To navigate a soft landing and the tech sector you need a “co-pilot”

Technology equities portfolio manager Alison Porter discusses the team’s outlook for 2024, highlighting the importance of navigating the return of the cost of capital and hype surrounding AI.

5 minute read

Key takeaways:

- AI should be considered the fourth wave of compute rather than just a theme, presenting compelling opportunities for productivity gains and innovation.

- With the strongest balance sheets in equities1 combined with AI development, the technology sector is well-placed to continue its long-term history of equity outperformance2.

- However, following a prolonged period of low interest rates, investors need to navigate the return of the cost of capital and hype cycles.

With the US Federal Reserve (Fed) currently on pause mode in terms of rate moves, investors are bracing for the lagged effect of higher interest rates on company earnings – a so-called “hard” or “soft” landing for the economy. While the Fed Chairman is undoubtedly the “main pilot”, as tech specialists we think investors need to be cognisant of artificial intelligence’s (AI) role as the “co-pilot” of the economy in terms of improving productivity and facilitating sustainable development. There is also a need for an experienced “investment co-pilot” to help navigate the return of the cost of capital following a prolonged period of low interest rates and the hype cycle that may emerge around AI.

AI is not just a theme

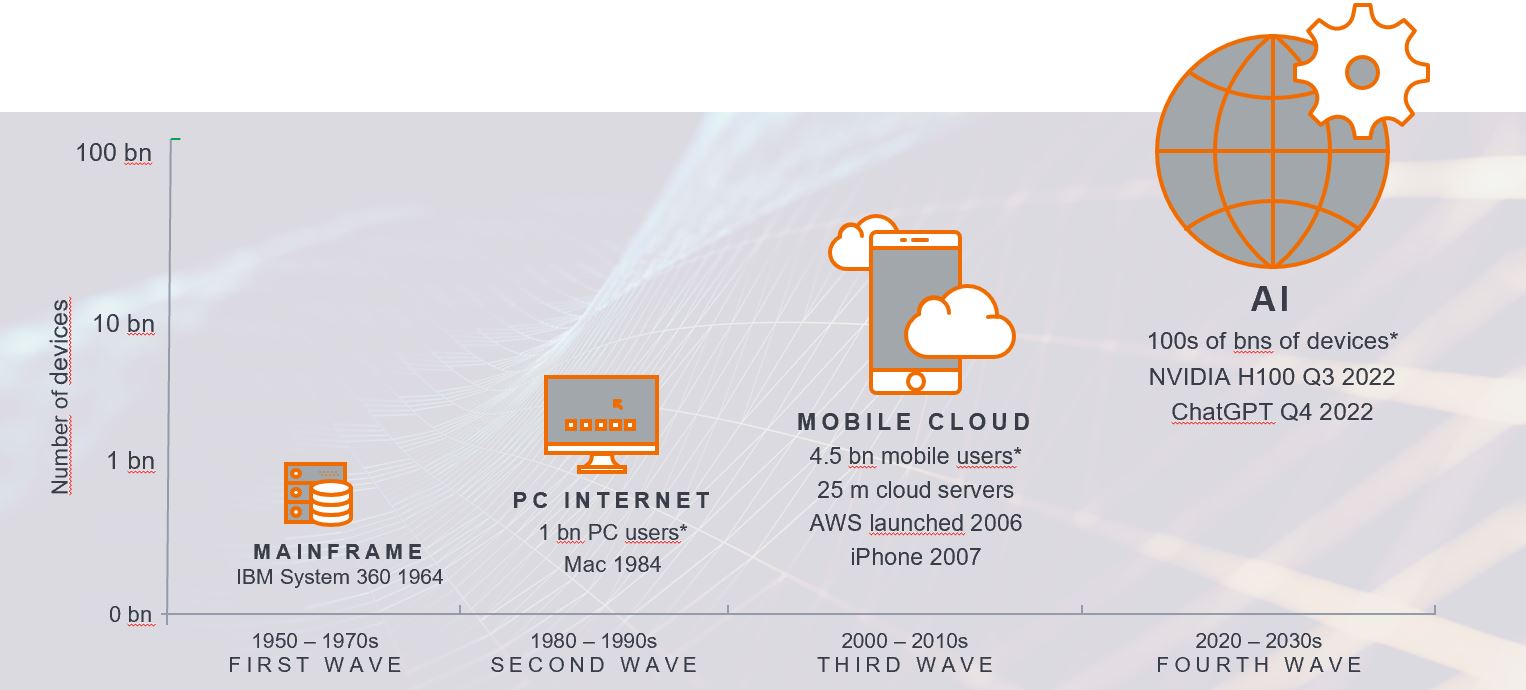

We view AI as the fourth wave of compute rather than just a theme. Compute waves happen only every 10-15 years, and touch on every layer of the technology stack (Figure 1). Each wave has tended to be bigger and more disruptive, bringing new and compelling opportunities while disrupting incumbent business models in the old economy. The PC internet era evolved throughout the Savings and Loans crisis in the US, while the iPhone in the midst of the Global Financial Crisis heralded a new wave of disruption from mobile cloud compute. We are at a critical juncture for the global economy. The coming of AI combined with the strongest balance sheets in equities,1 puts the technology sector in a relatively strong position to continue its long-term history of equity outperformance.2

Figure 1: The fourth wave of compute

Source: Janus Henderson Investors. Note: *Citi Research, as at 30 December 2016.

Another magnificent year for tech?

