Since the end of rate hikes across the developed world in mid- to late-2023, government bond markets have debated the scale of ‘soft-landing’ interest rate cuts (those permitted because inflation is moderating) and priced in a tail risk of ‘hard-landing’ interest rate cuts (those designed to combat an economic downturn).

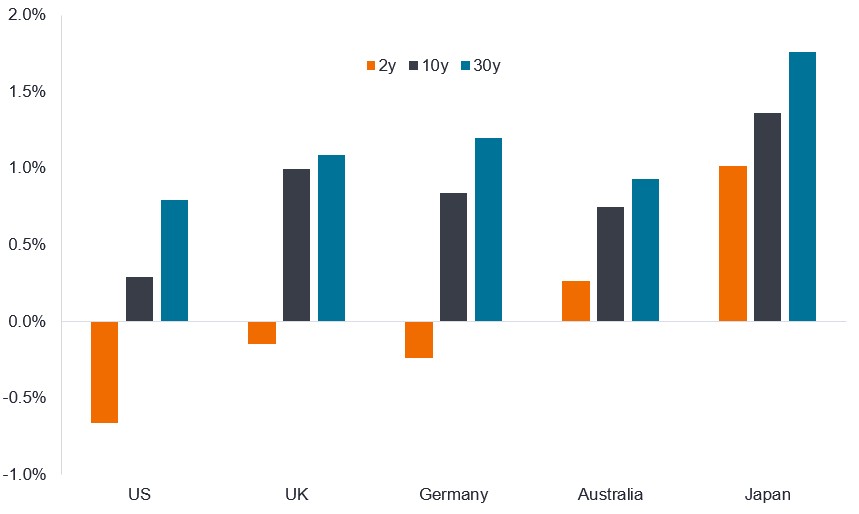

This downside focus for interest rate expectations has supported bond markets, particularly among shorter-dated maturities. However, 10-year yields have disappointingly only traded in wide ranges in most developed economies and failed to follow through to the downside, even in this rate cutting environment. Bond prices fall when their yields rise and vice versa. Thirty-year bond yields have fared even worse and sit close to the top of ranges that have held since 2022 or even broken out to new yield highs.

Figure 1: Yield change at different maturity points since end 2023

Change in yield among government bonds (%)

Source: Bloomberg, Government bond yields for respective countries and maturities, difference between yield at 31 December 2023 and at 8 December 2025. Data as at 8 December 2025. Yields may vary over time and are not guaranteed.

Shifting developed market interest rate expectations

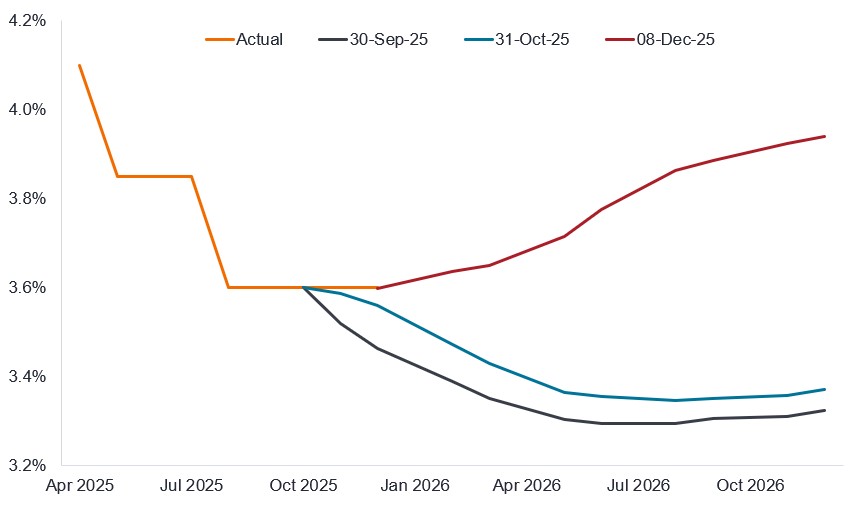

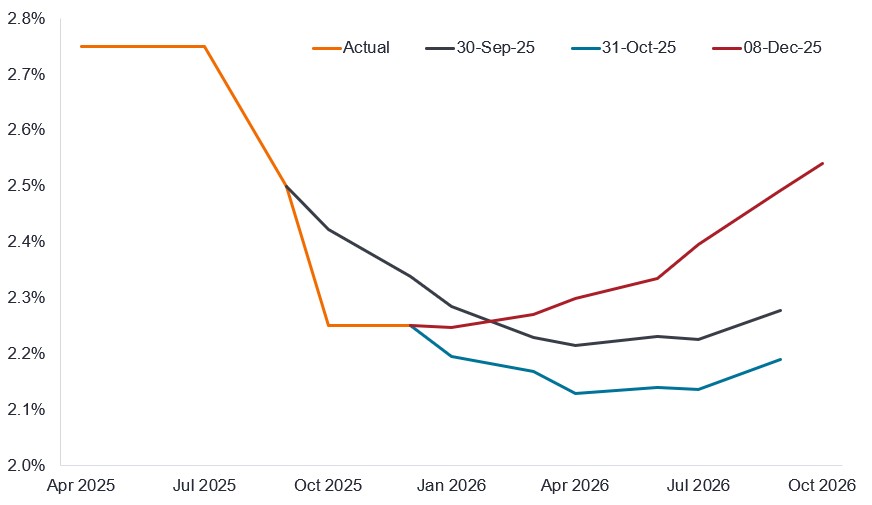

In 2026, soft landing rate cuts have come to an end in a number of economies (Eurozone, Canada, Australia, New Zealand, and South Korea), whilst economic data has proved resilient. Now, in the last month we have seen some dramatic re-pricings as bond investors price in the probability of rate hikes in a number of countries.

The most dramatic examples of this shift have been in Australia, following better employment data and high inflation data, and, as of early December, Canada, where a very strong employment report, the third consecutive one displaying strength, has dramatically shifted market expectations of monetary policy.

Figure 2: Interest rate probability path for Australia

Implied policy rate of Reserve Bank of Australia (%)

Source: Bloomberg, implied rate path derived from cash rate futures, actual rate path up to 8 December 2025. Data as at 8 December 2025. There is no guaranteed that past trends will continue, or forecasts will be realised.

Figure 3: Interest rate probability path for Canada

Implied policy rate of Bank of Canada (%)

Source: Bloomberg, implied rate path derived from overnight index swaps, actual rate path up to 8 December 2025. Data as at 8 December 2025. There is no guaranteed that past trends will continue, or forecasts will be realised.

With the US and UK bond markets still priced for further soft-landing cuts, the above market shifts provide a sobering case-study of how painful bond market pricing can be if employment data holds up or improves.

In a league of its own

The one exception has been Japan which has followed its own slow, but well-documented, process to exit zero / negative interest rates. But even this has accelerated in a more hawkish direction as debate moves on from what a neutral rate for the country might be, given rates are at just 0.5% today and expected to rise to only 0.75% at their December meeting. Only Switzerland has lower rates among developed markets.1

Duration positioning

The cyclical tailwind of rate cuts is abating and the risk of rate hikes rising. This is a sobering development given the travails of longer-dated bonds in recent years.

The end of rate cutting cycles across the developed world was a key driver of our decision to reduce duration (the sensitivity of a bond or portfolio to interest rate movements) through 2025 with reductions focused in those economies where the monetary policy story was becoming less supportive (Europe, Australia, Canada). For most of 2025 we have been actively cutting duration, scaling it back from high single digits in December 2024 to below 5 years by July 2025 and between 3-4 years by end October 2025. In contrast, credit risk has been increased over the last year with a particular focus post the Liberation Day sell-off in risk assets. This was to take advantage of attractive valuations and our ongoing belief that corporate conditions remain favourable.

1Source: Various developed market central bank websites, policy rates at 8 December 2025. Rates may vary over time.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Credit risk: The sensitivity of a company or a portfolio to economic and corporate conditions. Credit risk is the risk that a borrower will default on its contractual obligations to make the required interest payments or repay the loan. If a bond or portfolio has high credit risk, it may perform well when economic conditions are favourable but underperform if economic and corporate conditions sour.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Duration: Duration measures the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Hawkish: An indication that policy makers are looking to tighten financial conditions, such as by supporting higher interest rates to curb inflation. The opposite of dovish, which describes policymakers loosening policy, i.e. cutting interest rates to stimulate the economy.

Inflation: The rate at which prices of goods and services are rising in the economy.

Interest rate cycle: The interest rate cycle reflects the fluctuation of interest rates over time. It is typically linked to the economic cycle as central banks alter monetary policy in response to economic conditions.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary easing or stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Neutral rate: The interest rate level at which monetary policy is neither expansionary nor contractionary, i.e. one where the economy is at full employment with stable inflation.

Tail risk: Tail risk events are those that have a small probability of occurring, but which could have a significant effect on performance were they to arise.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.