Investors have fled to the perceived security of cash at various points throughout past market cycles for myriad reasons. This flight to safety is as inevitable as the bouts of volatility that often precipitate it.

In 2023 and 2024, investors were still feeling the pain of negative returns in both equities and fixed income in 2022. That experience, plus the fact that cash was finally providing a good yield following the Federal Reserve’s rate increase, lured many investors to the sidelines. With savings accounts, money markets, and certificates of deposit paying relatively attractive yields with minimal risk after a decade-plus of near-zero rates, some investors felt they weren’t sacrificing much to be in a risk-off stance.

In 2025, ongoing uncertainty around tariffs, inflation, geopolitical tensions, and the outlook for the global economy has caused many investors to continue to seek solace in cash or adopt a “wait-and-see” approach versus redeploying cash.

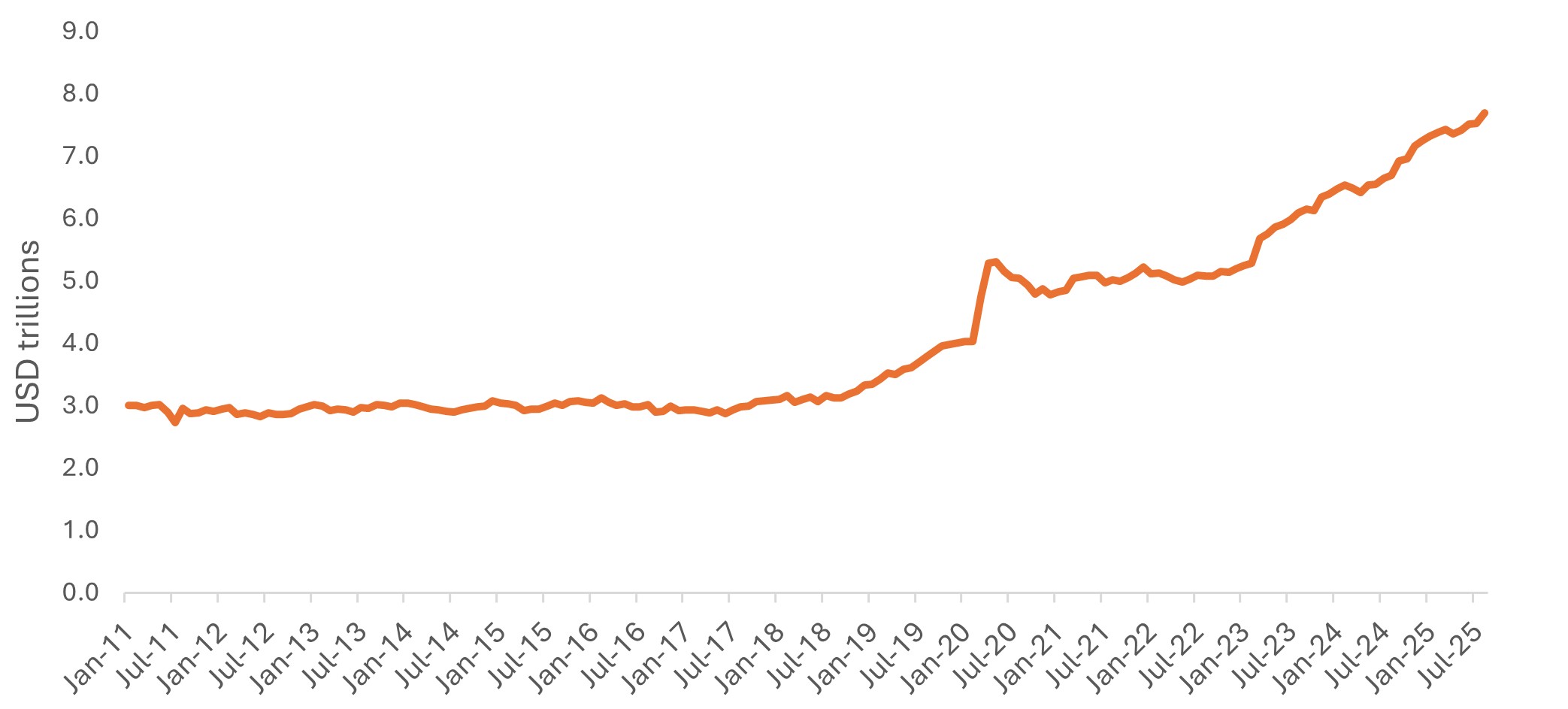

Exhibit 1: U.S. money market funds AUM at an all-time high

Source: Office of Financial Research, Money Market fund Monitor. Data presented are OFR-derived aggregates on an ultimate parent basis of the original source data. Updated 16 September 2025 with data through 31 August 2025.

