Surging supply from AI-driven tech giants is reshaping investment grade credit. Explore what this means for spreads, sector shifts, and investor strategies in 2026.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Marketing communication.

Modest economic growth should support high yield bonds but rich valuations demand selectivity.

Alex Veroude explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

How might capex spending on artificial intelligence be impacting credit spreads?

Are tight spreads justified and what tools can potentially help enhance returns?

Conversations with clients on fixed income at JHI's Madrid Investment Summit.

Possible reasons why high yield credit spreads could remain rangebound at low levels.

Why bond investors need a new playbook to maximize a fixed income allocation’s potential.

Three reasons why longer-dated bonds have struggled during 2025 despite central bank rate cuts.

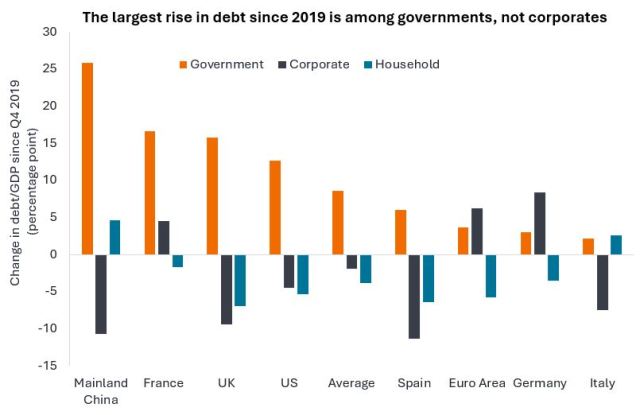

Exploring the potential interplay between government and corporate debt levels.

Looking at whether bond yields can offer predictive information about total returns from bonds.