Traditionally, many investors have relied on the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) as a proxy for their core bond allocation.

But sticking too closely to the U.S. Agg has historically proven to be suboptimal from a risk-return perspective. That’s why we believe investors should consider a multisector income fund for their core bond allocation.

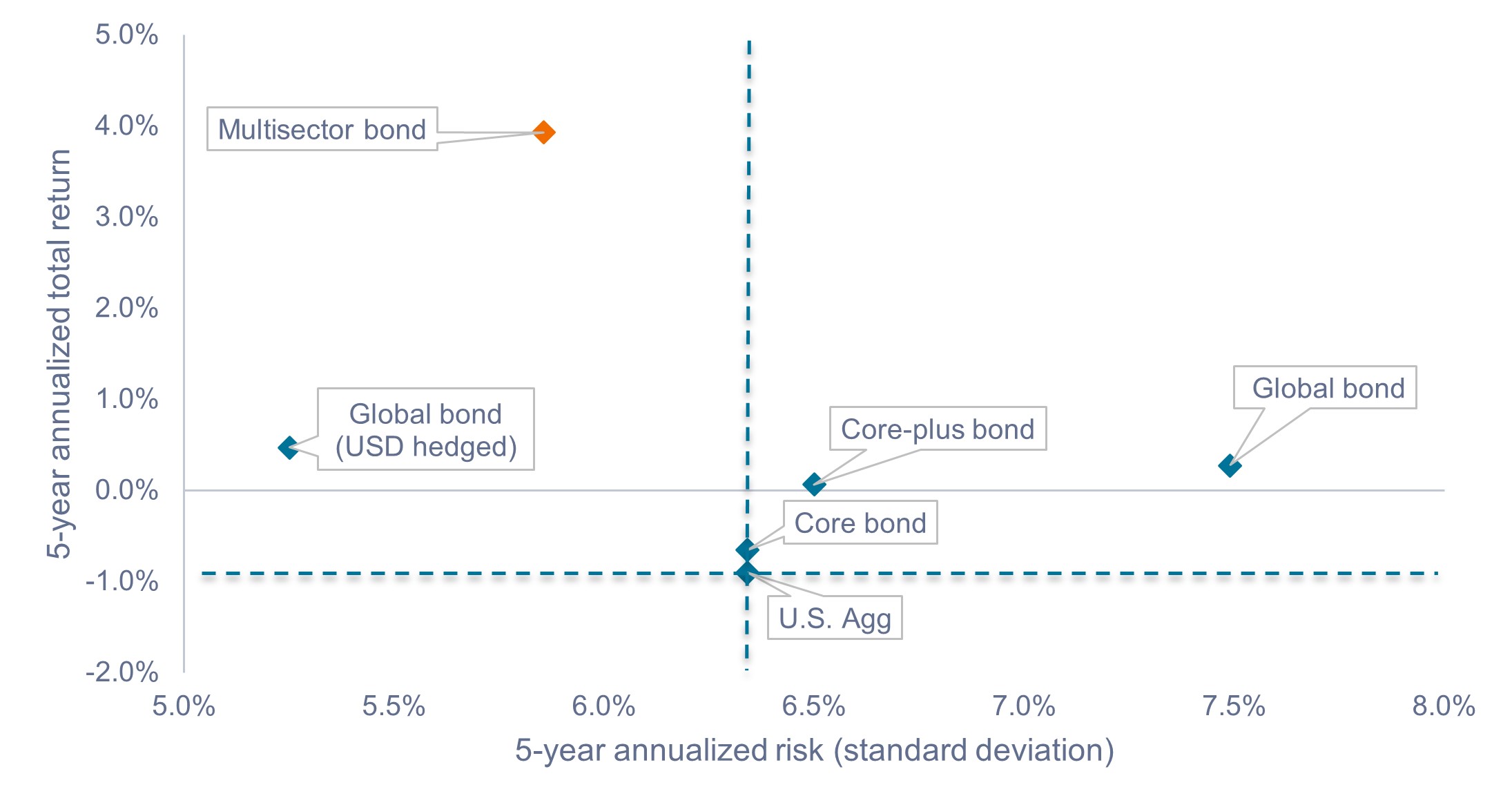

The number one reason to consider a multisector fund for a core bond allocation is that multisector funds have historically generated better risk-adjusted and absolute returns than the U.S. Agg, core, and core-plus categories.1

As shown in Exhibit 1, over the past five years, the multisector category has provided higher returns with lower volatility than the U.S. Agg, as well as the global bond, core bond, and core-plus categories.2

Exhibit 1: Total returns and risk (May 2020 – May 2025)

Multisector funds have recently been rewarded for their mix of interest-rate and credit-spread risk.