However, this comes at an opportunity cost, particularly with equity markets hitting new record highs in September.

Investors will always need to have a certain amount of cash available for short-term savings or liquidity needs, regardless of what happens in markets. But history shows that using cash as a long-term investment vehicle can be damaging to wealth creation.

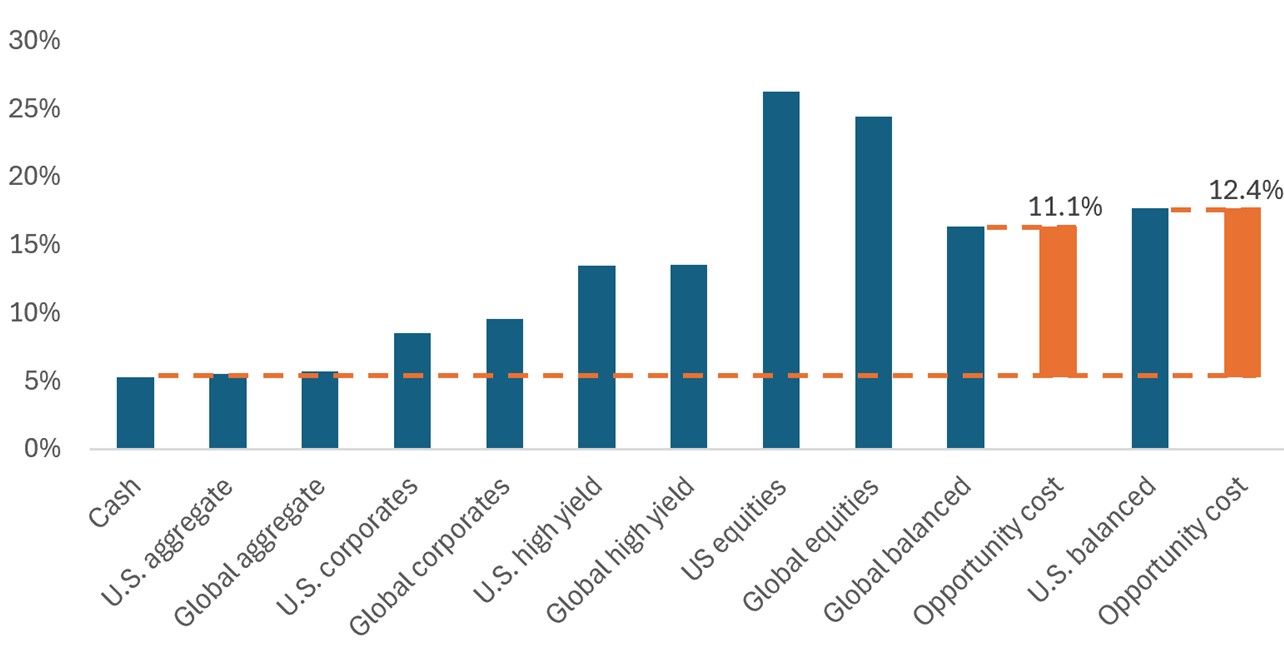

Exhibit 2: In 2023, money on the sidelines experienced a massive opportunity cost …

