Singapore – Janus Henderson Investors, a leading asset manager, is pleased to announce the launch of two new sustainability-focused funds.

The Janus Henderson Horizon Sustainable Future Technologies Fund and the Janus Henderson Horizon US Sustainable Equity Fund are available in a SICAV structure and are available to Singapore investors on a recognised and restricted basis.

The Janus Henderson Horizon Sustainable Future Technologies Fund aims to deliver long-term capital growth by identifying and investing in promising, sustainability-related technology companies. Established large-cap names are avoided.

It is an Article 9 ‘dark green’ fund (in line with the EU Sustainable Finance Disclosure Regulation) with a sustainable investment objective providing clients with a unique technology focused solution to growing market demand for sustainable focused funds.

The fund management team has solid environmental and sustainability credentials; this new fund builds on the success of the Janus Henderson Horizon Global Technology Leaders Fund, sharing the same investment team who have a strong, consistent track record; generating annualised returns of 13.1% versus 11.2%[1] for the sector group[2] since inception in 2005.[3] Janus Henderson Horizon Global Technology Leaders Fund is an Article 8 or ‘light green’ fund (in line with the EU Sustainable Finance Disclosure Regulation).

The fund uses a positive thematic framework to select investments; which will align with the UN’s Sustainable Development Goals and derive at least 50% of their revenues from fund’s sustainable technology themes.[4] The sustainability objective of the Sustainable Future Technologies Fund ensures meaningful diversification and differentiation from traditional tech, offering exposure to emerging technology companies aligned to the UN SDGs; this increases the breadth of sustainable investment solutions available to clients.

Richard Clode, Portfolio Manager said: “Clients increasingly expect and demand managers deliver positive social, environmental and financial outcomes. We are really excited by the potential of this fund; moving away from traditional technology, looking for emerging and overlooked companies who meet a stringent sustainability criterion. Technology has the ability to deliver across all of the components of ESG; while global regulation and classification initially concentrated on environmental sustainability, this fund is looking to go much further and expand to incorporate much wider social issues. The reach of technology is limitless and the sector has a unique and critical role to play in servicing social goals; to help democratise access to services, reduce inequality and upgrade quality of life.”

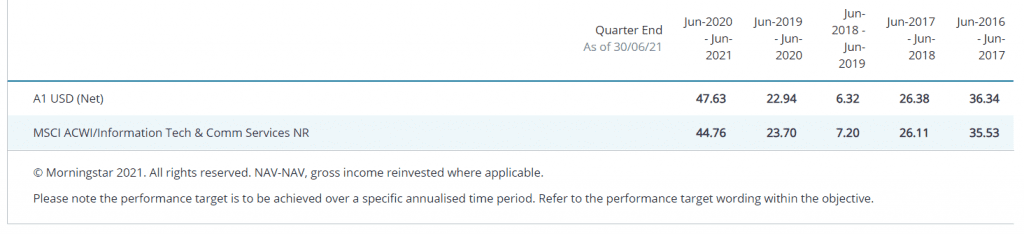

[1] Global Tech Leaders Fund, I ACC factsheet, see Discrete year performance

[2] Morningstar Sector Equity Technology

[3] Horizon Global Tech Leaders Fund, A1 USD factsheet, 31 July 2021

[4] Digital Democratisation, Tech Health, Low Carbon Infrastructure, Data Security, Smart Cities, Sustainable Transport, Resource & Productivity Optimisation and Clean Energy Technology.

The Janus Henderson Horizon US Sustainable Equity Fund aims to deliver long-term capital growth for investors by investing in US companies that are contributing positively to the development of a sustainable global economy.

The Fund is managed by Portfolio Manager and Head of Global Sustainable Equities, Hamish Chamberlayne, and Portfolio Manager, Aaron Scully, alongside a dedicated ESG analyst team and the broader Governance & Responsible Investor (GRI) team.

The Fund is an Article 9 ‘dark green’ fund (in line with EU Sustainable Finance Disclosure Regulation) and has sustainability as its core investment objective. The Fund applies both positive screening criteria based on environmental and social themes, and negative screening criteria to avoid companies with goods or services that contribute to environmental or societal harm.

