The stock market extended year-to-date gains in the fourth quarter on strong corporate earnings and resilient U.S. economic growth. Investors moved away from their worst-case fears about U.S. trade policy, which boosted the performance of risk assets.

The Fed delivered two additional rate cuts, joining other central banks that lowered rates throughout the year. While the extent of further easing will depend on the interplay of economic growth and inflation, lower interest rates could reduce funding costs and provide renewed support for sectors such as residential construction. Additionally, we were encouraged by stable economic growth outside of the U.S., especially in Europe, which may offer opportunities for companies with international exposure.

As we look ahead, we will continue to monitor shifting macro and policy currents and their impact on companies.

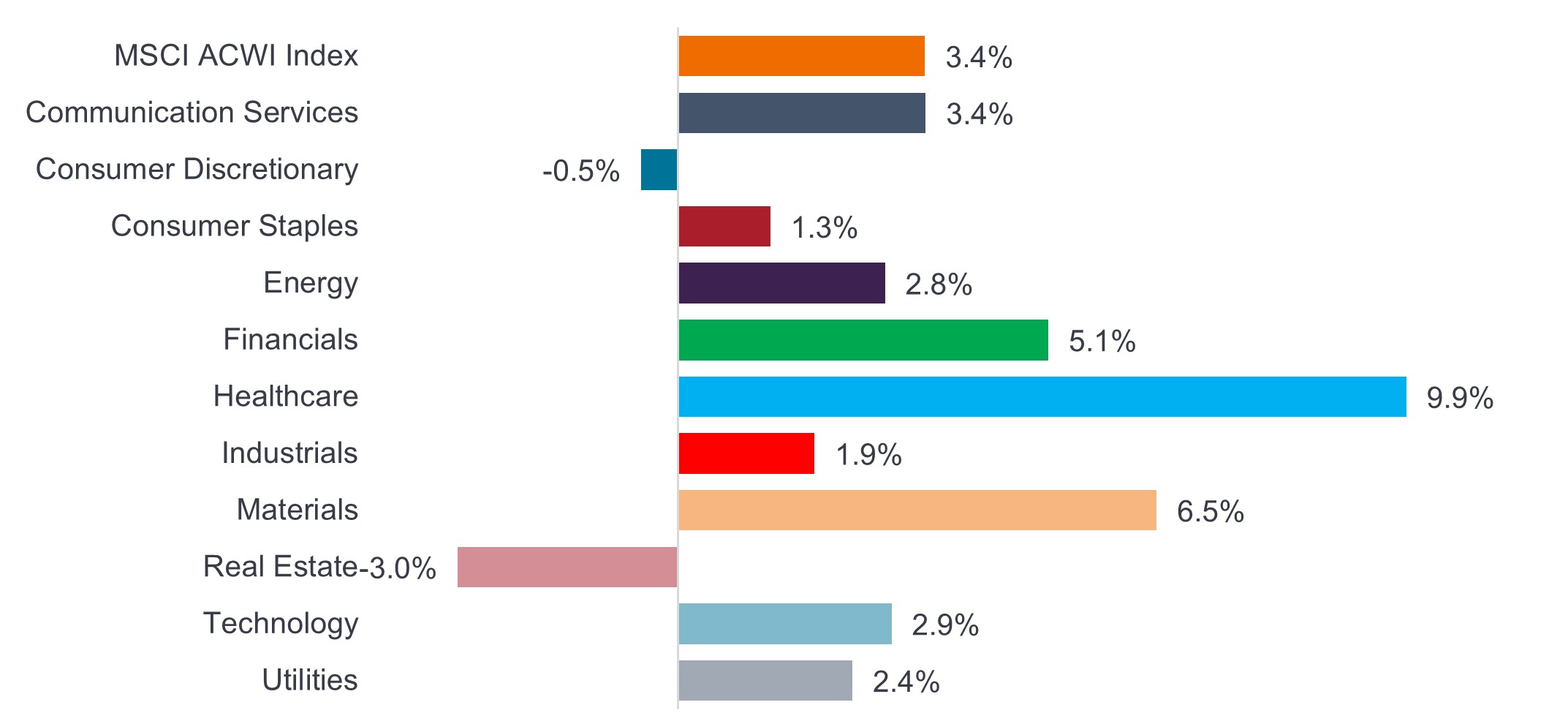

Q4 2025 global equity performance (total return)

All but two sectors performed positively during the quarter, with healthcare, materials, and financials leading the way. Real estate and consumer-related sectors struggled.

Source: Bloomberg, data from 30 September 2025 to 31 December 2025. Returns are for the MSCI All Country World Index (ACWI) and its 11 sectors. The MSCI ACWI Index captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries.

Communication Services: Continued opportunities around AI innovation and digital disruption

What happened: Communication services stocks experienced solid gains, in line with broader global equities. This strong performance reflected excitement over potential mergers and acquisitions (M&A), especially after Netflix announced plans to acquire Warner Bros. Discovery. Google-parent company Alphabet was a strong performer in the quarter, driven in part by excitement around its AI capabilities.

Looking ahead: We remain bullish on the long-term outlook for the communications services sector. We are especially excited about opportunities around AI, which in our view has the potential to be even more pervasive and value-generating than the market expects. We believe we could see further consolidation within the sector, as value and investor interest coalesce around the largest digitally native platforms best equipped to attract both content (supply) and users (demand).

Consumer: Bottom-up stock selection has continued to identify compelling opportunities

What happened: Consumer-related stocks underperformed the broader market as investors awaited clarity on the direction of the economy. However, we have been reassured by the continued strength in consumer spending. While we have seen signs of strain, especially for lower-income consumers, this has been offset by robust spending from higher-income households benefiting from equity-price appreciation. Against this backdrop, we saw strong share price performance from a range of consumer discretionary stocks, including home furnishings seller Wayfair and discount retailer TJX Companies, even as we saw a market rotation away from more defensive stocks, such as O’Reilly Automotive.

