Peeling back the onion: A concentric approach to investment decision making

Portfolio Managers Greg Wilensky and Jeremiah Buckley offer a framework for interpreting economic news for investment decision making.

7 minute read

Key takeaways:

- Investors are faced with an overwhelming amount of news and information daily that they often feel compelled to act on.

- Too often we see investors wanting to make big decisions about asset allocation, or whether to get in or get out of the markets, based on economic events.

- In our view, investors can benefit from a concentric approach to investment decision making that helps ensure they don’t allow attention-grabbing headlines to jeopardize their long-term investment success.

The past year has been punctuated by attention-grabbing headlines: The ongoing war in Ukraine, the U.K. pensions crisis, the collapse of Silicon Valley Bank, debt ceiling negotiations, the rise of ChatGPT … and the list goes on.

No society in human history has had access to as much information as we do today. While this access clearly has advantages, it also creates a new challenge: Processing and interpreting the sheer volume of information and using it to make better decisions has become a complex problem.

Investors in particular are faced with waves of new information every day regarding financial markets, the economy, and individual companies. So, the question becomes: What should one do with all this news?

The mistake

Too often we see investors overreacting to major (and minor) economic news by wanting to alter their asset allocation, or worse, wanting to stop or start investing altogether. In our view, one shouldn’t make major decisions about asset allocation, or whether to “get in” or “get out” of the markets, based on current events.

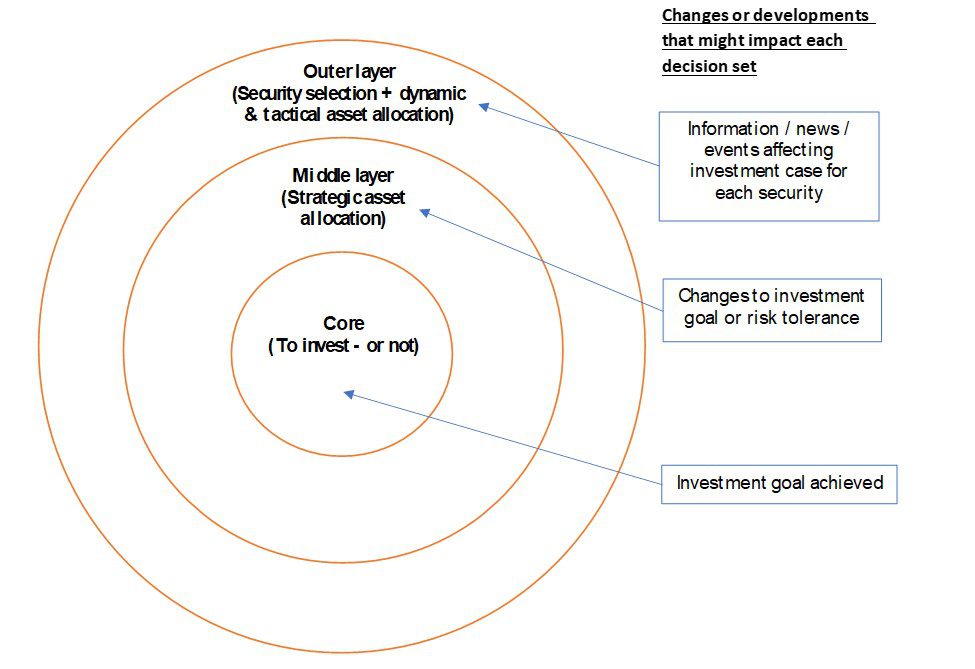

As such, we think investors can benefit from applying a defined framework to their investment decision making. In Exhibit 1, we propose a three-layer concentric approach to the investment decision-making process. Working outward from the center, each circle represents a decision set for the investor.

Exhibit 1: A concentric approach to investment decision making

The core: The decision to invest – or not

Before deciding what to invest in, one must first decide whether to invest – in simple terms, this is the decision to “get in” to the markets.

While this decision is often made tacitly, we think it’s important to consider it explicitly. Most importantly, we believe economic forecasts should not be a factor at this level.

