2025 in review

Amid a year of chaos surrounding the incoming Trump administration’s approach to trade policy, monetary policy, immigration, and its stance toward the Federal Reserve (Fed), 2025 turned out to be an exceptional year for fixed income.

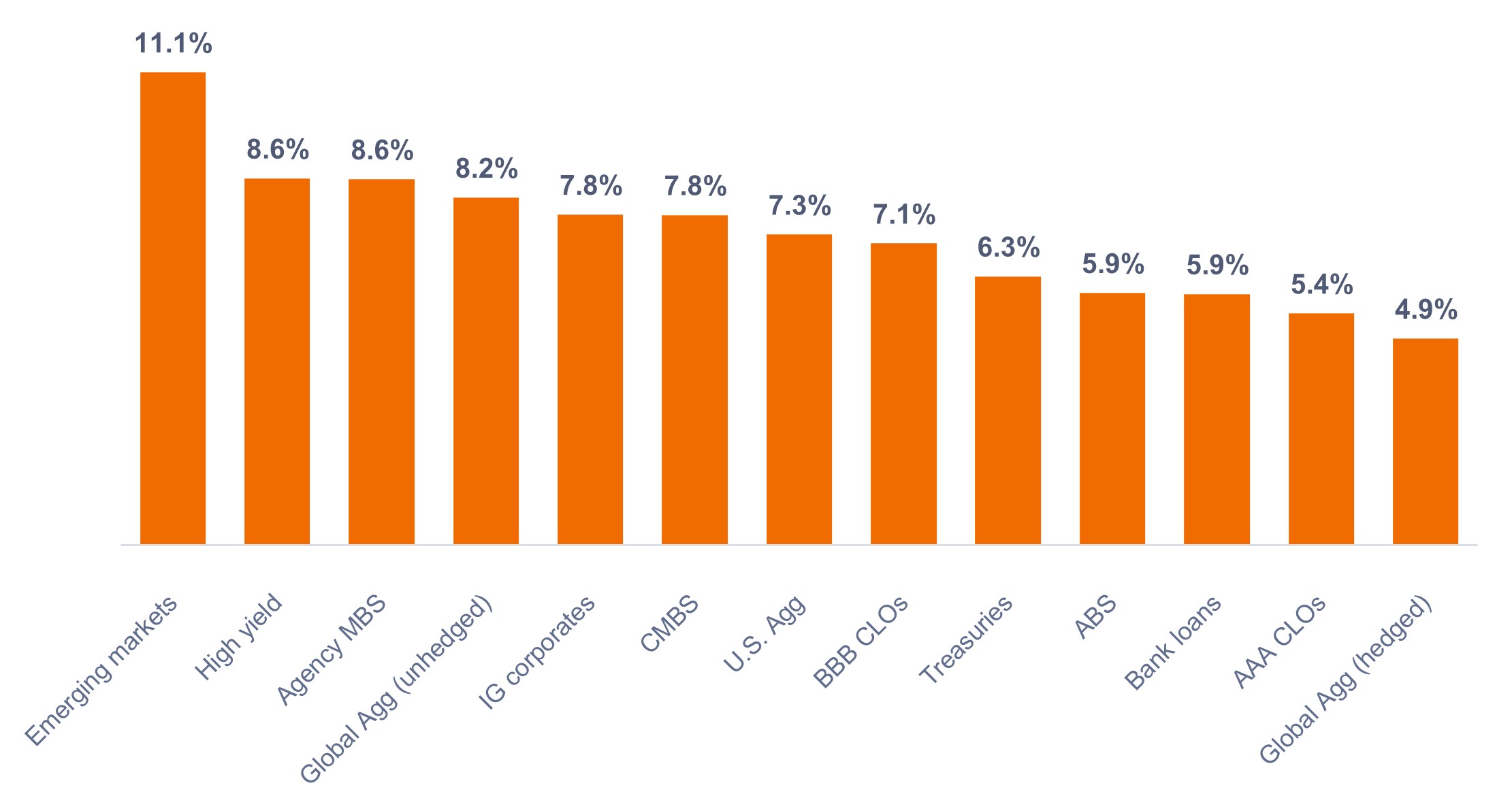

As shown in Exhibit 1, all major fixed income sectors recorded strong total returns, driven by a rally in yields and credit spreads on the back of continued economic growth, the resumption of the Fed’s rate-cutting cycle, and attractive starting yields at the beginning of 2025.

All U.S. fixed income spread sectors outperformed comparable maturity Treasuries, benefiting from their extra carry, or income. Meaningful spread compression further helped in sectors such as agency mortgage-backed securities (MBS) and sub-investment grade corporate bonds.

