Why investors should look beyond the Mag 7 for opportunities in AI

Portfolio Managers Julian McManus and Christopher O’Malley make the case for why certain non-U.S. tech companies could benefit as much as the Magnificent Seven (Mag 7) from the rise of artificial intelligence (AI).

5 minute read

Key takeaways:

- Investors have crowded into Mag 7 stocks as a way to capitalize on the growth potential of AI and other advanced technologies.

- This concentration has led some investors to overlook non-U.S. tech firms that, in our view, are just as key to the AI revolution but now trade a discount to Mag 7 peers.

- By considering such companies, including ASML, TSMC, and SK hynix, investors could invest in AI at more attractive valuations and potentially improve diversification within their technology holdings.

Over the past year, a small group of tech-focused stocks have dominated equity performance in the U.S. These stocks, known as the Magnificent Seven (Mag 7), doubled in 2023 as investors tried to get exposure to the theme of artificial intelligence (AI). Included in the group are tech giants such as Alphabet, Amazon, Meta, and Nvidia, all of which are driving the technology around AI.

However, a number of non-U.S. stocks are also at the nexus of AI and other advanced technology, as these companies are key enablers for much of the tech being developed by the Mag 7. These non-U.S. firms may sit outside the limelight – but have no less growth potential, in our view.

The growth potential of AI…

Investors have good reason to want exposure to artificial intelligence. The technology is expected to drive a sharp increase in productivity and ultimately be a deflationary force on the global economy. Already, myriad use cases for AI exist in retail, healthcare, manufacturing, automotive, and defense: AI now enables advertisers to more precisely target ads, helps doctors more quickly and accurately diagnose patients, improves manufacturing efficiency, and aids tactical decision making in defense. The technology could represent a transformative change, with the potential to drive innovation at a rate comparable to the Industrial and Digital Revolutions.