Source: Morningstar, as of 31 May 2025. Past performance does not predict future results. Bond categories as per Morningstar and defined in the Definitions and Disclosures section.

This record of strong risk-adjusted performance may come as a bit of a surprise to investors, many of whom think of multisector funds as being “higher risk” than core and core-plus funds.

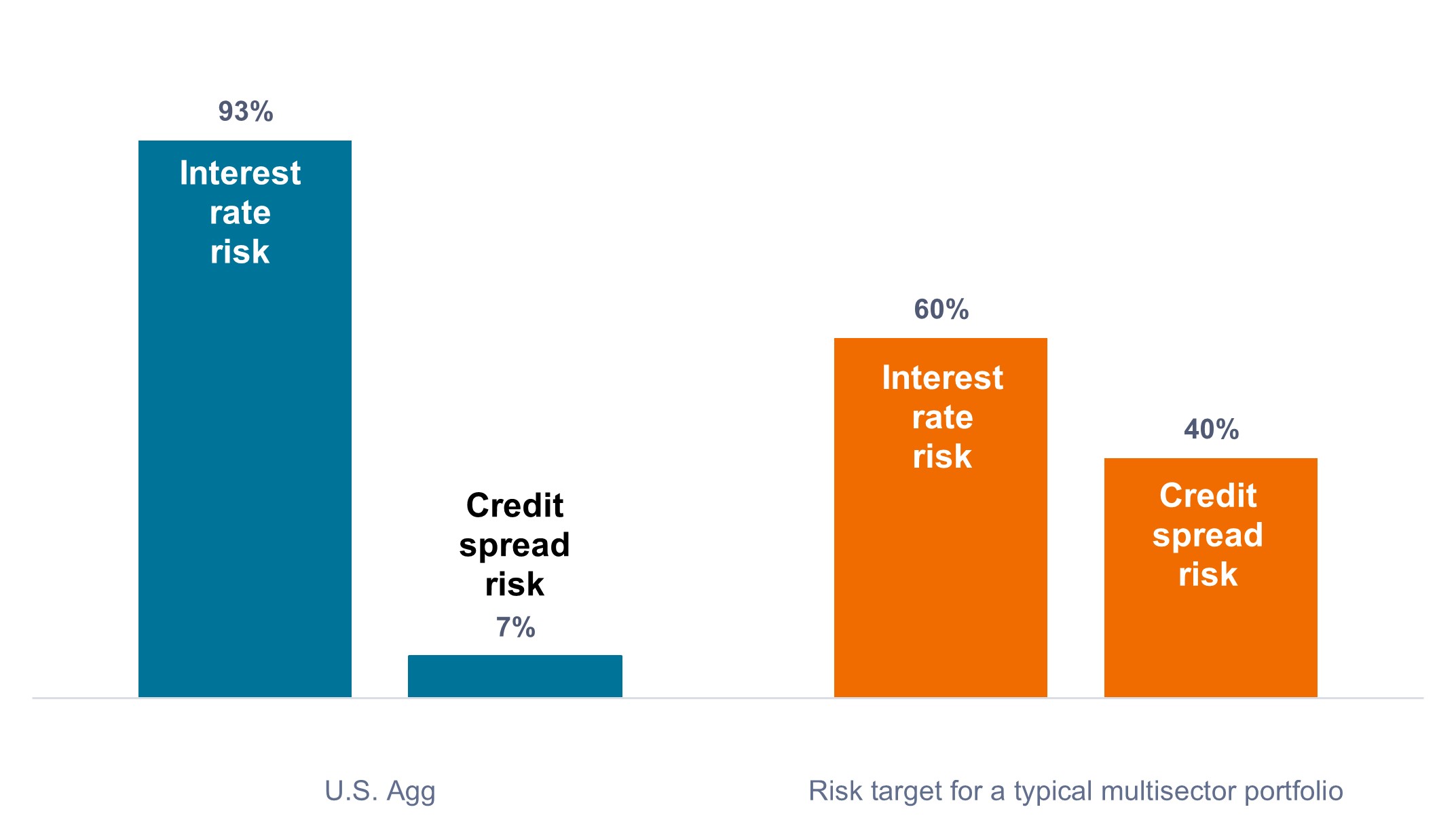

While it is true that over the long term multisector funds exhibit a higher level of volatility than core and core-plus categories, we think the more important takeaway is that the primary objective of multisector funds may not necessarily be to target a higher level of risk, but rather to target a more efficient mix of interest-rate and credit-spread risk.

