Market recap: An eventful and volatile year

2025 was a year full of unexpected events for Japanese stocks. After the market crash that followed the rate hike in August last year, the Bank of Japan (BoJ) raised its policy rate to 0.5% in January – some six months later; however, the market reaction was limited. With inflation hovering around 3%, investors assumed that monetary policy normalisation would progress steadily, with expectations for another hike to 0.75% by the summer. However, at the end of March, the US announced a 25% increase in import tariffs for Japanese goods, triggering another sharp decline in the equity market – this effectively put an end to further rate hikes. When tariffs were renegotiated to a much more reasonable level of 15% in July, investor risk appetite rapidly recovered.

Continuing corporate reforms: A key tailwind for Japanese stocks

Despite various external factors influencing the market, corporate governance reforms continued to progress. Notably, Toyota Motor Corporation’s decision to simplify its group structure by reducing its cross-shareholdings, making the business more transparent, efficient and improving financial clarity marked a significant step forward.

In the second half of the year, Japanese stocks were supported by inflation-driven margins improvement, ongoing governance reforms, demand for AI-related investments, and heightened policy expectations under new prime minister Sanae Takaichi. At the time of writing (10 December), the TOPIX Index’s total return year-to-date exceeded 20% in US dollar terms, outperforming the S&P 5001. Our constructive view on Japanese equities at the start of the year looks to have largely proved accurate. This was reinforced by a rebound in foreign inflows, although global investors remain underweight in the region.

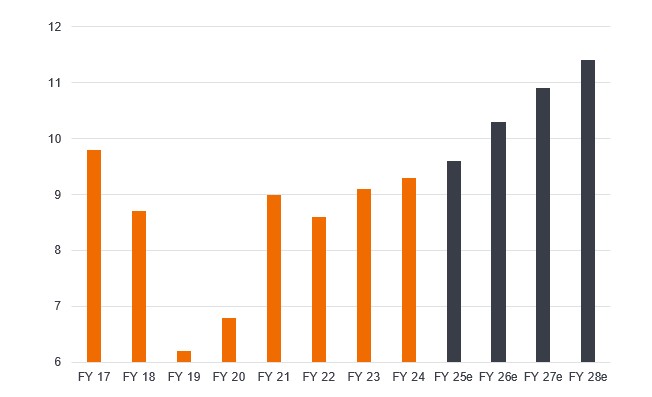

Figure 1: Foreign inflows are returning to Japanese equities (Yen, billions)

Source: Bloomberg, Janus Henderson as at 30 November 2025.

Our base case for Japan remains: Strong earnings growth underpinned by mild inflation

So, what can investors expect in 2026? First, we believe there is strong potential for Japanese equities to deliver double-digit earnings growth. Export sectors such as autos, which were hit by US tariffs, look likely to recover as they further localise manufacturing, diversify supply chains, and increase prices where possible.

In addition, domestic demand – particularly from the corporate sector, should benefit from strong investment appetite driven by inflation expectations and AI-related demand, supporting economic growth. Personal consumption remains solid, bolstered by rising incomes and increased government spending. Financials are also expected to see earnings boosted by the normalisation of monetary policy via interest rate hikes. In this context, we think earnings growth underpinned by mild inflation is a compelling opportunity to invest in Japanese stocks.

Furthermore, the asset class benefits from investor recognition of improving margins and return-on-equity (ROE), as well as expectations for further consolidation in Japan’s crowded industries such as retailers, autos, and other industrials, which could improve pricing power and further enhance margins and ROE.

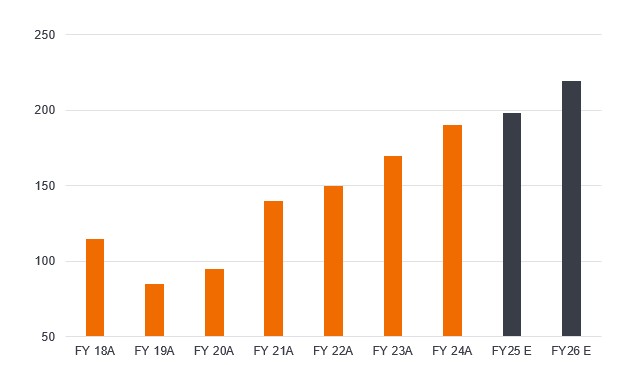

Figure 2: TOPIX ROE is improving (%)

Source: Bloomberg Finance LP, JP Morgan estimates as at 30 November 2025. Data through FY24 are actual figures and data from FY25 are forecasts. Forecast data may vary and are not guaranteed.

Corporate governance focus turns to more efficient use of Japanese corporates’ cash holdings

A revision of the Corporate Governance Code – the first in five years, is scheduled for mid-2026. This is likely to spark debate about the rationale for corporates to hold large cash piles; the largest companies held a total of ¥115 trillion (>US$750 billion) in cash and deposits as of March 2025.2 Japanese companies have typically maintained high cash levels and kept wages low to maximise profits and indirectly enable (the tradition for) lifetime employment and job security.

