At the time of this writing, biotech appears to be on track to deliver one of its best years of annual returns since the sector’s heady days of the Covid pandemic. The S&P Biotechnology Select Industry Index, a benchmark of small-, mid- and large-cap biotech stocks, is up 25% for the year through October.1 Should the gains hold, it would be the first year of double-digit returns for the index since 2020 – a feat made all the more remarkable given that by early April, the benchmark was down by more than -20%.2

Several events help explain the turnaround, from improved clarity about tariffs and drug pricing policy in the U.S. to a rise in merger and acquisition (M&A) activity. But we continue to see an undercurrent of developments that could deliver more positive returns. To make the most of the potential opportunity, here’s what we think investors should consider.

The growing need for M&A

Historically, biotech stocks have benefited in periods when M&A activity accelerates, as deals – particularly large, multibillion-dollar acquisitions – unlock value, free up capital, and draw investor interest to the sector. Since 2021, rising interest rates and regulatory uncertainty have led to a downswing in total deal value. But there are signs these headwinds may be abating.

After rising to near 5% in 2023, 10-year Treasury yields now sit closer to 4% and could decline further if the Federal Reserve, which began easing monetary policy this year, continues to cut its benchmark rate.3 At the same time, the Food and Drug Administration (FDA) has overcome worries about recent funding and staff changes to meet review deadlines and even advance drug innovation through the rollout of an expedited approval pathway for important new medicines.

