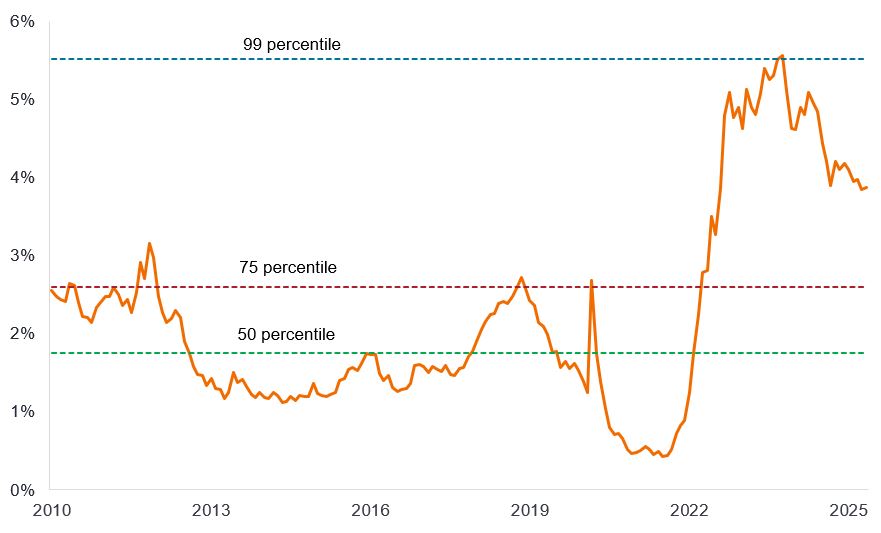

Capturing an attractive income for much of the last decade was a challenge when interest rates were near zero and bond yields not much higher. Today, investors do not have to take on much risk to achieve a historically attractive level of yield. Shorter-dated investment grade corporate bonds, i.e. those with maturities of one to three years carry relatively low interest rate risk, yet are on average offering yields of more than 3.5%. Going back over the last 15 years, today’s yield on global corporate bonds is much higher than the middle observation (50th percentile). In fact, yields have been lower more than 80% of the time. Locking in today’s yields could therefore be rewarding, particularly if yields were to head lower.

Figure 1: Yield on ICE BofA 1-3 Year Global Corporate Index

Source: Bloomberg, ICE BofA 1-3 year Global Corporate Index, 31 January 2010 to 31 May 2025. The yield shown is the yield to worst, which is the lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe an index, this statistic represents the weighted average across all the underlying bonds held. Percentile is a value on a scale of 100 that indicates the percent of a distribution that is equal to or below the datapoint. Yields may vary over time and are not guaranteed. Past performance does not predict future returns.

Strong cash flows

Companies have proved resilient in recent years. Corporates spent much of the years following the COVID pandemic strengthening their balance sheets, to help protect against future vulnerabilities. While interest costs climbed as central banks raised rates, refinancing costs have begun to flatten out as policy interest rates come down from their peak. Most companies, especially among investment grade borrowers, have adjusted well to the new environment. Equally, there has been only light merger and acquisition activity. Companies have avoided getting into expensive dealmaking – often funded by debt – and this has helped reduce the sensitivity of corporates to interest costs.

While financing costs have been kept in check, earnings have also been strong. The consumer has remained resilient despite higher interest rates. In the US, nearly all the companies that make up the S&P500 have reported earnings; for the first quarter of 2025, earnings rose c13.7% year-on-year.1 In Europe, around half the companies in the Stoxx 600 had reported earnings by mid-June, and so far, are showing an average 2.3% earnings increase in Q1 2025 compared to the same quarter a year ago.1

Resilient earnings are helping to keep credit metrics reasonably healthy. While tariffs are potentially creating a headwind to earnings in some areas – raising costs for companies and depressing volumes for exporters – some of this is offset by higher government spending. In the US, Trump’s “One Big Beautiful Bill Act” is expected to increase the US Federal deficit by $1.9trn over the 2025-29 fiscal years according to the US Congressional Budget Office.2 They estimate pass-through effects could raise gross domestic product (GDP) by 0.9% in 20262, which would be supportive for corporate bonds.

Most developed market countries have promised to raise their expenditure on defence while Germany has announced a big infrastructure programme. Taking just Germany’s infrastructure fund, the European Commission has modelled that Germany’s GDP could be around 1.25% higher by the end of the legislative term (2029) and 2.5% higher by 2035 due to the fund’s investments, with economic spillover potentially lifting EU GDP by 0.75% in 2035.3

Finding the sweet spot

Taken together, this bodes well for corporate revenues and cash flows. That does not mean being complacent. We take comfort from the fact that defaults (the failure to meet debt repayments) are typically very low among investment grade bonds and especially well-contained over short periods (see Figure 2). In our view, three years offers something of a sweet spot, where the incidence of cumulative defaults remains relatively low, allowing investors to pick up yield without taking on excessive risk.

