A clear theme stands out from this earnings season: Operating leverage is stronger than expected, with companies posting healthy revenue growth while keeping expense growth in check. This productivity dynamic is boosting margins and supporting continued earnings growth despite tariff pressures and rising costs.

The productivity tailwind is increasingly evident in companies’ earnings results. The S&P 500® Index’s net profit margin reached 12.3% in the second quarter, above both last year’s 12.2% and the five-year average of 11.8%. This marks the fifth straight quarter with margins above 12%, with consensus estimates projecting further increases through year end.1

Three sectors stand out with year-over-year margin improvements: Communication Services, Information Technology, and Financials. These gains reflect where companies can best leverage technology to improve operations, and it appears years of heavy technology spending are now paying off.

Tech and internet firms exemplify this trend. After investing heavily in digital tools and software capabilities, these firms streamlined operations and reduced headcounts. Now they’re realizing the benefits through lower sales, marketing, and research costs while maintaining – or growing – revenues.

Government data confirms the trend

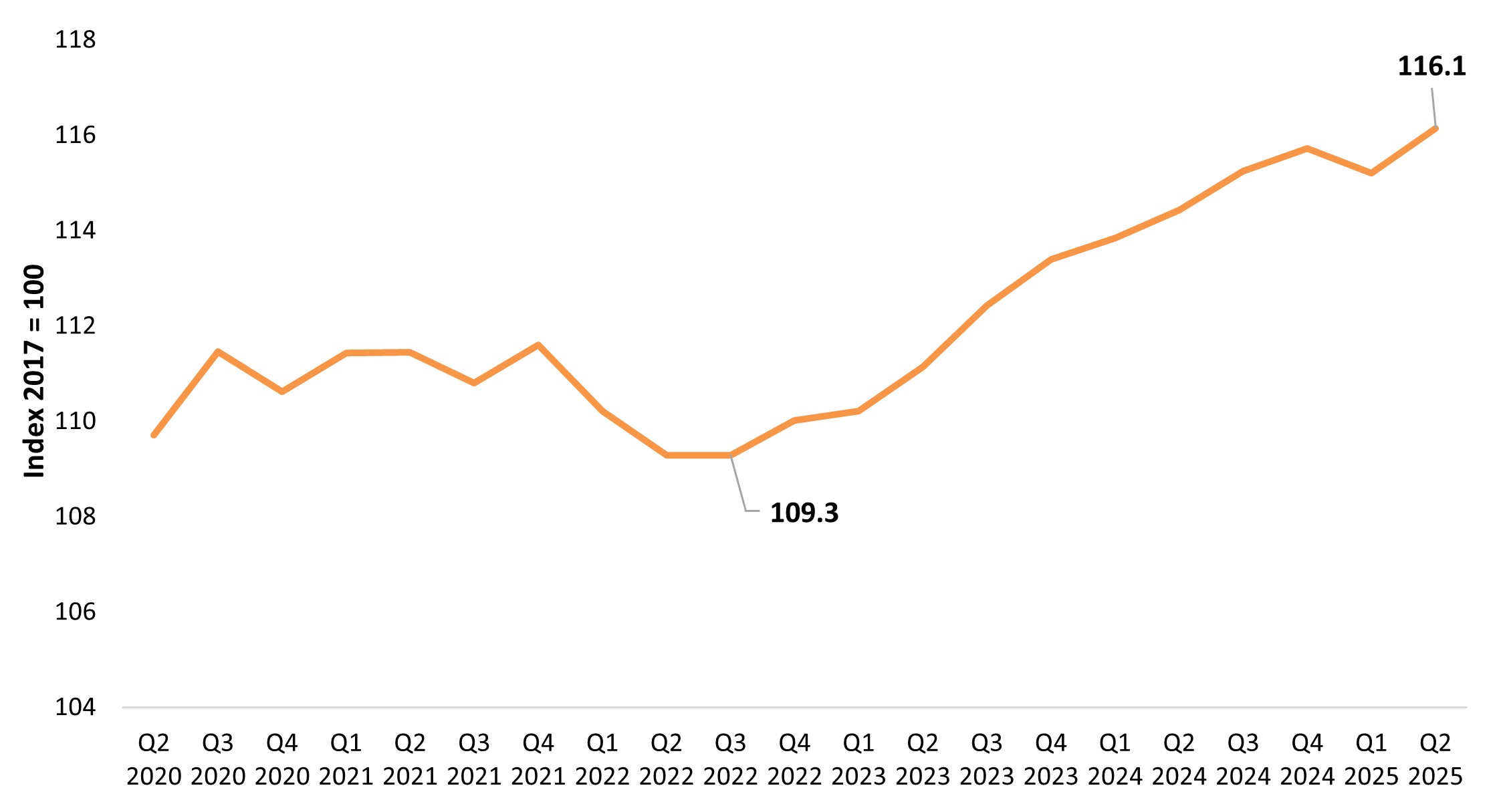

The U.S. Labor Productivity Index data supports what corporate earnings show. Productivity grew 3.3% in the second quarter of 2025 – the 10th increase in 11 quarters (Exhibit 1). Over the past two years, productivity has averaged 2.4% annual growth, well above the 10-year average of 1.7%.

Exhibit 1: U.S. Labor Productivity Index Source: U.S. Bureau of Labor Statistics, Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers. Index 2017 = 100, quarterly frequency, seasonally adjusted. Data as of 4 September 2025.

Source: U.S. Bureau of Labor Statistics, Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers. Index 2017 = 100, quarterly frequency, seasonally adjusted. Data as of 4 September 2025.

This sustained productivity improvement matters for the broader economy. Not only does it help maintain corporate margins, but it also supports wage growth and sustains consumer spending without fueling inflation. As tariff-related costs loom, this trend becomes even more significant.

Digitization and AI help drive productivity gains

The productivity story began with the broad digitization of businesses that accelerated during the COVID era. This includes everything from leveraging remote meetings to reduced travel budgets to the digitization of transactions and exchanges. These digital tools continue to deliver savings in sales, marketing, and administration.

Looking ahead, we believe AI could become the dominant catalyst. We’re still in the early stages of AI adoption, but companies are increasingly providing concrete examples of AI applications that are generating tangible productivity gains.