As shown in Exhibit 2, the multisector category may have more flexibility to balance these risks under varying market conditions as it seeks to maximize the long-term return potential from fixed income securities.

Exhibit 2: Risk factor decomposition (March 2020 – March 2025)

Multi-sector portfolios aim to provide a more balanced mix of risk factors.

Source: Bloomberg, Janus Henderson Investors, as of 31 March 2025.

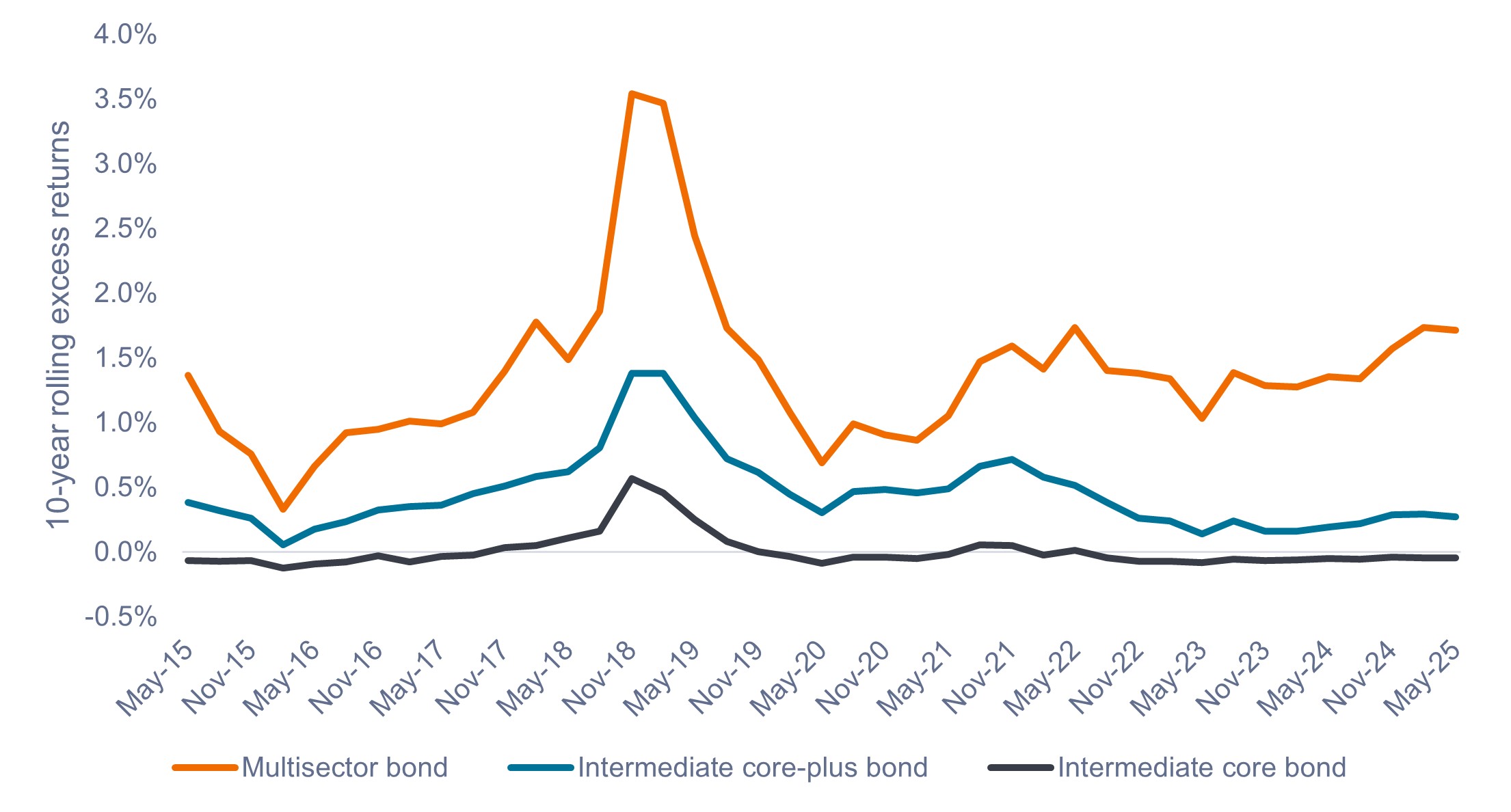

The present trend of multisector funds outperforming core and core-plus strategies is not only a recent phenomenon. The multisector category has outperformed the core and core-plus categories on an excess return basis for all 10-year rolling periods over the past 10 years, as shown in Exhibit 3.

Furthermore, over a 20-year period the multisector category has shown an ability to outperform the bellwether core-plus category through numerous economic, market, and policy cycles by a statistically meaningful 1.07% annualized.

In our view, the outperformance speaks to the benefit of having diversified income streams and a better balance of credit-spread and interest-rate risk.

Exhibit 3: 10-year rolling excess returns (May 2015 – May 2025)

Even through downturns, multisector funds have outperformed over the long term.

Source: Morningstar, as of 31 May 2025. Past performance does not predict future results.

