About this ETF

For investors looking for sector diversification and higher yield potential. JABS aims to generate income by actively allocating to high-quality opportunities across the vast U.S. consumer lending market.

Why invest in this ETF

Underrepresented opportunities

Offers direct access to the growing and complex asset-backed securities market often underrepresented in fixed-income benchmarks.

Income diversification

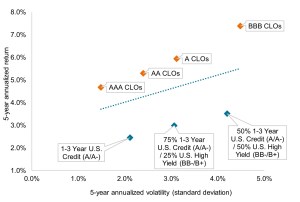

Helps diversify a traditional fixed-income portfolio, by potentially reducing credit risk, dampening overall duration, and increasing average credit quality.

Best ideas

Rigorous yield per unit of risk analysis designed to identify best ideas across the asset-backed securities opportunity set.