Euroland monetary trends have stabilised since mid-2018, suggesting weak GDP growth in the first half of 2019 but no further slowdown. The sectoral breakdown of the latest numbers, however, is troubling: corporate narrow money trends have deteriorated, particularly in Germany, signalling likely business retrenchment.

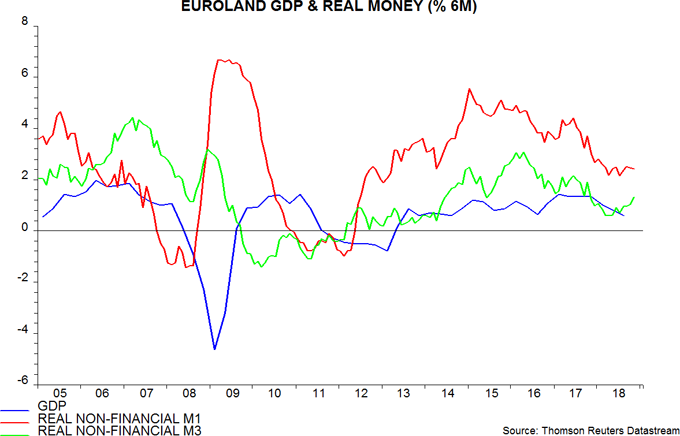

Six-month growth of real narrow money, as measured by non-financial M1 deflated by consumer prices, edged down in November but remained above a double-bottom low in April / July 2018. The corresponding growth rate of the broader real non-financial M3 measure rose further to an 11-month high, having bottomed in March / April – see first chart.

GDP appears to have grown at an annualised rate of only about 1% during the second half of 2018, well below ECB and consensus expectations. The headline money trends suggest little or no improvement during the first half of 2019. The December ECB staff forecast of a rebound in growth to 0.5% per quarter, or 2.0% annualised, looks fanciful.

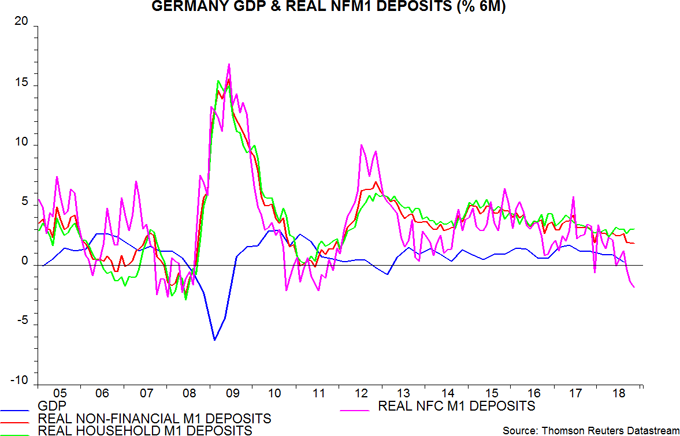

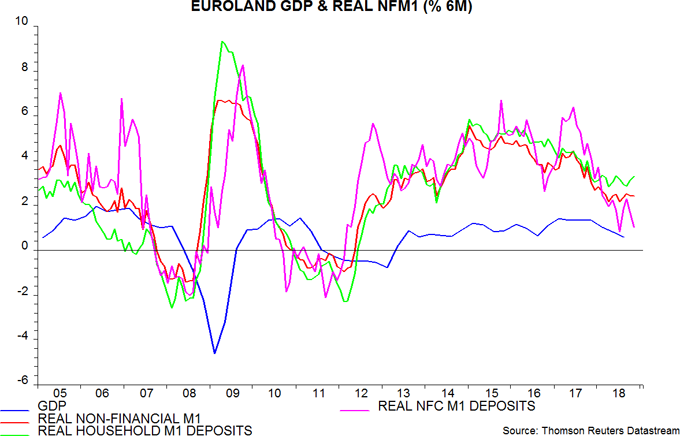

The sectoral breakdown of non-financial M1 deposits reveals a divergence between resilient household and weak corporate trends. Six-month growth of real deposits of non-financial corporations (NFCs) fell in November and is back near July’s six-year low – second chart. The concern is that corporate money weakness is signalling further cuts to investment and hiring plans, with knock-on effects to household incomes and money demand. Corporate money often leads household and aggregate trends, e.g. before the 2011-12 recession and the subsequent recovery.

The country breakdown shows that corporate real M1 deposits have contracted in Germany and Italy, contrasting with a recent recovery in growth rates in France and Spain. German weakness is comparable with that observed before the last two recessions – third chart.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.