The rise of AI chatbots in search

For years, Google has dominated Internet-based search and has been able to convert those queries into substantial revenues for parent company, Alphabet. But today, doubts are growing about whether that dominance can stand up to AI search and chatbots, which are quickly building scale and ushering in new forms of consumer behavior.

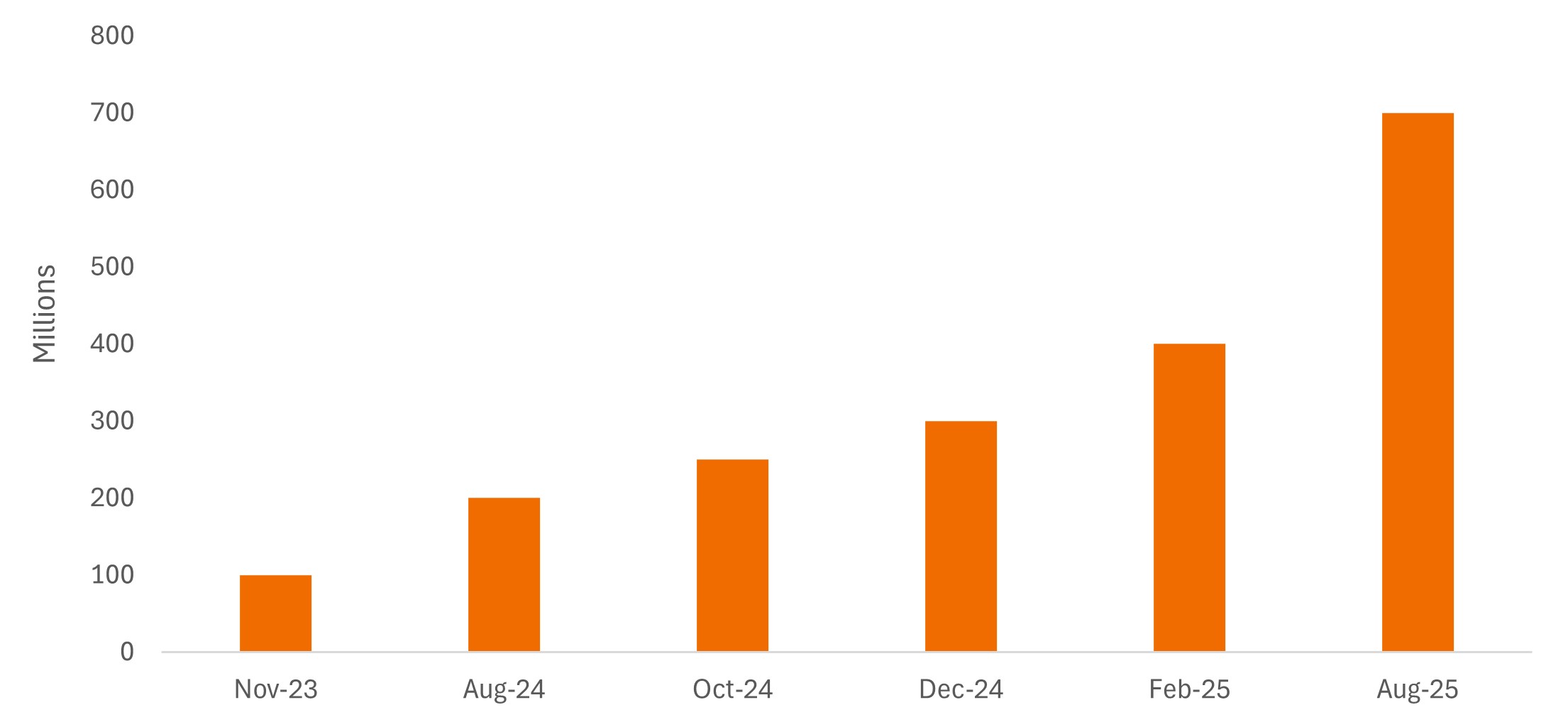

Indeed, ChatGPT – the large language model that made a splash in late 2022 with its user-friendly interface – is on track to potentially run away with the chatbot market, much as Google did with search in the early 2000s. Its creator, OpenAI, reports ChatGPT is set to hit 700 million weekly active users this month and says that number could reach one billion by the end of the year.

