AI is no longer just a buzzword − it’s a transformative force reshaping industries at an unprecedented pace. This article explores how AI is revolutionising industries and unlocking opportunities for sustainable growth, aligned with our team’s strategy, which links sustainable development and innovation to the potential for long-term compounding returns. With AI driving a new wave of innovation, we examine how our approach can capitalise on this era-defining trend while remaining true to our sustainable investment principles.

AI as a secular mega‑trend: A rapidly advancing general purpose technology

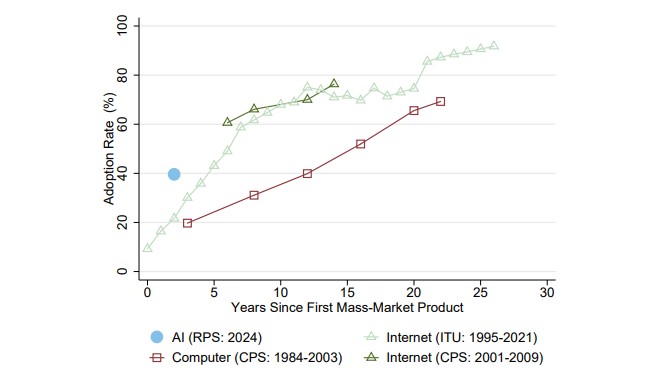

AI has emerged as a transformative general-purpose technology, akin to past innovations like electricity or the internet −only advancing at breakneck speed. Today’s AI systems are improving exponentially, tackling cognitive tasks that once required human intelligence. Some experts even speculate that artificial general intelligence (AI with near-human capabilities) could arrive within this decade, though such timelines are uncertain. What’s indisputable is that the AI revolution is unfolding much faster than previous tech revolutions. For context: the internet took over a decade to reach circa 40% of the world’s population, whereas generative AI tools have drawn hundreds of millions of users in just a couple of years. OpenAI’s ChatGPT famously hit one million users in five days, a record adoption speed that underscores AI’s extraordinary momentum.

Figure 1: The trajectory of computer, internet, and generative AI adoption

Source: Bick A, Blandin, A, Deming, D (2025); The Rapid Adoption of AI, National Bureau of Academic Research.

For investors, recognising AI as a secular mega‑trend means viewing it as a durable, structural force in the economy, not a passing fad. Much like electrification or computing before it, AI is poised to spawn new industries, reshape existing ones, and become embedded in daily life and business. This pervasive impact aligns with our all-sector approach: we assess how AI could bolster or threaten each company’s long-term prospects across our investment universe. The momentum behind AI is unmistakable. By 2024, over two-thirds of companies globally reported using AI in some form (up from roughly half just a few years prior).1 On recent earnings calls, nearly half of S&P 500 firms discussed AI as a core part of their strategy. Corporate investment is surging as well. Tech giants are spending tens of billions on AI capabilities − collectively the leading AI players Microsoft, Alphabet, Amazon and Meta are projected to spend well over $300 billion in 2025 on AI-related capex.2 Crucially, even outside the tech sector, firms in industries like finance, retail, and manufacturing are spending on AI solutions, often cloud-based, to enhance forecasting, marketing, supply chains, and more. In aggregate, Gartner had forecast worldwide IT spending to exceed $5 trillion in 20253 , with a sizeable portion of new budgets directed toward AI and automation initiatives.

This widespread adoption and investment is a green light signalling that AI is here to stay. We are beyond the point of isolated tech demos; AI is now a mainstream business tool, backed by C-suite commitment. This broad-based momentum reduces the risk of AI being a short-lived craze; instead, it suggests a durable growth trajectory as organisations increasingly rely on AI to stay competitive. However, it also means selectivity is key. With so many companies touting AI, we must discern which are truly leveraging it to build sustainable competitive advantages, rather than merely jumping on the bandwagon.

We examine how companies deploy AI within their operations or products. Are they using AI to improve resource efficiency, customer experience, or innovation in a way that aligns with long-term sustainable growth? If so, this can strengthen our investment thesis. For example, a healthcare company using AI to accelerate drug discovery or a utilities firm using AI for smarter grid management could fit well into our themes of Health or Efficiency, respectively – bolstering both investment returns and positive societal impact.

