The conditions that have driven markets over the past decade or more – globalised supply chains and strong corporate earnings growth, in a world of persistently low interest rates – are fading. Today’s environment looks very different. Rising geopolitical tensions, more uncertain, volatile inflationary pressures, the material needs of AI, re shoring and the energy transition, are all placing pressure on already tight commodity inventories and a supply base that is slow to adapt.

These forces are creating much bigger differences in how various commodities behave, ushering in a period where real assets could play a more meaningful role in investors’ portfolios than they have in many years. Yet investors are still significantly under exposed to commodities, for various reasons, from concerns about volatility and drawdowns to frustrations over traditional ways of accessing the asset class. Given the current macroeconomic backdrop, that under allocation is becoming increasingly difficult to justify.

The case for a new commodities ‘supercycle’

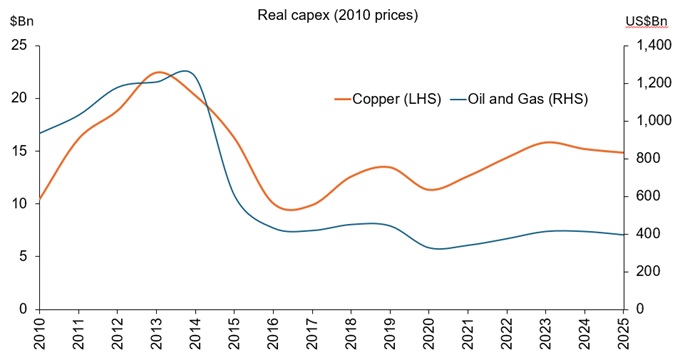

Commodity markets have faced years of underinvestment, a consequence of low capital expenditure (Exhibit 1), structural supply constraints and depleted inventories, with major projects taking a decade or more to build. At the same time, a sustained push towards de carbonisation is dramatically increasing demand for copper, nickel, lithium and rare earths, for electrification and renewable energy infrastructure.

Exhibit 1: Real capex in commodities has not grown, despite higher prices

Source: Baker Hughes, Goldman Sachs (GS) Global Investment Research, IEA, 2010 to 2025. Chart shows copper (lhs) and oil & gas (rhs) and real capex in 2010 US dollars terms. For oil and gas, chart uses GS data from 2010 to 2015. Post 2015, it uses IEA data.

Global fragmentation is reinforcing this trend. De globalisation and re shoring are prompting nations to secure domestic supply and build strategic stockpiles. Meanwhile, the rapid expansion of data centres and AI is driving new demand for power, cooling, and the metals that underpin digital infrastructure.

Rising defence spending is also adding pressure on the supply of specialised materials and fuels, while an ongoing trend of de dollarisation has supported interest in real assets and precious metals in particular. Finally, ongoing emerging market industrialisation and urbanisation are additional sources of structural demand increases – with incremental commodities demand growth moving from China to India and South East Asia.

“Commodities are re-emerging as an attractive investment prospect, but the way investors access them matters.” Robert Shimell, Portfolio Manager

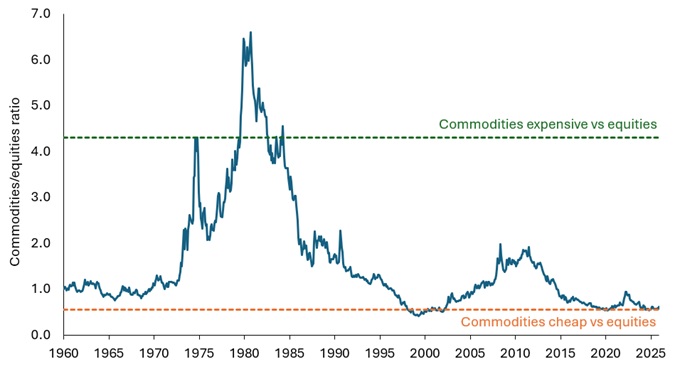

Together, these persistent forces point toward a durable, demand heavy environment for commodities. These are the building blocks of what we perceive as the early stages of a sustained commodities supercycle, at a time when relative valuations are close to historical lows relative to equities (Exhibit 2).

Exhibit 2: Commodities valuations look heavily discounted relative to equities

Source: Janus Henderson Investors, Bloomberg, using the Bloomberg Commodities Index and the Dow Jones industrial Average Index, February 1960 to January 2026. Past performance does not predict future returns.

Note: The dotted lines are statistical indicators that show the 5th and 95th percentile of commodities valuations relative to equities, indicating periods of historically cheap or expensive periods for relative valuations.