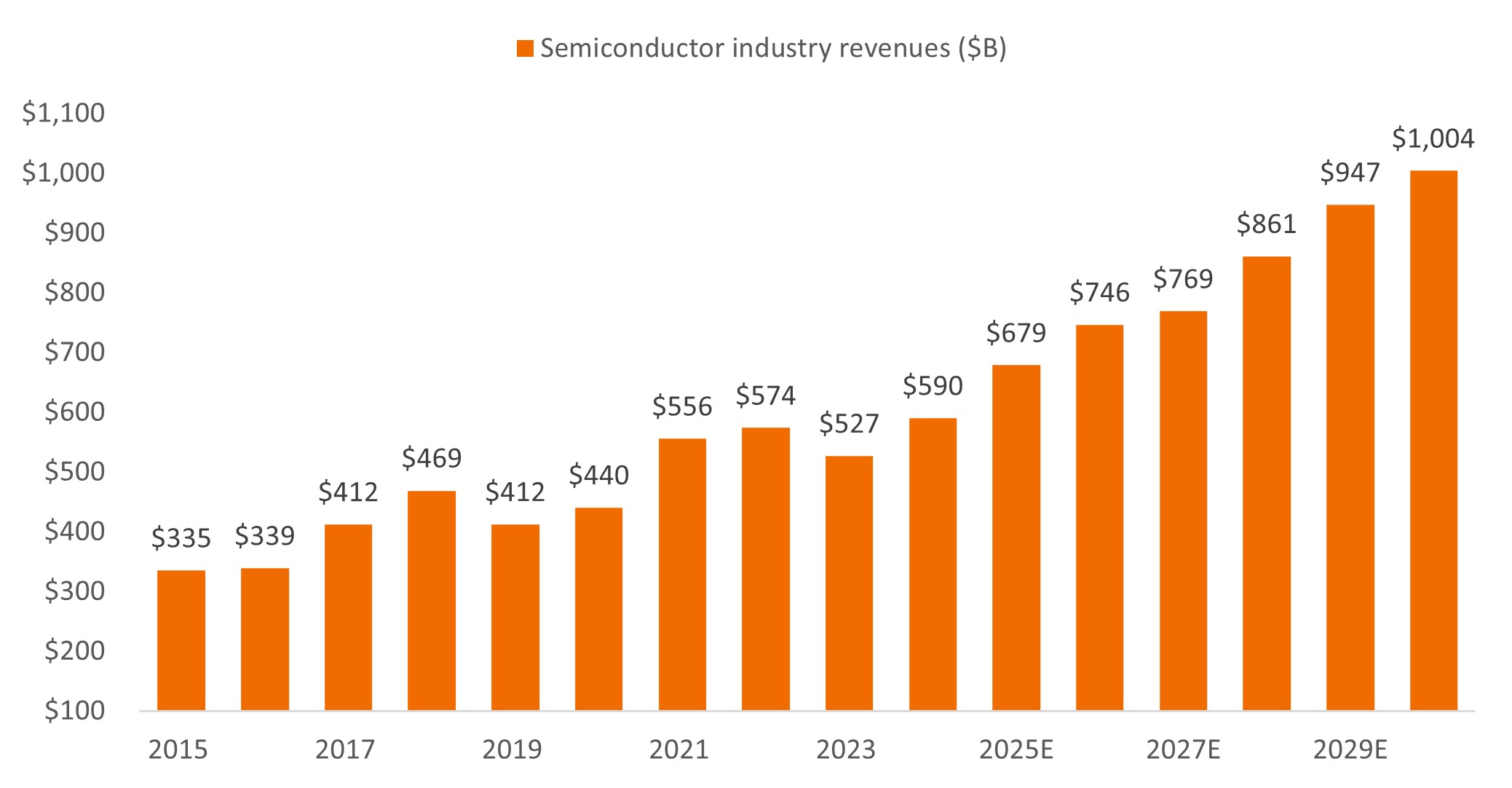

As these trends play out, the semiconductor market – the chips that form the bedrock of computing power – is expected to double from $400 billion in 2020 to over $1 trillion in 2030 (Exhibit 1). Graphics processing units (GPUs) – advanced semiconductor chips that are the brains of generative AI – are expected to see even more impressive growth, rising tenfold to $400 billion in sales over the same period.

Exhibit 1: Thanks to AI, semiconductor sales are projected to soar

Source: Gartner, World Semiconductor Trade Statistics, and Janus Henderson Investor estimates. Data from 2024 to 2030 are estimated.

Source: Gartner, World Semiconductor Trade Statistics, and Janus Henderson Investor estimates. Data from 2024 to 2030 are estimated.

GPUs are the fastest and most efficient way to process the calculations needed to analyze the vast sums of data required for generative AI. Nvidia has a virtual monopoly on the GPU market, and as AI models become more complex and more data is generated and stored, demand for Nvidia’s chips and data storage has exploded. In 2023, for example, the firm’s data center revenues were up more than 400% compared to 2019.

… is not limited to the Mag 7

But while Nvidia and other Mag 7 companies have been marked as obvious beneficiaries of AI, we believe a number of companies outside the U.S. could be just as well positioned. In fact, these firms produce the hardware and other tools that enable the Magnificent Seven to develop the technologies now so attractive to investors. What’s more, like Nvidia, many of these companies are the dominant suppliers in their respective markets, creating the potential for long runways of growth.

For example, Dutch semiconductor capital equipment maker ASML sits at the leading edge of semiconductor manufacturing. The company dominates within lithography, a process of using light to print patterns on silicon. In fact, the largest chip makers depend on ASML for the machinery that enables lithography for advanced chips, giving the firm an estimated market share of more than 80%. With the semiconductor market forecast to double over the next 10 years – driven by AI, as well as the Internet of Things, the automotive industry, data centers, and other digital trends – ASML appears well positioned for potentially sizable growth.

