Formulating an outlook for the Global Research Strategy typically entails highlighting the most salient themes emerging from our seven research sectors. Often, these themes are distinct to a specific industry, such as advancements in biotechnology. But for 2026 – and beyond – a singular theme has emerged that has the potential to transform not only business models across all sectors but also the entire global economy. That theme, of course, is artificial intelligence (AI).

In three years, we have gone from the ChatGPT moment to nearly every management team with whom we interact prioritizing how to integrate AI throughout their organizations. This development is owed to the power of the technology itself as well the degree to which AI can be leveraged to unlock productivity across front-, middle- and back-office business functions. We believe the past 12 months represent an inflection point as management teams have shifted from discussing AI in conceptual terms to giving concrete examples of it driving efficiencies. Perhaps even more importantly, AI has also offered new insights into their businesses and industries.

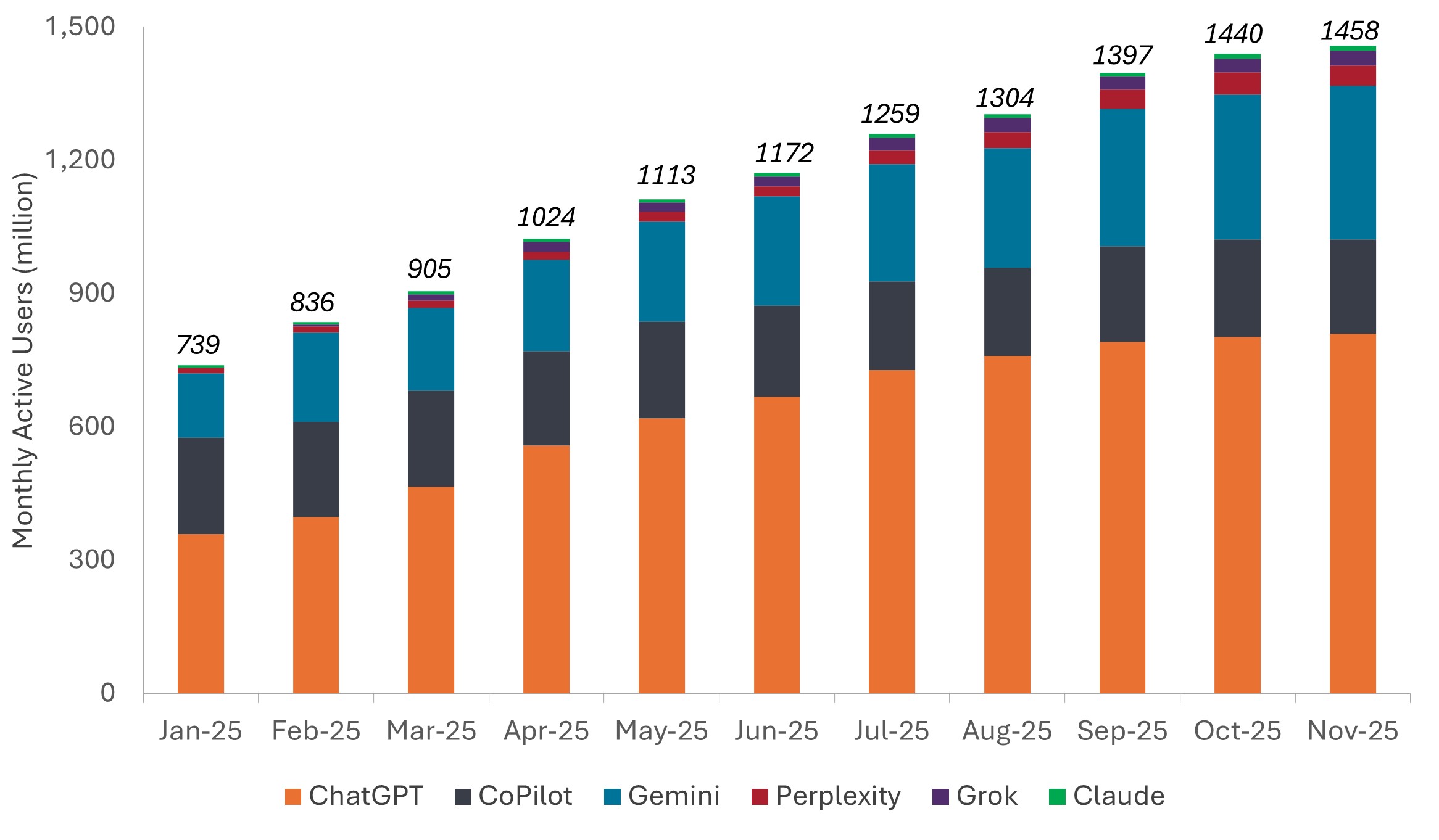

Exhibit 1: 2025 growth in AI monthly active users

Monthly active AI users doubled in 2025 as competing models leapfrogged each other in capabilities while consumers and enterprises sought productivity-enhancing applications.

Source: Techcrunch, Janus Henderson Investors, as of 15 December 2025.

Despite these advancements, it’s still early days. The AI enablement phase has largely been a story of infrastructure companies building out computing capacity and refining their models. These enterprises’ corporate end users, however, haven’t even begun to deploy those models in a manner that could create the durable competitive advantages that should define the AI winners.

As this handoff unfolds, investors will face a different environment than what has propelled equity markets to record levels. Market concentration in a handful of AI infrastructure winners allowed investors with beta exposure to participate in much of the rally’s upside. As attention turns to end users, we believe the ability to generate alpha – or excess returns – will play a greater role in investment outcomes as investors have the opportunity to identify the companies across industries that have formulated the best AI strategy and are executing against it.

A down payment on the AI future

Is too much being made of AI? No. In fact, we consider AI possibly the most disruptive force in computing in at least a generation. And with much of the global economy already digitized, that means nearly all sectors and business functions will be affected. We don’t view the technology as iterative but rather transformative. It’s akin to uninstalling the software upon which much of the global economy is based and replacing it with something faster and more collaborative that can think.

As evidenced by the roughly $2 trillion in capital major AI infrastructure companies are expected to deploy through 2027, this transition comes at cost. AI investment is analogous to the laying of railroads in the 19th century, electrification in the early 20th century, and the Internet in the 1990s. Time revealed that the rail network wasn’t only about Union Pacific, the benefits of electrification extended well beyond Edison Electric, and the widespread adoption of the Internet created wealth orders of magnitude larger than that accumulated by Cisco or EMC. Likewise, the AI story ultimately won’t merely be about infrastructure but rather AI’s broader use cases.