Yet conventional commodity strategies have disappointed

Despite the strong structural drivers, investors’ hesitancy is understandable. Long-only, futures-based commodity strategies have faced persistent headwinds. Negative carry from contango (where later‑dated contracts cost more than today’s price) can erode returns as investors roll into higher-priced contracts. Performance has been inconsistent, marked by episodic rallies and deep drawdowns.

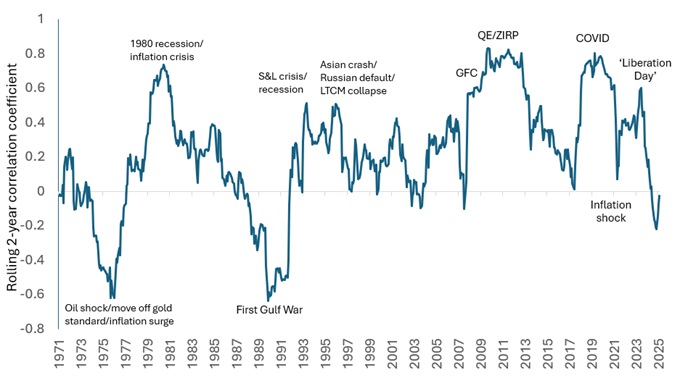

Commodity benchmarks also lack breadth, concentrating exposure in a small set of liquid futures while underrepresenting specialty metals, logistics, and downstream beneficiaries. Futures-only approaches limit responsible investing, offering little scope for stewardship or differentiation between credible and weak transition strategies. Finally, correlations often rise during market stress, reducing diversification when it is most needed (Exhibit 3).

Exhibit 3: Commodities/equities correlations can spike in periods of uncertainty

Source: Janus Henderson, Bloomberg, 31 December 1971 to 30 January 2026. Commodities/Equities correlation chart indices used: MSCI World Net Total Return USD Index & Bloomberg Commodity Index (BCOM).

These shortcomings, and the associated risks, explain why many allocators have treated commodities with caution and tactically, rather than a strategic diversifier. This is despite the potential portfolio benefits that the asset class offers during periods of high or rising inflation, or supply-shock regimes.

From mine construction to markets – the full commodities value chain

What is increasingly evident is that today’s commodities opportunity is playing out across extended supply chains, rather than solely through spot prices or futures curves. Take copper. Once a new mine is approved, it can take more than a decade to reach completion (an average of 17 years total from discovery to production). That long lead time helps explain why commodity cycles tend to persist, and why the opportunity extends beyond the underlying material itself. The argument is compounded by current projections, which suggest a 10 million metric tonne annual supply shortfall in global supply by 2040, without significant investment .

In any modern “gold rush”, the beneficiaries are not only the miners, but also the companies that enable production to scale. This is the period where equipment manufacturers, engineering firms and service providers play a significant role. Construction and agricultural machinery, energy services, digitised farm technology, and refining and processing infrastructure all see sustained demand as investment accelerates.

Across commodities the opportunity broadens to advanced farming systems, fertilisers and seed providers, logistics, storage, processing and downstream users – parts of the value chain that a solely futures based exposure cannot reach.

A more complete approach to commodities investing

Investors do not need to choose between a blunt, long only index proxy or an illiquid private equity option to access this opportunity. A liquid, hybrid long/short approach can potentially offer a third way – one designed to adapt to today’s regime of supply shocks, policy uncertainty and inflation variability.

From an allocation perspective, the rationale is built around four potential benefits: returns (access to cyclical and structural drivers as part of a commodities super-cycle), diversification (where a long/short strategy can differentiate from long-only equities or bonds), inflation mitigation and event risk protection (geopolitics and weather are often catalysts for sustained trends).

Importantly, commodity markets behave heterogeneously. For example, cocoa prices respond to West African weather and crop disease dynamics, while energy prices can pivot on OPEC policy, US shale production or geopolitics. That lack of correlated behaviour can help to boost the argument for diversification within a commodities strategy. Particularly one partnered with a long/short component, providing the capacity to go long where fundamentals are strong, and short where they are weak.

Modern solutions to accessing the potential within commodities

Commodities are re-emerging as an attractive investment prospect, but the way investors access them matters. The familiar challenges of long only futures exposure – negative carry, sharp drawdowns, correlation spikes, limited breadth, and ESG constraints – can be addressed through a more modern, hybrid approach. One that pairs allocating to commodity equities with commodity derivatives utilising a long/short approach, accessing the full supply chain, rather than just commodity producers alone.

This creates a framework designed to pursue attractive returns, while offering genuine diversification, the potential for inflation protection, and with consideration for event driven market shocks – all while maintaining daily liquidity. With deglobalisation, decarbonisation, and geopolitics reshaping markets, an innovative approach to commodities is a prudent response to the structural forces defining the next decade.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.