The surprise U.S. military operation in Venezuela over the weekend, including the capture of President Nicolás Maduro, provided a geopolitical jolt to start 2026. President Trump’s pledge to bring in U.S. oil majors to rebuild the country’s broken oil infrastructure could reshape global supply and the energy sector. Yet, oil prices have been fairly calm in the initial aftermath, reflecting the country’s diminished role in the global oil market along with the reality that a significant number of incremental Venezuelan barrels won’t hit the market overnight. Longer-term, the implications for refining economics and select energy equities could be more meaningful.

Near-term impact on oil will likely be limited

Despite the headlines, the developments in Venezuela will likely have limited impact on near-term oil prices. While there is some Venezuelan crude currently on the water – oil that was trapped by sanctions and could soon come to market – in the context of the global oil market, this isn’t expected to have a major impact on supply and demand balances.

Once a dominant oil producer, Venezuela’s output has fallen over the past two decades and now accounts for less than 1% of global supply, much of it flowing to China. Meanwhile, the market is grappling with a growing glut as OPEC+ and other producers add barrels against a backdrop of muted demand growth. We would expect Petróleos de Venezuela (PDVSA), the state-owned oil and gas company of Venezuela, to continue normal operations under interim governance by the U.S. with little change to near-term production.

Assessing the initial market reaction

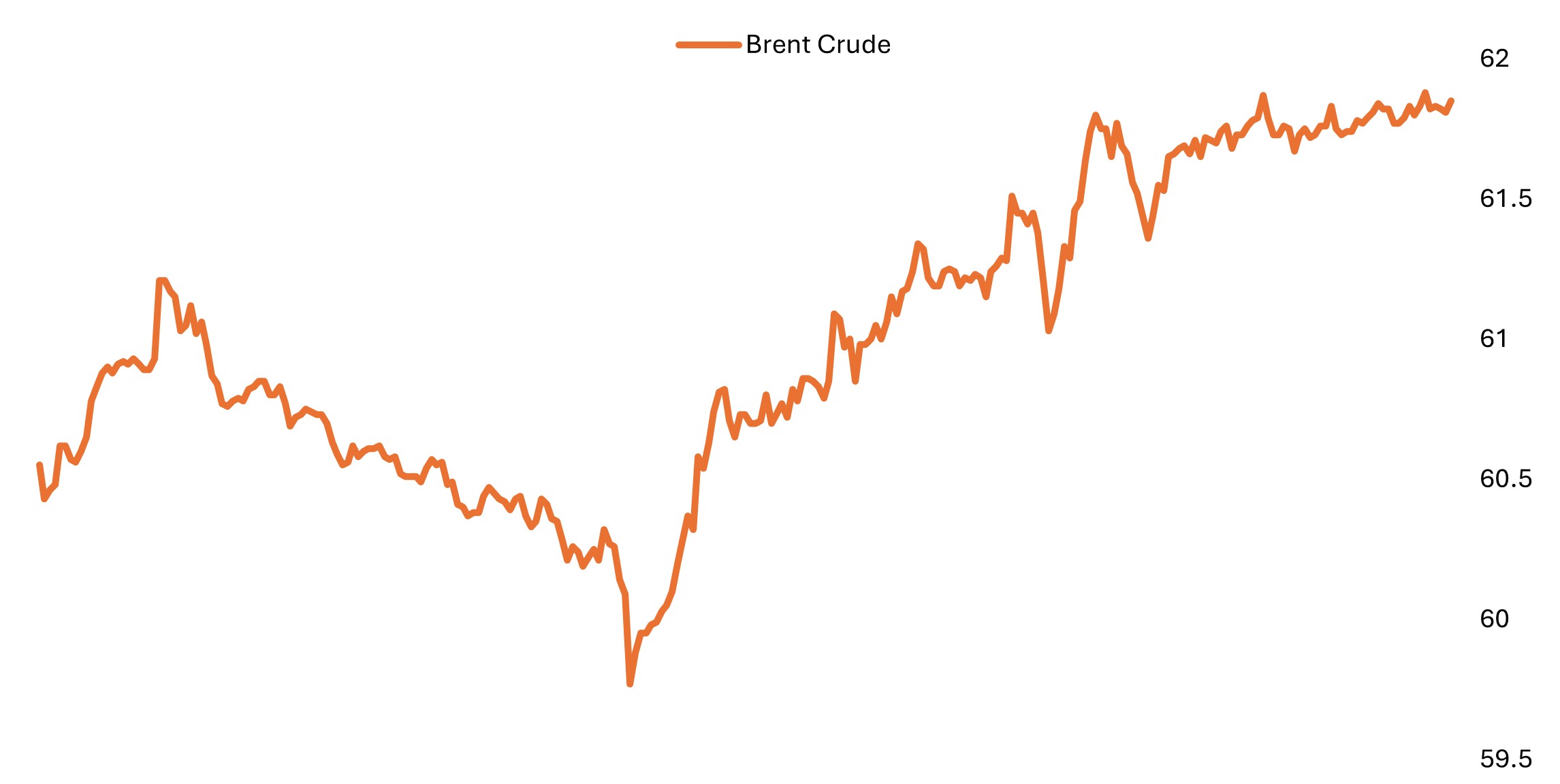

Initial price action in oil markets has been muted, with Brent crude futures trading within a fairly narrow range as of January 5. That said, while the initial move was lower, prices eventually swung higher, with near-term upside attributed to geopolitical uncertainty as well as positioning, with oil prices coming off their steepest annual decline since 2020. Meanwhile, energy was the best-performing sector within the S&P 500® Index on the day as shares of integrated majors, oil services firms, and refiners rallied.

Oil prices swung from a modest decline to a more than 1% gain

Brent crude futures fluctuated on Jan. 5, though net price movement was relatively muted.

Source: Bloomberg. Brent crude futures from 6:00pm ET on 4 January 2026 through 4:30pm ET on 5 January 2026.

Longer-term supply story appears bearish for oil prices

Venezuela sits on one of the world’s largest oil reserves, estimated at over 300 billion barrels, ranking the country at the top globally. However, production has fallen since the expropriation of foreign investor interests in 2007, from a peak of roughly 3.45 million barrels per day (bpd) in 1998 to less than one million bpd today.