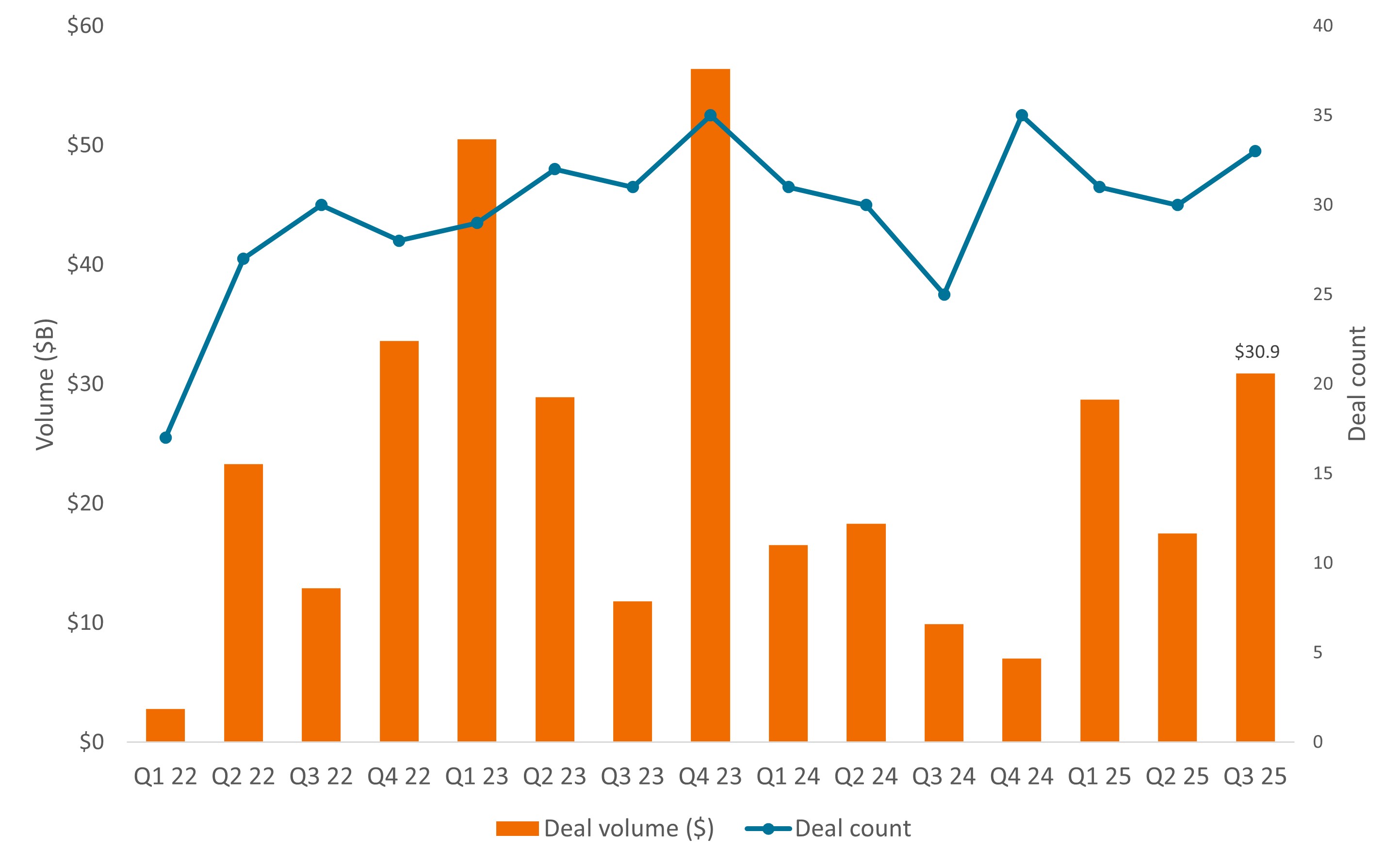

And in August, Pfizer reached a landmark deal with the White House, agreeing to an additional $70 billion in U.S. capital spending and selling select drugs to consumers at a discount. With the agreement seemingly satisfying administration priorities but avoiding the most draconian policy proposals (e.g., broad, most favored nation drug pricing), the biopharma industry has seen a pathway for preserving drug revenues. As such, M&A deal volume nearly doubled to $31 billion in the third quarter of 2025, up from just over $17 billion the prior quarter (Figure 1).

Figure 1: Policy relief and a patent cliff drive M&A

Source: J.P.Morgan, DealForma.com, as of 30 September 2025.

More M&A could follow. Roughly $300 billion in drug revenue is at risk of losing market exclusivity between now and 2030, one of the industry’s biggest “patent cliffs” in nearly two decades.4 With deadlines looming, drug companies are under increasing pressure to replenish pipelines quickly and have, by one estimate, as much as $1.2 trillion in balance sheet capacity to make acquisitions.5

An uptick in M&A can boost the biotech sector’s performance broadly, but investing in the individual companies being acquired often yields the biggest payoff. In 2025, M&A deals have typically been done at double-digit premiums to the preannouncement stock price, with a handful of purchases exceeding 100%.6

It is impossible to know in advance which companies will be acquired, but there are some commonalities to look for. Through the third quarter, mid- and small-cap biopharma firms accounted for 57% of the deal count in 2025, as these companies now drive the bulk of drug innovation. Firms developing drugs for large and growing market opportunities such as obesity, oncology, and fatty liver disease have been favored targets. And most M&A has been announced after clinical trials deliver positive data or a recently approved drug shows signs of a successful commercial launch.7

Capital markets that favor proven drug innovation

Even so, the outlook for biotech does not depend on M&A alone. Drug development is another key component, and here again we think trends are positive. Amid elevated interest rates, biotech initial public offerings slowed to a trickle. But funding from other public and private sources (such as follow-on equity offerings and venture capital) has lately started to climb, reaching $102 billion in 2024, up from $71 billion the year before.8

Capital investments are the lifeblood of drug development, and a groundswell of breakthrough therapies is helping attract investor interest. This includes the first new mechanism of action to be approved in decades for schizophrenia, the first-ever treatments for MASH (fatty liver disease) and Prader-Willi syndrome (a rare genetic disease that impairs children’s development), novel drugs for cardiomyopathy caused by TTR amyloidosis, and the first approved treatment for the lung disease bronchiectasis.

By transforming the standard of care, such therapies are seeing strong uptake at commercial launch and offering the potential for attractive earnings growth. According to one industry analysis, only about 20% of companies in the S&P Biotech Index were profitable between the years 2017 and 2024. By 2027, that figure could nearly double to 38% on the strength of ongoing drug research and development.9 In a sector known for volatility – in part because of the scarcity of earnings – this trend could be a catalyst for attracting a wider investor audience.

Market discipline could also play in biotech’s favor. Investors may be starting to warm to the sector, but they continue to favor “de-risked assets” – biotechs whose pipelines offer a strong pathway to development and/or near-term catalysts (such as regulatory approval). In a risk-off market, rewards are more likely to be dominated by companies with innovative pipelines that have shown clear evidence of clinical success.

