For months, uncertainty around potential sectorial tariffs on pharmaceuticals and drug pricing reform has weighed on the healthcare sector, particularly the biopharmaceutical companies whose revenues would be directly affected.

Near term, that uncertainty looks set to continue, with President Trump in recent weeks raising the potential levy on pharmaceuticals to as much as 250% (up from a previous cap of 200%) and sending letters to global drugmakers outlining steps companies “must take” to bring U.S. drug prices in line with those charged overseas.

But at the same time, signs have also emerged that the Trump administration recognizes that relocating drug manufacturing to the U.S. will take time and that biopharma innovation must be safeguarded. Both could mean sectorial tariffs and drug pricing reform may, in the end, be less punitive to the pharma industry than initially feared.

Pharmaceutical tariffs: Prospects for a more manageable ceiling

In a news interview on August 5, President Trump threated to impose tariffs of as much as 250% on pharmaceuticals, up from a previous cap of 200%. The following day, an index of European pharma stocks declined to a four-month low.

However, with the Trump administration also focused on lowering drug costs for Americans, we believe the triple-digit levy might be viewed as a tool to incentivize the reshoring of drug manufacturing in the U.S. To that point, the president said the tariffs – if enacted – likely wouldn’t take effect for 12 to 18 months to allow companies time to relocate operations.

The tactic is already yielding results. Drugmakers such as AstraZeneca, Eli Lilly, and Johnson & Johnson recently pledged to spend as much as $55 billion each over the next several years to expand their U.S. manufacturing presence, while other companies have vowed to lower drug prices.

