6th September: London & Denver – Janus Henderson Group plc (NYSE: JHG, ASX: JHG) announces the launch of the Janus Henderson Horizon Sustainable Future Technologies Fund, which will aim to deliver long-term capital growth by investing in sustainable technology-related companies. The Fund will be available as a SICAV and is primarily aimed at both wholesale retail and institutional investors in EMEA and Asian markets. This will be an Article 9 fund (in line with the EU Sustainable Finance Disclosure Regulation) with a sustainable investment objective providing clients with a unique technology focused solution to growing market demand for sustainable focused funds”.

The fund’s investment team: Alison Porter, Richard Clode and Graeme Clark are based in London and Edinburgh; together they have over 70 years of combined investment experience. They will be supported by a new and growing global team of ESG specialists, led by Janus Henderson’s Head of ESG Investments, Paul LaCoursiere. The fund will be supported by a dedicated analyst team (including a sustainability analyst), and the global team of specialists within the broader Governance & Responsible Investor (GRI) team, with access to a dedicated ESG data platform.

The fund management team has solid environmental and sustainability credentials; this new fund builds on the success of the Janus Henderson Horizon Global Technology Leaders Fund, sharing the same investment team who have a strong, consistent track record; generating annualised returns of 13.1% versus 11.2%[1] for the sector group[2] since inception in 2005.[3] Janus Henderson Horizon Global Technology Leaders Fund is an Article 8 or ‘light green’ fund (in line with the EU Sustainable Finance Disclosure Regulation).

The fund’s investment approach will use a positive thematic framework to select investments; which will align to the UN’s Sustainable Development Goals and derive at least 50% of their revenues from fund’s sustainable technology themes.[4] The sustainability objective of the Sustainable Future Technologies Fund ensures meaningful diversification and differentiation from traditional tech, offering exposure to emerging technology companies aligned to the UN SDGs; this increases the breadth of sustainable investment solutions available to clients.

Richard Clode, Fund Manager at Janus Henderson Investors said: “Clients increasingly expect and demand managers deliver positive social, environmental and financial outcomes. We are really excited by the potential of this fund; moving away from traditional technology, looking for emerging and overlooked companies who meet a stringent sustainability criterion. Technology has the ability to deliver across all of the components of ESG; while global regulation and classification initially concentrated on environmental sustainability, this fund is looking to go much further and expand to incorporate much wider social issues. The reach of technology is limitless and the sector has a unique and critical role to play in servicing social goals; to help democratise access to services, reduce inequality and upgrade quality of life.”

Ignacio de la Maza, Head of EMEA Intermediary & LATAM comments: “Growth in both technology funds and funds with a sustainable investment focus has been relentless in recent years; this fund combines Alison, Richard and Graeme’s expert technology capabilities, with a product focused more directly on positive ESG impact. The launch of this fund demonstrates Janus Henderson’s commitment to meeting client demand and working toward a more sustainable world.”

– ends –

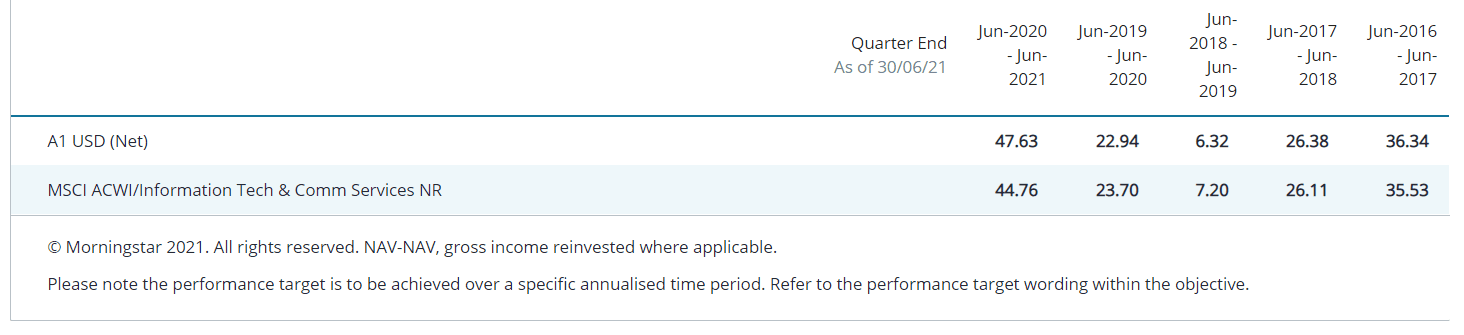

[1] Global Tech Leaders Fund, I ACC factsheet, see Discrete year performance

[2] Morningstar Sector Equity Technology

[3] Horizon Global Tech Leaders Fund, A1 USD factsheet, 31 July 2021

[4] Digital Democratisation, Tech Health, Low Carbon Infrastructure, Data Security, Smart Cities, Sustainable Transport, Resource & Productivity Optimisation and Clean Energy Technology.

Contact details

Stephen Sobey, Head of Media Relations

T: +44 0207 818 2523

M: +44 7836 631 776

E: stephen.sobey@janushenderson.com

Notes to editors: Fee structure

| Class ID | Class A | Class H | Class IU | Class GU | |

| Admin Fee Class Specific % | 0.08% | 0.08% | 0.04% | 0.04% | |

| Audit fee % | 0.01% | 0.01% | 0.01% | 0.01% | |

| Depositary/ trustee % | 0.01% | 0.01% | 0.01% | 0.01% | |

| Management Fees % | 1.20% | 0.70% | 0.85% | 0.70% | |

| Money Transfer Fees % | 0.01% | 0.01% | 0.01% | 0.01% | |

| Other Sundry Fees % | 0.01% | 0.01% | 0.01% | 0.01% | |

| Regulatory and Legal Fees % | 0.01% | 0.01% | 0.01% | 0.01% | |

| Safekeeping Fees % | 0.01% | 0.01% | 0.01% | 0.01% | |

| Shareholder Services Fees % | 0.50% | 0.30% | 0.00% | 0.00% | |

| Tax D’Abonnement % | 0.05% | 0.05% | 0.01% | 0.01% | |

| Total Uncapped OCF | 1.89% | 1.19% | 0.95% | 0.80% |

Horizon Global Tech Leaders Fund Performance: (I ACC)

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.