A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Energy disruption, not geopolitics, is driving emerging markets as higher energy prices could reshape the winners and losers. The persistence of higher prices will determine the eventual impact.

The severity and duration of crude oil price volatility depend upon how the conflict could impact energy infrastructure and/or shipping in the Strait of Hormuz.

An early reaction to military strikes in Iran and the implications for investors.

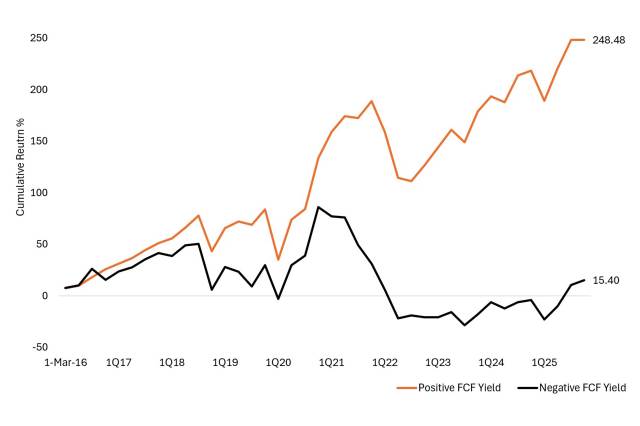

A divergence in performance between positive and negative cash-flow businesses could signal opportunity for investors focused on quality factors.

Key risks and opportunities within asset-backed securities (ABS) for investors seeking to navigate the evolving fixed income landscape.

Key highlights from NVIDIA’s latest quarterly earnings call includes the company citing 2026 as an agentic AI inflection point, driving increasing compute demand and revenue generation.

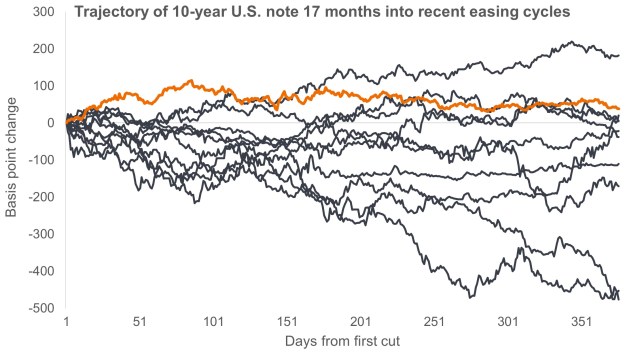

10-year U.S. Treasury yields charting a different course than what we’ve seen in recent easing cycles may indicate that this time could indeed be different.

Private credit has become a core allocation for investors. Hear insights from Janus Henderson and Victory Park Capital on the risk and opportunities in MENA and asset-backed finance.

Kenya’s external position has improved markedly, but beneath the surface emerges a more cautious story on fiscal reform and long term sustainability.

Hong Kong’s residential property market is in a recovery phase driven by supportive macro conditions, stronger household balance sheets, and renewed demand.