a rise in subprime delinquencies in aggregate, not all deal vintages exhibit the same default rates.

As shown in Exhibit 3, the 2020 and 2021 subprime pool performance has been far stronger than the 2022-2025 vintages. This was largely due to pandemic-related relief programs and a sharp rise in car prices, which created significant positive equity in the 2020/2021 loans.

Exhibit 3: Nonprime auto cumulative net losses by deal vintage and deal age (2020-2025)

Subprime loans originated in 2020/2021 have outperformed those originated in later years.

Source: Intex, as of 1 October 2025. Past performance does not predict future results.

Source: Intex, as of 1 October 2025. Past performance does not predict future results.

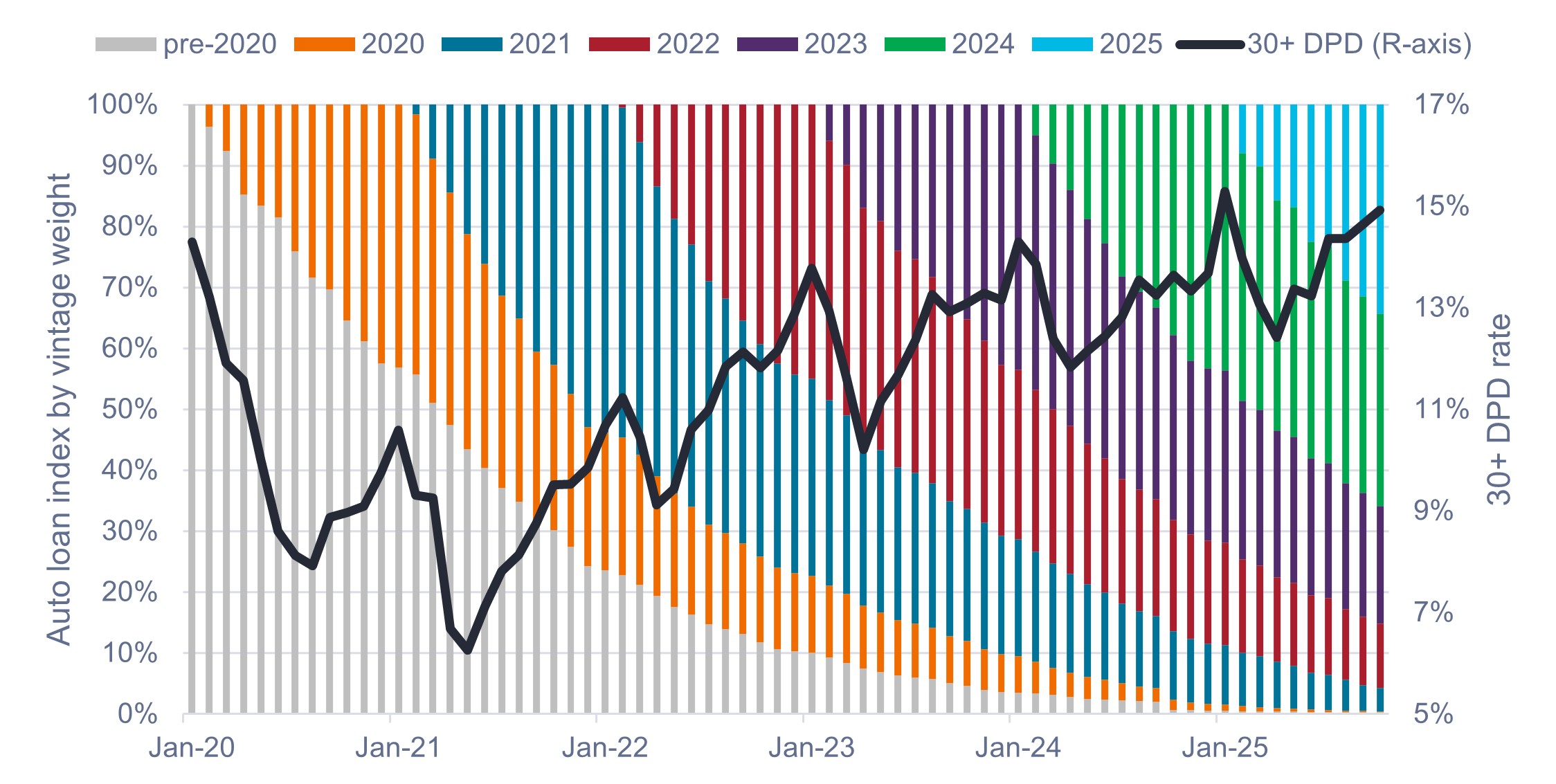

As the 2020 and 2021 loans continue to pay down, their contribution to the overall mix is diminishing. The aggregate subprime index is now more concentrated in the 2022–2025 vintages, which have higher levels of default.

Subprime auto ABS is also evolving because the major issuers (such as Santander, AMCAR, and Westlake, which historically have had excellent performance) are issuing less, or not at all. If they do issue ABS they are issuing investment-grade (IG) bonds exclusively because they have access to cheaper alternative financing versus issuing below-IG tranches. Essentially, while the overall subprime auto ABS market is still targeting the same consumers, less of the market is coming from the historically strongest issuers in the space.

While index-level data shows a rise in default rates due to the changing vintage mix, active managers may seek to avoid troubled spots and exploit pricing inefficiencies by focusing on older vintages with better credit metrics.

Exhibit 4: Subprime auto loan index by vintage weight and 30+ days past due (DPD) rate

Strong-performing loans are becoming a smaller share of the index, leading to a rise in the DPD rate.

Source: Intex, as of 31 October 2025. Vintages refer to deal vintages, which may not fully align with origination vintages, but should serve as a reasonable proxy.

In summary

The $800 billion U.S. ABS market presents a large, diverse, and inefficient opportunity suited to active management, with lower correlation to equities and offering a spread premium over traditional credit. We believe ABS may be a smart way to diversify fixed income exposure while seeking capital preservation and current income.

Given the Bloomberg U.S. and Global Aggregate Bond Indexes have de minimis exposure to the ABS market, at 0.5% and 0.2%, respectively, investors will need to be intentional about their exposure to ABS and seek out experienced active managers with a proven track record of investing in securitized markets.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

The Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Bloomberg U.S. Asset-Backed Securities (ABS) Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market. The index only includes ABS securities.

The Bloomberg US 1-3 Year AA Index measures the performance of AA rated, US dollar-denominated, fixed-rate, taxable corporate and government-related debt with 1 to 2.9999 years to maturity. It is composed of a corporate and a non-corporate component that includes non-US agencies, sovereigns, supranationals and local authorities.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Investment-grade securities: A security typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

- The Fund invests in Asset-Backed Securities (ABS) and other forms of securitised investments, which may be subject to greater credit / default, liquidity, interest rate and prepayment and extension risks, compared to other investments such as government or corporate issued bonds and this may negatively impact the realised return on investment in the securities.