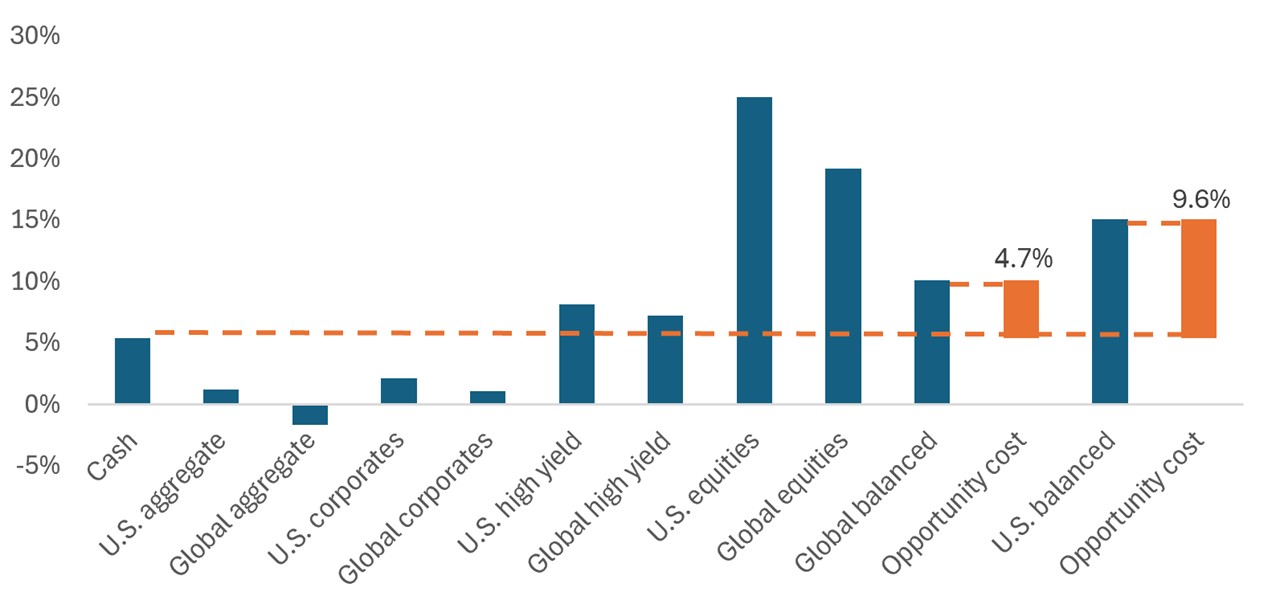

… and in 2024, it happened again.

Source: Janus Henderson Investors. Returns for calendar years 2023 and 2024. Total return indices in USD.

“Cash” = FTSE 3-month Treasury Bills, “U.S. aggregate” = Bloomberg US Aggregate Bond Index, “Global aggregate” = Bloomberg Global Aggregate Bond Index, “U.S. corporates” = Bloomberg U.S. Corporate Investment Grade Bond Index, “global corporates” = Bloomberg Global Aggregate Corporate Bond Index, “U.S. high yield” = Bloomberg U.S. High Yield Corporate Bond Index, “Global high yield” = ICE BofA Global High Yield Constrained Index USD Hedged, “U.S. equities” = S&P 500 Index, “Global equities” = MSCI World, “Global balanced” = 60% MSCI World, 40% Bloomberg Global Aggregate Bond Index, “U.S. balanced” = 60% S&P 5000 Index, 40% Bloomberg U.S. Aggregate Index.

Past performance is not a guarantee of future performance.

Déjà vu all over again?