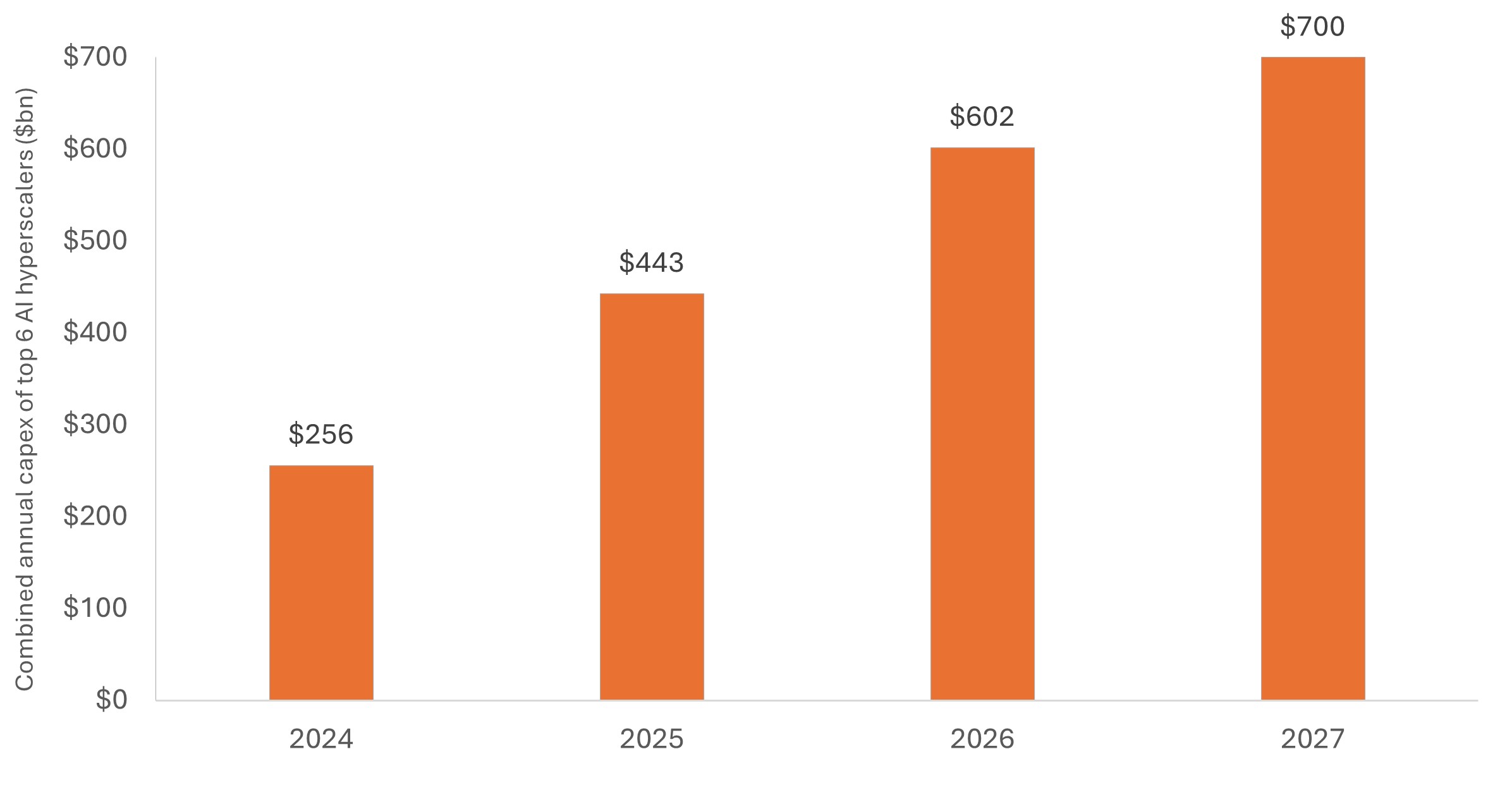

Exhibit 2: Annual AI infrastructure capital expenditure

The leading U.S. hyperscalers are on track to more than double their investments in AI infrastructure by next year, based on 2024 levels. While that pace may eventually slow, demand for advanced computing capacity has consistently exceeded expectations.

Source: Janus Henderson Investors, company data, as reported in third-quarter earnings calls. 2025-2027 data are estimates.

To fund this race toward deploying more advanced models – and potentially achieving artificial general intelligence (AGI) – leading AI companies have increasingly tapped debt markets in large volumes. This development has unnerved some investors. But while the size of this issuance has garnered headlines, perspective is needed. Even with the additional debt, most of these issuers possess sound balance sheets. This is owed to both low initial leverage and resilient business models that can generate significant cash needed to cover their obligations.

AI at the company level: Embracing the opportunity?

Just as hyperscalers are in a race, so too are AI enhancers and end users. Companies are seeking to procure the best data and access to models that could aid them in developing the AI applications that can widen their competitive moats. By moving at anything but full speed, companies increase the risk that their competitors will arrive at this objective first. And while the pace and breadth of implementation will vary based on industry-specific conditions, managers can rest assured that AI transformation is coming to most sectors.

Similar to earlier phases of digitization, for both AI platform operators and their corporate clients, scale matters. One key reason is data. Those able to collect the highest-quality data and develop methods to interpret it most effectively could benefit from a virtuous cycle premised on constantly feeding and improving models. Likely reinforcing this trend is test-time inference, where each query creates additional data that can be referenced later.