Just as someone might pick a place to live based on its climate rather than its weather on any particular day, investors should base their decision to invest on long-term market assumptions while disregarding the day-to-day “weather” in financial markets. (The proverbial weather will play a role at a subsequent level of decision making, however.)

It follows that the decision to invest should not be modified or questioned due to events taking place in the economy – but all too often we see investors trying to time their entry and exit from markets based on economic projections.

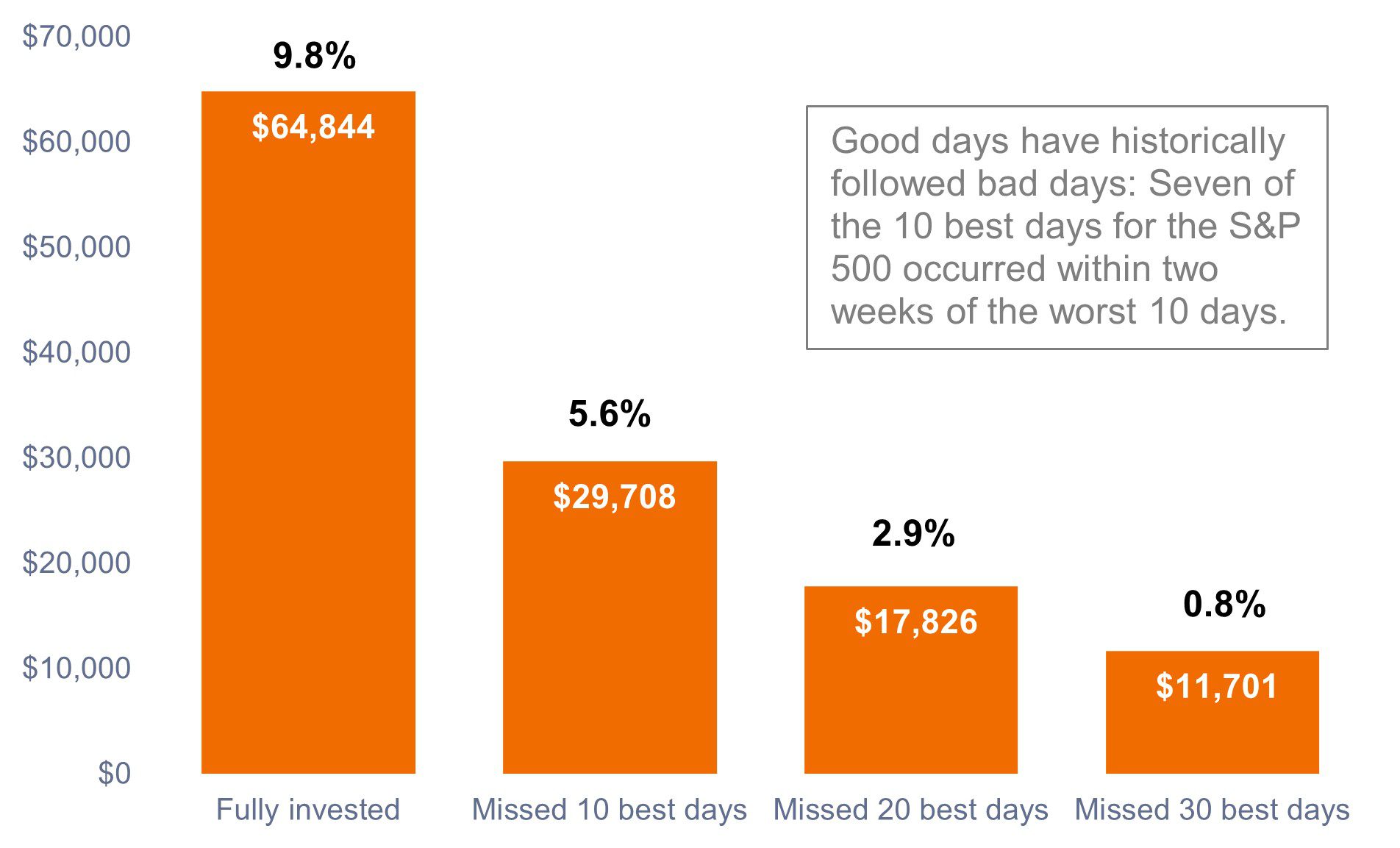

Numerous studies have shown that the average investor misses out on significant returns by trying to time the market. As shown in Exhibit 2, missing out on a handful of the best days over a 20-year period can drastically affect long-term investment returns. Investors should rather think about staying invested until they achieve their investment objective (e.g., child attends college and uses saved capital) to ensure they maximize what markets are offering.

