Why Janus Henderson for multi-asset investing?

Janus Henderson’s global multi-asset platform delivers tailored strategies designed to help clients balance growth with income, all while seeking to mitigate risk across market conditions.

Our experienced investment professionals combine market assumptions and modeling, rigorous research, and global insights to build diversified solutions.

Global, multi-asset platform

Global, multi-asset platform

Broad investment capabilities leveraging the best of Janus Henderson, including our award-winning Portfolio Construction & Strategy service.

Adaptive multi-asset solutions

Adaptive multi-asset solutions

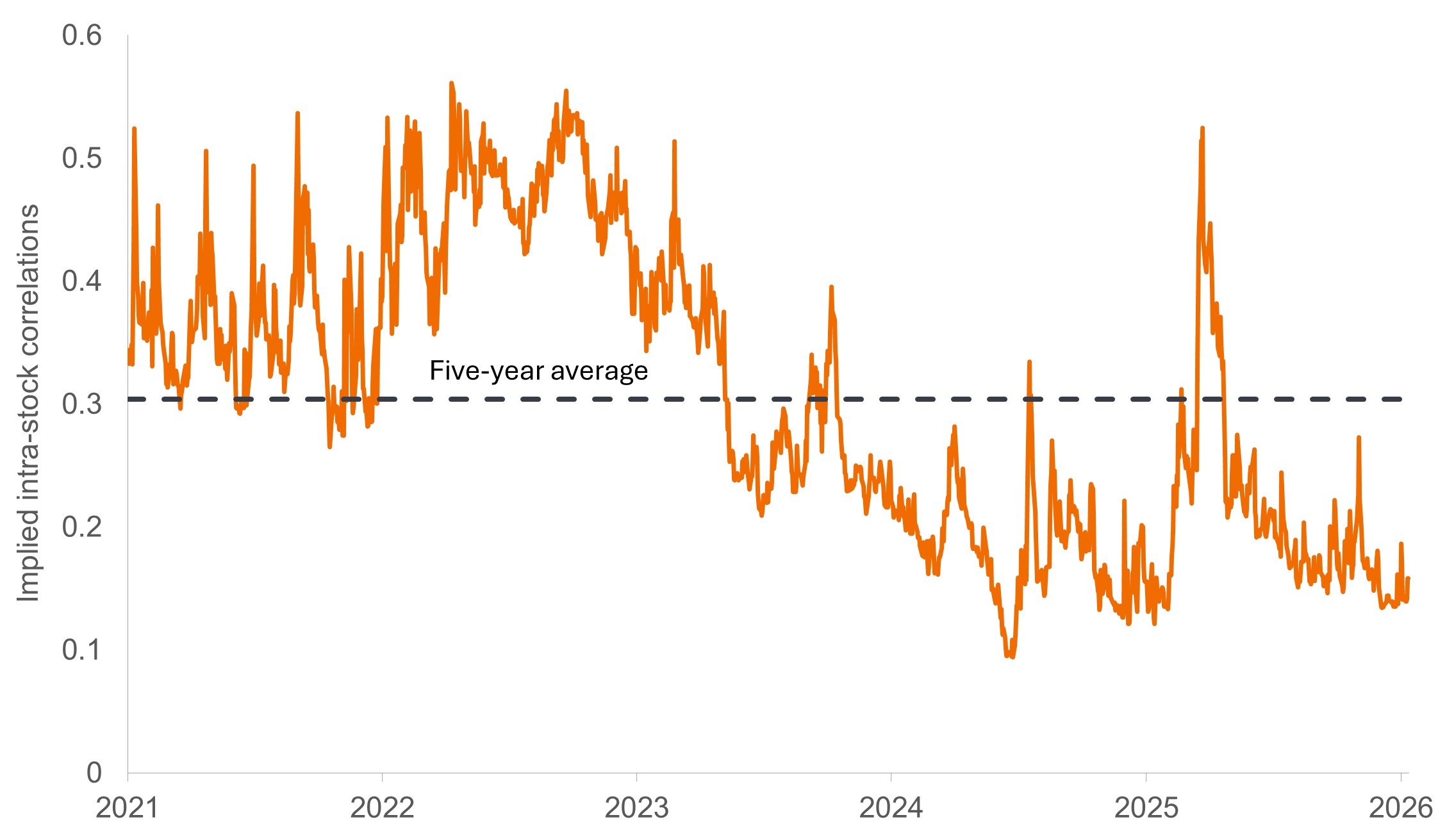

Informed by options market data, the adaptive platform seeks to enhance compound returns and manage downside risk across global stocks, bonds, cash, and commodities.

Established balanced strategy

Established balanced strategy

For 30+ years, this dynamic asset allocation strategy has served as a one-stop core solution for investors.

Our multi-asset platform

Balanced Fund

30+ year history of providing S&P 500-Like Returns with significantly less volatility

$58.8bn

Multi-Asset AUM

15

Multi-Asset investment professionals

21

Average years' experience

As at December 31, 2025

Differentiated insights

Insights delivered to your inbox

Receive timely perspectives on the themes shaping today’s investment landscape.