The imperative brought forth by AI aligns with our view that the best companies constantly seek to disrupt themselves. While in the past this restlessness may have been reserved for the highest performing management teams, it will be demanded of all companies in the AI era. Meeting the challenge will require a holistic effort, involving management, corporate boards, strategy, execution, and capital allocation. Those most effective at deploying AI have the potential to capture the power of compounding by consistently delivering higher earnings growth and requiring less incremental capital. Over longer horizons, these factors can separate winning stocks from market performers.

A time for disruption investing

Investors should not expect an AI infrastructure-driven rally to continue in perpetuity. While AI’s inference stage requires substantially more compute capacity – i.e., advanced chips and servers – than initially anticipated, the speed of AI deployment, in our view, means the time is now for investors to seek out the winners across all sectors that are likely to account for the lion’s share of the next phase of AI-related earnings growth.

The speed at which the global economy is embracing AI and the associated widening range of outcomes – given that many business models will fail to adapt – create an environment that lends itself to disruption investing and a focus on earnings growth. Success in each of these, in our view, requires in-depth, differentiated insight at the sector and company level. As companies incorporate AI, investors with the deepest understanding of industry dynamics and visibility into management’s ability to chart a path forward are likely best positioned to identify the companies embracing disruption – and those at risk of obsolescence.