Economic upside: Productivity boosts and new markets

The excitement around AI is not just about adoption rates – it’s also about the immense economic potential this technology can unlock. Analysts increasingly view AI as a key to reigniting productivity growth across the economy. Unlike earlier waves of IT, which primarily automated routine calculations or workflows, today’s AI can tackle cognitive tasks, including drafting documents, writing code, analysing images, making recommendations, etc, that previously required human intelligence. This expansion of automation into “knowledge work” is a game-changer. Knowledge industries (from professional services to education and research) employ roughly one-third of the global workforce and contribute about $20 trillion to the global economy.4 Even a modest 20% productivity improvement in this segment via AI would equate to around $4 trillion in additional economic output per year. In practice, gains could come from AI assistants helping human workers accomplish more in the same time – for instance, engineers coding faster with AI pair-programmers, or analysts getting instant insights from AI on large data sets.

Some estimates go further, suggesting that AI could replace 30% of US work hours by 2030.5 These figures include efficiencies in retail, banking, manufacturing, etc., as well as new products and services enabled by AI. For example, AI can improve supply chain logistics, reducing waste (good for profits and sustainability); or personalise consumer experiences, boosting sales.

From an investment perspective, the prospect of a productivity renaissance driven by AI is especially compelling for a long-term equity strategy. Higher productivity can translate into higher corporate earnings and economic growth over time. Companies that successfully harness AI to improve their processes or offerings could enjoy improved profit margins, faster growth, and resilient competitive moats. For example, a firm that uses AI to automate part of its customer support might lower costs and improve customer satisfaction simultaneously, enhancing its financial performance and stakeholder outcomes.

Importantly, AI isn’t just about cost-cutting – it can also spur new market opportunities. In our sustainable equity approach, we look for win-win scenarios where technology innovation drives economic and social value. AI’s ability to optimize resource use (doing more with less) also dovetails with sustainability objectives. A case in point – AI in energy management can cut electricity consumption in buildings by intelligently controlling heating/cooling, thus lowering emissions and saving money. AI also enables circular economy models by intelligently managing resource flows, minimizing waste, and optimizing energy use across sectors. For example, AI-powered systems can predict maintenance needs to extend product lifecycles, or facilitate materials recovery and reuse in manufacturing. In agriculture, AI can reduce input waste by tailoring irrigation and fertilization to real-time crop conditions. These capabilities align with sustainability goals by decoupling growth from resource consumption, and support efficiency, a circular economy, and cleaner energy. As companies adopt AI to embed circularity into their operations, they not only reduce environmental impact but also unlock cost savings and new revenue streams, reinforcing the idea that sustainability and profitability can go hand in hand.

In summary, the economic rationale for AI is strong. By augmenting human capital and opening new frontiers, AI can drive sustainable growth. Our strategy’s core belief that innovation and sustainable development go hand-in-hand resonates here. We strive to invest in companies that contribute to a more sustainable economy through their products and services, and AI is emerging as a vital tool to accelerate solutions, whether it’s in clean energy, healthcare, education or beyond. The upside for investors comes from selectively owning those businesses that leverage AI to create real value aligned with long-term societal needs.

Volatility and disruption: Navigating the hype cycle

While the economic promise of AI is enormous, investors must also contend with significant volatility and hype in the short-term. Every transformative technology in history – railroads, electricity, the internet – has gone through periods of euphoria and turbulence. AI is no exception. In fact, we expect the hype cycles in AI to be extreme, given the pace and scale of investment. The numbers are staggering. Nvidia is projecting AI related investment to increase to $3 to $4 trillion annually by 2030. While this represents an enormous growth opportunity for many companies, there are two critical issues that could act as constraining factors and thus accentuate volatility – physical constraints and the timing of return on investment.

The greatest potential physical bottleneck is in power generation and grid infrastructure. AI datacentres exceeding 1 GW are already being commissioned with power needs equivalent to the size of an average nuclear reactor. Some projections call for more than 60GW of additional power capacity in the US alone by 2030. It takes time to plan, build and connect new power stations to the grid and the risk is that the elevated expectations for the rate of growth of AI related technology will need to be tempered.

The timing of return on investment is a more subtle but even more important constraining factor. Revenue growth of 100s of billions will need to occur in order to support the economics of trillions of dollars of investment. To put this into context in 2024 the combined cloud revenues of Microsoft, Amazon, and Alphabet were $256bn. Revenue growth of this magnitude requires vast gains in productivity and, while this is the promise of AI, there is uncertainty over the timing to when companies will start to harness the real benefits. Indeed a 2025 MIT study found that 95% of corporate AI projects had thus far failed to deliver measurable value.6 This timing mismatch is typical of boom-and-bust cycles. First comes the investment phase and then comes the deployment phase and the winners in each phase can be very different.