In 2023 the outperformance of the technology sector was driven not only by the excitement over AI, but also by a combination of cautious positioning and low earnings expectations. The sector’s outperformance was narrow – focused on the “Magnificent 7” (Microsoft, Apple, NVIDIA, Alphabet, Meta, Amazon, and Tesla) but not irrational in our view, given the companies’ balance sheet strength, focus on margin improvement, and the fact these stocks were among the few actual beneficiaries of AI spend in this early stage of evolution.

As we enter 2024, investor positioning in tech equities remains cautious with a wall of money built up in money market funds. We expect there will continue to be volatility in sales growth but we believe that earnings growth for the sector will prove resilient given the focus on headcount reduction and the deployment of AI to drive profit margins.

As noted previously, valuation continues to vary widely within the sector. Overall, the tech sector’s valuation sits above its average but is within the historical 25-year trading range.3 We continue to avoid hyped technology stocks with no visible profitability. Given the fact that the pace of innovation is accelerating amid a higher cost of capital, predicting company cash flows beyond the next five years is proving more challenging than it has been in the last ten years.

We urge investors not to think of the Magnificent 7 as a monolith to be judged against the rest of the tech sector or broader equities. As was the case in prior compute waves, we expect the number of beneficiaries from AI to broaden gradually over the next three years with many of these companies key to enabling that wider adoption. Within the Magnificent 7, valuations and growth vary widely between companies. History tells us that uniformly strong performance from these seven names is not the norm – and we are positioned as such with a highly active stance.

Corporations are being forced to take a more holistic view of their future operating expenditure, which we believe will drive incremental spending towards our long-term secular themes of Next Generation Infrastructure, Automation & Productivity, Internet 3.0, Electrification and Fintech. For Next Generation Infrastructure we expect AI demand for large language models (LLMs) to enhance the role for cloud infrastructure, and a need for AI at the edge, where AI computation is done near the user, close to the data source – right to the device level. Sustainability considerations also necessitate a focus on power efficiency to limit cost and carbon intensity. The demand for clean energy tech solutions is rising with hardware and semiconductor companies well positioned to be key beneficiaries. Fintech is a theme that has not been in focus in 2023, but is an area where we continue to see a rich vein of quality compounding companies.