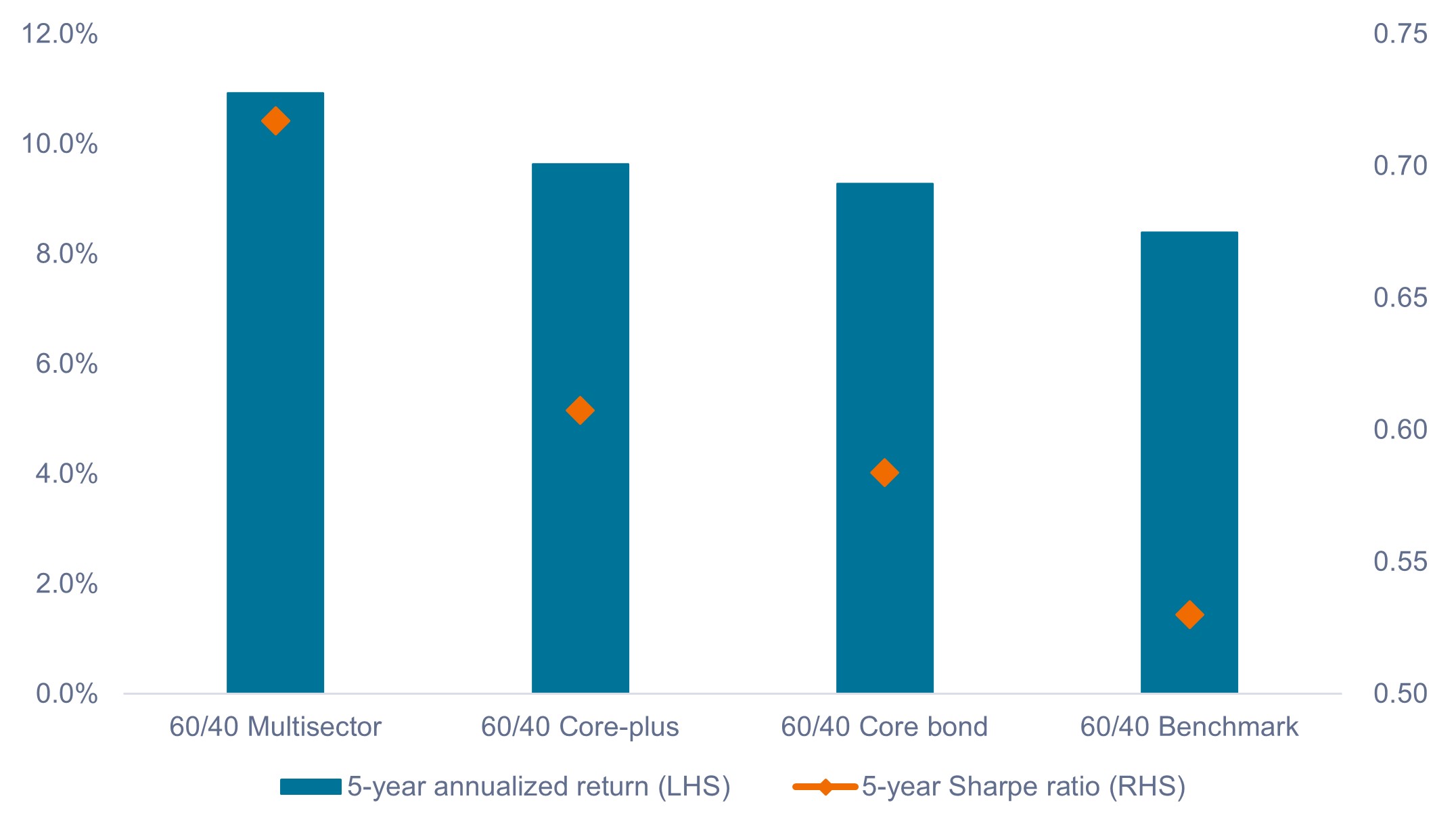

Some investors may be concerned that increasing risk within their fixed income allocation could reduce their bond allocation’s effectiveness in providing a ballast against equity volatility.

But we find that, within the confines of a 60/40 portfolio, using a multisector fund as a core bond allocation has resulted in marginal increases in volatility, while boosting total returns and Sharpe ratios, as shown in Exhibit 4.

Therefore, taking on a slightly higher and more even mix of risk within one’s bond allocation may be a more efficient way of building a balanced portfolio.