The extreme excitement over AI’s potential and the scale of investment, juxtaposed against these constraining factors, elevates the risk of boom bust dynamics in some parts of the market. So how do we invest for growth and for protection of capital? We believe our sustainable approach and our investment process are ideally calibrated to help us successfully navigate the AI hype cycle:

- Diversification While much of the current market performance is concentrated in a relatively small number of stocks it is important to recognise that, as a general technology, AI is a broad theme. We ensure exposure not just to one narrow aspect (say, only semiconductor stocks or only software) but across the spectrum of enablers, adopters, and beneficiaries of AI. This might include large-cap technology platforms, niche software specialists, as well as enterprises in other sectors (health, finance, industrials) that are integrating AI smartly. We are investing in companies addressing electrification and infrastructure bottlenecks and companies with unique data assets and attractive recurring revenue business models. We also invest in many companies that we view as being ‘immune’ or less impacted by AI such as building products and water infrastructure.

- Rigorous fundamental research to differentiate genuine value from hype. Not every company claiming to be “AI-driven” will live up to that promise; some may never develop a defensible business model. Our strategy’s disciplined evaluation framework helps us assess which businesses have real, sustainable advantages (strong management, solid financials, alignment with secular trends) versus those riding a fad.

- Staying on the right side of disruption. Major tech shifts inevitably create winners and losers: some incumbents will be outpaced by agile AI-driven competitors. We’ve already seen how swiftly AI can upend a business model—witness how online education company Chegg’s stock plummeted when students began using ChatGPT instead of its services, a stark reminder that no incumbent is safe if it ignores the AI trend. To avoid such pitfalls, we continuously assess whether the companies we own are leveraging AI effectively (to improve products, efficiency, customer experience, etc.) or at risk of being disrupted by those who do. We believe our sustainability focus can give us an edge here: it naturally steers us away from firms clinging to outdated or unsustainable practices (often the ones likely to face technological obsolescence or regulatory backlash) and towards those innovating for the future. In essence, by applying our “sustainable quality” lens, we aim to own the disruptors and not the disrupted.

- Valuation discipline. There is undeniably merit in the old adage: “let your winners run”. At the same time, sustainable growth investors should sensibly consider trimming positions and taking profits when exuberant pricing has overshot fundamentals, particularly in a scenario where an AI-exposed stock’s price implies perfection.

AI through a sustainable investing lens

Our team believes that sustainable development and innovation are deeply intertwined, driving long-term value creation. AI, when applied thoughtfully, epitomises this idea; it is an innovation that can accelerate sustainable development in multiple dimensions. From improving energy efficiency and enabling smarter cities (environmental benefits) to enhancing healthcare outcomes and education access (social benefits), AI can be a powerful enabler of progress on global sustainability challenges. We therefore view AI as highly relevant to our mission of investing in a more sustainable global economy.

Why does this matter for investors? Because AI is not just a technological shift – it’s a sustainability catalyst! Companies that harness AI to solve real-world problems are often more resilient, more efficient, and better positioned for long-term growth. And in a world increasingly shaped by environmental and social pressures, that’s where future value lies.

Our focus is on proprietary sustainable development themes across environmental and social verticals. AI cuts across many of these themes. Take “Knowledge & Technology,” one of our social themes: it encompasses companies spreading knowledge or digital innovation in a beneficial way. Clearly, firms at the forefront of AI advancement fit here, provided their innovations are used to better society —such as improving access to information, enabling other solutions, or enhancing digital infrastructure. For example, TSMC is using AI to optimize chip design and manufacturing processes, enabling more energy-efficient semiconductors that power everything from electric vehicles to smart grids. Another theme is “Efficiency,” where AI’s ability to optimise processes, like reducing energy waste or materials usage in manufacturing, can directly contribute to more sustainable outcomes. Schneider Electric has developed an AI solution leveraging machine learning to help industrial facilities reduce energy usage. According to the company, its ‘EcoStruxure Industrial Advisor – Predictive Energy’ platform enables up to 10% reduction in energy consumption and 40% reduction in associated emissions. We also see AI playing a role in “Health” – from diagnostics to personalised medicine – aligning with our goal to invest in healthier communities. Healthcare company McKesson, is integrating AI into its supply chain and clinical decision support systems to improve patient outcomes and streamline pharmaceutical distribution. AI intersects with other themes such as Cleaner Energy, Water, and Sustainable Property & Finance, by enabling smarter grids, predictive maintenance, and more accessible digital financial services. By mapping AI-driven opportunities to our themes, we ensure that any AI-related investment case isn’t just about hype or short-term growth, but also about a meaningful contribution to sustainability objectives.