The new Janus Henderson Horizon US Sustainable Equity Fund builds upon a 30-year strategy history of sustainable investing and innovative thought leadership and is part of the Janus Henderson Global Sustainable Equity strategy. At end of July the Janus Henderson Global Sustainable Equity strategy had $3.5 billion of assets under management and has a strong long-term track record, generating annualised returns of 20.06% vs. 14.9% against the benchmark over the last five years.[5][6] The Janus Henderson Horizon Global Sustainable Equity Fund, launched on 29 July 2019, has already reached $1.1 billion of assets under management while delivering annualised returns of 26.29% vs 18.46% against the benchmark since its inception.[7][8]

Hamish Chamberlayne, Portfolio Manager and Head of Global Sustainable Equities said: “Sustainability has gained considerable traction in the US over the past months and investors across the world are becoming increasingly aware of the role the US will play in delivering a sustainable future. The Horizon US Sustainable Equity Fund will invest in US companies that are positioned to confront the challenges posed by global megatrends, such as climate change, resource constraints, population growth and ageing populations, and those companies seeking to effect positive transformation in the industries in which they operate. The fund adopts a consistent ESG framework across the entire investment process, so investors can be assured that their capital is being properly directed towards sustainable investment and the truly long-term value creation that follows.”

Both investment teams are supported by a new and growing global team of ESG specialists within Janus Henderson led by our Global Head of ESG Investments, Paul LaCoursiere.

Scott Steele, Head of Distribution, Asia said: “The launch of these new, sustainability-focused strategies commemorates the 30th anniversary of our global sustainable equity strategy. Janus Henderson is committed to bringing sustainable solutions to the region to that meet our clients’ needs. Both the Sustainable Future Technologies and US Sustainable Equity investment teams will continue to build on their lengthy and successful track records within their respective areas to deliver long-term growth for our clients.”

[5] MSCI World Indes

[6] Composite data for the Global Sustainable Equity; see table below for full details

[7] The Janus Henderson Horizon Global Sustainable Equity Fund benchmark is the MSCI World Index

[8] A2 EUR Net USD returns, as at 31 July 2021

– ends –

Press Enquiries

Janus Henderson Investors

Aston Tan

T: +65 6813 1006

E: aston.tan@janushenderson.com

- Notes to editors: Janus Henderson Horizon Sustainable Future Technology fee structure

| A Class (USD) | GU Class USD | H Class (USD) | IU Class (USD) | E Class (USD) | |

| Annual Management Charge | 1.20% | 0.65% | 0.60% | 0.75% | 0.45% |

| OCF* | 1.88% | 0.75% | 1.08% | 0.85% | 0.55% |

- Notes to editors: Global Sustainable Equity Composite Performance – as at 30th June 2021

| Performance (%) | Q2 2020 | 1 Year | 3-Year | 5-Year | 10-Year | Since inception (1/1/09) |

| Composite Gross of Fees | 9.11% | 37.44% | 22.43% | 20.06% | 14.19% | 15.49% |

| Composite Net of Fees | 8.66% | 35.19% | 20.41% | 18.08% | 12.25% | 13.41% |

| MSCI World Index | 7.89% | 35.67% | 15.09% | 14.90% | 11.66% | 13.80% |

| Difference (Gross vs. benchmark) | +1.22 | +4.95 | +6.58 | +5.84 | +2.30 | +2.31 |

Janus Henderson Investors, as at 30 June 2021.

Note: Composite: Janus Henderson Global Sustainable Equity Strategy, in USD.

Hamish Chamberlayne became portfolio manager of the strategy in December 2013.

Returns greater than one year are annualized. Please see the appendix for the GIPS® compliant presentation and important disclosures. Past performance cannot guarantee future results.

- Notes to editors: Janus Henderson Horizon US Sustainable Equity Fund fee structure

| A Class (USD) | GU Class USD | H Class (USD) | IU Class (USD) | E Class (USD) | |

| Annual Management Charge | 1.20% | 0.65% | 0.60% | 0.75% | 0.45% |

| OCF* | 1.88% | 0.75% | 1.08% | 0.85% | 0.55% |

*Where the ongoing charges exceed the target outperformance relative to the benchmark the return is likely to be below the benchmark return, even when the Fund’s outperformance target (before the deduction of charges) has been achieved. For funds which charge performance fees, investors should note that the ongoing charges does not include performance fees and does not reflect the full fees charged if any performance fee was crystallised for the preceding performance period

Horizon Global Tech Leaders Fund Performance: (I ACC)

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Janus Henderson Group (JHG) is a leading global active asset manager dedicated to helping investors achieve long-term financial goals through a broad range of investment solutions, including equities, fixed income, quantitative equities, multi-asset and alternative asset class strategies.

At 30 June 2021, Janus Henderson had approximately US$428 billion in assets under management, more than 2,000 employees, and offices in 25 cities worldwide. Headquartered in London, the company is listed on the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX).