Euro IG corporate bonds: a tale of spreads and yields

European investment grade (IG) corporate bonds still offer investors the potential to enjoy an attractive income and future total return, according to Client Portfolio Manager Celia Soares and Portfolio Manager Tim Winstone. For active investors, considerable dispersion in the market adds to the upside appeal.

4 minute read

Key takeaways:

- Yields per unit of spread have trended lower for much of the past 15 years, reflecting a post Global Financial Crisis (GFC) period of accommodative central bank intervention, structurally low yields, high investor demand and low spreads. Typically, investors searching for an attractive yield in this environment needed to add risk by decreasing credit quality or extending duration.

- More recently, we have seen the yield-to-risk ratio for Euro investment grade corporates begin to improve and we expect this normalisation to continue. If corporate yields follow sovereign yields downward from recent highs, corporate spreads could stabilise or move slightly lower.

- Downside risks to spreads do exist (eg. rate volatility and a challenging economic backdrop in Europe). However, attractive all-in yields right now – as well as offering investors the potential for an attractive income and future total return – should serve as a buffer against possible volatility and spread widening.

2023 was a year of ups and downs for the Euro area. It started with surprising resilience to an energy crisis and the return of war to the continent but towards the second half of the year it was clear that the impact of monetary tightening, weaker global growth and high gas prices would have a lagged impact on European growth. This proved to be a challenge for European investment grade (IG) corporates, which saw their performance fall behind that of their counterparts in the United States.

Investors viewed this divergence of spreads as a potential opportunity and, as a result, European IG corporates have been recouping some of their relative underperformance. However, investors are now questioning if there is any value left in the current spreads due to the ongoing challenging economic backdrop and risks on the downside.

When attempting to answer this question, many analysts view the most recent 10-year average as representative sample and compare it to current spread levels. This, however, besides indicating some time-anchoring bias, reflects a time of suppressed yields, high investor demand and low spreads.

