Biopharma’s targeted approach to growth

A new drug targeting a common mutation found in tumours represents a breakthrough in cancer therapy. Portfolio Manager Andy Acker and Research Analyst Agustin Mohedas explain how the science could benefit patients and biopharma alike.

5 minute read

Key takeaways:

- The approval of the first oncology drug targeting so-called KRAS mutations represents a milestone in cancer treatment.

- The drug belongs to a growing class of targeted cancer therapies with the potential to dramatically improve patient outcomes.

- For biopharma, these medicines could be a significant source of revenue growth as patent expirations and generic competition weigh on sales of older drugs.

It has been described as the Death Star of cancer mutations, and the quest for a drug to address it as the Holy Grail of cancer research. But finally, last month, the U.S. Food and Drug Administration (FDA) approved the first therapy that targets KRAS, among the most frequently mutated oncogenes in human cancers. The mutation is often present in lung and colorectal cancers and is a signature of pancreatic cancer, which has among the lowest five-year survival rates of all cancers. In short, this medical breakthrough – pursued for roughly four decades – is a big deal.

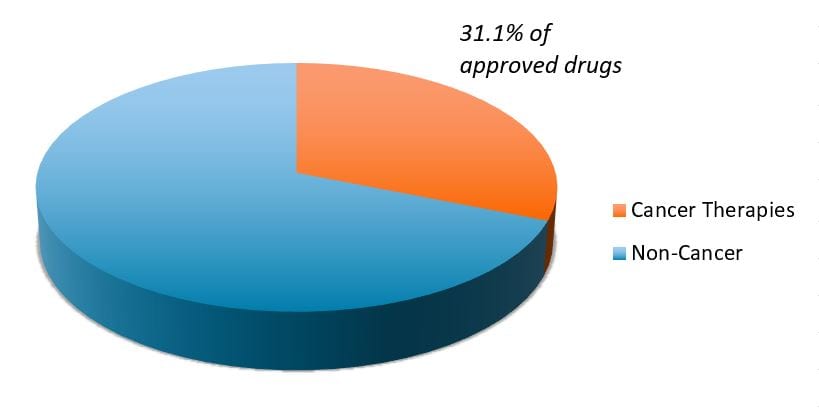

Cancer research dominates

It also represents a broader trend occurring in biopharma. As more areas of medicine face generic competition, research efforts have pivoted toward oncology and other disease categories with high, unmet medical needs. At the same time, the cost of genetic sequencing has dropped from roughly $1 billion in the early 2000s (when the first human genome was mapped) to a few hundred dollars today, leading to a boom in genetic disease research, including cancer. The net result has been a dramatic rise in new cancer therapies, which made up more than 30% of all novel drugs approved by the FDA in recent years (see chart).

FDA novel drug approvals (2015-2021)

It has been described as the Death Star of cancer mutations, and the quest for a drug to address it as the Holy Grail of cancer research. But finally, last month, the U.S. Food and Drug Administration (FDA) approved the first therapy that targets KRAS, among the most frequently mutated oncogenes in human cancers. The mutation is often present in lung and colorectal cancers and is a signature of pancreatic cancer, which has among the lowest five-year survival rates of all cancers. In short, this medical breakthrough – pursued for roughly four decades – is a big deal.

Exhibit 1:FDA novel drug approvals (2015-2021)

We believe this pattern is likely to continue, with important implications for biopharma. Cancer treatments are evolving from the blunt approach of chemotherapy and radiation, which attempt to kill all rapidly dividing cells and distinguish poorly between healthy tissue and tumors. Instead, new therapies target specific driver mutations in cancer, such as KRAS, leading to more effective and better tolerated medicines that can prolong both survival and quality of life.

A more targeted approach

In healthy cells, KRAS serves as an on-off switch that regulates cell growth. When the gene mutates, KRAS can become stuck in the “on” position, allowing cells to multiply uncontrollably. The KRAS-targeting drug approved by the FDA, Lumakras (sotorasib), treats adult patients with non-small cell lung cancer, the most common type of lung cancer (roughly 200,000 people diagnosed each year in the U.S.1) For those in advanced stages of the disease, there typically is no cure. In clinical trials, more than a third of patients who received Lumakras saw their tumors shrink significantly. Of those patients, more than half saw the effect last six months or longer, representing a remarkable improvement in progression-free survival.

Lumakras targets one specific type of mutation, KRASG12C, which occurs in about 13% of non-small cell lung cancer patients, but other variations of the mutation exist. All told, KRAS mutations are present in approximately 25% of all tumors, creating a significant market opportunity.2 As such, a number of other companies are developing KRAS-targeted drugs, with at least one expected to go for FDA approval later this year.

Until recently, KRAS remained an elusive target because of the nature of the protein encoded by the gene: it lacked an obvious entry point for a drug. But after years of screening thousands of molecules, biochemists succeeded in finding not only an entry point but also a characteristic that occurs only with KRAS-mutated proteins. This has made it possible for scientists to develop a highly targeted treatment – one affecting only cancerous cells while sparing healthy ones.

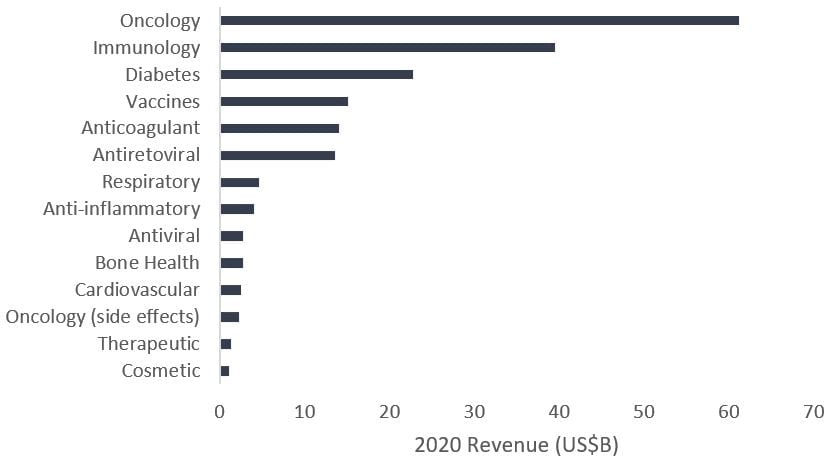

Driving biopharma revenue growth

At the same time, the pharmaceutical industry is recognizing the growth potential, spending billions of dollars on research and development, partnering with developers and acquiring biotech firms pioneering much of the research. As a result, while revenues for some blockbuster drugs4 have started to decline as generic competition ramps up, biopharma oncology sales have exploded.

Exhibit 2:Total franchise sales of top medicines for select pharmaceutical and biotech companies

We expect the trend could continue over the next decade, particularly as big data and machine learning capabilities improve, new drug targets are discovered, and a growing middle class around the globe – much of which is aging – increasingly seeks new cancer treatments. In our view, large pharmaceutical and biotech companies that integrate targeted cancer approaches into a diversified pipeline of new medicines could bolster their growth, offsetting the negative impacts of patent expirations and potentially surprising investors.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.