Over the past 50 years, technology has been dominated by mega-themes, from the dawn of the commercial Internet to the rise of cloud computing, mobile, machine learning, and now artificial intelligence (AI). With any theme of this magnitude, the question inevitably arises of whether it is over- or under-hyped – and in turn, whether the valuations of companies tied to those themes are justified.

Recent volatility in AI-related equities only sharpens this line of enquiry. To gain perspective, we believe investors need to understand the magnitude of the transformation underway and how it will invariably touch every corporate sector, impacting revenue growth, productivity and, in many cases, sending many business models toward obsolescence.

Furthermore, the shadow of AI is no longer just a question for equities investors, as typically conservatively funded mega-cap tech companies are tapping debt capital markets at record levels.

Perhaps the most important thing to consider when weighing valuations for today’s mega-cap tech stocks is that it’s still early days in the AI investment cycle. The technological shifts that have made AI possible occurred over a period of 25 or 30 years, and it’s hard to overstate how important those advancements were in laying the groundwork for the progress we’ve seen in the past three years.

Dispelling the myths of an AI bubble

There are a couple key areas about AI investing that we believe are underappreciated and that serve to dispel many of the concerns around an AI bubble. First, it’s important to understand that the reason AI has been the main driver for the market is because investors are recognizing how profound this technology shift is – not only in terms of the sheer revenue opportunity created by the winners but also the meaningful productivity and margin lift we expect to see globally as AI proliferates into the broader economy.

Second, the focus tends to be on the digital manifestation of AI, which will clearly have a significant impact on many sectors. But we think the physical manifestation of AI will be equally profound. We’re seeing meaningful progress in areas like full-service and autonomous driving, robotics, and other areas that will impact the physical economy.

The tech stocks of the early 2000s looked expensive at the time but ultimately grew earnings much faster than anyone anticipated. We anticipate the same with AI: We fully expect there will be companies that compound earnings and free cash flow materially faster than investors expect. And as the AI buildout cascades from infrastructure companies (enablers) to well-positioned software providers (enhancers), and ultimately into the broader economy, that is the point where forward-looking companies (end users) could reap significant economic benefits.

