The Horizon Discovering New Alpha (DNA) Fund is a high-conviction global equity portfolio focused on next-generation growth themes.

How the DNA fund positions you for tomorrow’s defining trends

Markets are more complex than ever. With information overload, clarity is essential to pursue investment objectives. Janus Henderson’s DNA Fund uses a high conviction global equity approach, leveraging deep research and broad investment expertise to uncover differentiated opportunities.

Marketing communication. Past performance does not predict future returns

The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Common concerns about global equity portfolios

1

Concentrated in large-cap stocks

2

Concentrated in specific sectors, particularly tech

3

Concentrated in market leaders, e.g. Mag 7

4

Concentrated in the top 10 holdings of the index

5

Concentrated in specific regions, e.g. the U.S.

Concentration risk across major indices

| Index name | Country/region | Key sector focus | Proportion of large-cap stocks | Top 10 holdings of index |

|---|---|---|---|---|

| NASDAQ-100 | U.S. | Technology, growth stocks | ~60% | ~70% |

| S&P 500 | U.S. | Broad market (large cap) | ~80% | ~30-35% |

| EURO STOXX 50 | Europe | Industrial, technology, banks | ~100% | ~41% |

| FTSE 100 | UK | Energy, consumer goods | ~90% | ~50% |

| Dow Jones Industrial Average |

U.S. | Industrial, blue-chip stocks | ~100% | ~45% |

| Index name NASDAQ-100 |

|

| Country/region U.S. |

Key sector focus Technology, growth stocks |

| Large-cap stocks ~60% |

Top 10 holdings ~70% |

| Index name S&P 500 |

|

| Country/region U.S. |

Key sector focus Broad market (Large Cap) |

| Large-cap stocks ~80% |

Top 10 holdings ~30-35% |

| Index name EURO STOXX 50 |

|

| Country/region Europe |

Key sector focus Industrial, technology, banks |

| Large-cap stocks ~100% |

Top 10 holdings ~41% |

| Index name FTSE 100 |

|

| Country/region U.K |

Key sector focus Energy, consumer goods |

| Large-cap stocks ~90% |

Top 10 holdings ~50% |

| Index name Dow Jones Industrial Average |

|

| Country/region U.S. |

Key sector focus Industrial, blue-chip stocks |

| Large-cap stocks ~100% |

Top 10 holdings ~45% |

Janus Henderson Investors, Factset, as at 31 December 2024.

Introducing the DNA Fund

The DNA Fund delivers a differentiated approach to global equity investing, built around Janus Henderson’s high-conviction stock ideas identified through rigorous research and deep sector insight. It provides investors with a focused approach aiming to seek differentiated opportunities beyond broad market exposure.

Dynamic approach to global equities

Move beyond traditional funds and outdated indices to focus on emerging trends and high-potential companies.

Navigate key trends

Achieve a globally diversified portfolio, optimised to be a core investment solution, whilst aligning to the key trends of tomorrow.

Authoritative expertise

Harness Janus Henderson's deep experience and successful track record to identify and capitalise on future growth opportunities.

Why choose the DNA Fund

Unconstrained idea generation across specialist teams

The DNA Fund brings together approximately 50 high-conviction investment ideas sourced from Janus Henderson’s specialist teams, including Technology, Healthcare, Sustainable Investing, Property, Financials, and Emerging Markets. Each idea is identified through rigorous bottom-up research, creating a portfolio designed to capture next-generation growth themes and structural market trends.