We consider AI in other ways too. We perform in-depth fundamental research of a company’s operations, including a “triple bottom line” analysis of a firm’s impact on people and planet alongside profit, before investing. This is important – investing in AI through a sustainable lens is about capturing long term durable growth, and this necessitates the consideration of the material environmental and social impacts that might arise from AI.

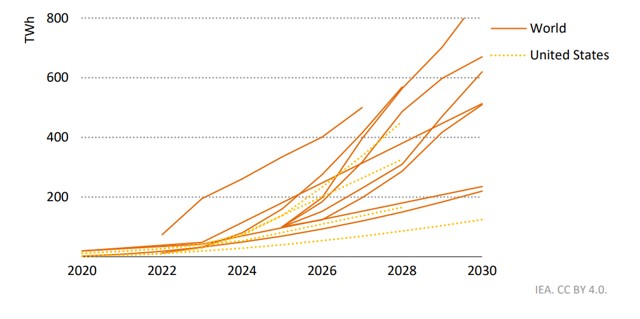

AI’s environmental footprint is a growing concern, and a critical part of the sustainability conversation. Training and deploying large-scale AI models, especially generative AI systems, requires immense computational power. This translates into significant energy consumption and carbon emissions. MIT estimates that processing a million tokens in a generative model can emit as much carbon as driving a petrol car several miles, and generating a single image can consume the energy equivalent of fully charging a smartphone. The infrastructure behind AI – hyperscale data centres packed with GPUs and accelerators – is energy- and water-intensive. These facilities already account for 1-2% of global electricity demand, with projections suggesting this could rise sharply as AI adoption accelerates

Figure 2: Estimated data centre electricity demand due to AI

Source: IEA; data for 2020-2030.

Much of this infrastructure is concentrated in the hands of a few cloud giants, who now hold disproportionate influence over AI’s sustainability trajectory. Their decisions on energy sourcing, cooling systems, and hardware efficiency will shape whether AI becomes part of the climate solution or exacerbates the problem. As investors, we monitor these firms closely, engaging on their renewable energy commitments, carbon accounting practices, and infrastructure design choices.

But we’re optimistic. AI is also a powerful tool: it helps us model climate risk, optimise energy grids, and accelerate breakthroughs in clean tech. The same innovation driving AI’s growth is also enabling smarter, greener infrastructure. Researchers have shown that carbon-aware scheduling, efficient model architectures, and renewable-powered data centres can dramatically reduce emissions by up to 90% in some cases.7 And many leading cloud providers are already investing in these solutions, from liquid cooling and modular chips to AI-powered energy optimization within their own facilities. We actively engage with companies at the heart of the AI ecosystem, asking not just what they’re building, but how. We look for transparency on carbon accounting, credible net-zero targets, and a commitment to continuous efficiency gains. The key is investing in companies that use AI responsibly to drive sustainability and long-term value.

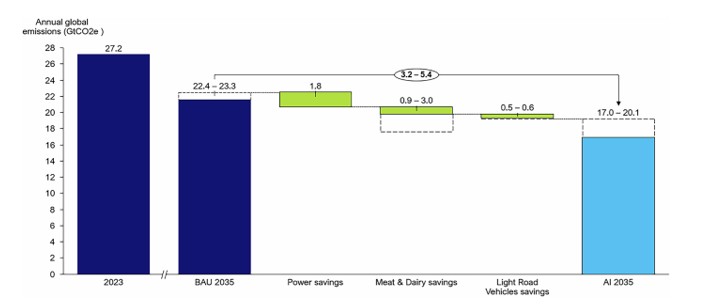

Figure 3: Total emissions and emissions savings from AI in 2035

Source: Stern et al, 2025; Green and intelligent: the role of AI in the climate transition, Total emissions and emissions savings from AI in 2035 (sectors Power, Meat and Dairy, Light Road Vehicles).

