The past few weeks have seen some encouraging signs of active diplomatic efforts, to try and restart stalled talks to end the Ukraine-Russia war. US President Trump has made much of his undoubtedly ambitious agenda to bring about a negotiated settlement. While the prospect of a swift end to conflict still seems remote, it remains a significant factor in our views on the long-term prospects for Europe and its economies. Here, we summarise some of our thoughts.

Europe at the heart of security initiatives

Following the recent summit in Alaska between the US and Russia, security guarantees for Ukraine have been at the forefront of discussions as western leaders try to build a post-conflict framework that could present a credible, sustainable ceasefire and a path forward for an independent Ukraine. While there is no clear detail, US President Trump’s comments suggest that he does not intend to put US ‘boots on the ground’ as part of any solution. Rather, it seems Europe would be expected to primarily fulfil this role, with the US potentially sharing intelligence and air support.

The White House originally claimed that Russia might agree to the US offering ‘Article 5-like protection’, echoing a core NATO principle[i], where an attack against one or more members is considered an attack against all. More recently, we saw suggestions from the US that it was ready to contribute access to critical security systems, intelligence and support, in what is arguably a significant shift from the US government[ii].

An unavoidable counter argument is that Ukraine has a history of security agreements that have failed in the modern era, from the Budapest Memorandum to the Minsk Agreements, while concessions over Ukraine’s territory could arguably undermine long-term confidence in global security and economic stability. To offset these concerns, Ukraine would certainly seem to have a strong case to demand more robust guarantees to ensure its future security.

Europe as a partner for reconstruction efforts

While we are keen to avoid being drawn into speculating about the shape of any potential permanent peace plan, we see a stable ceasefire as a catalyst to drive a broad widening of industry participation across Europe.

The World Bank, working with the European Commission, UN and Ukraine, has estimated the total price of reconstruction and recovery at US$ 524 billion over a decade[iii], with ramifications affecting all sectors in Europe to varying degrees, spanning housing, transport, energy, banks, agriculture, health, technology, materials, and beyond.

The need for heavy infrastructure equipment, for example, across transport and logistics, creates demand for potentially tens of thousands of large trucks during the peak phase of reconstruction (albeit a front-loaded cost), representing a sizeable boost to the industry.

Rebuilding infrastructure on such scale demands an enormous supply of raw materials, steel and concrete, where Europe has advantages both in proximity and capabilities. Europe’s raw materials firms can help Ukraine to develop, mine and process its own vast mineral reserves, to grow its economy and revenues and integrate its resources into the European supply chain.

Rebuilding is also highly labour intensive; this is where we would expect workers in neighbouring states like Poland, Slovakia and Romania to supply skilled contractors and labourers to offset significant shortages in Ukraine and help train workers in critical sectors.

European defence – a long-term theme

European defence stocks have retrenched over the past few weeks, as investors locked in profits after a period of strong performance in 2025 thus far. While we believe that the recent counter-rotation has room to continue, the rationale for a long-term defence investment theme seems very strong.

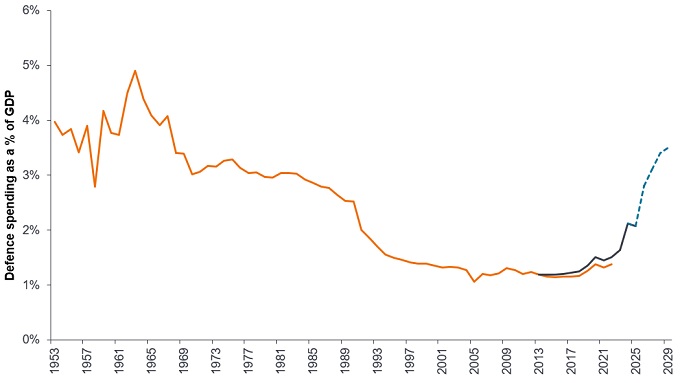

European governments have already announced plans to ramp up defence spending (Exhibit 1). This is in part to meet NATO commitments, where relevant, but also in response to the US pivoting away from Europe and towards the Pacific – a recognition that Europe needs to take greater responsibility for its own security.

Exhibit 1: Rearmament of the West

Source: NATO, SIPRI, UBS as at 9 July 2025. The blue line refers to SIPRI data, the orange line is NATO data (which goes back to 2014 only). Both use slightly different definitions. There is no guarantee that past trends will continue, or forecasts will be realised.

After decades of little to no growth in defence spending, there is a need for Europe to build out and scale up its capabilities, modernise existing assets, integrate new technologies, and redesign/consolidate supply chains. Events in Ukraine have challenged a lot of prevalent thought about the shape of modern warfare. This is an area where Germany is taking a leading role, with a significant spending package aimed at strengthening its defence capabilities and developing its infrastructure.

To illustrate, the supply of Leopard II main battle tanks to Ukraine attracted a lot of attention in 2023, and we are seeing production capacity being expanded to meet demand from European countries and NATO. EU states are focused on modernising their outdated or mothballed assets, but also seeking to procure a significant number of additional newer-generation platforms, with around 1,700 tanks on manufacturers’ order books at the start of 2025. There is also planned development of a cross-platform ground combat system to replace the Leopard II and France’s Leclerc tanks by 2040[iv].

European banking support

We would expect the prospect of tangible peace in Ukraine to drive demand for working capital, supporting growth in loans, consumption and investment. These are areas we European banks could play an outsized role, along with the EU, World Bank and the private sector. We also see broader support for banks domestically, reflected in strong earnings, even after weathering the bulk of rate cuts from the European Central Bank. The recent second-quarter reporting season reflected this more favourable environment for the sector, with most banks beating estimates and upgrading guidance.

European banks also have a strong tailwind from various initiatives across Europe to ease financial regulation, reduce bureaucracy and stimulate economic growth – areas where banks are prime beneficiaries. Reform in the securitisation market and the reduction in bank capital requirements, for example, favours not only the European financial sector, but also the European economy more broadly.

Europe taking centre stage

Talks in Alaska have revived hope for peace in Ukraine. And while it seems there are plenty of hurdles to overcome before we see tangible prospects for this, it spotlights the potential for Europe to take the lead on security and reconstruction, while heralding a potentially transformative period for economies across the region. With Europe at the centre of a significant global geopolitical realignment, there are many potential risks and opportunities for investors, emphasising the need for active stock selection and strategic insight into market trends.

—–

[iii] Assessment of Ukraine rebuild costs

[iv] Europe modernizes its battle tank fleets

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.