Securitised

Markets

Education and access

The securitised market, worth €13.2 trillion, offers investors significant opportunities

Explore each of the European securitised markets to learn the characteristics of each asset class

CLO

Collateralised Loan

Obligations

CLO

Collateralised Loan Obligations

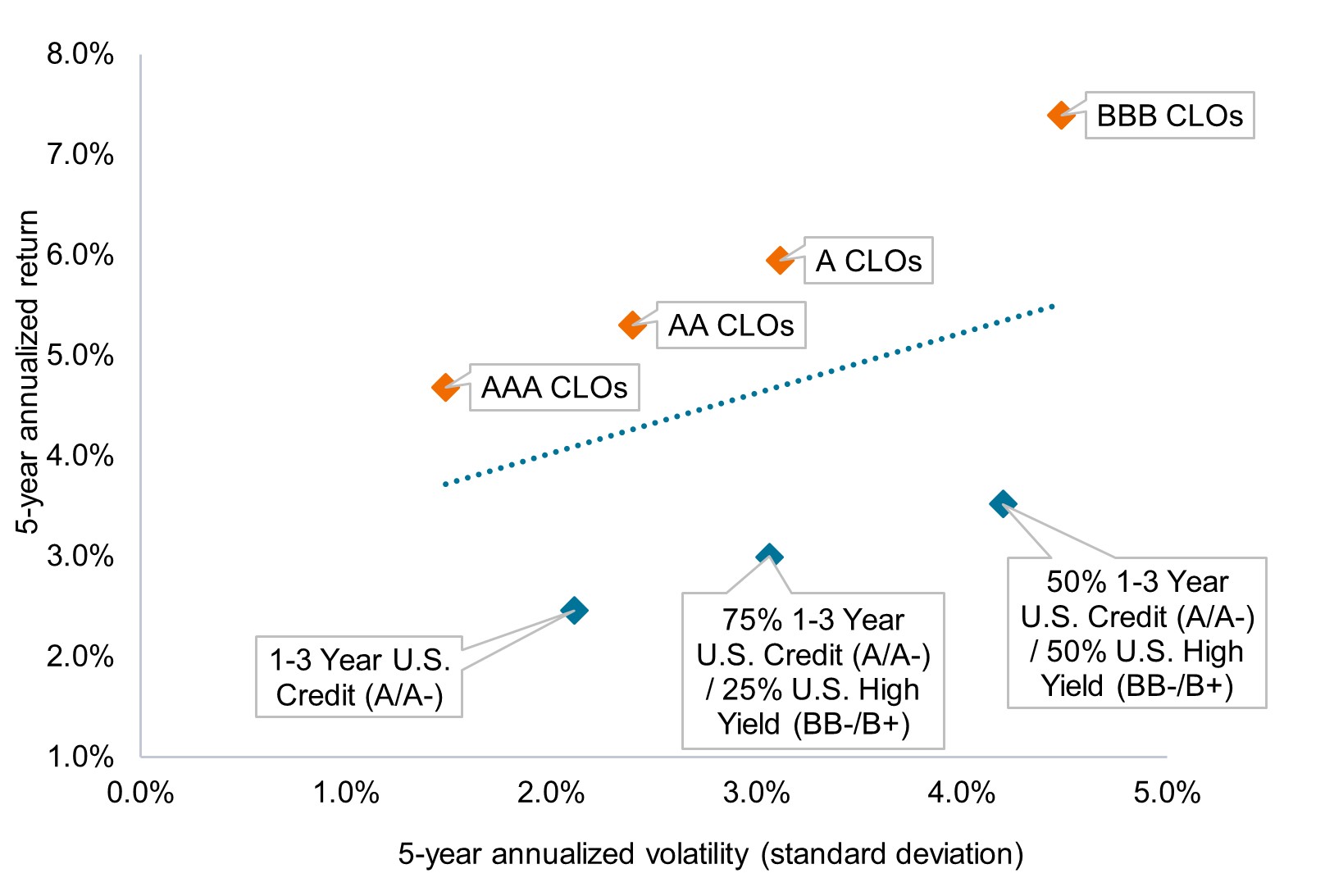

CLOs are managed portfolios of bank loans that have been securitised into new instruments of varying credit ratings. CLOs have increasingly become the link between the financing needs of smaller companies and investors seeking higher yields.

Learn moreAgency MBS

Mortgage-Backed

Securities

Agency MBS

Mortgage-Backed Securities

Agency MBS are issued or guaranteed by one of three government or quasi-government agencies: Fannie Mae, Freddie Mac, and Ginnie Mae. Because of this government support, the credit risk within agency MBS is considered negligible, similar to U.S. Treasuries.

Learn moreRMBS

Residential Mortgage-Backed

Securities

RMBS

Residential Mortgage-Backed Securities

The most liquid component of the European securitised market RMBS are collections of residential mortgages with similar characteristics that are packaged together. The cashflows (principal and interest payments) from the underlying mortgage loans are passed through to service investor debt tranches.

Ultimately, RMBS are important funding mechanisms for household mortgage lenders.

ABS

Asset-Backed

Securities

ABS

Asset-Backed Securities

ABS are built around pools of similar cash-flowing assets that include auto loans, credit card receivables, and student loans, all of which grant investors exposure to the consumer credit market.

Learn moreCMBS

Commercial Mortgage-

Backed Securities

CMBS

Commercial Mortgage-Backed Securities

CMBS are collections of commercial mortgage loans issued by banks, insurers, and alternate lenders to finance purchases of commercial real estate, such as office, industrial, retail, hospitality, and multi-family. CMBS structures help link the financing needs of real estate buyers with investors' capital.

Learn moreMeet the Janus Henderson team behind our success in securitised markets

1ST

Largest CLO ETF provider globally1

as at 31 January 2026

3rd

Largest active fixed income ETF provider globally by AUM2

as at 31 December 2025

€55B

in firmwide securitised assets3

as of 31 December 2025

¹Source: Morningstar, as at 31 January 2026.

²Source: Morningstar, as at 31 December 2025.

³Source: Janus Henderson Investors, 31 December 2025.

Explore our suite of securitised products

A high-quality, floating rate active ETF offering enhanced yield over investment grade corporates.

A high-quality, floating rate active ETF offering enhanced yield over investment grade corporates.

A high quality, conservatively managed fixed income solution aiming to provide downside resilience over cycles.