AI’s social impacts are of even greater importance than its environmental ones. We are keenly aware of the ethical considerations and potential unintended consequences of AI. One important principle for us is “do no harm.” We avoid companies involved in activities that cause clear harm to society or the environment. With AI, this principle translates into examining issues like data privacy, algorithmic bias, and the impact of automation on workers. For example, an AI system might inadvertently discriminate if trained on biased data, or an unchecked deployment of AI could erode privacy rights. We engage with companies to ensure they have strong governance around AI, such as policies for ethical AI use, transparency, and workforce retraining programmes when AI is used to automate tasks. Encouragingly, industry leaders and experts echo this need. Even in highly AI-driven fields like cybersecurity and healthcare, a “human touch” and oversight remain indispensable for success. In practice, that means companies should combine AI with human expertise and uphold accountability, rather than blindly trusting algorithms. This is reflected in those businesses that treat AI as a tool to augment human capabilities, not replace them wholesale in ways that diminish product/service quality or trust. For example, McKesson uses AI to support clinical decision-making and streamline pharmaceutical logistics, enhancing both efficiency and patient care while maintaining trust.

Finally, AI is also transforming how we invest sustainably. We increasingly use AI tools that extract insights from unstructured data – news articles, corporate filings, satellite imagery, and more. This allows us to assess sustainability performance with greater speed and depth, uncovering risks and opportunities that traditional analysis might miss. Whether it’s detecting environmental violations, tracking supply chain controversies, or identifying greenwashing, AI is not just something we invest in, it can enhance our ability to make informed, forward-looking decisions for our clients.

Conclusion: Positioning for the AI-powered future

Artificial intelligence is often described as the greatest technological transformation of our time – a catalyst that will touch all corners of the economy and society. For investors, and for the clients we serve, the rise of AI presents a pivotal moment. Handled wisely, AI can be a powerful engine of sustainable growth, driving efficiency, innovation, and solutions to global challenges. But it also requires navigating volatility, separating signal from noise, and ensuring that progress is achieved responsibly.

We believe the best way to benefit from AI is to invest in those companies leading and leveraging this technology to create real, lasting value, whether by improving their operations or delivering products that make the world smarter, cleaner, and healthier. At the same time, we aim to avoid the pitfalls of hype-driven excess and manage the risks inherent in rapid technological shifts. In practical terms, this means our portfolios today include a mix of AI enablers, adopters, and beneficiaries, as well as companies that are likely to be largely immune from AI.

As AI ushers in a new chapter of growth, we remain guided by the same mission: to deliver persistent returns for our clients by investing in the drivers of a more sustainable global economy. AI is now undeniably one of those drivers. By thoughtfully integrating AI insights into our sustainable investment framework, we aim to capture the tremendous opportunities this technology affords. The end result for our clients is an equity portfolio that not only seeks strong financial performance in the years ahead, but does so by backing the innovations and enterprises that are making a positive difference. In short, we see AI as a force multiplier for our strategy’s dual goal – achieving competitive investment returns and fostering sustainable development hand in hand.

1 McKinsey & Co.; The State of AI: Global Survey; 12 March 2025.

2 Nasdaq.com; Morgan Stanley’s forecast points to plenty of growth in 2025; 21 December 2024.

3 Gartner; Forecast Highlights Server Sales Increasing Exponentially, Led by Spending in GenAI; 23 October 2024.

4 IDC; AI to Contribute Nearly $20 Trillion to Global Economy by 2030; 29 September 2024.

5 McKinsey & Co.; AI A new future of work: The race to deploy AI and raise skills in Europe and beyond; 21 May 2024.

6 Fortune.com; MIT report: 95% of generative AI pilots at companies are failing; 18 August 2025.

7 MIT; AI has high data center energy costs — but there are solutions; 7 January 2025.

Environmental, Social and Governance (ESG) factors relate to the quality and functioning of the natural environment, the rights, well-being and interests of people and communities, and the governance of companies & their stakeholders.

Circular economy: An economy where markets provide incentives to reuse products and materials, rather than scrapping them and extracting new resources. All forms of waste are returned to the economy or used more efficiently.

ESG integration: The consideration of financially material ESG risks and opportunities throughout the investment process.

Greenwashing: When a company makes itself, or its products, look more environmentally friendly than they really are.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- The Fund follows a growth investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.