A very favourable environment for active stock pickers ahead

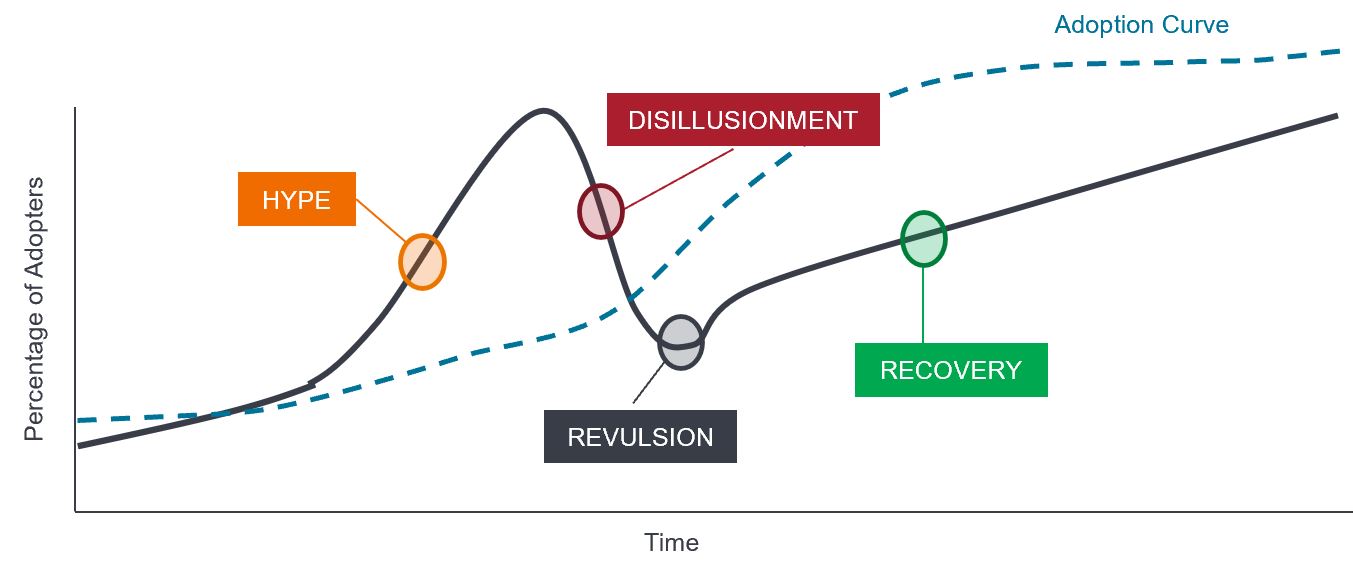

We are excited to be at the start of another great wave of technology innovation. Our philosophy has always been that technology is the science of solving problems. AI can deliver significant productivity gains to the economy and to companies, driving lower inflation and profit growth. But it may take years rather than months for this to be demonstrable and investors must be mindful of the hype cycle (Figure 2). The winners of AI development will broaden out but at a gradual pace; in the meantime investors should be wary of extrapolating early adoption in a parabolic manner.

Figure 2: Navigating the hype cycle

Source: Janus Henderson Investors.

Similar to how we have navigated prior compute waves, we continue to be focused on sustainable barriers to entry, incorporate environmental, social and governance (ESG) insights, and rely on our valuation discipline to guide us in identifying those companies that will become or will remain global technology leaders. The technology sector benefits from one of the strongest tailwinds in the equity market, but with macro turbulence ahead, experienced “investment co-pilots” with proven navigation skills are needed to help chart a smoother path to achieve investors’ risk and return objectives.

1 Janus Henderson Investors, Bloomberg consensus estimates, Bloomberg net debt and net cash data, as at 7 September 2023.

2 Janus Henderson Investors, Morningstar. MSCI ACWI Information Technology + Communication Services vs MSCI ACWI total returns in USD, 31 December 1995 to 30 September 2023. Past performance does not predict future returns.

3 Janus Henderson Investors, Bernstein. MSCI ACWI Information Technology + ACWI Communication Services price-to-forward earnings relative to MSCI ACWI, September 2000 to September 2023.

Hype cycle: a representation of the different stages in the development of a technology from conception to widespread adoption, with investor sentiment being a key driver of valuations of that technology and related stocks during the cycle.

Large language model (LLM): a specialised type of artificial intelligence that has been trained on vast amounts of text to understand existing content and generate original content.

Tech stack: a set of front and back-end technology services needed to build and run an application.

IMPORTANT INFORMATION

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.