Exhibit 4: Balanced portfolio (60/40) total returns and Sharpe ratios (May 2020 – May 2025)

The risk-return characteristics of multisector funds have been additive within balanced portfolios.

Source: Morningstar, as of 31 May 2025. Past performance does not predict future results.

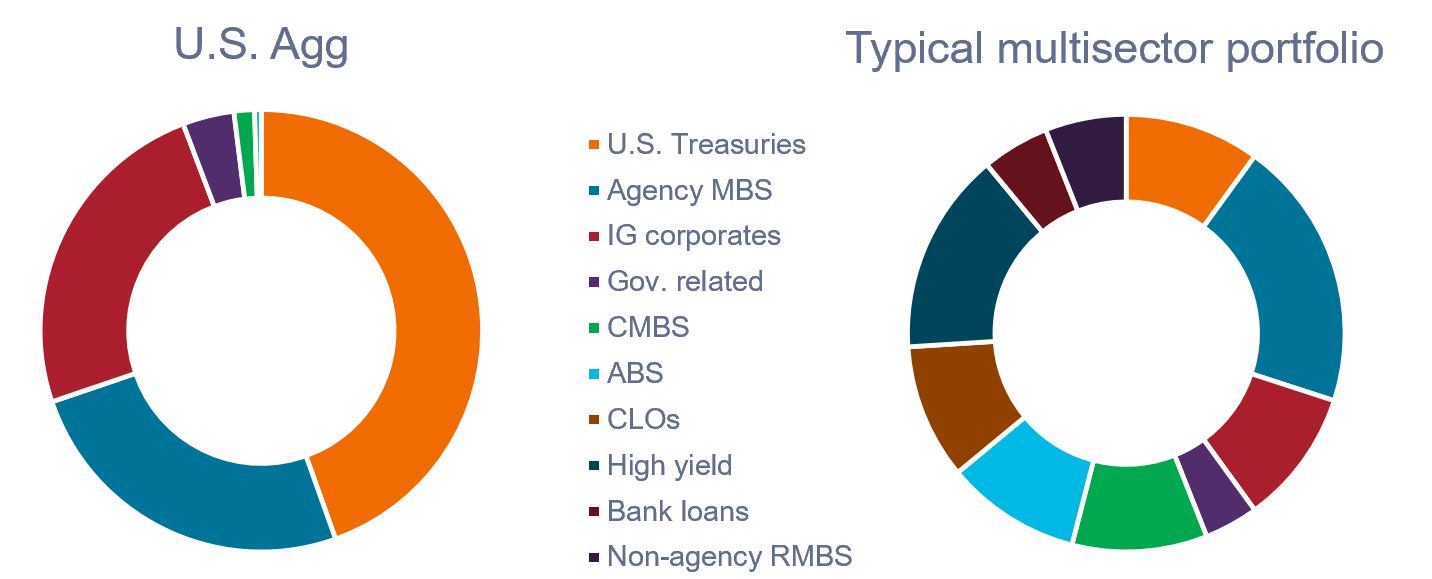

How do multisector funds differ from traditional core and core-plus funds? The primary distinction is that multisector portfolios typically offer exposure to a wider selection of fixed income sectors.