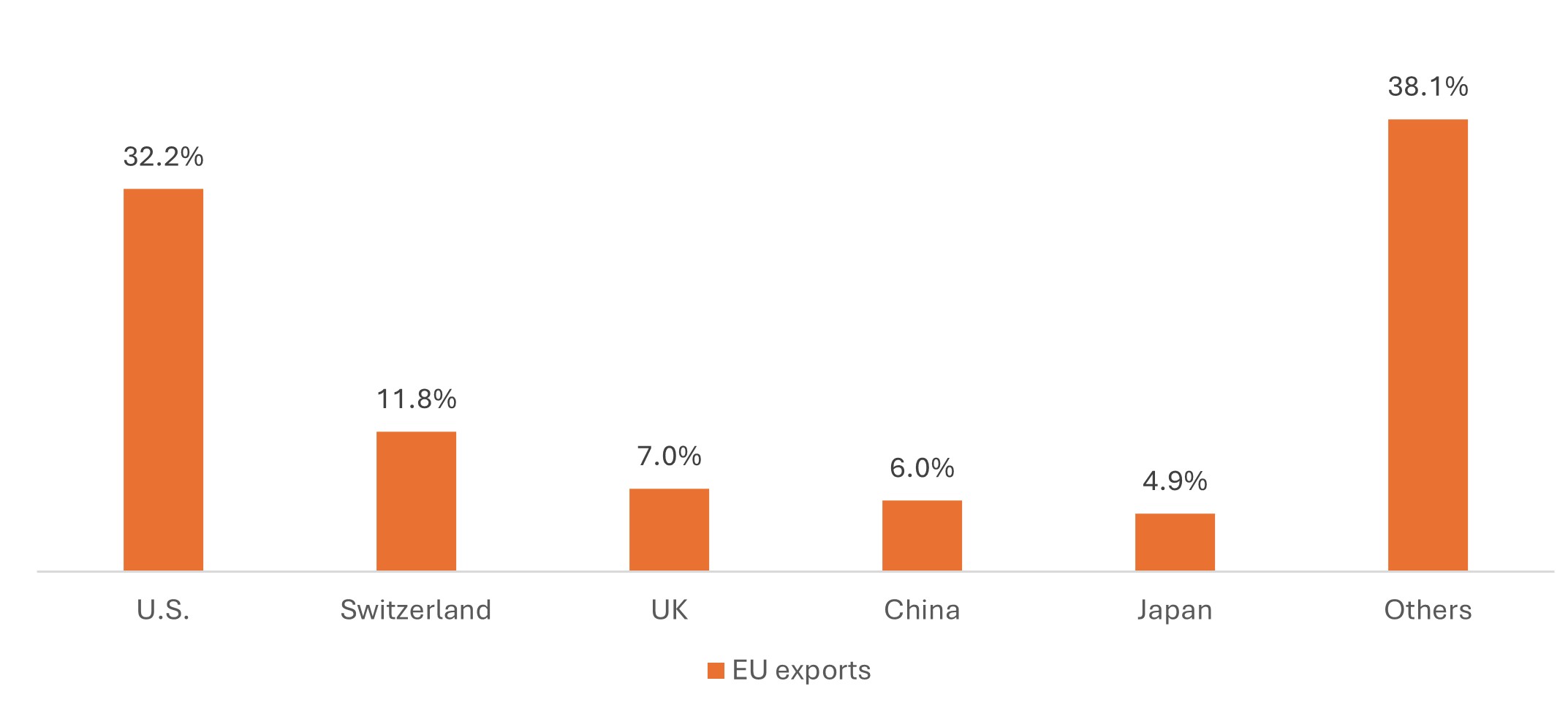

Meanwhile, trade negotiations between the U.S. and individual countries and/or regions could cap tariffs to a more manageable ceiling. Last month’s trade deal between the U.S. and European Union, for example, established a 15% tariff on all EU exports to the U.S. While it remains unclear if sectorial tariffs would supersede the trade arrangement, initial comments by European Commission President Ursula von der Leyen suggested the 15% rate would be the final cap for European pharma exports (with some generics exempted altogether). A similar agreement was reached with Japan earlier in the year, as well as with the UK, where tariffs were capped at 10% with a provision for “preferential treatment” for UK pharma exports.

Exhibit 1: What’s at stake for European pharma companies

European Union top 5 pharmaceutical trading partners, 2021

Source: European Federation of Pharmaceutical Industries and Association, The Pharmaceutical Industry in Figures, 2022.

Much remains unknown about the scope and final rate for pharmaceutical tariffs, which in the near term will likely drive volatility in pharmaceutical stocks. But with the administration increasingly focused on the strategic importance of the biopharma industry, we are optimistic that companies will be given a manageable pathway to meet U.S. manufacturing goals – without having to resort to dramatic price increases in drug costs.

Drug pricing reform: balancing drug affordability with biopharma innovation

That viewpoint is supported by the other half of the Trump administration’s pharmaceutical agenda – lowering drug prices in the U.S.

At the end of July, President Trump sent letters to 17 of the world’s largest drugmakers, outlining steps the companies must take to bring U.S. drug prices in line with those charged overseas, a policy known as “most favored nation” (MFN) pricing. Those steps include reducing drug prices in Medicaid (the federal insurance plan for low-income households) and applying MFN pricing to future drug launches across all insurance channels (both government and commercial). The president also encouraged companies to bypass pharmacy managers and sell directly to consumers at competitive prices.

Like tariffs, the threat of MFN pricing has hung over the biopharma sector for months, and clarity around how MFN might eventually be implemented would go a long way in removing a source of volatility for the sector.

But while the president gave companies 60 days to act on the letters’ mandates, much needs to be clarified. For one, the administration has yet to provide a method for calculating MFN, and enforcement could require legislative action. In addition, President Trump suggested trade negotiations could be leveraged to level the playing field of drug pricing, which would require complex negotiations and strategic alignment with trade policies – a lot to get done in only two months.