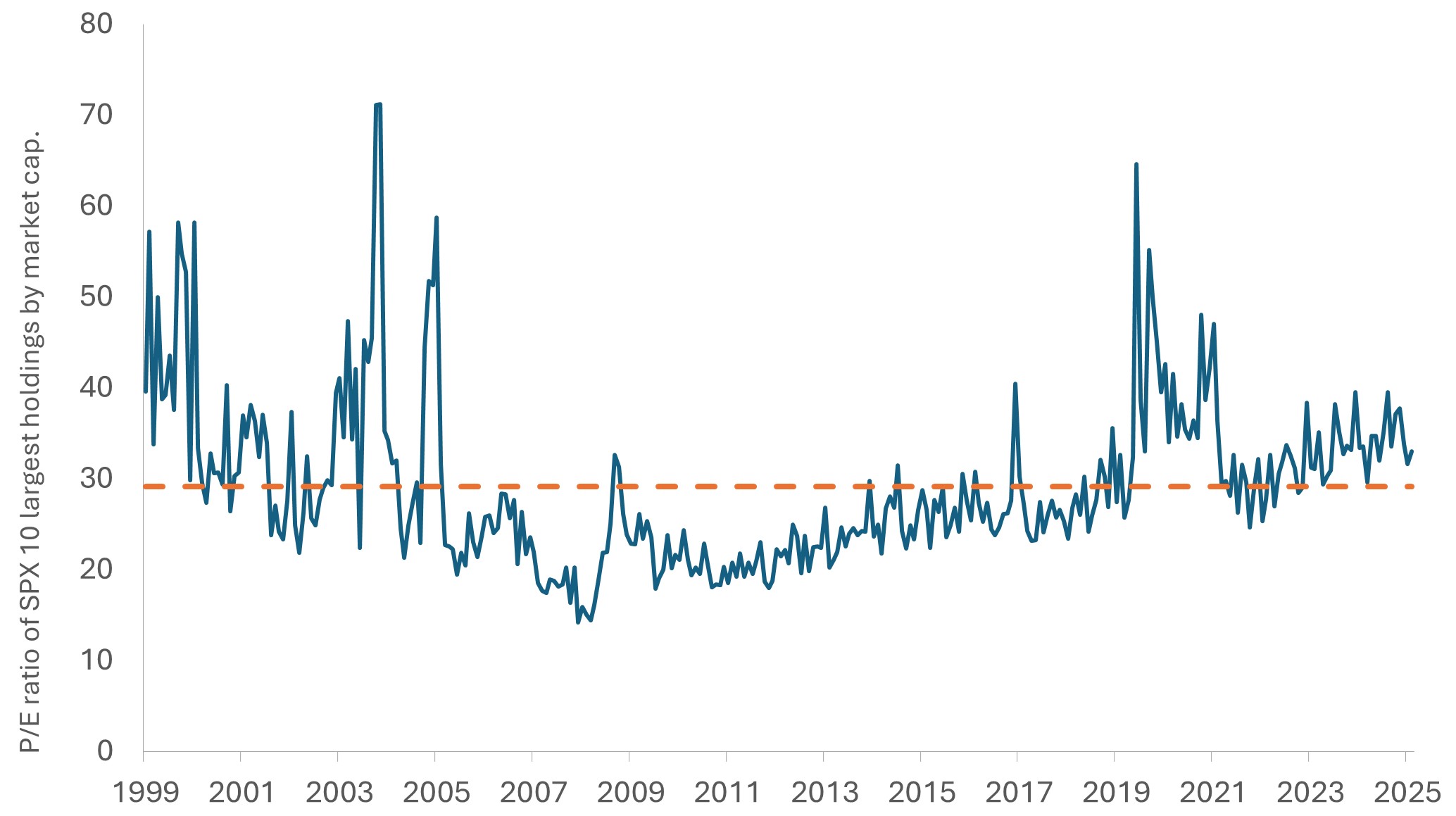

Exhibit 1: Price/earnings ratio of S&P 500’s top decile by market capitalization

At roughly 33 based on expected 2026 earnings, the P/E ratio of the S&P 500’s 10 largest stocks sits well below the frothy levels experienced during the dotcom era – and these megacaps are generating substantial cash off their deployed AI platforms.

Source: Bloomberg, as of 6 February 2026.

Funding the AI boom

With the bullishness around AI comes historic CapEx budgets. Accordingly, many AI hyperscalers have deviated from their script and have aggressively tapped debt capital markets, increasing leverage in the process. This shift has made the AI investment theme just as much of a fixed income play as an equities play.

New issuance varies widely across subsectors. Hyperscalers are tapping into the investment-grade (IG) credit markets for AI financing. This could put pressure on currently tight spreads in IG as that debt is absorbed. The high-yield market appears better positioned, as direct AI debt issuance is less than 1.0% of the Bloomberg US Corporate High Yield Index at present.

Additionally, we think there is significant room for growth in AI-related issuance in securitized credit. For one, commercial mortgage-backed securities (CMBS) are a major focus given the funding required to build new data centers.

Within CMBS, geography is a key consideration: A large percentage of data centers are concentrated in specific areas, so it’s important to ensure the real estate backing the deal is in one of the geographical “nodes” that are known for data center buildouts and have sufficient access to the power grid. While there are concerns around data center development given the burden they place on the grid, the market appears to be pricing in that risk, and we are seeing attractive CMBS spreads at relatively short maturities. Furthermore, shorter time horizons associated with projects funded by CMBS, in our view, should provide greater visibility in issuers’ ability to meet their obligations.