As shown in Exhibit 5, the U.S. Agg is overwhelmingly weighted in U.S. Treasuries (currently 45%), agency mortgage-backed securities (MBS), and investment-grade (IG) corporates. In contrast, typical multi-sector portfolios aim to provide exposure to a broad array of fixed income sectors, offering better diversification of risk exposures, borrowers, and sources of yield.

Exhibit 5: Sector weightings: U.S. Agg vs. a typical multi-sector portfolio

Multi-sector portfolios may provide better access to an array of fixed income opportunities.

Source: Bloomberg, Janus Henderson Investors, as of 31 May 2024.

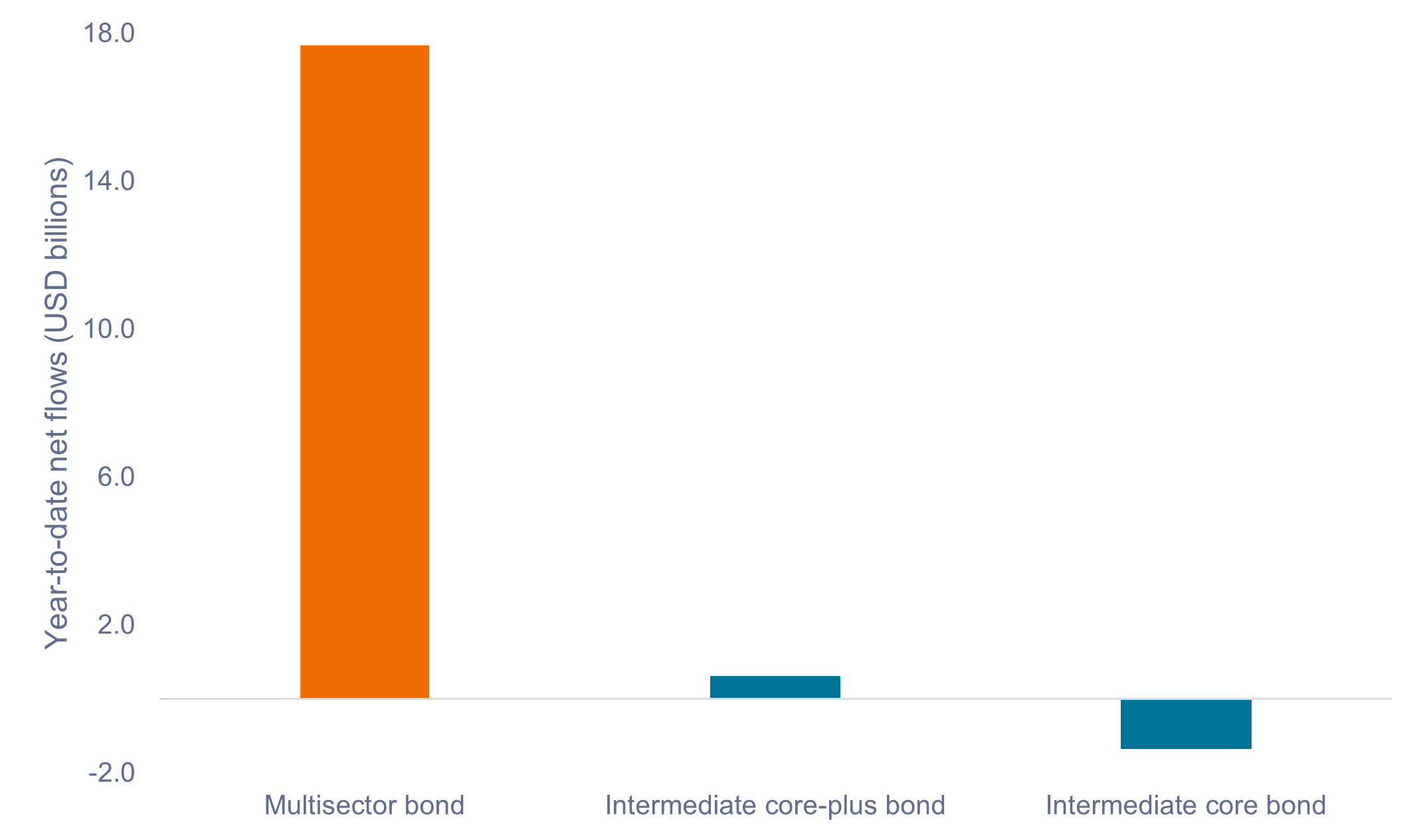

Thus far in 2025, investors have been voting with their dollars, as flows into multisector funds have far surpassed flows into other core and core-plus strategies. We believe this trend may point to multisector funds gaining recognition for their utility in building efficient portfolios suited to long-term investor goals.

Exhibit 6: Year-to-date net flows (Jan 2025 – May 2025)

Capital flows into multisector funds have far surpassed traditional core strategies in 2025.

Source: Morningstar, as of 31 May 2025. Past performance does not predict future results.

In summary

In our view, it is essential for an entire portfolio to contribute to an investor’s long-term investment goals. We believe that, over the long term, multisector income funds may lead to better outcomes through their more diverse exposure and better balance of interest-rate and credit-spread risk.

1 Multisector, core, and core-plus categories are as per Morningstar categories and are defined in the Definitions and Disclosures section. All data in this article relating to Morningstar categories are based on the peer group median.

2 By definition, core and core-plus strategies are constrained by their to the U.S. Aggregate Index.

The Bloomberg U.S. Aggregate Bond Index, often called the “Agg,” is a broad-based, market-weighted index representing the U.S. investment-grade, fixed-rate bond market.

Credit quality ratings are measured on a scale that generally ranges from Aaa (highest) to C (lowest).

Credit spread risk is the risk that changes in the spread between the yield of a corporate bond and a government bond will negatively impact the market value of the corporate bond. It reflects the perceived credit risk of the corporate issuer, as reflected in the difference in yields. A wider spread indicates higher credit risk and a greater yield premium demanded by investors.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Excess return refers to the difference between an investment’s actual return and the return of a benchmark or risk-free asset. Essentially, it’s the amount by which an investment outperforms a reference point, often a market index or a risk-free rate like a government bond.

Interest rate risk is the risk that the value of a bond or other fixed-income investment will be adversely impacted by a change in interest rates.

Morningstar’s intermediate core bond category describes fixed-income funds that primarily invest in investment-grade U.S. government, corporate, and securitized debt, with a duration between 75% and 125% of the three-year average effective duration of the Morningstar Core Bond Index. These funds generally hold less than 5% in below-investment-grade debt.

Morningstar’s core-plus bond funds invest primarily in investment-grade US fixed-income issues including government, corporate, and securitized debt. However, they generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-US currency exposures.

Morningstar’s multisector bond category generally takes on more credit risk than portfolios in the intermediate core and core-plus groups. Typically, multisector funds hold between a third and two thirds of their portfolios in bonds with below-investment-grade ratings. As the category name suggests, multisector funds invest across a wide range of bond sectors. These include corporate bonds, sovereign developed- and emerging-markets debt, and securitized credit, with some holding large stakes in nonagency mortgages.

Morningstar global bond funds invest 40% or more of their assets in fixed-income instruments issued outside the United States. These funds can have varying allocations between US and non-US bonds, as well as between high and low-quality bonds.

The Sharpe ratio is a metric used in finance to assess the performance of an investment by adjusting for its risk. It measures the excess return (return above a risk-free rate) per unit of risk (usually measured by standard deviation). A higher Sharpe ratio generally indicates a better risk-adjusted return, meaning the investment is providing more returns for the level of risk taken.

Standard deviation is a statistical measure that quantifies how much an investment’s returns deviate from its average return. Essentially, it tells you how volatile an investment is, meaning how much its price fluctuates over time. A higher standard deviation indicates greater price volatility, and therefore higher risk, while a lower standard deviation suggests more stable returns and lower risk.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

- The Fund invests in Asset-Backed Securities (ABS) and other forms of securitised investments, which may be subject to greater credit / default, liquidity, interest rate and prepayment and extension risks, compared to other investments such as government or corporate issued bonds and this may negatively impact the realised return on investment in the securities.