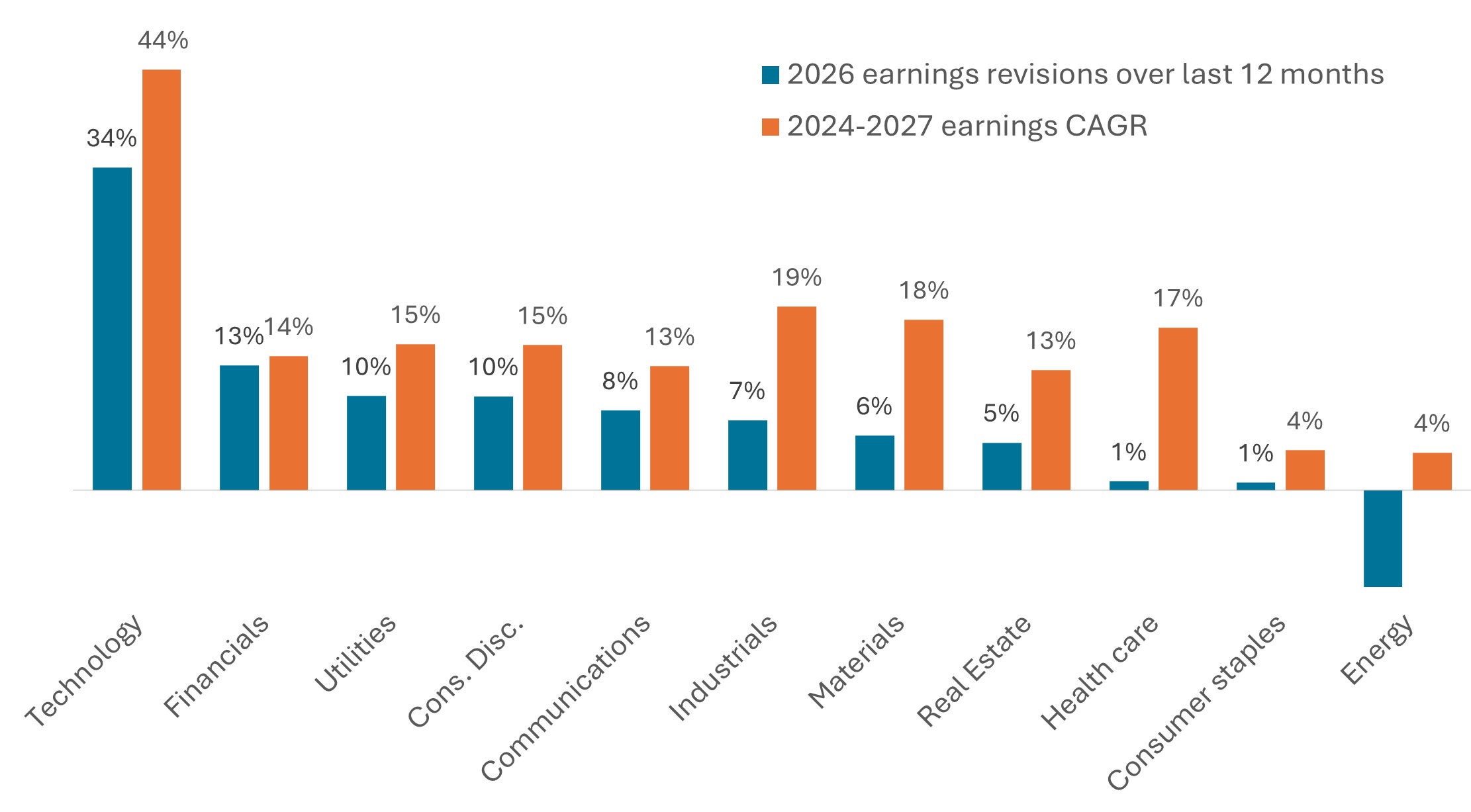

Exhibit 3: U.S. equities sector earnings growth in the AI era

2026 earnings estimates have been broadly revised upward, in part because investors anticipate corporate managers will increasingly integrate AI across business.

Source: Bloomberg, Janus Henderson Investors.

Company-level research also prioritizes the factor that, in our view, is the key determinant of long-term stock performance: earnings growth. This is especially true for companies associated with durable themes, as the market tends to overestimate the near-term earnings streams attributable to disruptive technologies but greatly underestimate them over longer horizons.

As earnings are the mechanism that delivers wealth to shareholders, investors will need to identify the companies whose AI deployment flows through to the bottom line. Unless a company has a defensible AI application, productivity gains are at risk of being competed away, resulting in most of the economic benefits accruing to customers rather than boosting earnings growth.

Getting earnings right also places valuations in perspective. Across sectors, there are always overvalued and undervalued stocks. By seeking visibility into earnings trajectories across the multi-year horizons over which themes like AI play out, investors can tune out much of the short-term noise that is often behind large swings in valuations.

The rest of the story: Innovation’s broad reach

Dedicating an annual outlook to a multi-year theme may seem like an artful way to dodge getting pinned down with nearer-term prognostications. Over the time horizons that allow the most promising technologies and stocks to rise to the top, however, we believe little can match the adoption of AI.

Still, other innovations continue to emerge. Within tech, the advancement of data centers will likely lead to efficiencies that extend beyond those attributable to AI. In the healthcare sector, scientists are targeting unmet medical needs with novel therapies. Included in this is research into how GLP-1s could be used to address a wider range of conditions.