Given the lack of investment in the country coupled with its deteriorating infrastructure, it would take a meaningful amount of time and money to get production back to prior levels. From 2010 to 2015, Venezuela averaged roughly 2.2 to 2.4 million bpd of production. Returning to these levels would likely take one to three years, though we believe this could skew toward the earlier end if U.S. oil majors decide to return to Venezuela. Importantly, these are largely conventional oil fields where U.S. companies have a long history of operations, which makes recovery faster than typical frontier projects.

Implications for the energy sector: Who are the potential winners and losers?

Should the U.S. move forward with meaningful investment in Venezuela, the increase to production (supply) would be bearish for oil prices longer term. At the same time, Gulf Coast refiners stand to benefit as they are well equipped to run this type of heavy crude, and shorter shipping distances would reduce transportation costs. Conversely, it could present a headwind for Canadian producers, as some of their heavy barrels would be displaced in favor of Venezuelan oil and would need to find a new market. The massive investment required to rebuild Venezuela’s oil infrastructure – upwards of $100 billion by some estimates – could also create significant opportunities for leading U.S. oil services companies alongside integrated majors.

Political stability remains a key hurdle

While we anticipate more clarity soon, the situation is highly fluid, and revitalizing the country’s oil industry faces significant challenges. At present, Chevron is the only U.S. oil major operating in Venezuela; its joint ventures with PDVSA account for between 20% and 30% of the country’s total production. Other U.S. companies that pulled out of the region years ago may wait until the political environment become more stable to re-enter. Broader participation will likely depend on assurances that past government seizures of private assets won’t be repeated as well as clarity around foreign joint ventures, particularly those involving China and Russia.

What to watch going forward

The situation in Venezuela highlights how quickly geopolitical shifts can ripple through energy markets. While near-term price impacts appear muted, the longer-term outlook hinges on policy clarity, infrastructure investment, and improved confidence around political stability.

For investors, these events highlight the value of an active management approach that is disciplined and prepared to navigate volatility, assess company-specific exposures, and position for opportunities as the situation evolves.

Integrated oil majors: Refers to large oil and gas companies that are involved in the entire value chain of the industry, from finding and extracting crude oil, to processing, transporting, and selling it to consumers.

S&P 500® Index: Reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.