Following almost two and a half years of consultations, the European Council (EU) formally adopted new rules on business insolvency on 6 June 2019. Secured loans specialists within the Secured Credit Team, Elissa Johnson, Portfolio Manager and, Guillaume Bezard-Falgas, Associate Portfolio Manager, share their views and shed light on the new directive.

EU directive for insolvency and restructuring: good news for senior lenders

European secured loans (European loans) have performed strongly this year. For their investors, in particular senior lenders in the loan structures, the directive on ‘insolvency, restructuring and second chance’ is a welcome development, providing an extra layer of comfort.

This is an important matter for loan investors as it will impact their recovery prospects when a company is, or is likely to become, insolvent. Up until now, lending in certain EU countries has been a source of concern for senior creditors as the rules and procedures for recovery differs under differing regimes.

On 28 March 2019, European Parliament members (MEPs) approved a directive on ‘insolvency, restructuring and second chance’1 aimed at enhancing restructuring and insolvency rules in its Member States. This was then adopted by the EU Council on 6 June 20192. Thus, over the next two years, insolvency laws across Europe are likely to become more senior lender friendly, following recent trends that have seen Spain and the Netherlands, in particular, improve their insolvency and restructuring laws.

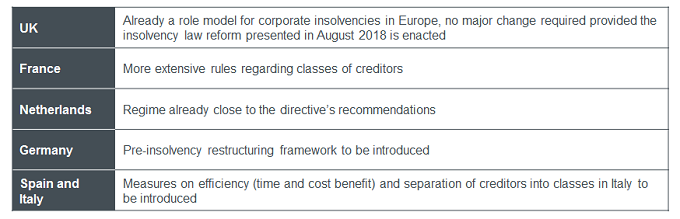

What does this EU directive bring to the table?At the moment, insolvency regimes vary widely from country to country in the EU3, with some considered more creditor friendly than others (eg, UK versus France). Well known and tested procedures in the US or in the UK such as Chapter 11, the Scheme of Arrangement or ‘pre-pack’ (pre-packaged administration) do not necessarily have their equivalent in all European countries.

The directive is about promoting “entrepreneurial spirit by facilitating restructuring of companies in financial distress”. It is not an attempt to harmonise insolvency laws but to complement the regulations already in place. Thus, the goal is to agree on a balanced set of incentives and tools shared across the region for businesses and for capital to flow more easily.

The directive sets out measures for convergence around three themes:

- The availability of a preventative restructuring framework involving certain common principles; for example, the negotiation of a restructuring plan while distressed companies can continue to operate and preserve jobs

- A second chance for insolvent or over-indebted individual entrepreneurs through a full debt discharge after a maximum period of three years (not applicable to companies)

- Targeted measures to increase the efficiency of the insolvency, restructuring and discharge procedures.

From our perspective as loans managers, there are three key conditions in a pre-insolvency or insolvency scenario that mainly influence the outcome:

- The ability for a procedure to be launched well ahead of what could become a business in terminal state due to long lasting financial distress

- The legal recognition of the different classes of creditors and their respective priority of claim

- The time and costs involved with the procedure

[caption id=”attachment_110370″ align=”alignnone” width=”680″] Source: Freshfields Bruckhaus Deringer, White & Case, Janus Henderson Investors, as at 12 June 2019Elsewhere, and in particular in Eastern Europe, changes required should be more significant given the existing insolvency regimes, which is why we have chosen to invest only in Western Europe to date.[/caption]

Source: Freshfields Bruckhaus Deringer, White & Case, Janus Henderson Investors, as at 12 June 2019Elsewhere, and in particular in Eastern Europe, changes required should be more significant given the existing insolvency regimes, which is why we have chosen to invest only in Western Europe to date.[/caption]

We welcome this move by the EU to improve insolvency regimes, which should benefit senior lenders, but as ever the devil is in the detail. Each member state will have two years to implement the directive in a way that fits its own insolvency regime. Thus, it will be open to interpretation and, domestic adoption will take time before being tested in each judiciary system.

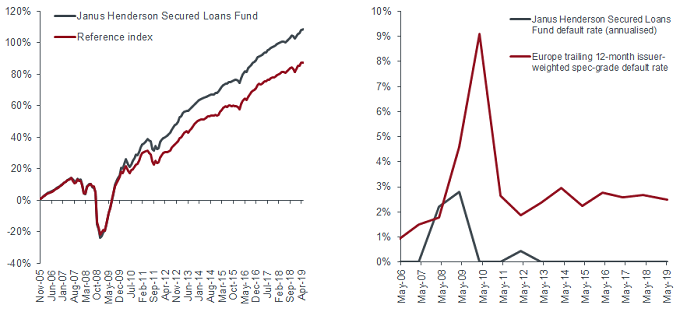

Our track record in avoiding businesses, which default on their loan obligations, is significantly better than the market as a whole over the long-term and yet, we have delivered strong performance with lower risk.

Our focus: loss avoidance and low default rates

[caption id=”attachment_110381″ align=”alignnone” width=”680″] Source: Janus Henderson Investors, Credit Suisse, as at 31 May 2019

Source: Janus Henderson Investors, Credit Suisse, as at 31 May 2019

Note: Bid pricing, gross of fees, base currency. Reference index relates to the Credit Suisse Western European Leverage Loan Index. Past performance is not a guide to future performance.[/caption]

We retain a conservative investment bias and apply higher investment hurdles for loans where the jurisdiction of the borrower has poor rights for senior lenders. Hence, in our view, any improvements in insolvency regimes that enhance recovery prospects would improve the risk/return available from the loan market.

Notes:

1Directive of the European Parliament and of the Council on preventive restructuring frameworks, on discharge of debt and disqualifications, and on measures to increase the efficiency of procedures concerning restructuring, insolvency and discharge of debt.

2The original proposal for the directive was presented in November 2016 and an agreement by the European Council and the European Parliament regarding the shape of the directive, was reached in December 2018. Following the recent Parliament’s endorsement in March 2019, it was adopted at the European Council meeting in June 2019. Each European member state will then have two years to implement the directive.

3The Doing Business report published by the World Bank assigns doing business scores to 190 economies every year; a metric used for assessing the relative level of regulatory performance across countries. Looking at the 28 EU states’ scores, on the ease of resolving insolvency or their recovery rates, there is a fairly high level of discrepancy. Recoveries for example range from 33.2% (Greece) to 89.8% (the Netherlands) based on the 2019 report.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.