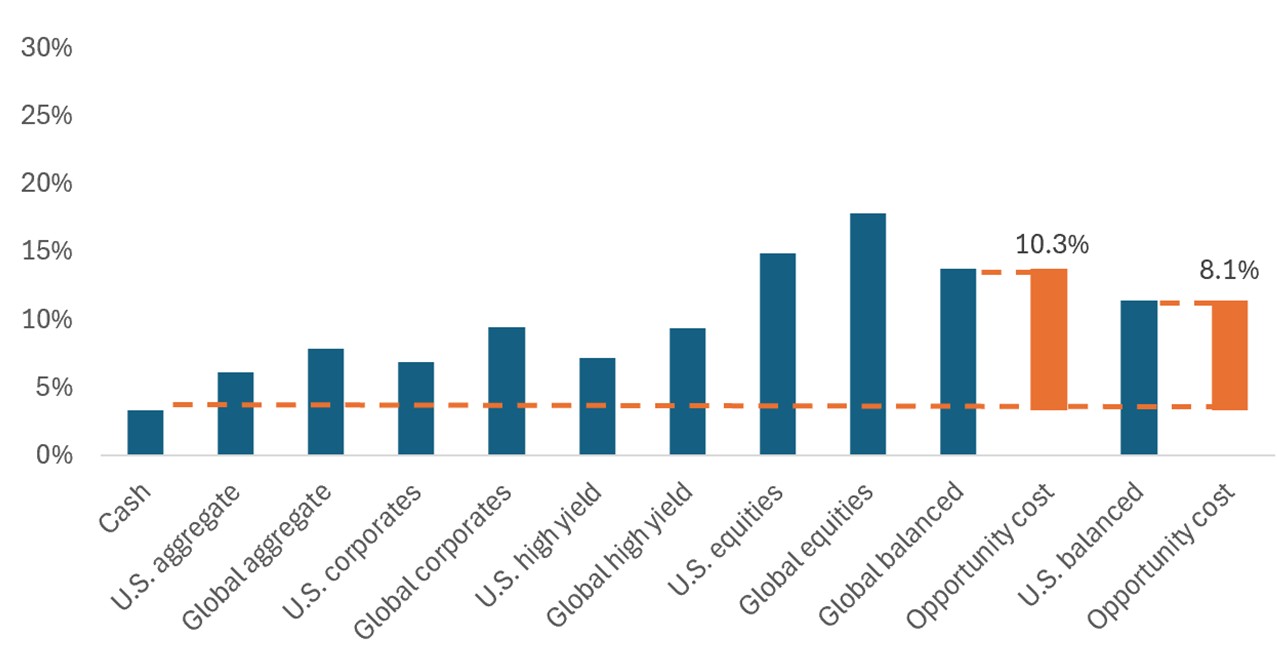

2025 is shaping up to be another “déjà vu” moment for investors still sitting in cash. And there is little sign of that trend reversing, especially as economic uncertainty appears set to continue.

Not helping matters is the fact that the post-Liberation Day sell-off in April is still fresh in investors’ minds. That period of extreme volatility – and the multiple shock waves of market turbulence that followed – likely remains a significant source of reluctance to re-enter markets, despite the subsequent rally virtually retracing those losses in a matter of days. Indeed, April’s sell-off is a prime example of how stocks have often gone on to stage significant moves to the upside following swift drawdowns, and why riding out the inevitable fluctuations has historically paid off.

Source: Janus Henderson Investors. Year-to-date total returns through 30 September 2025 in USD. Past performance is not a guarantee of future performance.

Source: Janus Henderson Investors. Year-to-date total returns through 30 September 2025 in USD. Past performance is not a guarantee of future performance.A more balanced approach

While market volatility and economic uncertainty are unsettling, there are investment strategies that can help investors mitigate downside risk while participating in upside gains. In fact, one well-known, time-tested strategy is specifically designed for that purpose: The 60/40, or balanced strategy, which typically represents a mix of 60% equities and 40% high-quality fixed income.

The 60/40 mix has long been synonymous with prudent, risk-adjusted investing by providing a portfolio allocation with historically less downside risk than an all-equity portfolio that instills confidence in maintaining market exposure through volatile conditions. Historically, the blended approach has allowed investors to enjoy solid returns with less stomach-churning volatility than a 100% equity portfolio.

Equities

Despite near-term volatility, equities remain a key component of building long-term wealth. The primary role of the equity allocation in a balanced strategy is to provide capital appreciation, which is why it’s crucial that this part of the portfolio be positioned to grow, even amid tougher economic conditions.

Fixed income

A core tenet of a balanced strategy is that reducing the impact of drawdowns matters significantly to long-term performance. For this reason, the fixed income allocation, needs to perform two duties – maximizing income and limiting drawdowns during periods of stock market stress.

Given the complexities of achieving these duties in tandem, options that employ active approaches to both equities and fixed income, in combination with the ability to dynamically adjust the equity-to-bonds mix may better position investors to weather changing market conditions.

More volatility to come? A balanced strategy may ease re-entry into markets

Markets have been wrought with volatility in 2025, and it is likely to persist. But while the allure of cash in uncertain times is understandable, staying on the sidelines has come at a significant opportunity cost amid strong performance in risk assets in 2023, 2024, and 2025 year to date.

We think balanced strategies may help reverse this trend by providing a lower-volatility option to an all-equity portfolio to help investors re-enter markets. These strategies seek to deliver strong returns during positive market environments while limiting drawdowns during equity market selloffs, helping more cautious investors combat economic- or volatility-related uncertainties while still capitalizing on market gains.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

The Bloomberg U.S. Aggregate Bond Index, often called the “Agg,” is a broad-based, market-weighted index representing the U.S. investment-grade, fixed-rate bond market. S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance. Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.