As always, sector-specific developments present additional opportunities – some related to AI, others not. The bottlenecks in building data centers – e.g., permitting and construction constraints – should act as a natural governor to growth and extend the period in which chip and server demand outstrips supply. These conditions will invariably impact other sectors. Growing electricity demand should prove supportive of utilities, especially those operating in unregulated markets.

Within industrials, the associated need for turbines is leading to delivery times being measured in years. In the meantime, industrial companies could also be the beneficiaries of lower rates in the U.S. and further clarity on an evolving global trade framework.

Given the volume of data produced by customers and transactions, financial services companies are prime candidates to leverage AI’s analytical capabilities. Other sector tailwinds include the growth of electronic payments and a favorable regulatory environment – especially in Europe – that could have a range of benefits, including increased consolidation.

U.S. consumer balance sheets are strong, although a weakening labor market over the back half of 2025 merits monitoring. Corporate earnings have proven resilient, and the boost in productivity due to AI could place growth on a higher trajectory. We will, of course, watch how certain jobs could be impacted.

The past three years have provided evidence of how fast the AI revolution is moving. And end users are just starting to ramp up their usage. The disruption – and opportunity – that we believe will occur across all sectors is potentially unmatched in our professional careers. To meet this challenge, a premium will be placed on differentiated views, sector expertise, and the constant calibration of financial models to incorporate fast-moving developments – with some anticipated and others complete surprises.

IMPORTANT INFORMATION

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.