JHI

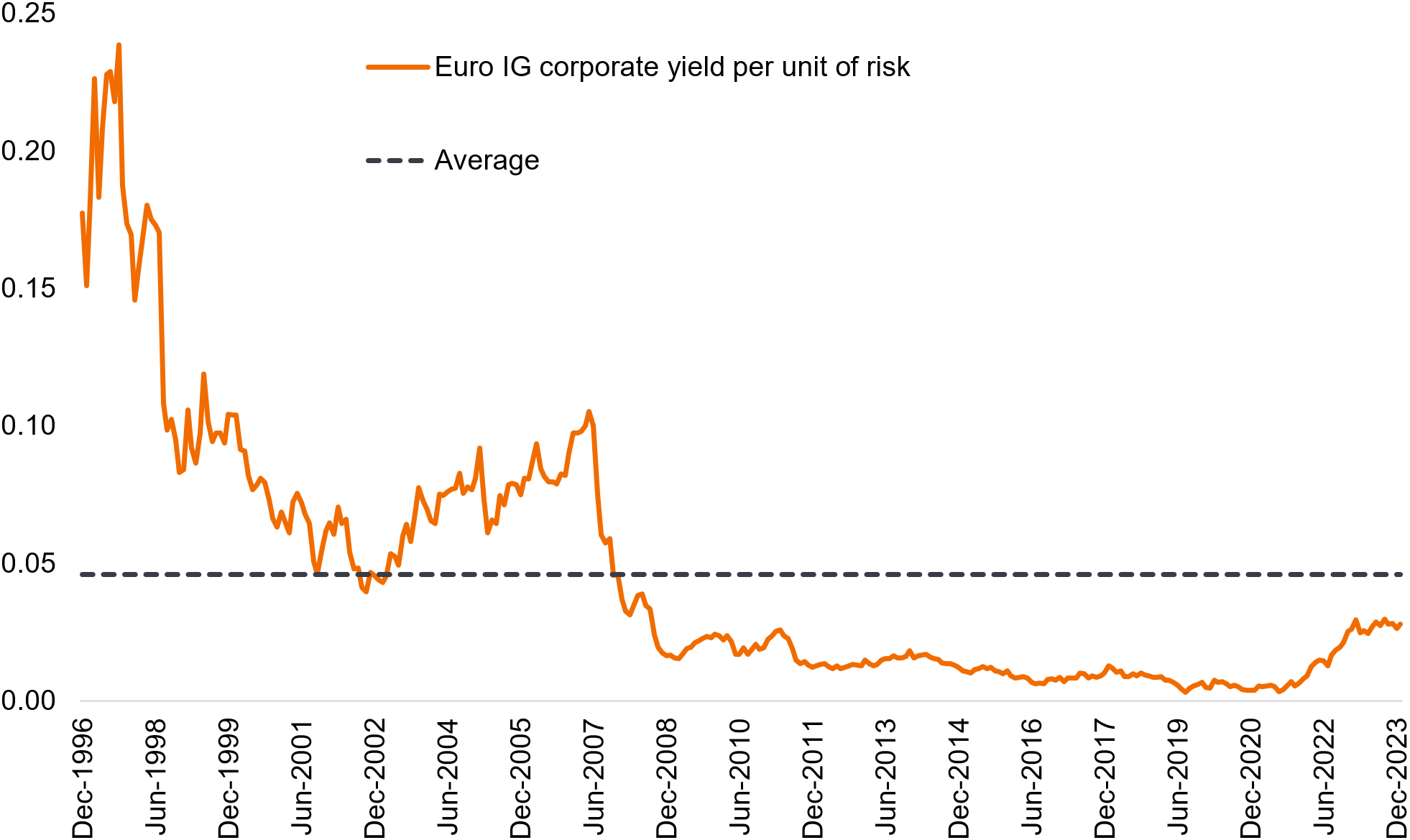

As shown in Figure 1, the yield investors receive per unit of spread has been on a downward trend since the Global Financial Crisis (GFC), and only recently has it started to tick upwards back to its long-term average. In order to add the same yield, post-GFC investors had to add more risk to their portfolios by decreasing credit quality or extending maturity.

Figure 1: Euro IG yield per unit of risk: a long-term perspective

Yield per unit of risk has been on a downward trend since the Global Financial Crisis

Source: Janus Henderson, Bloomberg 2024 (ICE Bofa Euro Corporate Index). Data from 31 December 1996 to 31 January 2024. Past performance does not predict future returns.

But are Euro IG corporate markets post-GFC intrinsically different? The last decade was marked by strong central bank intervention which kept yields structurally low, but with recent inflationary pressures and rapid central market intervention, we are perhaps turning the corner on ultra-low yields. As a result, we should expect the yield-to-risk ratio to continue to normalise, which means that if IG corporate yields follow sovereign yields’ downward trend (from recent highs), we could see IG spreads stabilising at these levels, or moving slightly lower.

We are, however, not complacent to the downside risks of spreads and how rates volatility can impact spread returns. But we also see the opportunity these current yields offer, as they can provide a substantial buffer to total returns during periods of volatility and/or spread widening.