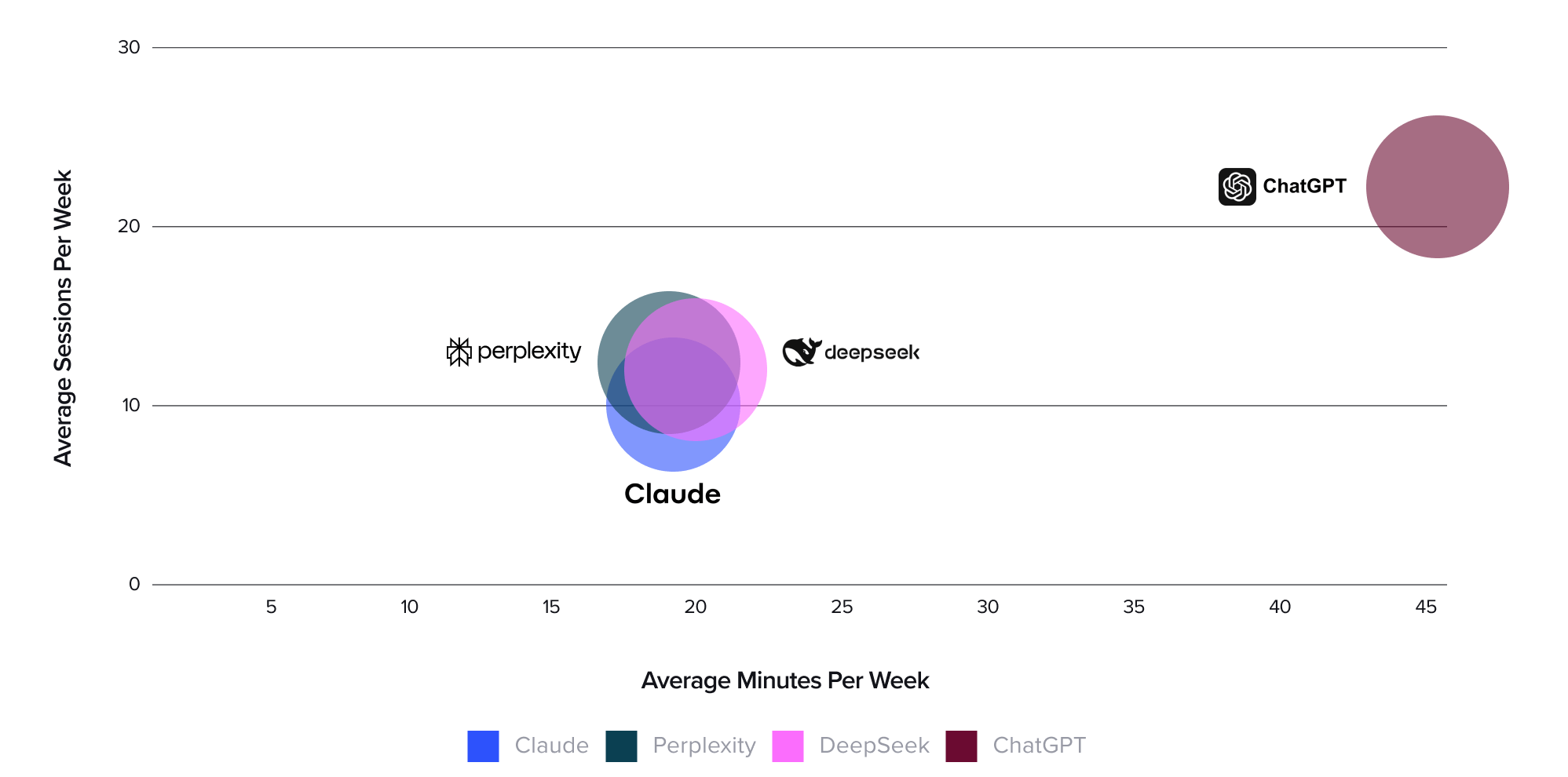

ChatGPT takes an early lead among chatbots

Source: Andreessen Horowitz, The Top 100 Gen AI Consumer Apps, 4th edition, 6 March 2025.

By comparison, Google’s equivalent chatbot, Gemini, currently has 450 million monthly active users, according to the company, and on a daily basis, Gemini users average four queries per day, versus 7.5 for ChatGPT.1

Given that AI chatbots are extremely adept at keeping consumers’ attention, with highly personalized responses and follow-up questions, the implications for all Internet platforms could be significant. Google Search is no exception.

Implications for legacy search models

For investors, the biggest question now is whether ChatGPT eventually usurps Google Search as the predominant way consumers seek out information. In 2024, Google Search generated just over $198 billion in revenue, or 57% of Alphabet’s total revenue. Google still attracts huge volumes of traffic – roughly 14 billion daily queries vs. 2.5 billion prompts on ChatGPT.2

However, those searches are increasingly being directed to the AI overviews that now appear at the top of every query result, as well as Google’s AI Mode, which recently launched in the U.S., India, and the UK and now has more than 100 million monthly average users.

This shift threatens to shake up the legacy search model (i.e., the “ten blue links”), as well as the open web, which depends on traffic from Google Search.3 Already, traffic to sites providing news, product reviews, vacation guides, and health tips is down significantly since Google launched AI Overviews.4

In fact, there is a growing theory that we could soon enter a “zero-click” world, where users search and buy almost instantly, à la Amazon transactions today. And in the not-too-distant future, AI chatbots might be able to “agentize” many of workflows, such as researching and booking travel.

Investor takeaways

In short, we think the stakes could not be higher for legacy search, and that companies will need to adjust to a potentially zero-click reality. Already, we are seeing the emergence of software startups that promise to optimize brand positioning in AI overviews by analyzing how chatbots respond to text prompts and rank brands in their responses.

If there’s a silver lining for legacy players, it may be that better search outcomes could yield higher-value interactions with consumers. Publishers such as Google have reported higher-quality clicks, as users spend more time on sites with greater relevance to their queries. That could enable companies to charge advertisers more per click.

Still, we wouldn’t take for granted that past growth rates of Internet search, and the corresponding ad revenues, will continue in the near term. We think investors should brace for change and seek out companies doing the same.

By the numbers – growth in chatbot usage

ChatGPT weekly active users

Source: As of 4 August 2025. Axios, TechCrunch, Reuters, The Information.

2 Jancer, M. “People Send ChatGPT 2.5 Billion Prompts a Day. That’s Billion, With a B.” Vice.com. July 22, 2025.

3 The “open web” refers to the portion of the internet that is freely accessible to the public, without the need for logins or subscriptions, and where information is readily indexed by search engines.

4 Vidushi Dyall, Chamber of Progress. April 2025.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.