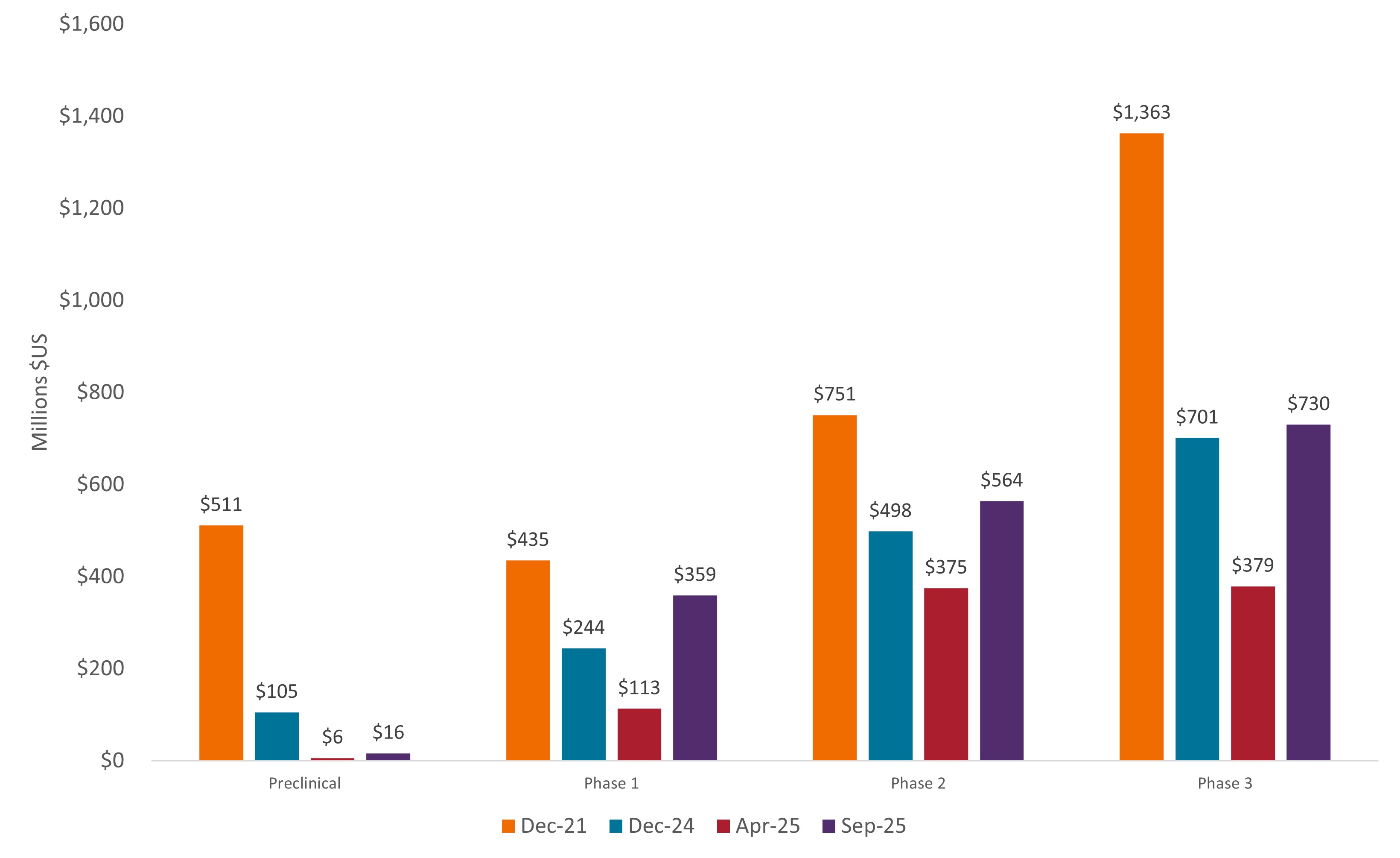

The market’s recent volatility underscores the point. At the end of 2024, biopharma companies with a phase 3 drug had an average enterprise value of $701 million. That value was cut almost in half ($379 million) by April 2025, at the height of policy uncertainty, but then rebounded to $730 million by mid-September. For preclinical companies, the story was much different (Figure 2).

Figure 2: Capital markets continue to favor late-stage biotech companies

Average enterprise value* of public U.S. biotech companies by stage of drug development

Source: CapitalIQ, Stifel. As of 31 December 2021, 31 December 2024, 11 April 2025, and 12 September 2025. *Enterprise value is a company’s market capitalization plus total debt, preferred shares, and minority interest, minus cash and cash equivalents. It represents the theoretical takeover price of a company, accounting for both equity and debt.

Long term, this discipline could have broader benefits. Biotech is now a leaner and more competitive sector than it was coming out of its 2021 market peak. Today, the number of public biotech firms that can boast “very good” datasets – pipeline drugs with a high probability of meaningfully improving the standard of care for a disease – is estimated to be more than 80%. In 2022, the figure was only 47%. Furthermore, since then, the number of publicly traded biotechs has declined by over 20%.10

In other words, the sector is setting a higher bar for companies to get going, but of those that survive, the opportunity for value creation may be better than ever.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Volatility measures risk using the dispersion of returns for a given investment.

1 Bloomberg, from 31 December 2024 to 31 October 2025.

2 Bloomberg, from 31 December to 9 April 2025.

3 Federal Reserve Bank of St. Louis, as of 31 October 2025.

4 Evaluate, Portfolio tactics to scale the $300bn patent cliff, as of 13 October 2025.

5 Stifel, as of 16 September 2025. Based on 18 large-cap biopharma companies and assumes a ratio of net debt / earnings before interest, taxes, depreciation, and amortization (EBITDA) of five times.

6 BiopharmaDive, as of 26 October 2025.

7 JPMorgan, as of 30 September 2025.

8 IQVIA Institute, Global Trends in R&D 2025, as of March 2025.

9 Cantor, The XBI may FINALLY be poised to Deliver—Here’s why, as of 27 August 2025.

10 Stifel, as of 11 September 2025.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.