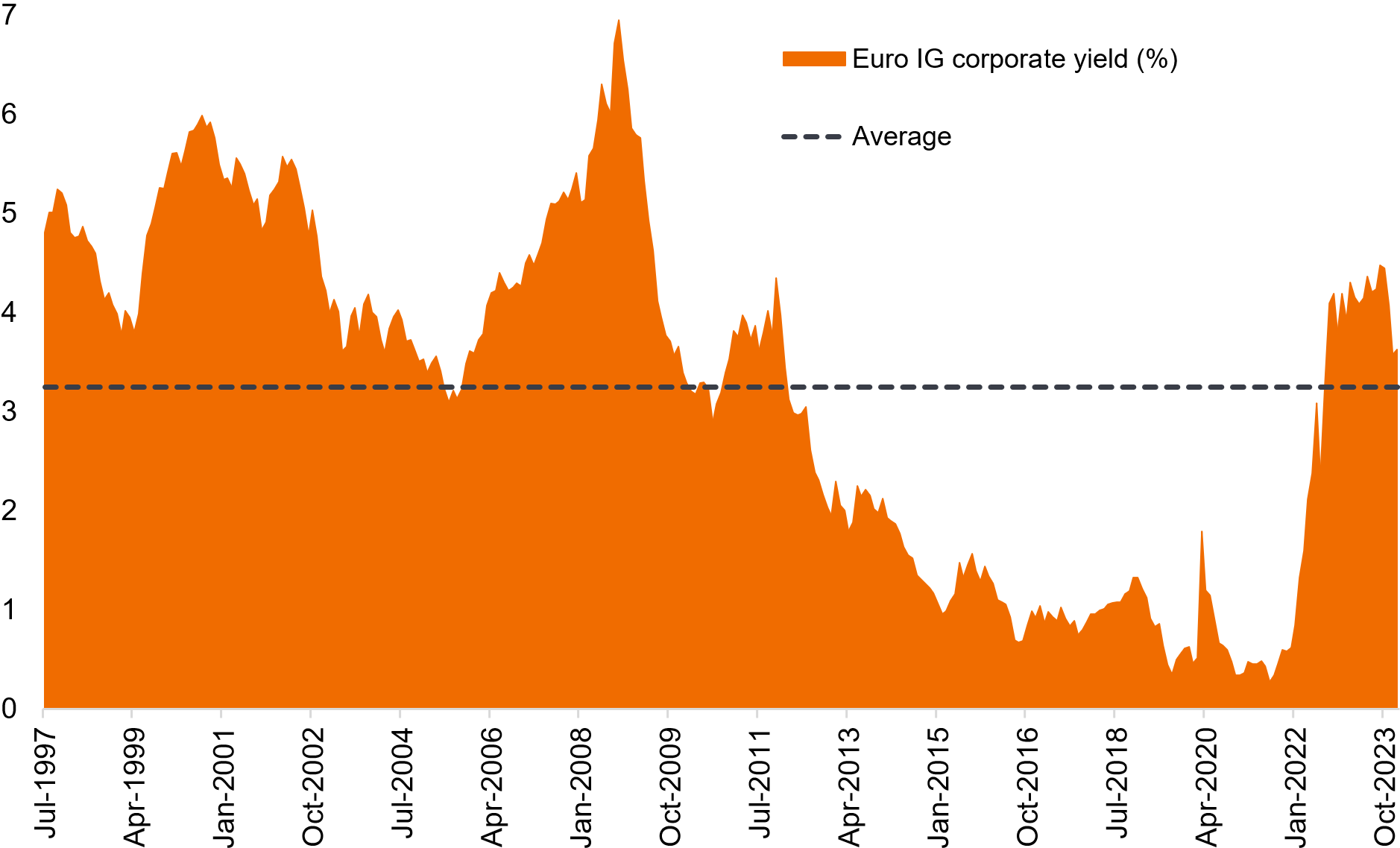

Figure 2: Euro IG yields remain attractive in a historical context

Source: Janus Henderson and Bloomberg (ICE Bofa Euro corporate). Data from 31 July 1997 to 31 January 2024. Past performance does not predict future returns.

The yields available in the European IG market still offer potential for attractive future returns and an appealing income. There is also considerable dispersion in the market, which should provide a fertile hunting ground for active investors.

Active investing. An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis and the investment choices they make. The opposite of Passive Investing.

Bond. A debt security issued by a company or a government, used as a way of raising money. The investor buying the bond is effectively lending money to the issuer of the bond. Bonds offer a return to investors in the form of fixed periodic payments (a ‘coupon’), and the eventual return at maturity of the original amount invested – the par value. Because of their fixed periodic interest payments, they are also often called fixed income instruments.

Bond yield. The level of income on a security expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. There is an inverse relationship between bond yields and bond prices. Lower bond yields mean higher bond prices, and vice versa.

Corporate bond. A bond issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Credit rating / credit quality. An independent assessment of the creditworthiness (credit quality) of a borrower by a recognised agency such as Standard & Poors, Moody’s or Fitch. Standardised scores such as ‘AAA’ (a high credit rating) or ‘B’ (a low credit rating) are used, although other agencies may present their ratings in different formats.

Credit spread. The difference in yield between a corporate bond and a benchmark rate (e.g., yield on a government bond). It gives an indication of the additional risk that lenders take when they buy corporate debt versus government debt of the same maturity. Widening spreads generally indicate a deteriorating creditworthiness of corporate borrowers, while narrowing indicate improving.

Dispersion. A measure for the statistical distribution of given data. There are several methods to measure dispersion, also sometimes referred to as “scatter” or “variability”.

ICE Bofa Euro Corporate Index. The ICE BofA Euro Corporate Index tracks the performance of EUR denominated investment grade corporate debt publicly issued in the eurobond or Euro member domestic markets.

Investment grade (IG). A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Monetary policy. The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Important information

Volatility measures risk using the dispersion of returns for a given investment.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers and narrowing indicate improving.

Swaps, if any, are reported based on notional exposure.

There is no guarantee that past trends will continue, or forecasts will be realised.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.