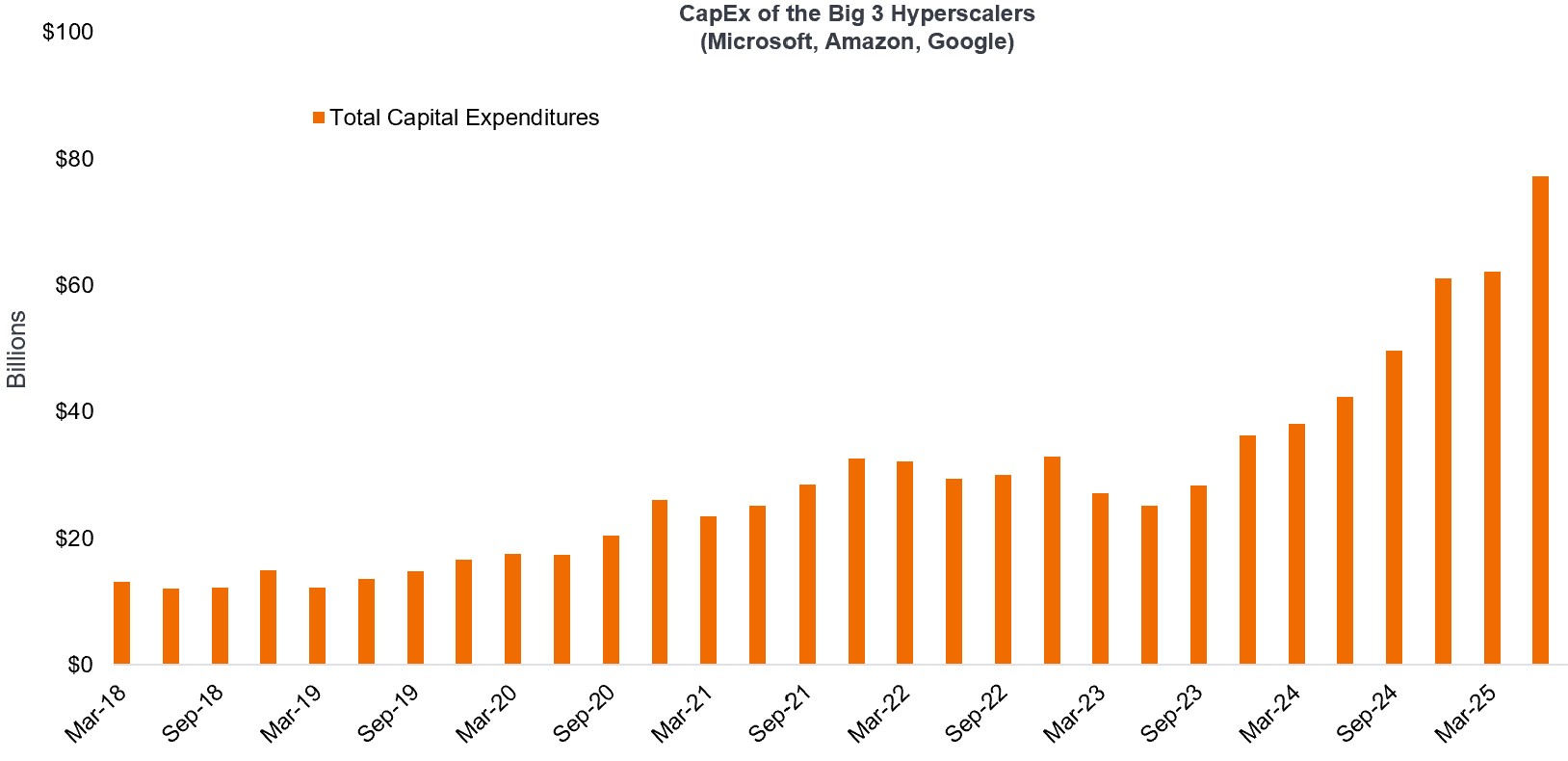

On that front, CapEx trends show data center growth is here for the foreseeable future. To put the power demand of AI chips and application in perspective, some estimates suggest that three New York City’s worth of power will be needed to sustain the grid by 2030.

As some of the AI hyperscalers want to own data centers, we may also see more private deals. But ultimately, companies will be seeking the lowest cost of capital and looking to diversify the channels through which capital is obtained. We expect the massive CapEx programs of investment-grade hyperscalers to benefit companies across the entire fixed income spectrum as spending flows through the AI data center supply chain.

CapEx of the big three hyperscalers (Microsoft, Amazon, Google)

Capex trends suggest data center growth is here to stay.

Source: Dell’Oro, JP Morgan estimates. CSP capex by: Microsoft, Google, Amazon.

Utility companies are also issuing debt for the AI buildout as power demand continues to create a bottleneck. We view this as a compelling opportunity, because traditionally low-growth utilities businesses are turning into high-growth businesses as power demand from AI continues to increase.

From rising tides to the imperative of selectivity

From both an equity and debt perspective, one of the biggest concerns around AI is obsolescence, especially since it has advanced so quickly. Remember, we are only a few years removed from the launch of ChatGPT, and today the AI agent is being used daily across the globe.

While AI applications like ChatGPT may feel like they became ubiquitous overnight, recall that laying the foundation to make these technologies possible took decades. Likewise, the work of continuing to build out the AI training infrastructure will be ongoing for many years. And the time horizon for end users to not only implement but reap benefits from AI is longer still. Meanwhile, the inference stage of this technology is on the verge of exploding given the move to an agentic world.

Importantly, the rising tide will not lift all boats forever. If we look across the spectrum, there are AI infrastructure companies that are clear winners and continue to separate themselves; these stocks, based on our projected cash flows, are not expensive when one considers they are leading the technology transformation. Likewise, there are companies in the enhancer space that have developed competencies over many years and that are navigating the AI infrastructure more efficiently than their competitors.

At the same time, many areas will face significant disruption. For example, we recently wrote about the (understandable) investor angst around the future of software as a service (SaaS) companies, noting that the next generation of software winners will likely be those that embrace AI not as a feature but as the foundation of their operating models.

It’s also worth noting that some tech stocks are trading at 50 times revenues due largely to the “AI halo” effect, even though they have limited revenues or products and services that may not even be deployed until 2030.

As we’ve said many times before, AI disruption will not be linear. While the direction of travel over the next decade is clear, what happens over a year or two is not. Technological shifts of this magnitude are a fertile environment for active management. In our view, selectivity will be critical to identifying the next wave of winners and capitalizing on the broad spectrum of opportunities that arise as the AI transformation continues in the years ahead.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

Investment-grade securities: A security typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.