This explains why Japan’s labour share (the part of national income, or a particular economic sector, allocated to wages (labour) remains low compared to other developed countries.

If companies are now required to justify the level of cash on their balance sheet, this could have an impact on the allocation of profit/shareholder value, which has been improving via rising dividends and share buybacks. It will also spur companies to reconsider the appropriate level of wages for employees, which could lead to multi-year income growth, boosting consumption.

Risks to watch: Monetary and fiscal policy uncertainty

While we maintain a positive outlook for Japanese equities, we acknowledge risks remain with uncertainty around monetary and fiscal policy. The BoJ is still behind the curve in terms of monetary policy normalisation. Leaving significant real negative rates unchecked has impacted a wide range of areas, including exchange rates and real estate prices. We expect the policy rate to be raised to 0.75% soon, but the timing of the next hike is unclear. If political factors or economic concerns delay hikes, it may be positive for markets in the short term, but could introduce instability in the medium term. As referred to earlier, Prime Minister Takaichi’s pro-growth policies have been well received by markets, but while tax revenues have increased in a strong economy, some policies lack secure funding, which may have an impact on the bond market. On a positive note, the new administration is managing policy more credibly than previous governments, so confidence in monetary and fiscal policy should be maintained, although careful monitoring is required.

Multiple reasons underpinning expectations for double-digit earnings growth for Japan in 2026

Despite macro volatility in 2025, Japanese companies have generally avoided profit declines, which leaves the equity market well positioned to deliver attractive returns. In 2026, we believe the market has the potential to achieve returns in line with double-digit earnings per share (EPS) growth. With inflation looking to be entrenched for the fourth year running, we anticipate that share buybacks, accelerated corporate actions such as mergers and acquisitions, and management buyouts will also restore dynamism to Japan’s capital markets, as well as a continuation of foreign investor inflows.

Figure 3: TOPIX EPS upgrades

Source: Bloomberg, Janus Henderson Investors, IBES consensus data, JP Morgan as at 2 December 2025. Data for FY25 and FY26 are forecasts. Forecast data may vary and are not guaranteed.

Meanwhile, while AI and related stocks mainly led market gains in 2025 and look set to continue doing so next year, stock selection will likely become more important. We also expect to find opportunities in other sectors of the market as the economy improves. As always, our focus is on identifying and investing in high-quality, well-managed companies with strong cash flow generation that trade at reasonable valuations.

1 Bloomberg; TOPIX (+24.6%) versus S&P500 (+17.2%). Total returns in USD terms from 31 December 2024 to 10 December 2025. Past performance does not predict future returns.

2 Nikkei Asia; “Japan to pressure companies to start spending $750 bn in cash reserves”; 23 October 2025.

TOPIX is a free-float adjusted market capitalisation-weighted index and is used as a benchmark for investment in Japanese stocks.

S&P 500 is a float-adjusted (meaning the market caps of its components are adjusted by the number of tradable shares), market-capitalisation-weighted index tracking 500 leading US public companies.

Corporate governance: A set of rules, practices, and processes used to run and control a company. This includes key areas such as environmental awareness, ethical behaviour, corporate strategy, compensation, and risk management. Cross-shareholdings: When a publicly-traded company holds a significant number of the outstanding shares of another publicly-traded company. This can lead to complex corporate structures and inefficient capital usage. Earnings Per Share: EPS is the bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares. Fiscal policy: Policy measures taken by governments to promote stable and sustainable growth via setting tax rates and spending levels. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes. Fiscal austerity refers to raising taxes and/or cutting spending with the aim of reducing government debt. Management buyout: The acquisition of a business by its own management team, typically funds by private equity, Margins: Business margins are the differences between the price of a good or service and the amount of money required to produce it. Profit margin is a measure of the income remaining after costs are deducted from sales revenue. A higher margin indicates greater profitability and efficiency. Margin ratios enable companies to analyse operational efficiencies, and compare profitability versus competitors. Monetary policy: Policies of a central bank aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. Monetary policy normalisation: The phasing-out of unconventional monetary policies (setting zero- or low-interest rates and purchases of short-term government bonds) that are put in place to stimulate an economy. Real negative interest rates: Occurs when inflation is higher than nominal interest rates. Return on equity: A measurement of a company’s profitability compared to its peers. Calculated using a company’s net income (income minus expenses and taxes) over a specified period, divided by the amount of money its shareholders have invested. A higher ROE generally indicates that a management team is more efficient at generating a return from investment. Share buybacks: When a company buys back its own shares from the market, it leads to a reduction in the number of shares in circulation, and as a consequence increases the value of each remaining share. A company may launch a buyback because it believes its shares are undervalued and it wants to provide investors with a better return. Tariff: A tax or duty imposed by a government on goods imported from other countries. Valuation: An estimation of the current worth of an asset based on future performance and current financial data.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.