Within the value sector of the European market where do the best and most consistent returns lie?

This is a question I am often asked by clients and my typical answer is that quality value tends to outperform deep value over time. Yes, deep value has its moments in the sun, but these tend to be of short duration and are usually superseded by prolonged periods of quality value outperformance.

To illustrate this phenomenon, I conducted a study in Euro denominated markets. The results demonstrate that deep value stocks tend to outperform when the valuation spread (the difference in valuation between cheap and expensive stocks) in markets is at high or extreme levels. Once these spreads begin to narrow, quality value stocks tend to take over as the outperformers.

The value test

For the purposes of the exercise, I used historic price-to-book (P/B) valuations to define deep value as, in my opinion, this metric most closely reflects the business environment for individual companies via retained earnings/losses. Quality value was defined as stocks mispriced relative to their balance sheet structure, earnings/cashflows, their retention policy and current rating relative to their assumed sustainable return profile, the core of the screen we use to find quality mispriced stocks for the Euroland strategy.

Using FactSet we analysed 20 years of historic company data (31/01/2003 – 31/01/2023) and plotted the returns of the cheapest stocks in two groups (deep value and quality value, as defined above). Both groups had roughly the same sample size and there was no survivorship bias in the study; however, it is important to note that there is a small cap effect in the overall results, as all holdings were equally weighted over the 20-year period. In addition, financial stocks are shown separately because the screen used to identify quality value for non-financial stocks includes a cash measure which is not appropriate for the financial sector.

The study supports the premise that at valuation extremes, deep value does indeed outperform quality value, but that such outperformance comes about over a relatively short period and is ultimately eroded and surpassed.

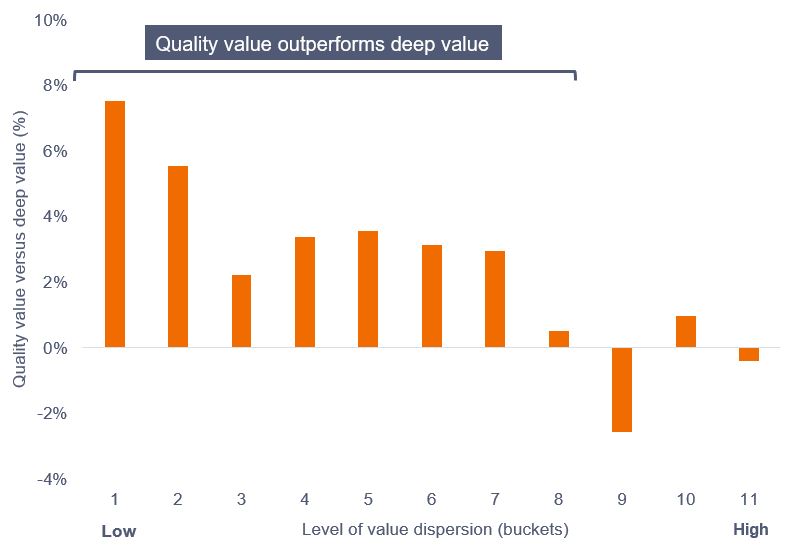

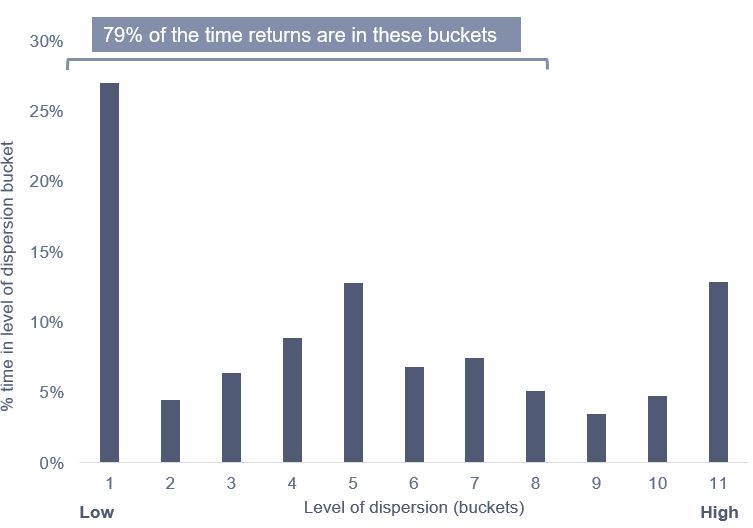

The study suggests that, over the period studied, quality value outperforms deep value roughly 80%+ of the time for non-financials and roughly 85% of the time for financials. Average comparative returns for each bucket shown in chart 1 are for the 12-month holding period from the date of selection. Numerically the lower the value for the bucket the lower the valuation dispersion in markets and vice versa.

For the non-financials universe, the average 12-month returns over the 20-year period were as follows: Deep value: 9.4% per annum, quality value: 13.0% per annum.

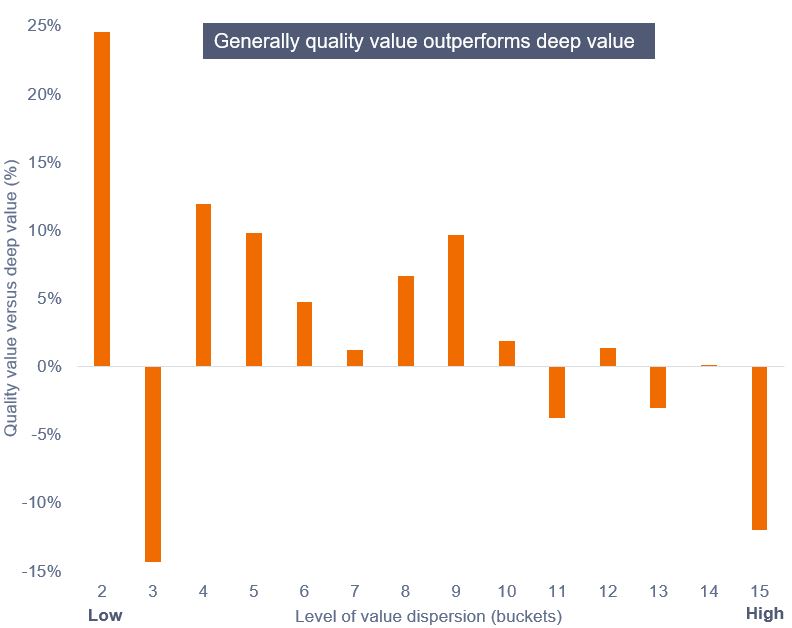

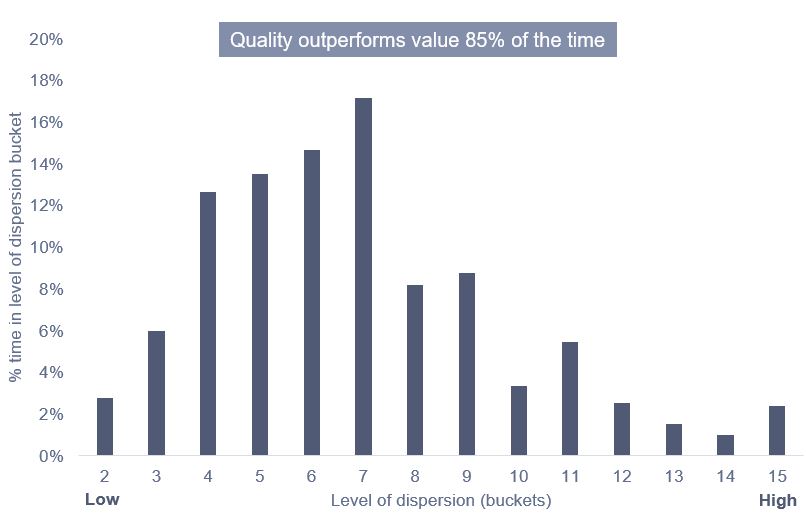

For the financials universe, the average 12-month returns over the 20-year study period were as follows: Deep value: 0.5% per annum, quality value: 4.0% per annum.

Non-Financials

Chart 1: Quality value returns versus deep value returns and levels of dispersion (non-financials)

Source: FactSet/Janus Henderson, Universe = MSCI EMU Index & FTSE World EMU region Index non-financial stocks amalgamated. 20-year difference in average monthly returns between Quality Value and Deep Value from January 2003 to January 2023. Buckets assigned associated with levels of valuation dispersion within markets, valuation determined by P/B. Past performance does not indicate future returns.

Chart 2: Time spent in level of dispersion bucket (non-financials)

Source: FactSet/Janus Henderson, Universe = MSCI EMU Index & FTSE World EMU region Index non-financial stocks amalgamated, 20-years from January 2003 to January 2023. Buckets assigned associated with levels of valuation dispersion within markets, valuation determined by P/B. Past performance does not indicate future returns.