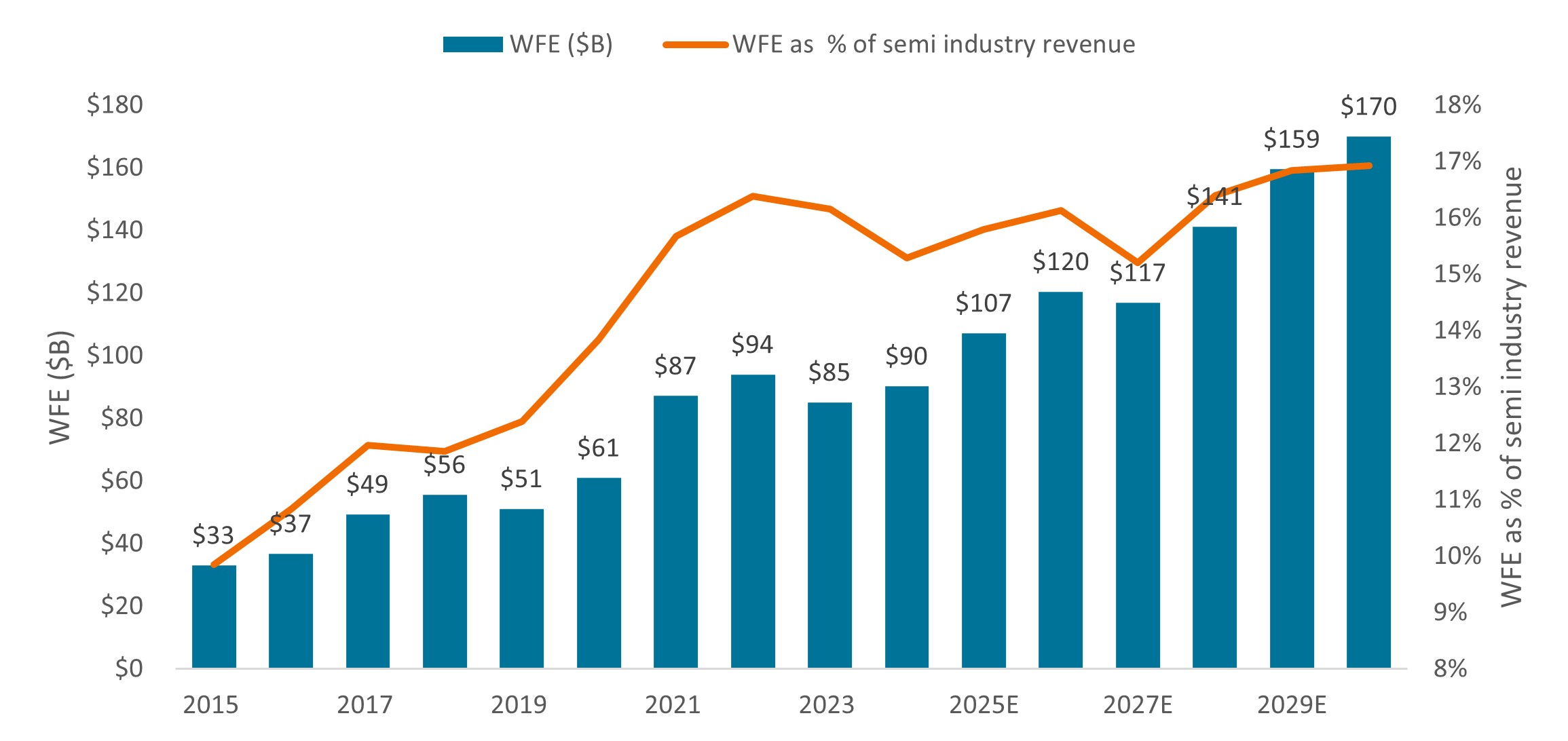

Exhibit 2: Wafer fab equipment (WFE) sales

Sales of WFE – the hardware needed to produce semiconductor chips – are increasing in absolute terms and as a percentage of the semiconductor market.

Source: Gartner, World Semiconductor Trade Statistics, and Janus Henderson Investor estimates. Data from 2024 to 2030 are estimated.

Source: Gartner, World Semiconductor Trade Statistics, and Janus Henderson Investor estimates. Data from 2024 to 2030 are estimated.

In Taiwan, investors will find the world’s largest foundry, or contractor of semiconductor manufacturing, Taiwan Semiconductor Manufacturing Company (TSMC). The firm has roughly 50% of global market share thanks to its technology leadership in manufacturing and packaging, as well as superior execution and management. Currently, AI represents around 6% of revenues, but management forecasts its AI business will grow by 50% annually over the next five years. Given its positioning in advanced node semiconductors and packaging, TSMC could solidify its position within AI chip making for the foreseeable future.

Finally, based in South Korea, SK hynix is the leading producer of cutting-edge memory chips, including high bandwidth memory (HBM), an essential component for AI servers. Currently, AI server demand is 10% of memory demand. However, the company expects the market to grow by 40% annually for the next five years, driving sales growth for its HBM chips by 60% to 80% per year over the same time period.

In short, while many investors have turned to the Magnificent Seven for exposure to AI, it is important to remember that this complex technology is dependent on many tools and resources, not all of which are derived in the U.S. Furthermore, many of these non-U.S. tech firms now trade at a discount to their Mag 7 peers, given the equity market concentration of 2023. In our view, investors who want to maximize the AI theme would be wise to broaden their view in 2024.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.