Software has long been one of the key drivers of returns and growth within the technology sector. This was reflected in venture capitalist, now tech-philosopher Marc Andreessen’s much quoted 2011 report, “Why Software is Eating the World”. However, over the last year or so sentiment around the software sector has changed materially, with artificial intelligence (AI) being seen as a threat to software. The new narrative of “Is AI going to eat software?” has led to a significant sell-off of software stocks or “SaaSpocalypse”.

Concerns that software will be a victim of AI was heightened following AI development company Anthropic’s announcement yesterday1 that it had launched a new suite of AI automation plug-ins focusing on a broad range of job functions, including sales, finance, marketing and legal.

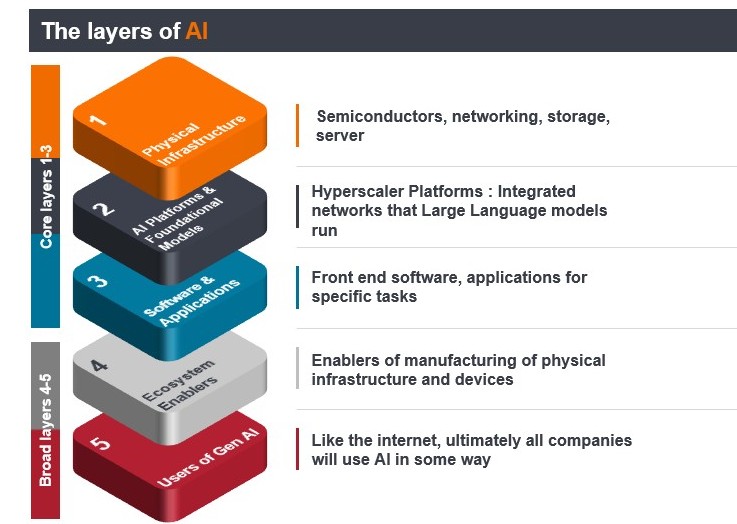

However, we believe investors need a better understanding of the different elements at play in the underperformance of software stocks over the last 12 months. The development of major new technology waves like artificial intelligence typically occurs in phases, with the physical infrastructure developed first, followed by platforms and devices, and later, the software applications. Following that playbook, we have looked to invest in the earlier phases of investment for example stocks related to semiconductors, infrastructure and platforms.

Investing in the right AI layer, at the right time

Source: Janus Henderson Investors, 31 December 2025. For illustrative purposes only.

What are our views on the three main concerns around AI and software?

But there is much more at play around the market’s concerns about AI’s impact on the software sector, which is being driven by several factors. First, AI driving automation potentially means fewer software users. This has implications for seat-based models, which is software licence with a pricing approach based on pay per user (each seat = one licenced user). That could put pressure on SaaS revenues (Software‑as‑a‑Service – a way of delivering software over the internet as a subscription, rather than it being installed and maintained on a company’s own servers or computers). This assumption ignores the fact that AI agents accessing software will also need “seats”. Software companies should be able to monetise those agentic seats, so there may be a seat expansion opportunity when including those agentic seats.

Second, there is a concern around vibe-coding (where AI writes the code based on a plain language prompt). Would software applications be replaced by vibe-coded or AI-native products? Anthropic’s Claude Code is seen as the leader here. However, it is very unlikely that any mission critical software solution like ERP (Enterprise Resource Planning) core mission critical software for finance, HR, manufacturing, supply chain, procurement, manufacturing software and others can be easily replaced by AI given this entails huge risks for companies.

And finally, there is a concern that AI could take some of the additional revenues from software companies for example add-on modules and services revenues, potentially reducing the long-term growth potential for software. These concerns have been magnified by Anthropic’s Claude Cowork, general desktop agent, which is seen as capable of performing the agentic tasks that most software companies are developing and selling. Cowork recently announced plug-ins with capabilities across multiple areas including finance (analyse financials, build models, track key metrics); CRM (research prospects, prep deals, follow sales processes); data (query, visualise, interpret datasets) and customer support (triage issues, draft responses, surface solutions). The fact that Cowork’s desktop agent needs to plug-in to existing software providers in order to access data, context and workflows, in our view highlights why mission critical software solutions are unlikely to be disintermediated in the short-term.

What does this mean for investments in software stocks?

At the time of writing, the launch of Anthropic’s offerings has seen a sizeable impact on a number of SaaS and data plays in areas where these plug-ins were targeted such as legal data companies, financial software providers and data software stocks.2 What we are seeing now in the markets appears to be more sentiment rather than fundamentals-driven price movements. In the current earnings reporting season, in general the software space results have continued to be strong, particularly since the volatility around the US “Liberation Day” tariffs announcements and Department of Government Efficiency (DOGE)/US government shutdowns has passed.

Even some of the most secure areas of spending like cybersecurity has seen multiples contract, despite the opportunity for cybersecurity software companies increasing from the threat of AI-enabled “bad actors” is greater than it was before.

This week we have also seen a significant sell-off in IT Services names, due to concerns about the people-based business model and headwinds to traditional IT Services businesses from the proliferation of AI tools. This recent IT Services sell-off seems to have been sparked by Palantir’s comments on its results call, where the company talked about its AI FDE (Forward Deployed Engineer) being able to underpin complex SAP ERP migrations (from the legacy ECC implementations to its new S/4 Hana platform) in a matter of weeks relative to historically these projects potentially taking IT Services companies years – this claim from Palantir has yet to be verified and is being disputed by the IT Service companies.

Reiterating the importance of active management in a fast evolving, high growth sector like technology

We have been talking about artificial intelligence as the next major wave in technology for some time now. A wave that we believe will enable the technology sector to take share from the wider economy, underpinning continued strong growth for the sector. We are seeing that happening with AI use cases across a broad range of vertical markets driving efficiency and improving outcomes. While we had anticipated AI would disrupt some areas of technology, like IT Services, we had not expected the “AI will eat software” narrative to lead to such a significant de-rating of the software sector.

We continue to believe in the importance of mission critical software as an essential underpinning to modern AI-powered enterprises, and continue to monitor the developments in the software sector closely. We remain enthused about AI as a true technology wave and as it matures, we believe active fund management will be more important than ever.

1 FT.com; 3 February 2026. US stocks drop on fears AI will hit software and analytics groups.

2 The Guardian.com; 3 February 2026; Anthropic’s launch of AI legal tool hits shares in European data companies.

3 Palantir Investor Relations; 2 February 2026; Earnings call Q4 2025.

Active management: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis, and the investment choices they make. The opposite of passive investing.

Agentic AI: An AI system that uses sophisticated reasoning and iterative planning to autonomously solve complex, multi-step problems. Vast amounts of data from multiple data sources and third-party applications are used to independently analyse challenges, develop strategies and execute tasks.

De-rating: The downward adjustment of a company’s financial ratios, such as the price-to-earnings (P/E) ratio, in response to business or market uncertainty.

Fundamentals: Information that contributes to the valuation of a security, such as a company’s earnings or the evaluation of its management team, as well as wider economic factors.

Multiple: A financial tool used to assess a company’s valuation by helping to compare companies’ valuations within the same industry. In the case of equities, a de-rating refers to the downward adjustment of a company’s multiples (financial ratios), such as the price-to-earnings (P/E) ratio, in response to business or market uncertainty.

Re-rating: Occurs when investors are willing to pay a higher price for shares, usually in anticipation of higher future earnings or other positive fundamental catalysts.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.