Our conviction in the AI secular growth theme continues to increase. Capital spending on AI remains robust with no signs of plateauing. As businesses accelerate AI deployment across sectors, productivity improvements are likely to persist.

This quarter also brought slower jobs growth, aligning with an uptick in management commentary about AI’s impact on staffing decisions. Some companies have signaled slower future headcount growth as AI tools mature. In general, businesses appear to be hesitant to hire and are expecting AI and automation to help support labor efficiency.

Earnings strength broadens beyond technology

In another encouraging sign, earnings strength has extended beyond AI and technology this quarter. Commercial aerospace, capital markets, medical technology segments, and travel have delivered impressive results. This breath suggests corporate health is more widespread than some narratives suggest, which is important as tariff headwinds may not have fully materialized. These challenges could put pressure on the roughly one-third of the market comprised of manufacturing and product-oriented companies in the latter half of 2025 through mid-2026.

However, we believe the other two-thirds could continue benefiting from productivity gains, helping offset these pressures. The market is entering this higher-cost period from a position of strength, with more tools to manage challenges than in previous cycles.

With earnings growth expected at 12% to 13% for 2025 and 11% to 12% for 2026, we believe the foundation for market gains remains solid.

Investment implications

For investors seeking to capitalize on productivity trends, two areas stand out:

First, focus on the enabling infrastructure. Semiconductor and software companies, as well as enterprise platforms developing AI and automation solutions, could be direct beneficiaries as adoption accelerates.

Second, consider large-scale companies with resources to implement these technologies. We believe firms with healthy balance sheets are best positioned for the capital investment required to stay ahead. Companies lacking scale or investment capabilities risk falling behind and losing market share.

Looking ahead

Productivity gains provide companies with tools to navigate cost pressures effectively. With these improvements helping offset challenges and earnings growth remaining robust, we remain optimistic about the market outlook even as businesses face tariff uncertainty and economic shifts.

The combination of sustained productivity gains and targeted investment in AI and digitization supports operating leverage across many parts of the market. We believe this creates opportunities for investors focused on companies that are enabling technologies and the large firms that are capable of deploying those tools effectively.

As productivity improvements persist, they provide a stronger foundation for profitability – a development that isn’t surprising given years of technology investment now bearing fruit. The key now is identifying companies positioned to sustain and expand these gains.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.