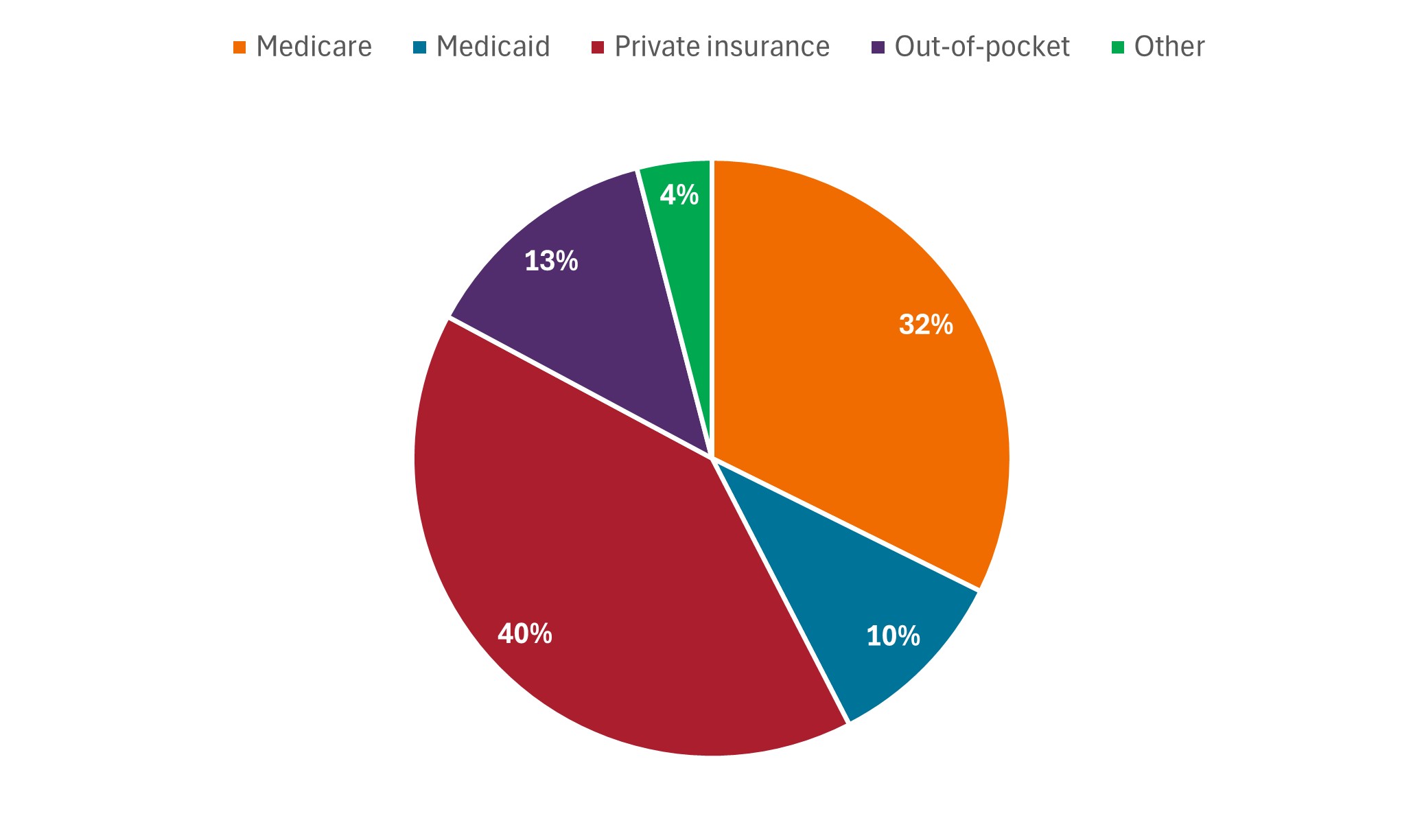

Exhibit 2: Total U.S. expenditure on retail prescription drugs by payer, 2021

Source: Kaiser Family Foundation analysis of data from National Health Expenditure (NHE) data from Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group, as of 15 September 2023.

Source: Kaiser Family Foundation analysis of data from National Health Expenditure (NHE) data from Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group, as of 15 September 2023.

As such, investors will likely have to wait a while longer for a resolution to MFN. More encouraging, however, is that as with tariffs, the administration seems willing to give companies time to adjust to a new pricing model. For most drug companies, Medicaid represents a relatively small percentage of existing revenues (Exhibit 2), and broader applications of MFN, as currently outlined, would be limited to future drug launches.

Furthermore, improving affordability isn’t solely about lowering prices in the U.S. but getting other countries to pay their fair share of the cost of drug innovation. Companies, as a result, would be empowered to negotiate for higher prices in other countries and return excess revenues to U.S. patients in the form of savings – without undermining investment into future research, a precedent the industry has long sought.

Put another way, the administration seems to understand that pharmaceutical tariffs and MFN reforms should not weaken companies’ ability to continue innovating. The more evidence we see of this approach, the more confidence we think investors should have that the industry can adapt and still be profitable – and the sooner a sustained recovery in biopharma stocks could begin.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.