Exhibit 2: The risk of market timing

Cumulative return on a hypothetical $10,000 investment in the S&P 500® Index (Jan 2003 – Dec 2022)

Source: J.P. Morgan, Bloomberg, as of 31 December 2022. Past performance is no guarantee of future results.

The middle layer: Strategic asset allocation

Once a decision is made to put capital to work, one can move to the next level of decision making, which is to decide on an appropriate long-term mix of asset classes – stocks, bonds, cash, real estate, private equity etc.

Determining a strategic asset allocation is a matter of personal goals, and risk tolerance. While this may sound simple in theory, in practice it requires careful planning and consideration. Financial professionals spend much of their time helping clients define their goals and risk tolerance to help ensure their investment allocation meets their objectives.

At this level, too, we often see investors wanting to adjust their asset allocation to be “risk-on” or “risk-off” based on market events or economic projections. We would advise against this form of de facto market timing and would encourage investors to invest in a portfolio they’re comfortable holding through an entire market cycle. When does it make sense to alter a strategic allocation? In our view, only when the investor has realized a change in their investment goal or risk tolerance.

The outer layer: Security selection, and dynamic and tactical asset allocation

The final level of decision making focuses on a) making marginal tactical and dynamic tilts to asset allocation, and b) selecting securities to fill each asset class bucket. In our view, it is at this level that the proverbial weather in financial markets comes into play.

Importantly though, instead of focusing on backward-looking economic data releases, we believe looking at leading and current indicators and anticipating where those economic data points will go in the future is the correct approach. And while there is still much information to process, we can filter it through a single lens, focusing on which companies we think will do better given current and expected future conditions.

Regarding security selection, investors can buy an index – thereby owning all securities in an asset class – or they can hire an active manager to select individual securities. As an active manager, we believe one is inherently buying individual businesses when investing, and we like to know what we own and why we own it.

The case for active management amid higher interest rates

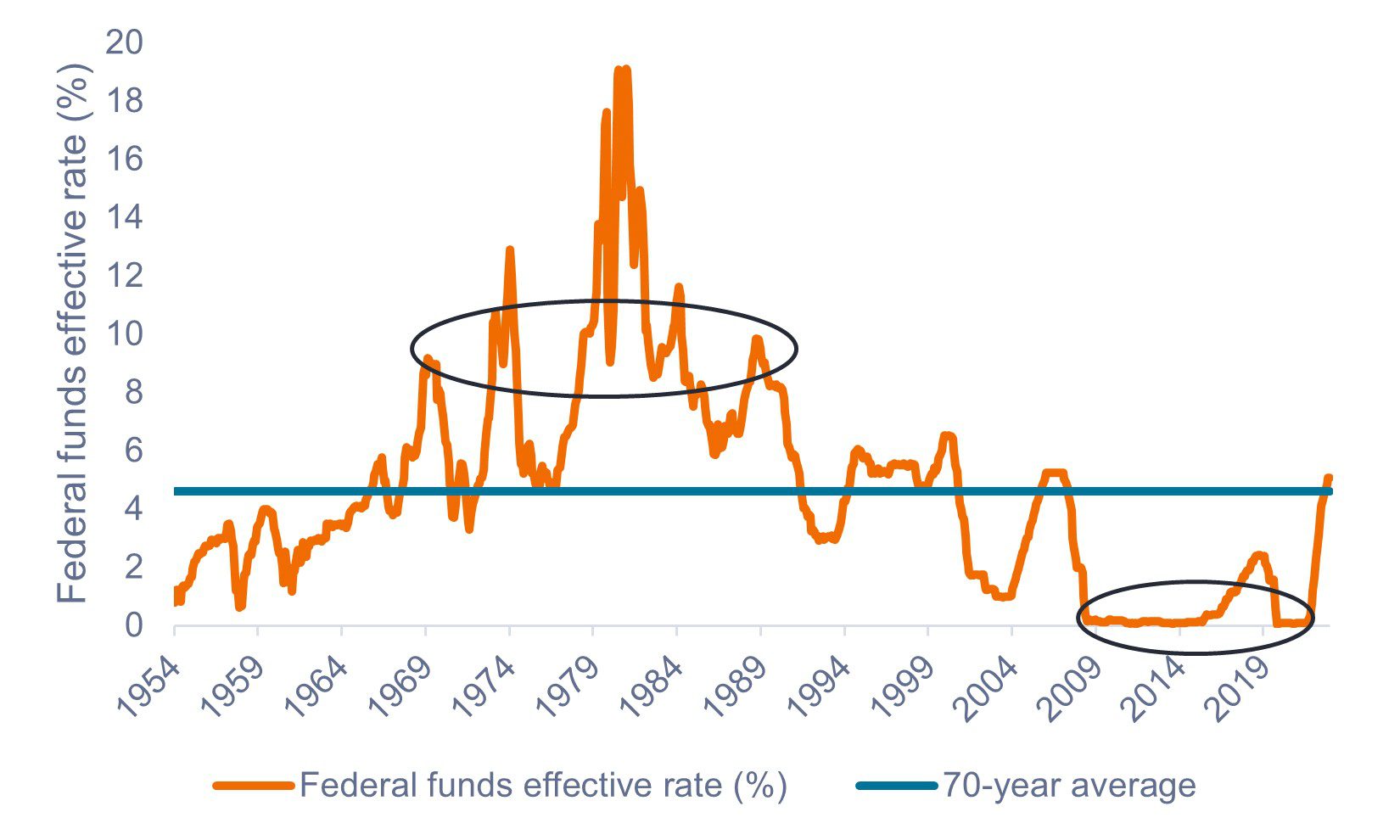

We believe the active approach will be especially crucial as the global economy returns to a more normalized (read: higher) interest-rate regime. While index-based investing has grown substantially in the past decade, it is important to note that it did so under macroeconomic conditions that were utopian for it – namely 15 years of zero interest rates and major quantitative easing by central banks.

Interest rates are to companies what a high-jump bar is to track-and-field athletes – with the bar on the floor, it’s easy for all competitors to clear it irrespective of their athletic ability. But as the bar is raised, only those with the requisite athletic ability to jump can clear the bar. Similarly, a zero interest-rate policy favors all companies in an index being winners, whereas higher rates are likely to result in clearer separation between winners and losers.

We have seen this play out recently in the banking sector, where cracks have started to show in the weaker players as interest rates have risen. We think this trend will continue across industries, and investors will therefore be better served being selective about what they own versus owning every stock and bond in the universe.

As shown in Exhibit 3, over the last 70 years, there have been a handful of periods where interest rates were either unusually high or low. The period of zero interest rates between 2008 and 2022 and the resulting economic incentives, were, historically speaking, more abnormal than normal. As such, we expect a return to a more normal interest-rate environment with clear separation between winners and losers.

Exhibit 3: Federal funds effective rate (1954- 2023)

Circled areas indicate extended periods of abnormally high or low interest rates, which we consider unsustainable in the long term.

Source: Board of Governors of the Federal Reserve System, as of 30 June 2023.

Source: Board of Governors of the Federal Reserve System, as of 30 June 2023.

Conclusion

With the amount of information that’s thrown at investors every day, figuring out what to do with it all can be an overwhelming task. We believe a concentric framework for investment decision making, coupled with an active approach emphasizing security selection and dynamic and tactical asset allocation, may lead to better long-term investment outcomes.

Furthermore, while current news flow should not impact one’s decision to invest or their strategic allocation, we believe investors should use forward-looking analysis that incorporates news flow to help inform bottom-up security selection and drive moderate dynamic asset allocation shifts with portfolios.