Relatively tight corporate spreads by historical standards were not a barrier to outperformance, as these sectors were supported by strong fundamentals and favorable demand technicals. U.S. dollar-denominated emerging markets (EM) debt benefited from attractive starting valuations, relatively robust economic performance, and strong supply/demand dynamics.

Exhibit 1: U.S. fixed income sector returns (2025)

Bonds across the board provided strong total returns.

Source: Bloomberg, as of 31 December 2025. Indices used to represent asset classes as per footnote.1 Past performance does not predict future returns.

Looking ahead to 2026

We are constructive on the outlook for 2026, albeit with a focus on earning carry rather than pursuing significant spread compression, given starting spread levels.

In our view, active managers may add value in the present environment by way of enhanced sector-level diversification, as well as striking the right balance of yield and duration. Additionally, we believe it is important to tilt toward sectors that have historically generated stronger risk-adjusted excess returns over time, such as BB-rated corporates, securitized credit, emerging markets, and front-end corporates.

Furthermore, we believe investors will be rewarded by clipping attractive coupons and picking individual bonds with positively skewed risk-return expectations, as opposed to making macro bets.

U.S. economic growth is expected to remain positive, with real GDP projected at over 2.0% in 2026. While some sectors exhibit late-cycle characteristics, resilient consumer spending – supported by tax cuts under the One Big Beautiful Bill Act (OBBBA) – and corporate profitability bolstered by artificial intelligence (AI) adoption should sustain economic momentum. Significant AI-driven investments in chips and data centers are anticipated to further fuel growth. AI-driven productivity gains could help reduce inflation, though it also could result in reduced labor demand.

We think the inflationary impact of tariffs on the year-over-year inflation statistics is generally expected to dissipate over the second half of 2026. While the disinflationary progress in energy and housing will continue, overall inflation is likely to remain above the Fed’s 2% target through the end of 2026.

Given our positive view on economic growth, we are modestly bearish on interest rate risk, as policy rates and rates farther out on the curve might stay higher than expected. That said, we prefer the front end of the yield curve versus longer maturities because we consider the front end to be a better hedge if the economy falters, as the Fed has ample room to cut rates. There is also the possibility that the new Fed leadership may try to push rates lower despite a strong economy. If this were to happen, we would expect term premiums to rise, resulting in further curve steepening.

Key themes we are focused on in 2026 include our bullishness on credit-spread carry amid robust credit fundamentals and expected continued economic growth. In addition, the Fed’s decision to start growing its balance sheet again should help provide more liquidity, which supports our positive view on credit-spread sectors. Furthermore, real yields remain above 1% and offer inflation-adjusted return potential.

Finally, attractive valuations and strong credit quality within securitized assets relative to corporates support our constructive approach to securitized sectors. Securitized credit sectors look attractive to us both structurally, because they increase diversification and have generally provided good excess carry per unit of excess return volatility, and tactically, because their spreads are attractive on a relative basis.

We believe the currently resilient economy, AI-driven investment, the positive impact of recent rate cuts, and the possibility of more cuts in the future create a favorable backdrop for fixed income in 2026. Active, diversified strategies focused on carry and risk-adjusted returns remain essential, in our view.

1 Emerging markets = Bloomberg Emerging Markets USD Aggregate Index, High yield = Bloomberg Corporate High Yield Bond Index, Agency MBS = Bloomberg U.S. Mortgage Backed Securities Index, Global Agg = Bloomberg Global Aggregate Bond Index, IG corporates = Bloomberg U.S. Corporate Bond Index, CMBS = Bloomberg Commercial Mortgage Backed Securities Investment Grade Index, U.S. Agg = U.S. Aggregate Bond Index, BBB CLOs = JP Morgan BBB CLO Index, Treasuries = Bloomberg U.S. Treasuries Index, ABS = Bloomberg Aggregate Asset Backed Securities Index, AAA CLOs = JP Morgan AAA CLO Index, Bank loans = Morningstar LSTA Leveraged Loan Index.

Carry is the excess income earned from holding a higher yielding security relative to another.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative easing (QE) is the introduction of new money into the money supply by a central bank purchasing public or private securities using funds created on its balance sheet for this purpose.

Quantitative tightening (QT) is a contractionary monetary policy tool applied by central banks to decrease the amount of liquidity or money supply in the economy.

Real yields are the return on an investment after accounting for the loss of purchasing power due to inflation.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Volatility measures risk using the dispersion of returns for a given investment.

The yield curve is a graph that plots the yields of U.S. government bonds with different maturities at a single point in time. It is used to visualize the relationship between the interest rates (yields) and the time until the bonds mature, providing insights into economic expectations.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.