Financials

The study for financials was more problematic in two ways. First, the dispersion of valuations in the sector has been much higher over the last 20 years. For this reason, we have included more buckets in our analysis. Second, the more eagle-eyed readers may spot that there is no ‘bucket 1’. This is because 1) the level of dispersion in the financials sector never got low enough to enter the parameters we set for this bucket and 2) the returns were more volatile on a 12-month basis. If we were to move the holding period out to a longer time frame – say two to three years – the shape of return comes closer to that of the rest of the market. However, to enable us to better compare financials and non-financials, we have maintained a 12-month timeframe. As was the case for non-financials, the financials sector demonstrates prolonged outperformance for quality value.

Chart 3: Quality value returns versus deep value returns and levels of dispersion (financials)

Source: FactSet/Janus Henderson, Universe = MSCI EMU Index & FTSE World EMU region Index financial stocks amalgamated. 20-year difference in average monthly returns between Quality Value and Deep Value from January 2003 to January 2023. Buckets assigned associated with levels of valuation dispersion within markets, valuation determined by P/B. Past performance does not indicate future returns.

Chart 4: Time spent in level of dispersion bucket (financials)

Source: FactSet/Janus Henderson, Universe = MSCI & FTSE World EMU region financial stocks Index amalgamated. 20-years from January 2003 to January 2023. Buckets assigned associated with levels of valuation dispersion within markets, valuation determined by P/B. Past performance does not indicate future returns.

Conclusion

Our study supports the premise that at valuation extremes, deep value outperforms quality value but that such outperformance comes about over a relatively short period and is ultimately eroded. Over the longer term, the study (20 years of monthly data) suggests that quality value outperforms deep value roughly 80%+ of the time for non-financials and roughly 85% of the time for financials.

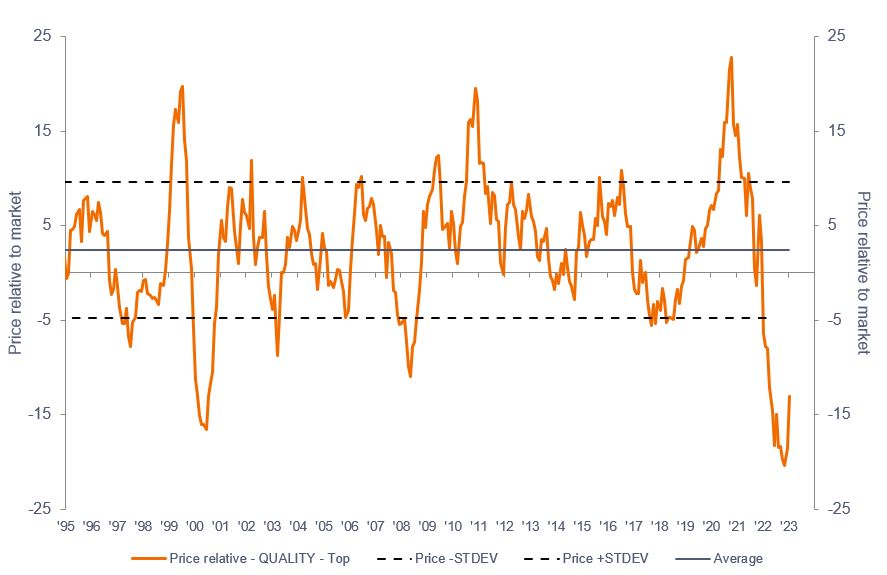

At present levels in Europe, quality has underperformed, on a relative basis, to levels last seen in 1999/2000 – chart 5.

Chart 5: Relative performance for European quality stocks

Source: JP Morgan. Data from December 1994 to January 2023. Past performance does not indicate future returns.

While timing will always be difficult to predict, when answering the question of why investors should hold quality value rather than deep value, the argument supports holding quality value over anything other than the short term.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Un Fondo che presenta un’esposizione elevata a un determinato paese o regione geografica comporta un livello maggiore di rischio rispetto a un Fondo più diversificato.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

- Il Fondo segue un approccio d’investimento value, che comporta una preferenza per determinate tipologie di società. Ciò può comportare una significativa sottoperformance o sovraperformance del Fondo rispetto al resto del mercato.