Quarterly Update

Watch the investment team recap this quarter.

(Note: Filmed in January 2026).

INVESTMENT OBJECTIVE

The Fund aims to provide capital growth over the long term.

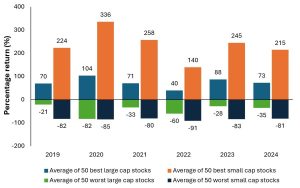

Performance target: To outperform the MSCI World Small Cap Index, after the deduction of charges, over any 5 year period.

More

The Fund invests at least 80% of its assets in shares (equities) and equity-related securities of smaller companies, in any industry, in any country.

The Fund may also invest in other assets including cash and money market instruments.

The Investment Manager may use derivatives (complex financial instruments) to reduce risk or to manage the Fund more efficiently.

The Fund is actively managed with reference to the MSCI World Small Cap Index, which is broadly representative of the companies in which it may invest, as this forms the basis of the Fund's performance target and the level above which performance fees may be charged (if applicable). The Investment Manager has discretion to choose investments for the Fund with weightings different to the index or not in the index, but at times the Fund may hold investments similar to the index.

Less

The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.

Potential investors must read the prospectus, and where relevant, the key investor information document before investing.

This website is a Marketing Communication and does not qualify as an investment recommendation.

ABOUT THIS FUND

- Experienced lead manager and regional managers with local expertise

- Dispassionate screening approach to stock selection combined with qualitative fundamental research

- Balanced style and regional exposure reduces factor risk, allowing the strategy the potential to outperform in a variety of market conditions

RATINGS AND AWARDS

Lipper Fund Awards based on Horizon Global Smaller Companies Fund Class A2 USD shares only. Availability of this share class may be limited by law in certain jurisdictions. Performance records are detailed on the specific KID, fees and charges may vary and further information can be found in the fund’s prospectus and KID which must be reviewed before investing. Please consult your local sales representative if you have any further queries.

The European Rating Agency Scope Group is the leading European provider of independent credit ratings, ESG analysis, and fund research. Janus Henderson Investors was named Best Asset Manager 2026 for small-cap equities by Scope Fund Analysis.

The European Rating Agency Scope Group is the leading European provider of independent credit ratings, ESG analysis, and fund research. Janus Henderson Investors was named Best Asset Manager 2026 for small-cap equities by Scope Fund Analysis.