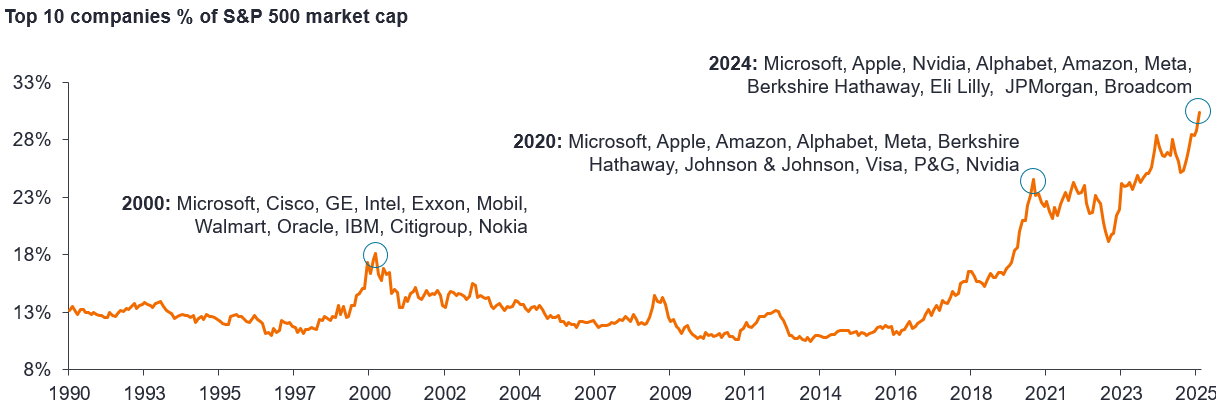

Addressing concentration risk and index bias

Traditional indexes reward past winners, leading to extreme concentration risk (eg. the Magnificent 7), and along with this valuation and diversification concerns. Our highly active approach aims to look beyond the index to uncover exciting emerging opportunities.

US stock market concentration

Any reference to individual companies is solely for illustrative purposes and should not be interpreted as a recommendation to buy or sell, nor as advice regarding investment, legal, or tax matters.

Investing in tomorrow’s acronyms today

History shows that future market leaders often start as overlooked challengers. Spotting them early is key to long-term success. With a track record of identifying structural shifts and disruptive innovation, Janus Henderson’s authority is already targeting the companies that could define the next wave of growth.

Navigate key trends

The DNA Fund applies our thematic investing insights as a strategic overlay to identify companies that emerge from these long-term growth opportunities sets and themes:

Smarter automation

Automating the real world

Mobility

Redefining journeys

Lifestyle 2.0

Evolution of how we work and play

Sovereignty

Re-localisation and security

Longevity

Re-imagining demographics

Biotech

Addressing unmet medical needs

Net zero 2.0

Resiliency in energy and sustainability

Meet the team behind the DNA Fund

Janus Henderson's mission is to help clients define and achieve superior financial outcomes through differentiated insights, disciplined investments, and world-class service.

With more than 90 years of insight-led investing experience, our team of investment experts uncover the real-world implications of market trends to form independent, research-driven perspectives.

The DNA Fund is powered by the collective expertise of 140+ specialist stock pickers worldwide, bringing together high-conviction ideas from teams focused on healthcare, technology, property and more. This collaborative approach enables us to identify next-generation growth opportunities and deliver a truly global equity approach.

Portfolio Manager

- 22 years experience

- Portfolio Manager on firm’s Global Technology Leaders Team, a position he has held since 2014

- Managed portfolios: Global Technology Leaders, Sustainable Future Technologies

- Holds a first-class honours degree in Modern History from the University of Oxford and is a CFA charterholder

Portfolio Manager

- 15 years experience

- Portfolio Manager on the firm’s Multi-Asset Team, a position he has held since 2017

- Joined Henderson in 2015 as a quantitative risk manager

- Managed portfolios: Multi-Asset solution; Global Allocation Fund - Conservative, Growth & Moderate

- Holds a BSc degree in economics from Birmingham University, MSc in economics from Warwick University, MPhil in economics from Oxford University and is a CFA charterholder

The DNA Fund is powered by the collective expertise of 140+ specialist stock pickers worldwide, bringing together high-conviction ideas from teams focused on healthcare, technology, property and more. This collaborative approach enables us to identify next-generation growth opportunities and deliver a truly global equity approach.

Graeme Clark

Technology

31 years of experience

Alison Porter

Technology

30 years of experience

Andy Acker

Healthcare

29 years of experience

John Jordan

Financials

28 years of experience

Aaron Scully, CFA

Sustainable

27 years of experience

Tal Lomnitzer

Natural resources

27 years of experience

Daniel Lyons, PhD, CFA

Healthcare

27 years of experience

Tim Gibson

Property

24 years of experience

Hamish Chamberlayne, CFA

Sustainable

22 years of experience

Guy Barnard, CFA

Property

22 years of experience

Doug Turnbull, CFA

Emerging markets

18 years of experience

Matthew Culley

Emerging markets

17 years of experience

Tim McCarty, PhD

Healthcare | Med tech & services

13 years of experience

Augstin Mohedas, PhD

Biotechnology

11 years of experience

Luyi Guo, PhD, CFA

Healthcare | Pharmaceuticals

12 years of experience

and many more

As at December 31, 2025

Differentiated insights

Featured Outlook

Investing in tomorrow’s acronyms today: Time to rethink global equity allocations?

Global equity allocations can come with challenges. Portfolio managers Richard Clode and Nick Harper consider the best way to gain exposure to exciting new themes through high conviction stock picking balanced with optimised portfolio construction.

Insights delivered to your inbox

To implement any of these solutions or to find out more about how they can help you excel, contact your Janus Henderson sales director.