Figure 2: Cumulative default rates

Source: Moody’s, Janus Henderson Investors, as at 31 December 2023. Past performance does not predict future returns.

By selectively adding some high yield bonds, investors can additionally harvest higher yields from among sub-investment grade bonds. For example, the yield on BB-B rated high yield bonds (equivalent to Ba-B bonds as rated by Moody’s) with 1-3 year to maturity averaged 5.7% at the end of May 2025.4 Through careful analysis of bond issuers and limiting exposure to high yield to a small percentage of a portfolio, investors can seek to capture some of this additional yield while limiting exposure to default.

Central banks remain in interest rate cutting mode. While the US Federal Reserve (Fed) is on pause, both markets and the Fed’s own economic projections anticipate further rate cuts in the next 12 months. Similarly, there are expectations that the European Central Bank and Bank of England will pursue further cuts.5 With this is mind, we believe it remains a compelling time to utilise fixed rate corporate bonds as a tool to lock in relatively attractive yields ahead of further cuts in interest rates and declines in money market rates.

Investors could seek to lock in today’s yield by buying an individual bond, but we think that a fixed maturity bond fund could be a less risky route. Just like an individual bond it has a regular coupon and fixed maturity date but comes with the added benefit of diversification across a portfolio of bonds. Furthermore, credit selection is undertaken by a team of experts, who will monitor the portfolio throughout its fixed term, helping to avoid default risk and maximise the yield.

1Source: LSEG I/B/E/S, S&P500 2025Q1 Earnings Dashboard, 13 June 2025. STOXX 600 Earnings Outlook, 17 June 2025. Earnings are subject to subsequent revision.

2Source: Congressional Budget Office, H.R.1, One Big Beautiful Bill Act (Dynamic Estimate), 17 June 2025.

3Source: The potential economic impact of the reform of Germany’s fiscal framework, 19 May 2025.

4Source: Bloomberg, ICE BofA 1-3 Year BB-B Global High Yield Non-Financial Constrained Index, yield to worst, 31 May 2025. Yields may vary over time and are not guaranteed.

5Source: Bloomberg, World Interest Rate Projections, 20 June 2025; Federal Reserve, Economic projections, 18 June 2025. There is no guarantee that past trends will continue, or forecasts will be realised.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please note that diversification neither assures a profit nor eliminates the risk of experiencing losses.

ICE BofA 1-3 Year Global Corporate Bond Index tracks the performance of investment grade corporate debt publicly issued in the major domestic and Eurobond markets, with a remaining term to final maturity less than 3 years.

ICE BofA 1-3 Year BB-B Global High Yield Non-Financial Constrained Index tracks the performance of USD,CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets, with a remaining term to final maturity less than 3 years and caps issuer exposure at 2%.

Basis points: Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%.

Corporate bond: A bond issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Corporate fundamentals: The underlying factors that contribute to the price of an investment. For a company, this can include the level of debt (leverage) in the company, its ability to generate cash and its ability to service that debt.

Coupon: A regular interest payment that is paid on a bond, described as a percentage of the face value of an investment. For example, if a bond has a face value of $100 and a 5% annual coupon, the bond will pay $5 a year in interest.

Credit rating: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P (Moody’s) ranks investment grade bonds from the highest AAA (Aaa) down to BBB (Baa3) and high yields bonds from BB (Ba1) through B (B1) down to CCC (Caa1) in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit spread: The difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario.

Duration: A measure of the sensitivity of a bond’s price to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Bond prices rise when their yields fall and vice versa.

Federal Reserve (Fed): The central bank of the US which determines its monetary policy.

Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal discipline is where governments do not borrow excessively, i.e. keeping borrowing as a percentage of the output of the economy low so that the overall debt burden does not expand aggressively.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Inflation: The rate at which prices of goods and services are rising in the economy. The Consumer Price Index is a measure of inflation that examines the price change of a basket of consumer goods and services over time.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Issuance: The act of making bonds available to investors by the borrowing (issuing) company, typically through a sale of bonds to the public or financial institutions.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money.

Tariff: A tax or duty imposed by the government of one country on the import of goods from another country.

Total return: The combined return from income and any change in capital value of an investment.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

Yield to worst: The lowest yield a bond (index) can achieve provided the issuer(s) does not default; it takes into account special features such as call options (that give issuers the right to call back, or redeem, a bond at a specified date).

Volatility measures risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.