Looking ahead: While we have welcomed relatively stable consumer spending trends, we recognize risks around slowing employment growth and higher living costs. Given these crosswinds, we are focused on companies with high-quality business models, strong balance sheets, and resilient earnings growth. We have also found opportunities in companies benefiting from secular growth themes such as AI and digitization.

Energy & Utilities: High-quality energy assets and utility companies may benefit from AI

What happened: Both energy and utilities stocks lagged the broader MSCI ACWI Index in the fourth quarter. Energy stocks had flat performance but outperformed crude oil prices, which fell to below $61 per barrel by quarter-end. This decline reflected concerns over market oversupply, which offset expectations for a moderate acceleration in market demand in 2026.

Looking ahead: We believe the current price of crude already reflects most of this oversupply risk. However, we think there is more downside than upside risk for oil prices, especially if U.S. involvement in Venezuela results in more crude reaching the market. Given this risk, we remain defensive in our positioning, even as we focus on energy companies with high-quality, long-duration assets that we believe are underappreciated by the market.

We remain constructive on the outlook for utilities stocks. We believe the expanding AI complex will remain a large consumer of electricity. This growing demand, combined with the ongoing electrification of the broader economy, makes a strong case for investing in utilities, especially in companies with exposure to unregulated power markets. While regulated utilities have less direct exposure to these trends, we see the potential for multiple expansion for these stocks given the expected strength and duration of the power growth theme.

Financials: Financial services companies capitalizing on cyclical and secular global trends

What happened: Financials stocks rose in the fourth quarter, backed by a rising equity market, solid economic and earnings growth, and a constructive capital markets environment. We were encouraged by rising global wealth and relatively low levels of credit delinquencies and losses.

Looking ahead: The global financial services sector continues to offer many opportunities to put our deep fundamental research to work. We remain excited about secular trends such as the growth in electronic payments, as well as opportunities for businesses leveraging proprietary data and advanced technologies such as AI. We are also constructive on the outlook for select European banks, which in our view may benefit from significant capital return, an improving regulatory backdrop, and potential industry consolidation. Interest rates also remain well above zero in most major markets, which may provide an earnings tailwind for financial services companies.

Healthcare: We remain excited about innovation and increased M&A in the healthcare space

What happened: Healthcare was a top-performing sector during the fourth quarter, buoyed by continued innovation and accommodative Fed policy, which helped to spur M&A activity. We saw notable drug approvals as well as successful commercial launches that underscored support in the U.S. healthcare system for novel therapies. Headwinds for share price performance also eased as uncertainties around drug costs, tariffs, and regulation dissipated.

Looking ahead: We anticipate additional M&A activity in 2026 as cash-rich pharmaceutical companies seek to strengthen their pipelines by acquiring emerging biotech firms. We are excited about the potential for additional drug launches and promising clinical trials, even as we monitor risks such as uncertainty around the leadership of key government healthcare agencies. We continue to see opportunities across early commercial-stage companies with potential breakthrough products, as well as lower-risk, late-stage development companies that face less clinical uncertainty. Additionally, we see opportunities in medical device companies and managed care companies that trade at a discount to both historical averages and the market.

Industrials: Focus on stable growers and unique catalysts for profitability

What happened: Industrials stocks saw modest gains in the fourth quarter, ending a year of solid performance. While manufacturing activity has remained sluggish, overall economic growth has been relatively stable, according to available data. Company earnings performance has also been generally positive. However, share price gains for industrial stocks have largely reflected multiple expansion, as investors have hoped that Fed interest rate cuts may spur a recovery in cyclical end markets as we head into 2026.

Looking ahead: We remain on the lookout for signs of a short-cycle recovery, even as we monitor risks around tariffs, geopolitical uncertainty, and trends in consumer and business confidence. For our part, we continue to prioritize companies capitalizing on powerful secular themes, such as commercial aerospace, electrification, and precision farming, that we believe are less exposed to cyclical uncertainty. While valuations of such companies have experienced multiple expansion, we remain excited about strong revenue growth potential that may flow through to higher margins and profits. We have also looked for opportunities in well-managed companies that are making operational improvements or are exposed to unique catalysts that may drive stable profit growth even in uncertain times.

Technology: Artificial intelligence represents a generational investment opportunity

What happened: Information technology stocks advanced in the final quarter of 2025, if at a slower pace than the broader equity market. AI has remained a driving theme, even though investors have become more deliberate in considering how this revolutionary technology may impact specific business models and companies. We saw a major development with Google’s AI platform, Gemini, which claims performance advantages over OpenAI’s ChatGPT. This development has demonstrated that massive investment in infrastructure continues to improve AI capabilities.

Looking ahead: We believe AI represents the most profound technology shift in a generation, with tremendous implications for individual companies and the broader economy. Companies continue to invest rapidly in AI, and we believe they have no incentive to slow their spending as they work to meet surging demand and strengthen their competitive footing. At present, much of this activity has centered around AI enablers such as hyperscalers, graphics processing unit manufacturers, networking equipment companies, and power providers. As the market evolves, we expect to see investors pay more attention to other companies poised to benefit from the AI revolution, including software and internet companies that may leverage AI advances to improve their value propositions.

IMPORTANT INFORMATION

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Consumer discretionary industries can be significantly affected by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Consumer staples industries can be significantly affected by demographics and product trends, competitive pricing, food fads, marketing campaigns, environmental factors, and government regulation, the performance of the overall economy, interest rates, and consumer confidence.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.